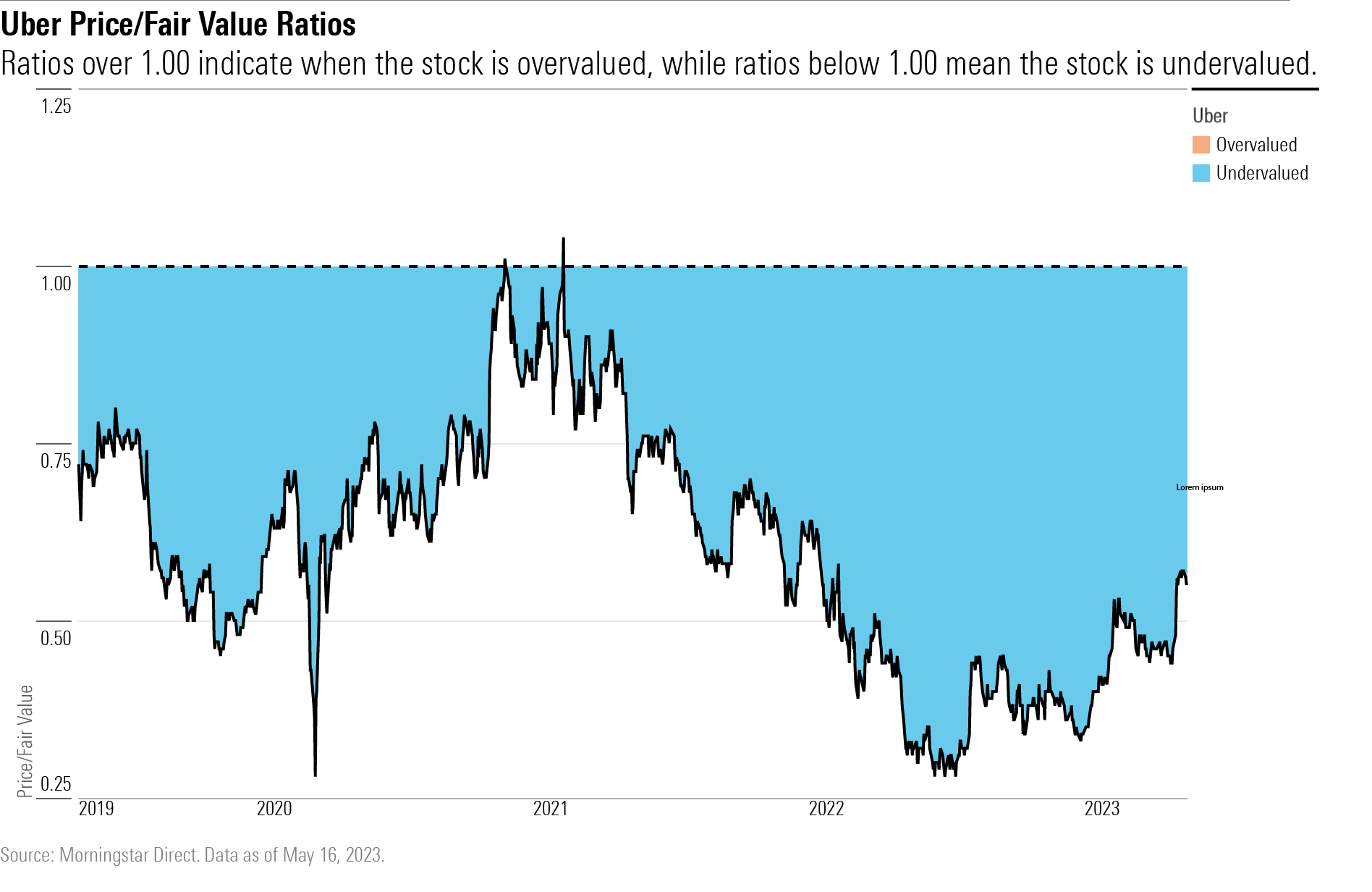

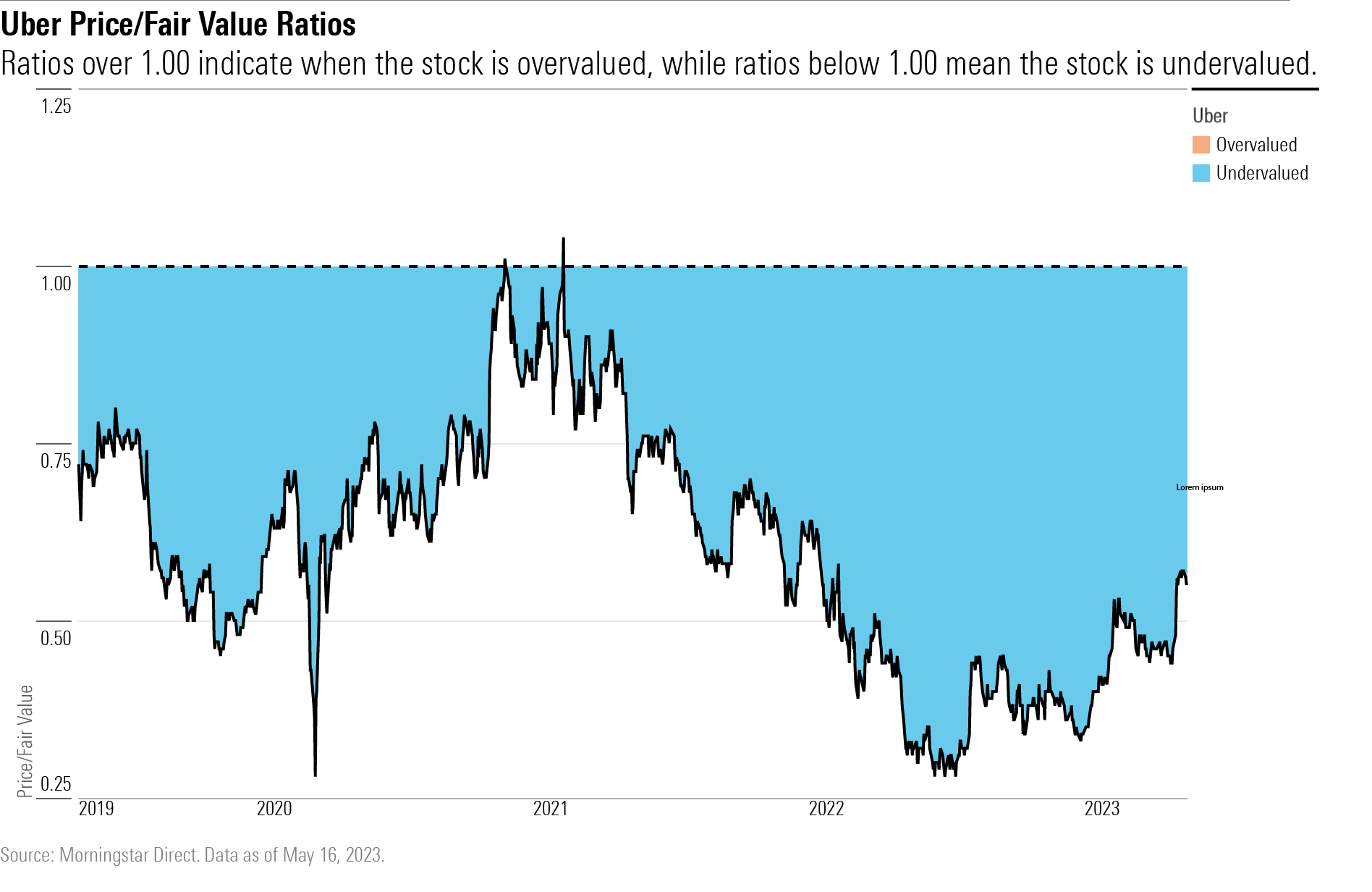

Uber Stock Surge: Understanding April's Double-Digit Rally

Table of Contents

Improved Financial Performance and Earnings Reports

The most significant driver of the Uber stock surge was the company's surprisingly strong first-quarter (Q1) earnings report. This positive financial performance significantly boosted investor confidence.

Stronger-than-expected Q1 Earnings

Uber's Q1 results exceeded analyst expectations across several key metrics.

- Revenue Growth: Uber reported a substantial increase in revenue, exceeding projections by a significant margin (insert specific percentage here if available). This signifies a strong recovery and growth in both its ride-sharing and Uber Eats delivery services.

- EBITDA: The company showed marked improvement in its Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), indicating progress towards profitability. (Insert specific numbers here if available). This positive trend suggests improved operational efficiency and cost management.

- Net Income (if applicable): If Uber reported a net profit, highlight this achievement and compare it to previous quarters and analyst forecasts. (Insert specific numbers here if available).

This improved financial performance was driven by several factors:

- Increased Ride-Sharing Demand: The post-pandemic recovery fueled a significant increase in ride-sharing demand, boosting Uber's core business.

- Growth in Uber Eats: The food delivery segment continued to perform well, capitalizing on the ongoing popularity of online food ordering.

- Cost-Cutting Measures: Uber's effective cost-cutting strategies contributed to improved margins and profitability.

Positive Market Sentiment Towards Ride-Sharing and Delivery

The positive Q1 results weren't just a company-specific phenomenon. The broader market displayed a positive outlook for the ride-sharing and food delivery industries.

- Competitor Performance: Positive performance by competitors in the sector further reinforced the market's belief in the growth potential of these industries.

- Industry Trends: Reports suggesting continued growth in the gig economy and increased adoption of on-demand services contributed to the overall positive sentiment.

- Market Growth Predictions: Industry analysts forecast continued expansion in the ride-sharing and food delivery markets, further fueling investor optimism.

This overall positive market sentiment significantly boosted investor confidence in Uber's future prospects.

Strategic Initiatives and Technological Advancements

Beyond the immediate financial results, Uber's strategic investments and technological advancements contributed to the Uber stock surge. Investors reacted positively to these forward-looking initiatives.

Investments in Technology and Automation

Uber's ongoing investments in cutting-edge technologies played a key role in shaping investor perceptions.

- Autonomous Vehicle Technology: Progress in developing self-driving technology promises long-term cost reductions and efficiency improvements.

- Driverless Delivery Initiatives: Expansion into autonomous delivery services could significantly disrupt the logistics sector and improve margins.

- Other Technological Advancements: Investments in other areas such as improved app functionality and data analytics also contribute to operational efficiency.

These innovations suggest a positive long-term outlook for the company, influencing the stock surge.

Expansion into New Markets and Services

Uber's strategic expansion into new markets and service offerings also played a part in the stock price increase.

- New Geographical Markets: Expansion into new geographic regions provides access to new customer bases and revenue streams. (List specific regions here if available).

- New Service Offerings: Introduction of new services beyond ride-sharing and food delivery diversifies Uber's revenue streams and strengthens its position in the market. (List new services here if available).

These expansions demonstrate Uber's commitment to growth and innovation, further bolstering investor confidence.

External Factors Influencing the Uber Stock Surge

External market forces also contributed to the positive response to Uber's performance.

Overall Market Conditions

The broader economic climate played a role in shaping investor sentiment.

- Interest Rate Changes: Interest rate decisions by central banks can affect investor appetite for risk and influence stock market performance.

- Inflation Levels: Inflation rates influence consumer spending and overall economic growth, which can impact companies like Uber.

- Overall Market Trends: The overall trend in the technology sector and the broader stock market can affect investor sentiment towards specific tech stocks.

Favorable market conditions enhanced the positive impact of Uber's own performance.

Analyst Upgrades and Positive Ratings

Positive analyst ratings and price target increases played a significant role in driving the Uber stock surge.

- Investment Bank Upgrades: Several prominent investment banks upgraded their ratings on Uber stock, citing the positive Q1 results and future growth potential. (List specific banks and their revised price targets here if available).

- Positive Analyst Sentiment: Analysts highlighted the company's improved financial performance, strategic initiatives, and positive market outlook.

This positive analyst sentiment further fueled investor confidence and contributed to the stock price rally.

Conclusion

April's double-digit Uber stock surge resulted from a confluence of factors. Improved earnings, technological advancements, strategic expansion, and favorable market conditions all contributed to increased investor confidence. Understanding these contributing factors is crucial for anyone interested in the future performance of Uber stock. To stay informed on future Uber stock surges and the company's overall performance, continue to monitor financial reports, industry news, and analyst insights. Remember to conduct thorough research before making any investment decisions related to Uber stock.

Featured Posts

-

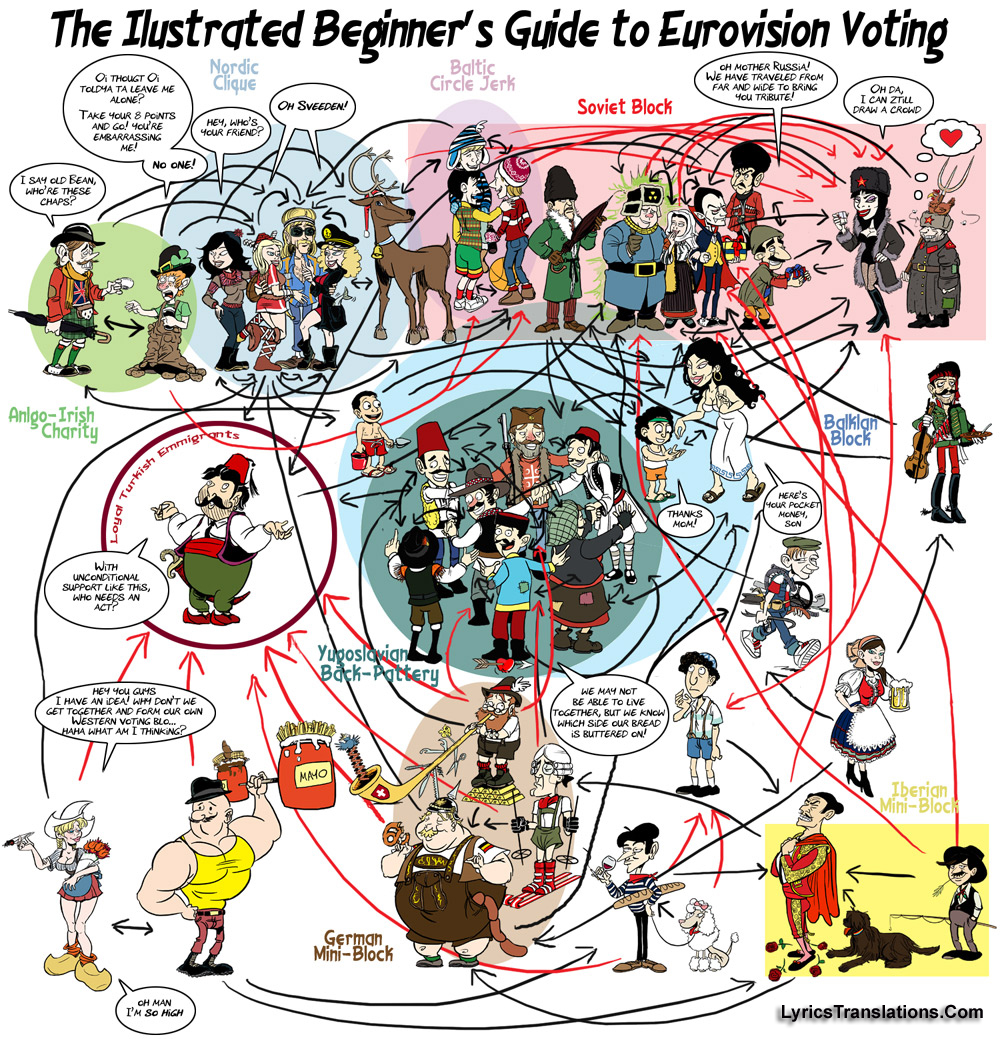

Eurovision Voting Explained From Jury To Televote

May 19, 2025

Eurovision Voting Explained From Jury To Televote

May 19, 2025 -

Tampoy Sto Mega Nea Epeisodia Nees Istories

May 19, 2025

Tampoy Sto Mega Nea Epeisodia Nees Istories

May 19, 2025 -

5 Time Grammy Nominee Announces Retirement Due To Age And Memory Issues

May 19, 2025

5 Time Grammy Nominee Announces Retirement Due To Age And Memory Issues

May 19, 2025 -

Restauration De Notre Dame De Poitiers Le Role Du Departement

May 19, 2025

Restauration De Notre Dame De Poitiers Le Role Du Departement

May 19, 2025 -

Michael Morales Continues Success Double Performance Bonus At Ufc Vegas 106

May 19, 2025

Michael Morales Continues Success Double Performance Bonus At Ufc Vegas 106

May 19, 2025