U.S. Dollar's Troubled Beginning: A Comparison To Nixon's Presidency

Table of Contents

The Early Years of the U.S. Dollar and its Inherent Weaknesses

Establishing a stable currency in a newly formed nation is a monumental task, and the early U.S. dollar was no exception. Its journey was fraught with challenges, laying bare the inherent weaknesses of a young economic system.

The Coinage Act of 1792 and its Limitations

The Coinage Act of 1792 established a bimetallic standard, defining the value of the U.S. dollar in terms of both gold and silver. While aiming for stability, this system proved flawed. The fluctuating relative prices of gold and silver created opportunities for arbitrage, weakening the dollar's value. Furthermore, the lack of a robust central banking system meant the young nation lacked a crucial mechanism for regulating the money supply and ensuring stability.

- Lack of a central banking system: This led to inconsistent monetary policy and reliance on often-unregulated private banks.

- Reliance on private banks: These banks frequently issued their own banknotes, further complicating the monetary landscape and creating inconsistencies in the value of currency across the nation.

- Fluctuating commodity prices: The value of the dollar was directly linked to the price of gold and silver, making it vulnerable to market fluctuations and international events.

The First Bank of the United States and its eventual demise

The First Bank of the United States, chartered in 1791, played a crucial role in stabilizing the early U.S. dollar. It acted as a central bank, regulating the money supply and providing financial services. However, its existence was controversial. Debates raged about the constitutionality of a national bank and the balance of power between the federal government and individual states. The bank's charter was not renewed in 1811, leading to a period of renewed instability for the U.S. dollar.

- Debates about federal power: The very existence of the national bank sparked fierce political debates, highlighting the tensions between states' rights and federal authority.

- State vs. national interests: The bank's policies often favored national interests over those of individual states, further fueling political opposition.

- Impact of the bank's failure on the dollar's stability: The closure of the bank contributed to a period of economic instability and uncertainty, undermining the U.S. dollar's value and highlighting the need for a strong, centralized financial system.

The Nixon Shock and its Impact on the U.S. Dollar

The Nixon Shock of 1971, a series of economic measures implemented by President Richard Nixon, profoundly impacted the U.S. dollar and the global monetary system. This marked a turning point in the currency's history.

The Context of the 1971 Decision to Close the Gold Window

The Bretton Woods system, established after World War II, had pegged the value of most currencies to the U.S. dollar, which was itself convertible to gold at a fixed rate. However, persistent inflation and growing trade deficits put immense pressure on the U.S. dollar and the system itself. Nixon's decision to close the gold window, effectively ending the dollar's convertibility to gold, was a response to these economic pressures.

- Inflation: Rising inflation eroded the purchasing power of the dollar, both domestically and internationally.

- Trade deficits: The U.S. was running large trade deficits, meaning more dollars were flowing out of the country than were coming in, putting pressure on the dollar's value.

- Loss of confidence in the dollar's convertibility to gold: Growing concerns about the U.S.'s ability to maintain the gold standard fueled speculation and a loss of confidence in the dollar.

Short-Term and Long-Term Consequences of the Nixon Shock

The Nixon Shock had immediate and far-reaching consequences. The short-term impact included increased inflation globally. In the long term, it led to a shift towards floating exchange rates, where currency values are determined by market forces rather than fixed rates. This also contributed to the rise of the petrodollar, further solidifying the U.S. dollar's global influence.

- Increased inflation: The decision to abandon the gold standard contributed to a period of increased inflation worldwide.

- Floating exchange rates: The move away from fixed exchange rates created a more volatile but also more flexible global monetary system.

- Rise of the petrodollar: The decision to price oil in U.S. dollars increased the demand for the currency globally.

- Long-term shift in global monetary policy: The Nixon Shock fundamentally altered the global monetary landscape, creating the system we know today.

Parallel Challenges: Instability and Political Uncertainty

Both the early years of the U.S. dollar and the Nixon era were characterized by significant economic and political uncertainty. These parallels offer valuable insights into the relationship between political stability and the health of a national currency.

Economic Uncertainty Impacting Public Trust

The economic anxieties of the early republic, marked by financial panics and fluctuating currency values, mirrored the uncertainty experienced during the Nixon administration. High inflation and economic instability during Nixon's tenure eroded public trust in the government's ability to manage the economy. In both periods, political polarization further exacerbated economic anxieties.

- Public distrust in government: Both periods saw a significant erosion of public trust in the government's ability to manage the economy effectively.

- Political polarization: Intense political divisions hindered effective policymaking and contributed to economic uncertainty in both eras.

- Parallels in economic policy debates: The debates surrounding economic policy, including the role of government intervention, showed remarkable similarities across both periods.

The Role of International Relations and Global Trade

International relations profoundly impacted the U.S. dollar's value and stability in both the early republic and the Nixon era. Managing trade balances and navigating complex global economic relations proved challenging in both periods.

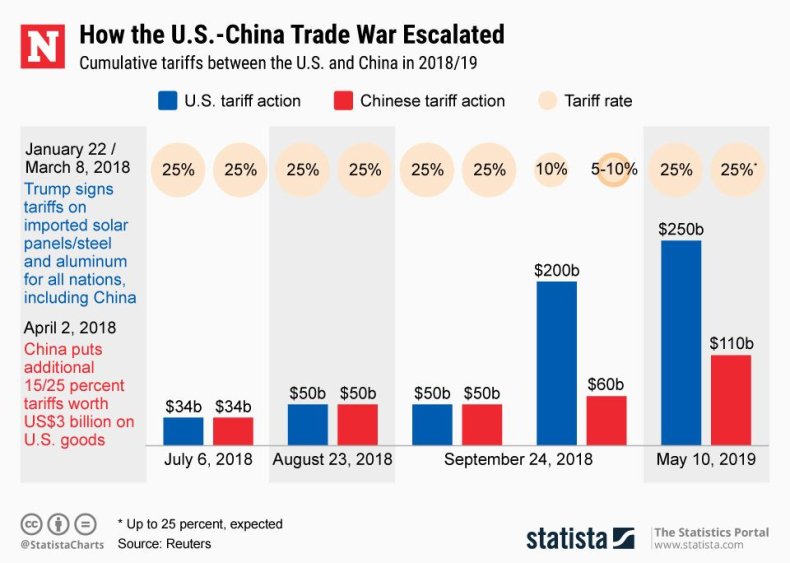

- Trade wars: The early republic faced trade disputes with European powers, and the Nixon administration also navigated challenges related to global trade and international economic relations.

- Global economic crises: Both eras witnessed global economic crises that further destabilized the U.S. dollar and the broader global economy.

- Competing economic powers: The U.S. faced competition from other major economic powers in both periods, impacting the dollar's relative strength.

Conclusion

The U.S. dollar's journey, from its troubled beginnings to its current position, reveals vital lessons about economic stability and the interplay between domestic policy and global affairs. Comparing its early struggles with the tumultuous Nixon era highlights the enduring challenges of managing a complex financial system within a volatile political landscape. Understanding this historical context is crucial for navigating the present and future economic landscape. Further research into the history of the U.S. dollar and its relationship with political events will provide deeper insights into its resilience and future prospects. Learn more about the fascinating history of the U.S. dollar and its ongoing evolution.

Featured Posts

-

Is Espn Right Analyzing Their Red Sox 2025 Prediction

Apr 28, 2025

Is Espn Right Analyzing Their Red Sox 2025 Prediction

Apr 28, 2025 -

Kl Ma Tryd Merfth En Fn Abwzby 19 Nwfmbr

Apr 28, 2025

Kl Ma Tryd Merfth En Fn Abwzby 19 Nwfmbr

Apr 28, 2025 -

Us China Trade Some Products Escape Tariffs

Apr 28, 2025

Us China Trade Some Products Escape Tariffs

Apr 28, 2025 -

How The Red Sox Can Replace Tyler O Neill In 2025

Apr 28, 2025

How The Red Sox Can Replace Tyler O Neill In 2025

Apr 28, 2025 -

New York Mets Vs Minnesota Twins Final Score 6 3

Apr 28, 2025

New York Mets Vs Minnesota Twins Final Score 6 3

Apr 28, 2025