Uber Technologies (UBER): Is It A Good Investment Right Now?

Table of Contents

Uber's Financial Performance and Growth Potential

H3: Revenue Streams and Profitability: Uber's revenue streams are multifaceted, encompassing ride-sharing, Uber Eats (food delivery), and freight services. While the company has demonstrated significant revenue growth, achieving consistent profitability remains a challenge. Recent financial reports showcase fluctuating EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and uneven revenue growth across different segments.

- Challenges:

- Intense competition from Lyft, Didi, and other ride-sharing and delivery services.

- High driver costs and associated expenses, including insurance and regulatory compliance.

- Regulatory hurdles and legal battles in various jurisdictions impacting operations and profitability.

- Positive Aspects:

- Increasing market share in key regions, particularly in developing economies.

- Strong growth trajectory for Uber Eats, capitalizing on the increasing demand for food delivery services.

- Ongoing efforts to optimize pricing strategies and operational efficiency.

H3: Long-Term Growth Strategy: Uber's long-term growth hinges on strategic initiatives such as: expansion into new, underserved markets; technological advancements in autonomous vehicles; strategic partnerships with other businesses; and diversification into new service areas.

- Potential Impact: Successful implementation of these strategies could significantly boost revenue and improve profitability, solidifying Uber's position as a dominant player in the transportation and logistics sectors. Autonomous vehicles, if successfully deployed, could drastically reduce operational costs.

- Associated Risks: Technological setbacks in autonomous vehicle development, changing regulations that hinder expansion, and intense competition from established and emerging players pose significant risks. Failure to adapt to evolving consumer preferences and technological disruptions could also impact future growth.

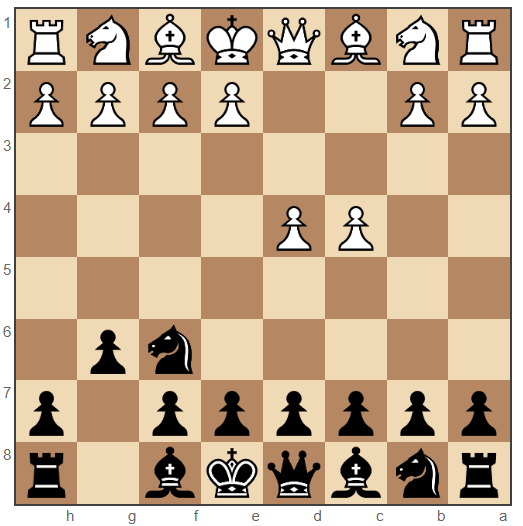

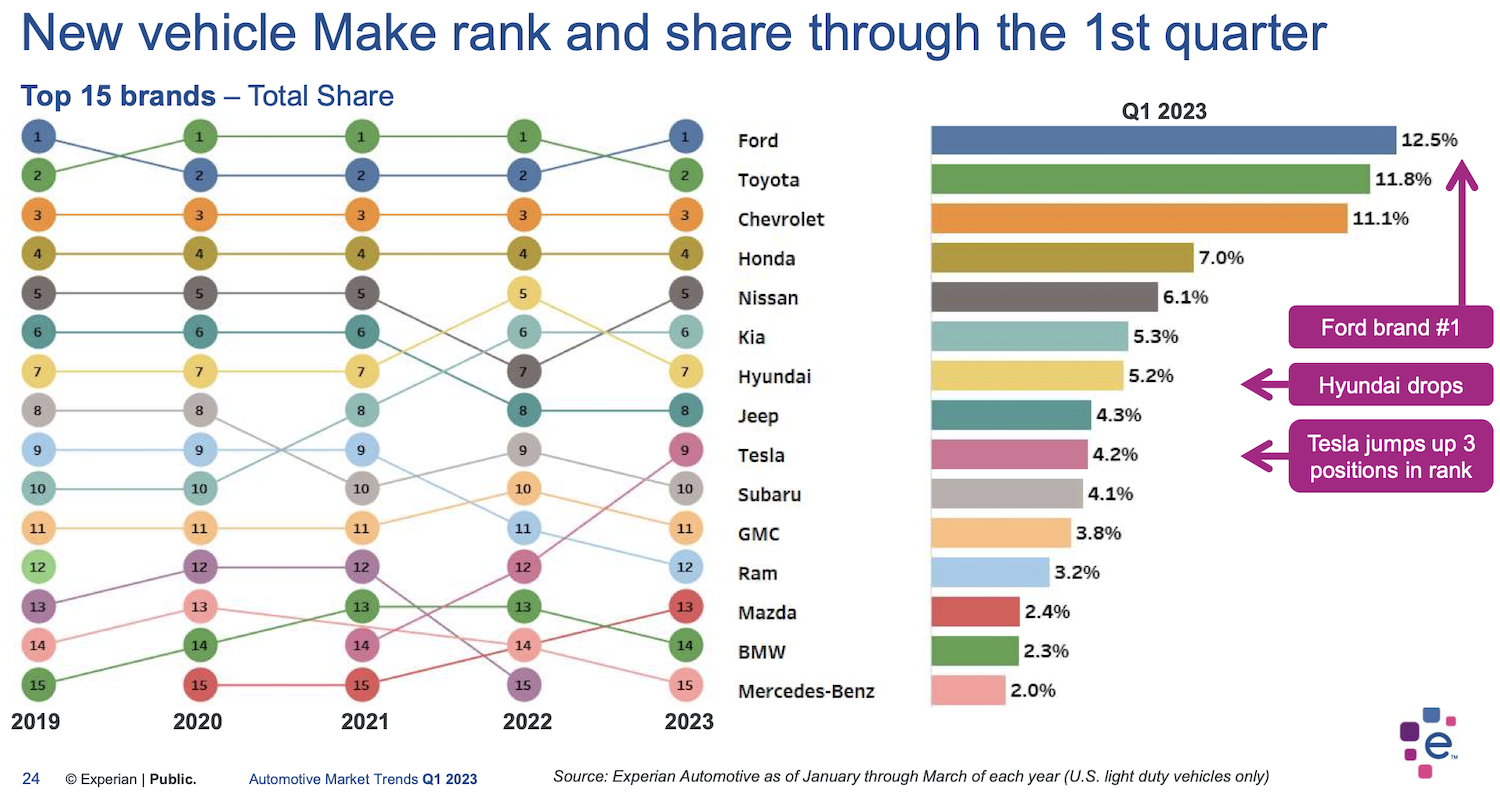

Competitive Landscape and Market Share

H3: Key Competitors and Market Dynamics: Uber faces stiff competition from established players like Lyft in the US and Didi in China, as well as emerging regional competitors. The ride-sharing market is characterized by intense price wars and a constant battle for market share.

- Competitive Analysis: Lyft's operational model and market penetration in the US represent a significant challenge. Didi's strong position in the Chinese market highlights the importance of navigating region-specific regulatory environments.

- Impact on Pricing and Market Share: Competitive pressures often lead to aggressive pricing strategies, impacting profit margins and requiring constant innovation to maintain a competitive edge.

H3: Market Saturation and Future Opportunities: While certain established markets might approach saturation, significant opportunities remain in emerging economies and untapped service areas.

- International Expansion: Uber's continued international expansion, particularly into developing markets with growing middle classes, offers substantial growth potential.

- Future Services: Diversification into micromobility (e.g., e-scooters, e-bikes), logistics and delivery services beyond food, and other related areas can create new revenue streams and mitigate reliance on a single service.

Risks and Challenges Facing Uber Technologies (UBER)

H3: Regulatory and Legal Issues: Uber operates in a heavily regulated environment, facing challenges related to licensing, labor laws (classification of drivers as employees vs. independent contractors), and data privacy.

- Regulatory Impact: Unfavorable regulations can significantly increase operational costs, restrict expansion, and impact profitability. Changes in labor laws could lead to substantial increases in driver compensation.

- Legal Battles and Investigations: Ongoing legal battles and investigations into various aspects of Uber's business pose financial and reputational risks.

H3: Economic Factors and External Threats: Macroeconomic factors like inflation, recession, and fuel price volatility can significantly impact Uber's business model and consumer demand.

- Economic Sensitivity: During economic downturns, consumers may reduce discretionary spending on ride-sharing and food delivery, directly affecting Uber's revenue.

- External Disruptions: Geopolitical instability, natural disasters, and unforeseen events can disrupt operations and negatively impact financial performance. Fuel price increases directly affect operational costs.

Conclusion

Investing in Uber Technologies (UBER) presents a complex scenario. While the company demonstrates significant revenue growth and has diversified its offerings, achieving sustained profitability remains a key challenge. Intense competition, regulatory hurdles, and economic uncertainties pose significant risks. However, the potential for future growth through technological advancements, international expansion, and diversification offers long-term upside.

Investment Recommendation: Based on the current analysis, a "hold" rating is tentatively suggested. Further observation of its financial performance and strategic initiatives is necessary before a definitive recommendation can be made.

Call to Action: While investing in Uber Technologies (UBER) presents both opportunities and challenges, thorough due diligence is crucial. Continue your research, analyze the latest financial reports, and consult with a financial advisor before making any investment decisions regarding Uber Technologies (UBER) or any other stock.

Featured Posts

-

Chinas Satellite Support To Pakistan Concerns Raised By Indian Defense Group

May 19, 2025

Chinas Satellite Support To Pakistan Concerns Raised By Indian Defense Group

May 19, 2025 -

Parg Armenias Eurovision In Concert 2025 Performance Announced

May 19, 2025

Parg Armenias Eurovision In Concert 2025 Performance Announced

May 19, 2025 -

The China Factor Analyzing The Automotive Industrys Difficulties In The Chinese Market

May 19, 2025

The China Factor Analyzing The Automotive Industrys Difficulties In The Chinese Market

May 19, 2025 -

Discover 7 Outstanding Irish Sci Fi Films This St Patricks Day

May 19, 2025

Discover 7 Outstanding Irish Sci Fi Films This St Patricks Day

May 19, 2025 -

Angie Nicholson Named Meac Softball Coach Of The Year

May 19, 2025

Angie Nicholson Named Meac Softball Coach Of The Year

May 19, 2025