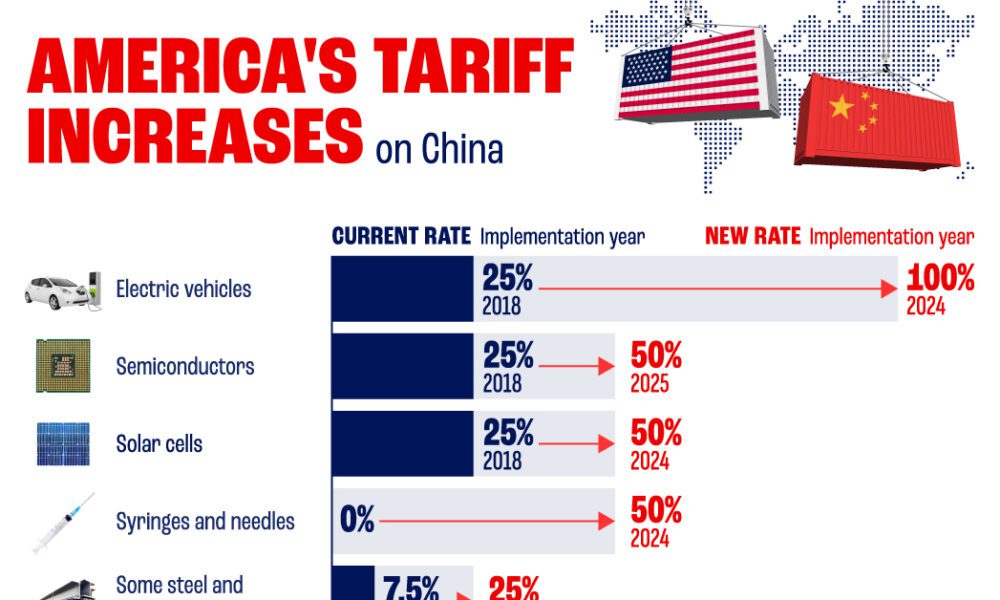

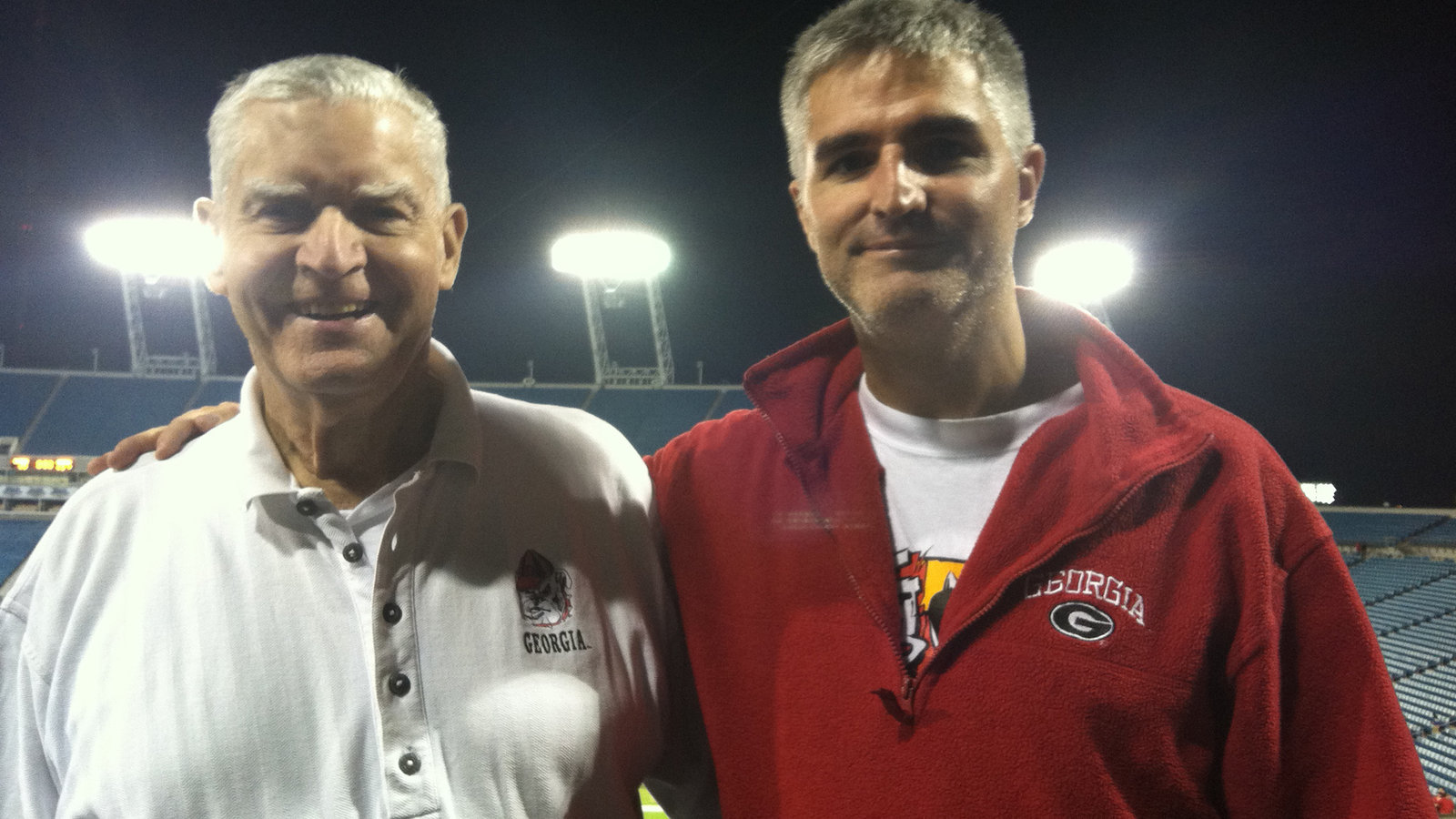

U.S. Economy And The U.S.-China Tariff Rollback: A Comprehensive Analysis

Table of Contents

Impact on Inflation and Consumer Prices

A U.S.-China tariff rollback could significantly impact inflation and consumer prices in the United States. The reduction or elimination of tariffs on Chinese goods would directly translate to lower import costs for American consumers and businesses.

Reduced Import Costs

- Examples of specific goods affected: Electronics, clothing, furniture, and numerous manufactured goods currently subject to tariffs would likely see price reductions. This could lead to a noticeable decrease in the Consumer Price Index (CPI).

- Potential impact on consumer spending: Lower prices could boost consumer purchasing power, stimulating demand and economic growth. Consumers might allocate more disposable income towards other goods and services, driving overall economic activity.

- Analysis of existing inflation data: Current inflation data, particularly regarding import prices, can be analyzed to model the potential impact of a tariff rollback. This requires comparing pre-tariff and post-tariff price levels for various goods to gauge the potential magnitude of price reductions.

Supply Chain Efficiency

Easing trade tensions through a tariff rollback could improve supply chain efficiency and reduce transportation costs.

- Potential bottlenecks relieved: Reduced trade friction could alleviate existing supply chain bottlenecks, streamlining the flow of goods from China to the U.S. This could lead to more predictable delivery times and reduced inventory costs for businesses.

- Impact on manufacturing timelines: Manufacturers would benefit from more reliable access to components and materials, shortening production timelines and improving overall operational efficiency.

- Potential for job growth in logistics and related sectors: Increased trade volume resulting from a tariff rollback could create job opportunities in logistics, transportation, and warehousing, boosting employment in these sectors.

Effects on Specific U.S. Industries

The effects of a U.S.-China tariff rollback would vary significantly across different U.S. industries.

Agriculture

- Specific crops and products affected: Soybeans, pork, and other agricultural products that faced significant tariffs would likely see increased export opportunities to China.

- Analysis of market share changes: A tariff rollback could significantly impact market share, potentially boosting U.S. agricultural exports and competitiveness in the global market.

- Impact on farm incomes: Increased demand and higher prices for agricultural products could translate into improved farm incomes and greater economic stability for rural communities.

Manufacturing

- Sectors most affected (e.g., steel, technology): Industries like steel and certain technology sectors that faced substantial tariffs would see the most direct impact, potentially leading to increased competitiveness and job creation.

- Potential for job creation or loss: While some sectors might experience job growth, others might face challenges adapting to increased competition from lower-priced imports. A thorough assessment of potential job displacement versus creation is crucial.

- Impact on domestic production: The rollback could lead to shifts in domestic production, potentially affecting the viability of certain manufacturing facilities.

Technology Sector

- Impact on innovation: Reduced trade tensions could foster greater collaboration between U.S. and Chinese tech companies, potentially accelerating innovation. However, concerns regarding intellectual property protection remain significant.

- Supply chain disruptions: The rollback could ease existing supply chain disruptions affecting the technology sector, improving the reliability of component sourcing.

- Potential for increased competition: Lower import costs for Chinese tech products could increase competition in the U.S. market, driving innovation and potentially impacting prices for consumers.

Geopolitical Implications and International Trade

A U.S.-China tariff rollback carries significant geopolitical implications.

Impact on U.S. Global Standing

- Impact on trade agreements: The rollback could set a precedent for future trade negotiations, potentially influencing the U.S.'s approach to trade agreements with other countries.

- Potential for increased trust and cooperation: Reduced trade tensions could lead to increased trust and cooperation between the U.S. and China, potentially improving overall international relations.

- Implications for future trade policies: The success or failure of a tariff rollback will heavily influence future trade policy decisions, impacting the overall direction of U.S. trade relations.

Shifting Global Trade Dynamics

- Potential new trade partnerships: A change in U.S.-China trade relations might prompt businesses to explore alternative trade partnerships, potentially reshaping global supply chains.

- Diversification of supply chains: Companies might diversify their sourcing to reduce reliance on a single country, enhancing the resilience of their supply chains.

- Impact on global economic growth: The overall impact on global economic growth would depend on the extent to which the rollback reduces trade friction and fosters greater international cooperation.

Conclusion

A U.S.-China tariff rollback would have multifaceted impacts on the U.S. economy. While it could potentially ease inflationary pressures, boost consumer spending, and improve supply chain efficiency, it also presents challenges for certain U.S. industries and necessitates careful consideration of its geopolitical implications. Understanding the intricacies of the U.S. economy and the U.S.-China tariff rollback is crucial for informed decision-making. Further research into the long-term effects of this trade policy is essential. Continue the conversation by sharing your thoughts on the potential impacts of a U.S.-China tariff reduction on the U.S. economy.

Featured Posts

-

Myanmar Memperkuat Upaya Pemberantasan Judi Online Dan Penipuan Telekomunikasi

May 13, 2025

Myanmar Memperkuat Upaya Pemberantasan Judi Online Dan Penipuan Telekomunikasi

May 13, 2025 -

Spisak Glumaca U Filmu Avengers Doomsday

May 13, 2025

Spisak Glumaca U Filmu Avengers Doomsday

May 13, 2025 -

Cp Music Productions A Father Son Legacy In Music

May 13, 2025

Cp Music Productions A Father Son Legacy In Music

May 13, 2025 -

Derbito Go Reshi Se Barnli I Lids Povtorno Vo Premier Ligata

May 13, 2025

Derbito Go Reshi Se Barnli I Lids Povtorno Vo Premier Ligata

May 13, 2025 -

Pochemu Lishili Roditelskikh Prav Syna Kadyshevoy Semeyniy Skandal

May 13, 2025

Pochemu Lishili Roditelskikh Prav Syna Kadyshevoy Semeyniy Skandal

May 13, 2025