U.S. Federal Reserve Rate Decision: Weighing Economic Pressures

Table of Contents

Inflationary Pressures and the Fed's Mandate

The Federal Reserve's primary mandate is to maintain price stability and maximum employment. However, these two goals can sometimes conflict, creating a complex challenge for policymakers. Currently, inflationary pressures are a major concern.

Persistent Inflation

Inflation remains stubbornly high, significantly deviating from the Fed's target of 2%.

- CPI data: The Consumer Price Index (CPI) continues to show elevated inflation rates.

- PPI data: Producer Price Index (PPI) data also reflects persistent inflationary pressures throughout the supply chain.

- Core inflation: Even when volatile food and energy prices are excluded (core inflation), inflation remains above the target.

- Impact of supply chain issues: Ongoing global supply chain disruptions continue to contribute to higher prices for many goods.

- Energy prices: Fluctuations in energy prices, particularly oil, significantly impact overall inflation.

- Food prices: Rising food prices, driven by factors such as climate change and geopolitical instability, add to inflationary pressures.

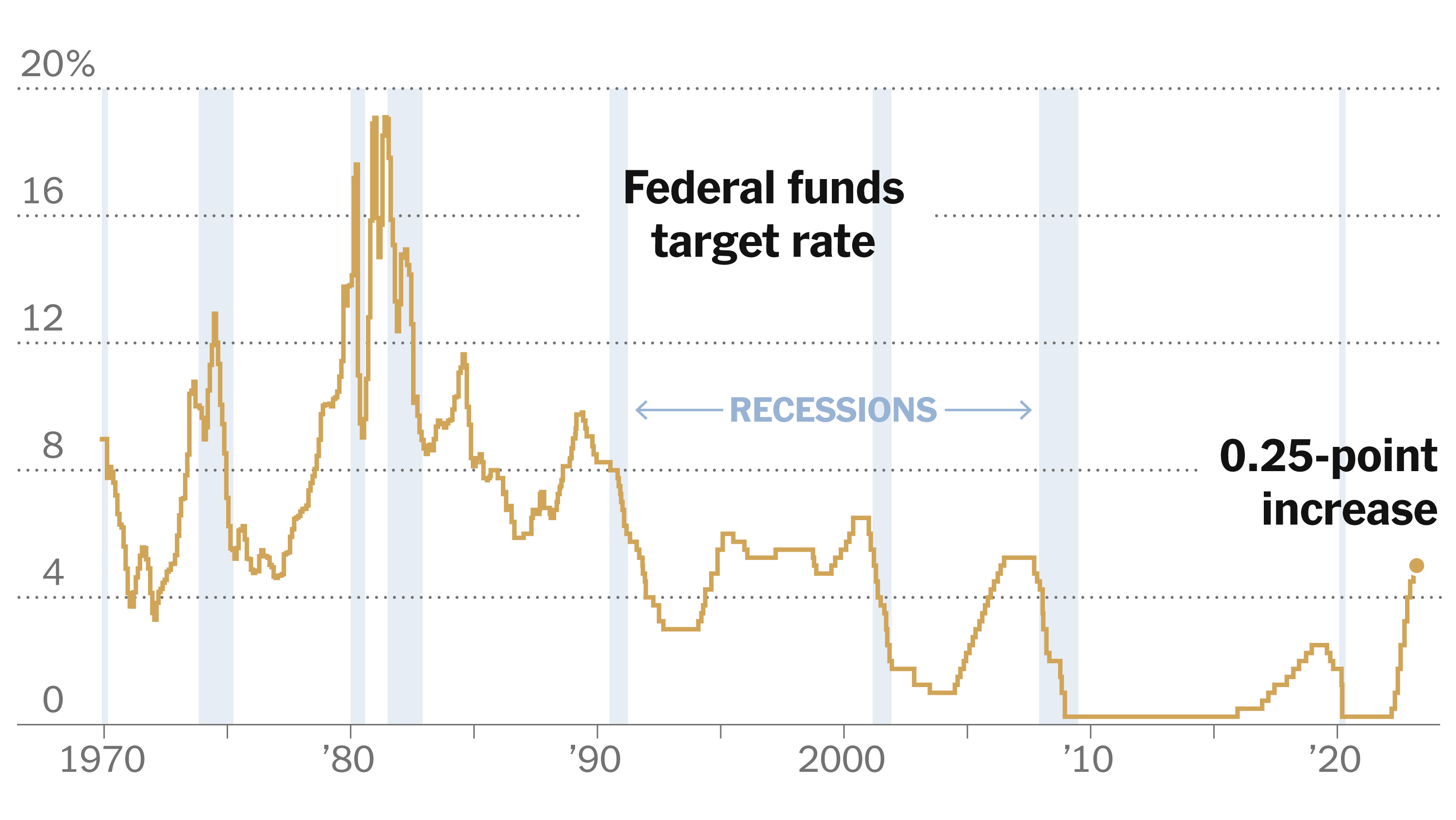

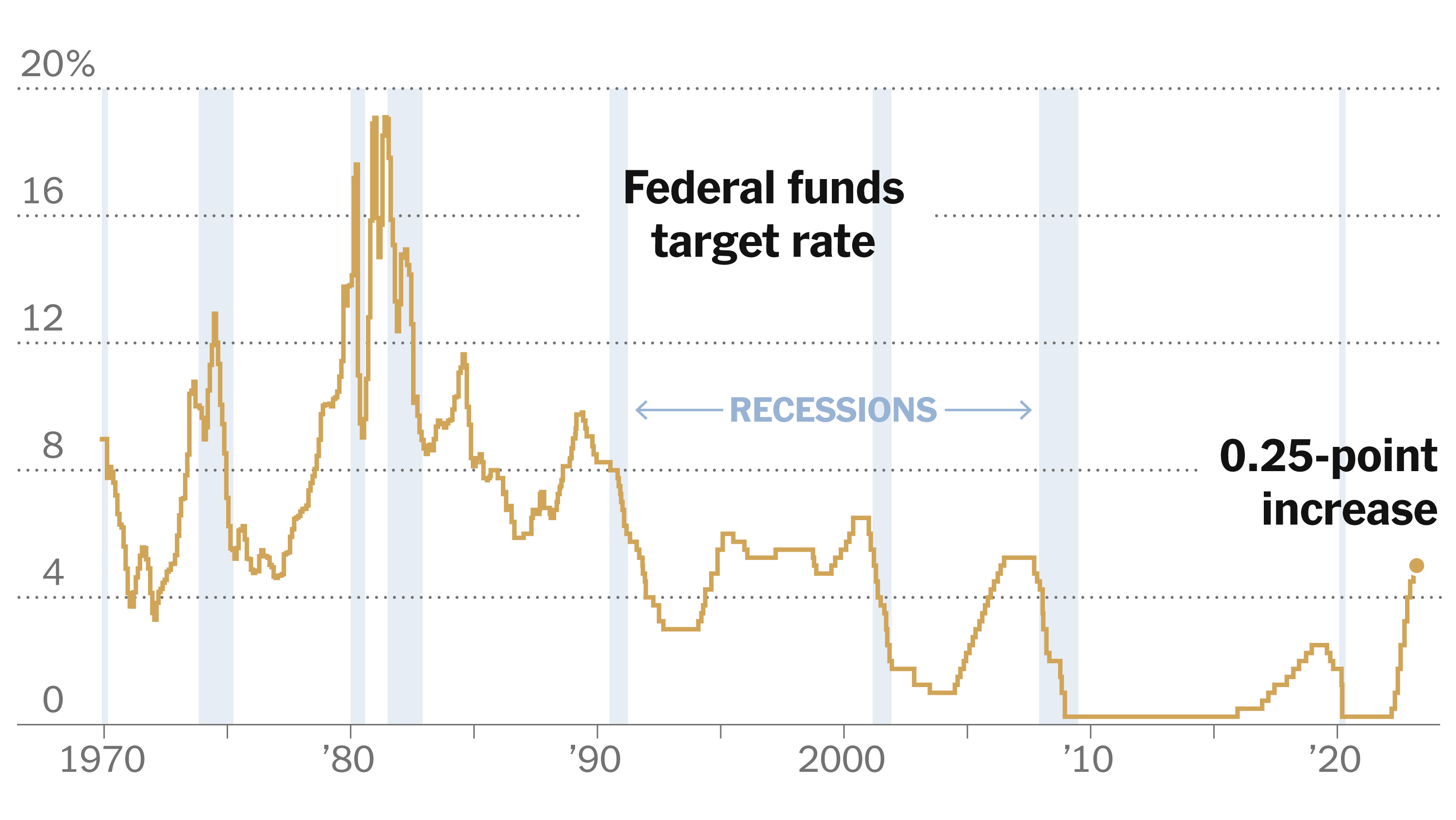

Persistent inflation forces the Fed to consider raising interest rates to cool down the economy and curb demand. Higher interest rates make borrowing more expensive, potentially slowing down economic activity and reducing inflationary pressure.

The Fed's Dual Mandate

The Fed's dual mandate requires a delicate balancing act. While controlling inflation is crucial for long-term economic health, raising interest rates too aggressively risks triggering a recession and increasing unemployment.

- Balancing inflation control with employment growth: The Fed must carefully weigh the risks of higher inflation against the risks of higher unemployment.

- Potential trade-offs: There's always a trade-off between controlling inflation and fostering employment growth. The Fed aims to find a sustainable path that minimizes negative impacts on both fronts.

The Fed analyzes various economic indicators to determine the optimal course of action, striving to achieve both price stability and maximum employment, even if it means accepting some degree of short-term pain.

Economic Growth and Recessionary Risks

The health of the overall economy plays a significant role in the Fed's rate decisions. Strong economic growth can tolerate higher interest rates, while a weakening economy requires a more cautious approach.

GDP Growth and Forecasts

Current and projected GDP growth rates are crucial indicators.

- Recent GDP reports: Recent GDP reports provide insights into the current state of the economy.

- Forecasts from various economic institutions: Forecasts from organizations like the IMF, World Bank, and private sector economists provide valuable perspectives on future economic growth.

- Potential for a recession: The risk of a recession significantly influences the Fed's decision-making process. A looming recession might lead to lower interest rates to stimulate economic activity.

A slowdown in GDP growth increases the likelihood that the Fed will opt for a less aggressive approach to interest rate hikes or even consider rate cuts to prevent a recession.

Job Market Dynamics

The strength of the job market is another key factor.

- Unemployment rates: Low unemployment rates often suggest a strong economy, allowing for higher interest rates.

- Job creation numbers: Consistent job creation indicates a healthy economy, providing the Fed with more leeway in its monetary policy.

- Wage growth: Rapid wage growth can fuel inflation, prompting the Fed to raise interest rates to cool down wage increases.

- Labor force participation rate: The labor force participation rate reflects the overall health of the labor market.

A robust job market, with low unemployment and strong wage growth, gives the Fed more flexibility to manage inflation through interest rate increases.

Global Economic Factors and Geopolitical Risks

The U.S. economy is interconnected with the global economy, making international conditions and geopolitical events influential factors in the Fed's decisions.

International Inflation

Global inflation trends directly impact the U.S. economy.

- Inflation rates in major economies: High inflation in other countries can lead to increased import prices in the U.S.

- Impact of global supply chains: Global supply chain disruptions continue to influence inflation worldwide, impacting the U.S. economy.

International inflation significantly influences the Fed's assessment of domestic inflationary pressures and its subsequent policy decisions.

Geopolitical Uncertainty

Geopolitical events can create uncertainty and volatility in the markets.

- Examples of geopolitical events and their economic consequences: Wars, trade disputes, and political instability can all disrupt supply chains, increase prices, and impact investor confidence.

Geopolitical risks, by adding uncertainty to the economic outlook, can influence the Fed's decision to adopt a more cautious approach to interest rate adjustments.

Conclusion

The upcoming U.S. Federal Reserve rate decision is a complex calculation, weighing several interconnected factors. Inflationary pressures, economic growth, job market dynamics, global economic conditions, and geopolitical risks all play crucial roles. The Fed faces a delicate balancing act, aiming to control inflation without triggering a recession. Understanding these pressures is crucial for navigating the economic landscape.

Call to Action: Stay informed about the upcoming U.S. Federal Reserve rate decision and its impact on your financial decisions. Monitor reliable economic news sources for updates and analyses of the U.S. Federal Reserve rate decision and its implications. Understanding these factors empowers you to make informed financial choices and adjust your investment strategies accordingly. Keep up-to-date on future U.S. Federal Reserve rate decisions to effectively manage your financial well-being.

Featured Posts

-

El Salvador Prison Transfers Jeanine Pirros Stance On Due Process

May 09, 2025

El Salvador Prison Transfers Jeanine Pirros Stance On Due Process

May 09, 2025 -

Review St Albert Dinner Theatres Hilarious Fast Flying Farce

May 09, 2025

Review St Albert Dinner Theatres Hilarious Fast Flying Farce

May 09, 2025 -

Madeleine Mc Cann Case New Dna Evidence And A 23 Year Olds Claim

May 09, 2025

Madeleine Mc Cann Case New Dna Evidence And A 23 Year Olds Claim

May 09, 2025 -

Edmonton Unlimited A New Strategy For Global Tech And Innovation

May 09, 2025

Edmonton Unlimited A New Strategy For Global Tech And Innovation

May 09, 2025 -

Kilmar Abrego Garcia From El Salvadors Gang Violence To Us Political Controversy

May 09, 2025

Kilmar Abrego Garcia From El Salvadors Gang Violence To Us Political Controversy

May 09, 2025