Uber Stock And Recession: Why Analysts Remain Bullish

Table of Contents

Uber's Diversified Revenue Streams as a Recession Hedge

Uber's diversified revenue streams act as a significant hedge against economic downturns. Unlike companies reliant on a single product or service, Uber's business model spans multiple sectors, mitigating risk during periods of economic contraction. This diversification, encompassing rides, Uber Eats, and Uber Freight, ensures that even if one segment experiences a slowdown, others can compensate, contributing to the overall resilience of the business model.

-

Increased demand for cost-effective food delivery services during economic hardship. When disposable income shrinks, consumers often seek more affordable dining options, boosting demand for food delivery platforms like Uber Eats. This increased reliance on convenient, at-home meal solutions translates directly into higher revenue for Uber.

-

Growth in Uber Freight as businesses seek efficient logistics solutions. Even during a recession, businesses still need to transport goods efficiently. Uber Freight offers a flexible and scalable logistics solution, making it an attractive option for businesses looking to optimize their supply chains and reduce costs. This segment’s relative stability provides a buffer against downturns in other areas.

-

Resilience of the ride-sharing segment due to essential travel needs. While discretionary travel may decrease during a recession, essential travel, such as commutes to work and medical appointments, remains relatively consistent. This underlying demand ensures a baseline level of activity within Uber's ride-sharing segment, contributing to its overall resilience.

Strong Pricing Power and Cost-Cutting Measures

Uber demonstrates significant pricing power and employs effective cost-cutting measures, enhancing its profitability even during economic contractions. Their ability to dynamically adjust pricing based on demand ensures revenue optimization, while their focus on operational efficiency minimizes unnecessary expenses. This strategic approach contributes to margin expansion and strengthens their position during uncertain economic times.

-

Dynamic pricing mechanisms to optimize revenue during fluctuating demand. Uber's sophisticated algorithms adjust pricing in real-time, responding to changes in demand. This ensures revenue maximization even when overall ridership or delivery orders fluctuate.

-

Efficient operational strategies to minimize expenses. Uber continuously refines its operational processes, focusing on efficiency improvements to minimize costs. This includes optimizing driver routes, streamlining logistics, and leveraging technological advancements to reduce operational overhead.

-

Focus on driver retention and engagement to avoid recruitment costs. By prioritizing driver satisfaction and retention, Uber reduces the significant costs associated with recruiting and training new drivers. This contributes to cost stability and enhances overall profitability.

Long-Term Growth Potential in Emerging Markets

Uber's international expansion into emerging markets presents substantial long-term growth opportunities. These developing economies offer untapped potential for increased market penetration and significant future revenue streams. This expansion strategy positions Uber for continued growth irrespective of short-term economic fluctuations in established markets.

-

Untapped markets with significant growth potential in Asia, Latin America, and Africa. These regions offer vast populations with increasing smartphone penetration and a growing demand for convenient transportation and food delivery services. This represents a massive opportunity for Uber to expand its user base and revenue.

-

Increased smartphone penetration driving adoption of ride-hailing and food delivery services. As smartphone ownership increases in emerging markets, so does the adoption of app-based services like Uber. This trend fuels the growth of Uber's services in these regions.

-

Strategic partnerships to accelerate market entry and penetration. Uber actively pursues strategic alliances with local businesses and organizations to accelerate its market entry and penetration in these new territories. This approach helps to navigate regulatory hurdles and build brand awareness more quickly.

Technological Innovation and Future-Proofing

Uber's commitment to technological innovation and its investment in autonomous vehicles are key factors underpinning its long-term growth prospects. These initiatives enhance efficiency, improve user experience, and ultimately contribute to a more resilient and future-proof business model, irrespective of short-term economic cycles.

-

Development of self-driving technology for cost reduction and improved efficiency. The successful implementation of autonomous vehicles could dramatically reduce operating costs, increasing profit margins and enhancing the company's competitiveness.

-

Investment in data analytics to optimize operations and enhance user experience. Uber's data-driven approach helps to optimize routing, pricing, and other operational aspects, improving efficiency and providing a better user experience.

-

Exploration of new mobility solutions and services. Uber continues to explore and develop new mobility solutions and services, diversifying its offerings and ensuring its position as a leader in the evolving transportation and logistics landscape.

Conclusion

Despite the current economic uncertainty, analysts remain bullish on Uber stock due to its diversified revenue streams, pricing power, substantial growth potential in emerging markets, and ongoing technological innovation. These factors suggest that Uber possesses the resilience to navigate economic headwinds and continue its long-term growth trajectory. The company’s adaptability and strategic focus on various sectors position it as a potentially recession-proof stock.

Call to Action: Consider adding Uber stock to your portfolio as part of a diversified investment strategy. Research the company's financials and market position further to make an informed decision about investing in this potentially recession-proof stock. Remember to consult with a financial advisor before making any investment decisions regarding Uber stock or other similar opportunities.

Featured Posts

-

Best Bitcoin And Crypto Casinos In 2025 The Ultimate Guide

May 17, 2025

Best Bitcoin And Crypto Casinos In 2025 The Ultimate Guide

May 17, 2025 -

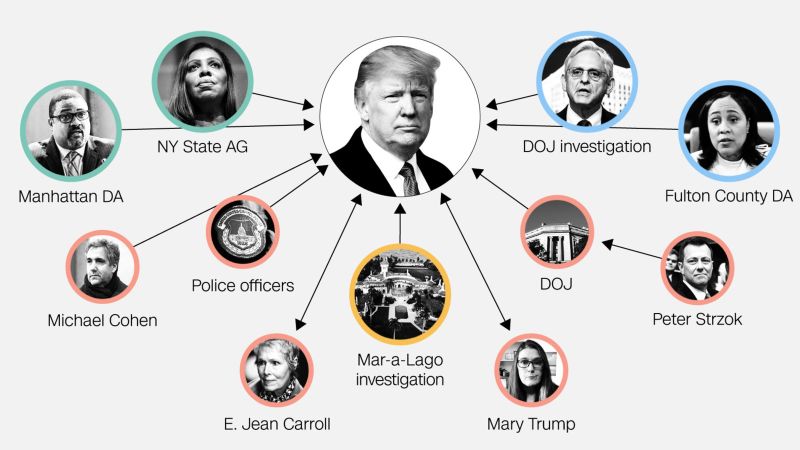

Donald Trumps Scandals Did Allegations Of Sexual Misconduct Impact His Election

May 17, 2025

Donald Trumps Scandals Did Allegations Of Sexual Misconduct Impact His Election

May 17, 2025 -

Fortnites In Game Store Epic Games Faces Fresh Legal Action

May 17, 2025

Fortnites In Game Store Epic Games Faces Fresh Legal Action

May 17, 2025 -

Analyzing Warner Bros Pictures Cinema Con 2025 Presentation

May 17, 2025

Analyzing Warner Bros Pictures Cinema Con 2025 Presentation

May 17, 2025 -

Condo Crack Crisis Seaweed Innovation And Corporate Turmoil News Summary

May 17, 2025

Condo Crack Crisis Seaweed Innovation And Corporate Turmoil News Summary

May 17, 2025