Uber Stock Rebound Hinges On Autonomous Vehicle Success

Table of Contents

The Current State of Uber's Autonomous Vehicle Program

Uber's autonomous vehicle program faces significant challenges, but also holds substantial promise. Success in this arena is crucial for the company's future.

Technological Challenges

Developing fully autonomous vehicles is incredibly complex. Uber, like its competitors, grapples with numerous technological hurdles:

- Software Development Complexities: Sensor fusion—combining data from various sensors like lidar, radar, and cameras—is a major challenge. Accurate perception of the environment and robust decision-making algorithms are equally critical and require significant advancements. Even minor errors can have severe consequences.

- Hardware Limitations: The reliability and performance of sensors are paramount. Current lidar technology can be expensive and susceptible to adverse weather conditions. Computational power needed for real-time processing of sensor data also presents a significant challenge.

- Regulatory Hurdles and Safety Concerns: Governments worldwide are carefully regulating the deployment of autonomous vehicles. Ensuring public safety is a top priority, leading to rigorous testing and approval processes that can significantly delay market entry. Public perception and acceptance of self-driving technology also play a crucial role.

Competition in the Autonomous Vehicle Market

Uber is not alone in the race to develop self-driving technology. Waymo, Cruise (General Motors), and Tesla are major competitors, each with their strengths and weaknesses.

- Waymo: Possesses a significant head start and extensive testing data.

- Cruise: Focuses heavily on urban environments.

- Tesla: Integrates its Autopilot system into its consumer vehicles, offering a different approach to autonomous driving.

Uber's strategic advantage lies in its existing ride-hailing network and vast user base, providing a ready-made platform for deploying autonomous vehicles. However, it faces a steep uphill battle against well-funded and established competitors.

Financial Investments in AV Technology

Uber has invested heavily in its Advanced Technologies Group (ATG), responsible for its autonomous vehicle development. The financial commitment is substantial, including significant R&D spending and potential future capital expenditures.

- R&D Spending: Millions of dollars are being poured into research, engineering, and testing.

- Potential ROI: The potential return on investment (ROI) is massive if Uber can successfully deploy a fleet of self-driving cars, significantly reducing operational costs and expanding its market reach. However, this ROI is uncertain and heavily reliant on technological breakthroughs and regulatory approvals.

The Potential Impact of Autonomous Vehicles on Uber's Business Model

The successful implementation of autonomous vehicles could revolutionize Uber's business model.

Reduced Operational Costs

Self-driving cars promise to drastically cut operational expenses.

- Eliminating Driver Wages: This is the most significant cost reduction, potentially saving billions annually.

- Reduced Insurance Costs: Autonomous vehicles could eventually lead to lower insurance premiums due to improved safety records (though initial costs may be high).

- Lower Fuel Consumption: Optimized routing and driving styles could contribute to fuel savings.

Increased Efficiency and Scalability

Autonomous vehicles can operate 24/7, maximizing vehicle utilization and increasing overall efficiency.

- 24/7 Operation: Unlike human drivers, autonomous vehicles don't require breaks or rest periods.

- Optimized Routing: Sophisticated algorithms can determine the most efficient routes, minimizing travel time and fuel consumption.

- Dynamic Pricing: Real-time data analysis can optimize pricing strategies based on demand and availability.

Expansion into New Markets and Services

Autonomous vehicles open doors to new revenue streams and market opportunities.

- Autonomous Delivery: Expanding beyond ride-sharing to encompass food delivery, package delivery, and other logistics services.

- Autonomous Ride-Sharing in Underserved Areas: Providing transportation options in areas with limited public transport or ride-sharing services.

- New Vehicle Types: Exploring opportunities with different vehicle types, such as self-driving buses or trucks.

Investor Sentiment and Stock Market Predictions

Investor sentiment towards Uber's stock is closely tied to the progress of its AV program.

Analyst Opinions on Uber's AV Strategy

Analyst opinions vary. Some are optimistic about the long-term potential of Uber's AV technology to significantly boost profitability and drive stock price appreciation. Others remain cautious, citing the significant technological and regulatory challenges.

Market Volatility and the Influence of AV Progress

Uber's stock price often reacts significantly to news related to its autonomous vehicle program. Positive developments, such as successful test runs or partnerships, tend to boost the stock, while setbacks or delays can lead to declines.

Long-Term Stock Projections Based on AV Success

The success or failure of Uber's autonomous vehicle program will have a profound impact on its long-term stock performance. If Uber successfully integrates self-driving technology into its operations, significant stock appreciation is likely. However, failure to achieve this goal could lead to a continued decline in stock value.

Conclusion

The future of Uber stock is intrinsically linked to the success of its autonomous vehicle program. The potential benefits—reduced operational costs, increased efficiency, and expansion into new markets—are substantial. However, significant technological, regulatory, and competitive challenges remain. Staying informed about Uber's AV progress and its implications for investors is crucial. The ultimate trajectory of the Uber stock rebound depends heavily on achieving autonomous vehicle success. Keep a close watch on this critical development that could significantly impact your investment portfolio.

Featured Posts

-

Jayson Tatum Colin Cowherds Persistent Criticism And The Ongoing Debate

May 08, 2025

Jayson Tatum Colin Cowherds Persistent Criticism And The Ongoing Debate

May 08, 2025 -

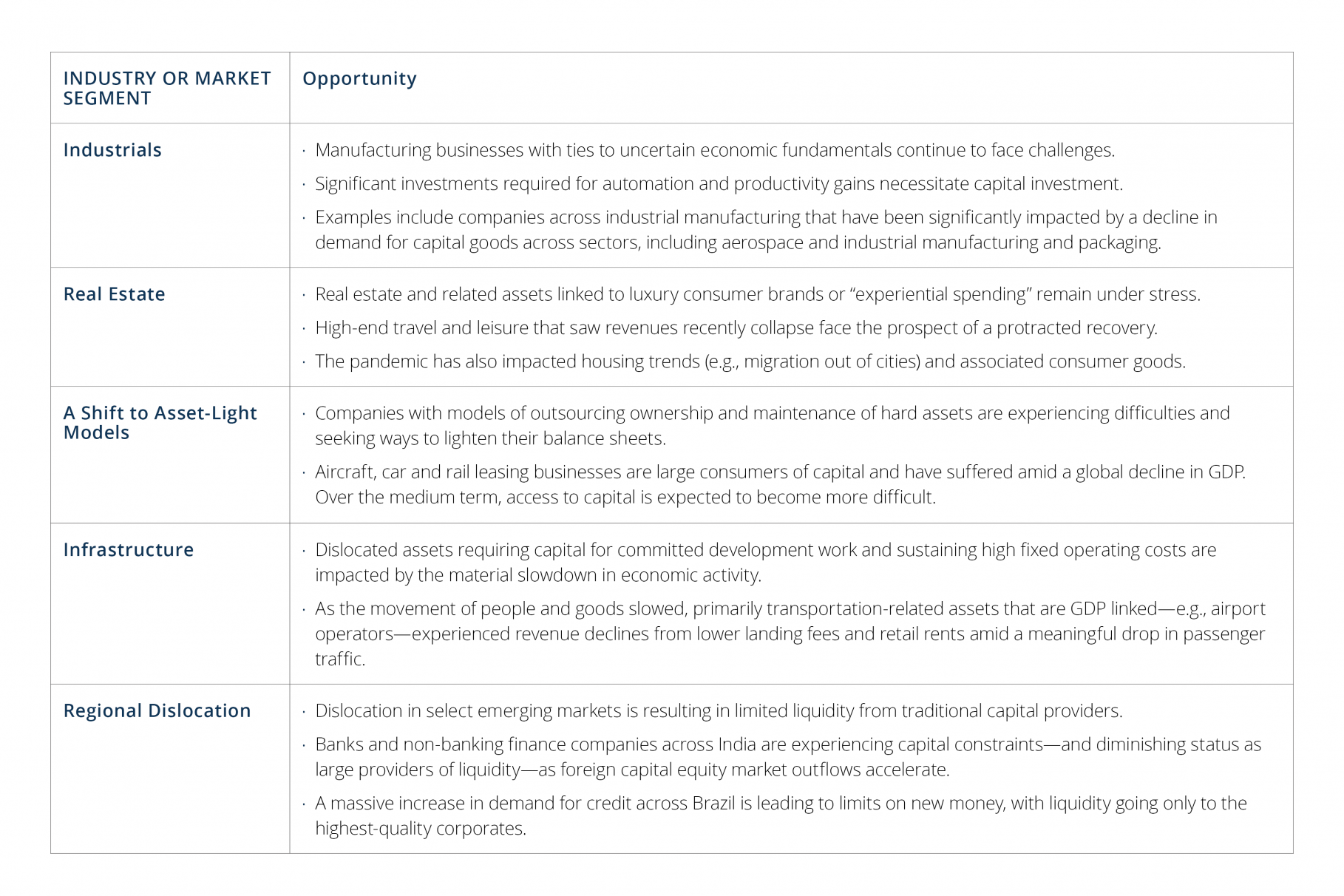

Brookfield Capitalizes On Market Dislocation With Opportunistic Investments

May 08, 2025

Brookfield Capitalizes On Market Dislocation With Opportunistic Investments

May 08, 2025 -

Urgent Action Needed The Overvalued Canadian Dollar And Its Economic Impact

May 08, 2025

Urgent Action Needed The Overvalued Canadian Dollar And Its Economic Impact

May 08, 2025 -

Why Did Scholar Rock Stock Fall On Monday A Detailed Look

May 08, 2025

Why Did Scholar Rock Stock Fall On Monday A Detailed Look

May 08, 2025 -

Wga And Sag Aftra Strike A Joint Hollywood Production Halt

May 08, 2025

Wga And Sag Aftra Strike A Joint Hollywood Production Halt

May 08, 2025