Uber Stock Recession-Proof? Analyst Insights

Table of Contents

Uber's Business Model and Recessionary Resilience

Uber's business model, built on a large network of independent contractors providing on-demand transportation and delivery services, presents a unique set of characteristics when considering its recession-proof potential. Its resilience depends heavily on its adaptability and cost-cutting capabilities.

Demand Elasticity and Pricing Power

Uber's pricing dynamically adjusts to changes in supply and demand. This flexibility is a key factor in its potential recession resilience.

- Analysis of historical data showing Uber's pricing strategies during past economic slowdowns: Studies of previous recessions show that Uber adjusted its pricing and implemented promotions to maintain rider volume. While demand did soften, it didn't collapse completely, demonstrating some resilience.

- Discussion of the price sensitivity of different user segments (e.g., essential vs. discretionary trips): Essential trips (e.g., commuting, airport transfers) are less susceptible to price changes during a recession than discretionary trips (e.g., entertainment, social outings). Uber’s ability to target these different segments with tailored pricing is vital.

- Examination of Uber's ability to adjust its service offerings (e.g., promotions, cheaper ride options) to maintain demand: Offering discounts, promotions, and cheaper ride-sharing options allows Uber to retain customers during a downturn. This strategic flexibility is critical to mitigating the impact of reduced spending.

Cost-Cutting Measures and Operational Efficiency

Uber's ability to control costs is another crucial aspect of its recession resilience.

- Discussion of Uber's efforts to optimize driver compensation and reduce operational overhead: Uber continually seeks ways to optimize its operations, including exploring strategies to balance driver earnings with platform costs.

- Analysis of Uber's technological investments aimed at improving efficiency and reducing costs: Technological advancements, like improved route optimization algorithms and automated customer service systems, contribute to cost reductions and increased efficiency.

- Assessment of Uber's ability to effectively manage its workforce during economic uncertainty: The gig economy nature of Uber's workforce offers flexibility during downturns. The company can adjust the number of active drivers based on demand without the significant fixed costs associated with traditional employment.

Analyst Perspectives on Uber Stock During Recessions

Analyst opinions on Uber's recession-proof nature are varied. Understanding these perspectives provides valuable insight into the potential risks and rewards.

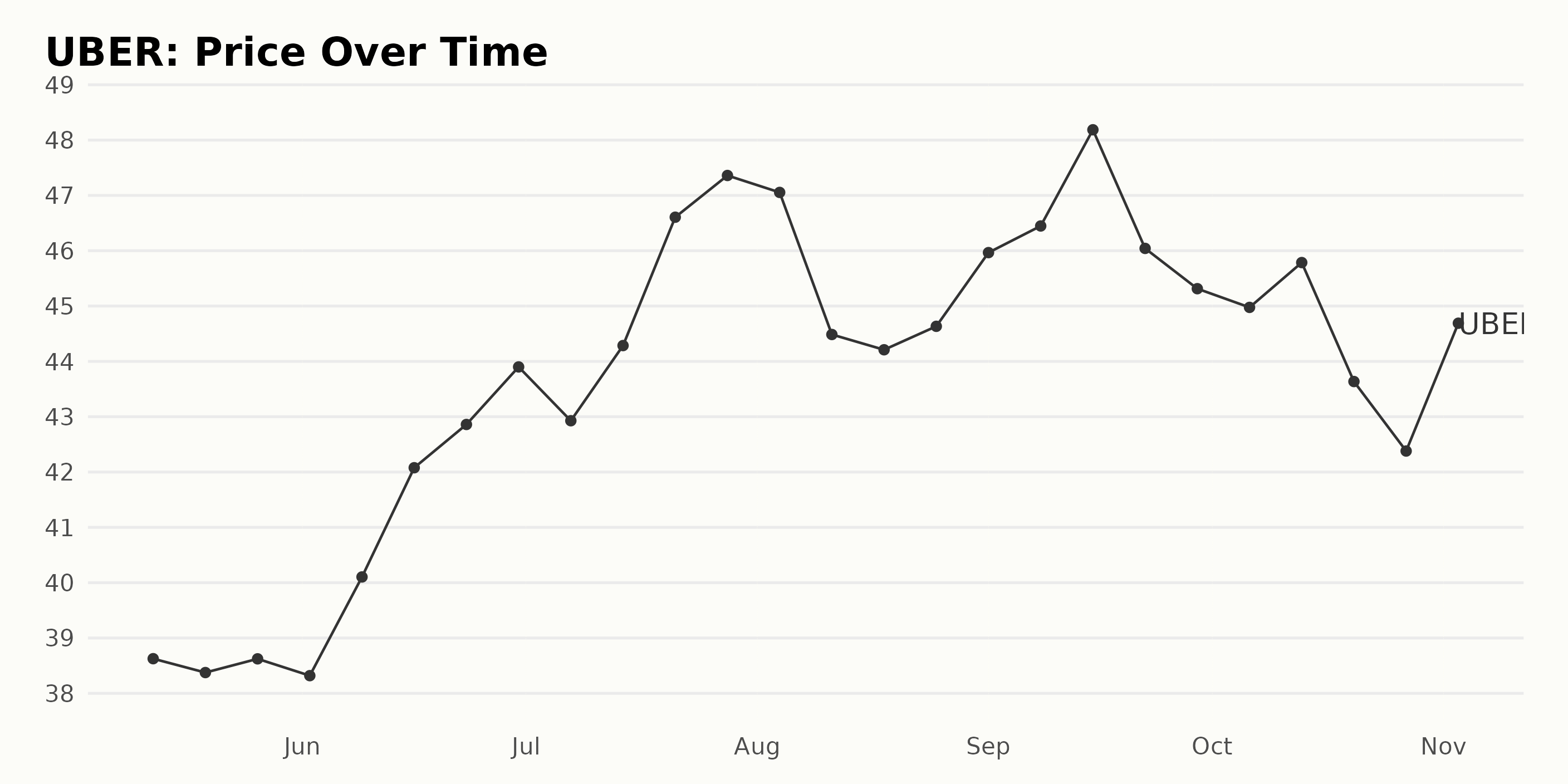

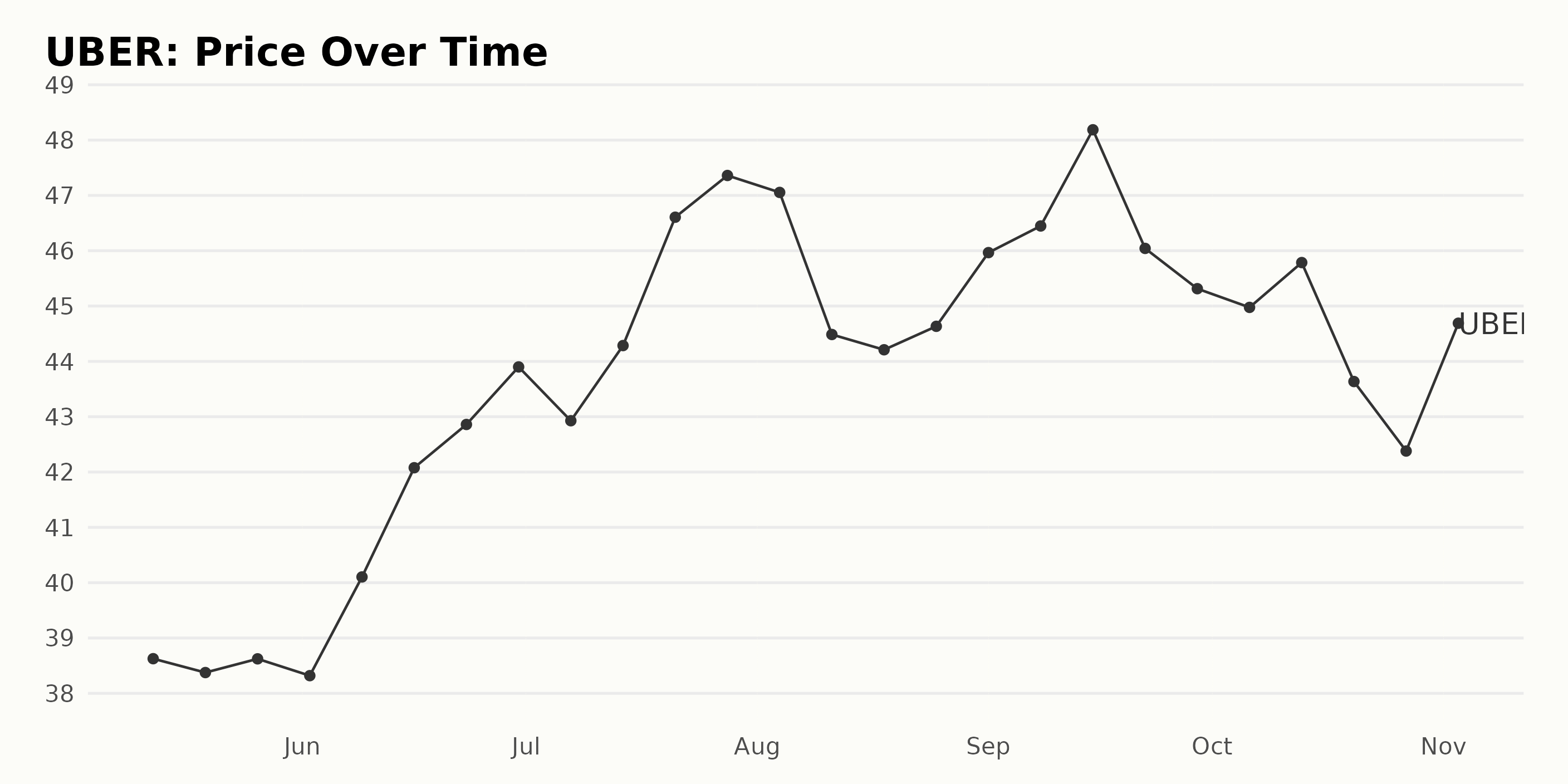

Recent Analyst Ratings and Price Targets

A review of recent analyst reports reveals a range of opinions on Uber stock's future performance.

- Compilation of buy, sell, and hold ratings from major investment banks: Leading investment banks have issued a mix of buy, sell, and hold ratings, highlighting the uncertainty surrounding Uber's future prospects in a potential recession.

- Analysis of the range of price targets assigned by analysts: Price targets for Uber stock vary significantly, reflecting different views on its resilience and growth potential during economic uncertainty.

- Identification of any key factors influencing analysts' opinions: Analyst opinions are shaped by factors such as projected ridership, the impact of inflation and fuel costs, and competition from other transportation options.

Comparison with Competitors in Similar Industries

Comparing Uber's performance to competitors reveals its relative strength and weaknesses in a recessionary environment.

- Analysis of how competitor performance during past recessions: Examining how similar transportation and technology companies fared in past recessions helps gauge the industry's overall resilience.

- Examination of factors contributing to differences in recessionary performance: Different business models, pricing strategies, and cost structures contribute to differing levels of recession resilience among competitors.

- Assessment of Uber's competitive advantages and disadvantages: Uber's global reach and diverse service offerings are advantages, but its dependence on consumer spending and fluctuating fuel costs pose risks.

Macroeconomic Factors Influencing Uber Stock

Macroeconomic factors significantly impact Uber's stock performance, influencing its resilience to recessions.

Interest Rate Changes and Inflation

Monetary policy plays a critical role in Uber's financial health.

- Analysis of how interest rate hikes affect Uber's borrowing costs and investment decisions: Higher interest rates increase Uber's borrowing costs, potentially slowing growth and impacting profitability.

- Examination of the relationship between inflation and consumer spending on ride-sharing services: Inflation can reduce consumer spending on discretionary services like ride-sharing, affecting Uber's revenue.

- Assessment of the overall macroeconomic environment's impact on Uber's growth prospects: The overall economic climate significantly influences consumer behavior and business investment, thereby affecting Uber's growth trajectory.

Fuel Prices and Their Effect on Uber's Profitability

Fluctuating fuel prices directly affect Uber's operational costs and profitability.

- Analysis of the historical relationship between fuel prices and Uber's profitability: Higher fuel prices typically squeeze Uber's profit margins, impacting its overall financial performance.

- Examination of Uber's strategies for mitigating the impact of rising fuel costs: Uber implements various strategies, such as dynamic pricing and fuel surcharges, to mitigate rising fuel costs.

- Assessment of the overall impact of fuel price volatility on Uber's long-term prospects: Fuel price volatility presents a significant risk to Uber’s long-term profitability and sustainability.

Conclusion

This article explored the complex question of whether Uber stock is truly recession-proof. While Uber's business model demonstrates some inherent resilience through adaptability and cost-cutting measures, its performance is still significantly influenced by macroeconomic factors like interest rates, inflation, and fuel prices. Analyst opinions are varied, reflecting the inherent uncertainties in predicting future market behavior. Ultimately, the decision of whether to invest in Uber stock during a recession or potential recession remains a personal one based on your individual risk tolerance and investment strategy. Further research and careful consideration of the factors discussed above are crucial before making any investment decisions regarding Uber stock's recession-proof potential. Thoroughly analyze the current economic climate and Uber's financial performance before making any investment choices related to the recession-proof nature of Uber stock.

Featured Posts

-

Poker Stars Casino How To Play The St Patricks Day Spin Of The Day

May 18, 2025

Poker Stars Casino How To Play The St Patricks Day Spin Of The Day

May 18, 2025 -

Uber Kenya New Incentive Program For Riders And Delivery Partners

May 18, 2025

Uber Kenya New Incentive Program For Riders And Delivery Partners

May 18, 2025 -

The 2025 Eurovision Song Contest Analyzing The Uks Choice And Past Controversies

May 18, 2025

The 2025 Eurovision Song Contest Analyzing The Uks Choice And Past Controversies

May 18, 2025 -

Barbara Mensch Recounting The Brooklyn Bridges History

May 18, 2025

Barbara Mensch Recounting The Brooklyn Bridges History

May 18, 2025 -

Neverovatno Podatak O Novaku Dokovicu Iznenaduje Posle 19 Godina

May 18, 2025

Neverovatno Podatak O Novaku Dokovicu Iznenaduje Posle 19 Godina

May 18, 2025