Uber's Autonomous Vehicle Push: Investing In The Future With ETFs

Table of Contents

Uber's Autonomous Driving Technology and its Market Potential

Overview of Uber's Self-Driving Program (ATG) and its Progress

Uber's Advanced Technologies Group (ATG) is at the forefront of autonomous vehicle development. Their progress includes significant milestones:

- Extensive Testing: Millions of miles driven in autonomous mode across various cities.

- Strategic Partnerships: Collaborations with leading technology companies in areas like sensor technology, mapping, and AI.

- Geographic Expansion: Operational testing in multiple regions, continuously expanding its reach.

The potential market disruption from autonomous ride-sharing is immense. Imagine a future with on-demand, driverless transportation, impacting everything from personal commuting to logistics and delivery. However, Uber ATG faces challenges:

- Regulatory Hurdles: Navigating evolving regulations surrounding autonomous vehicles.

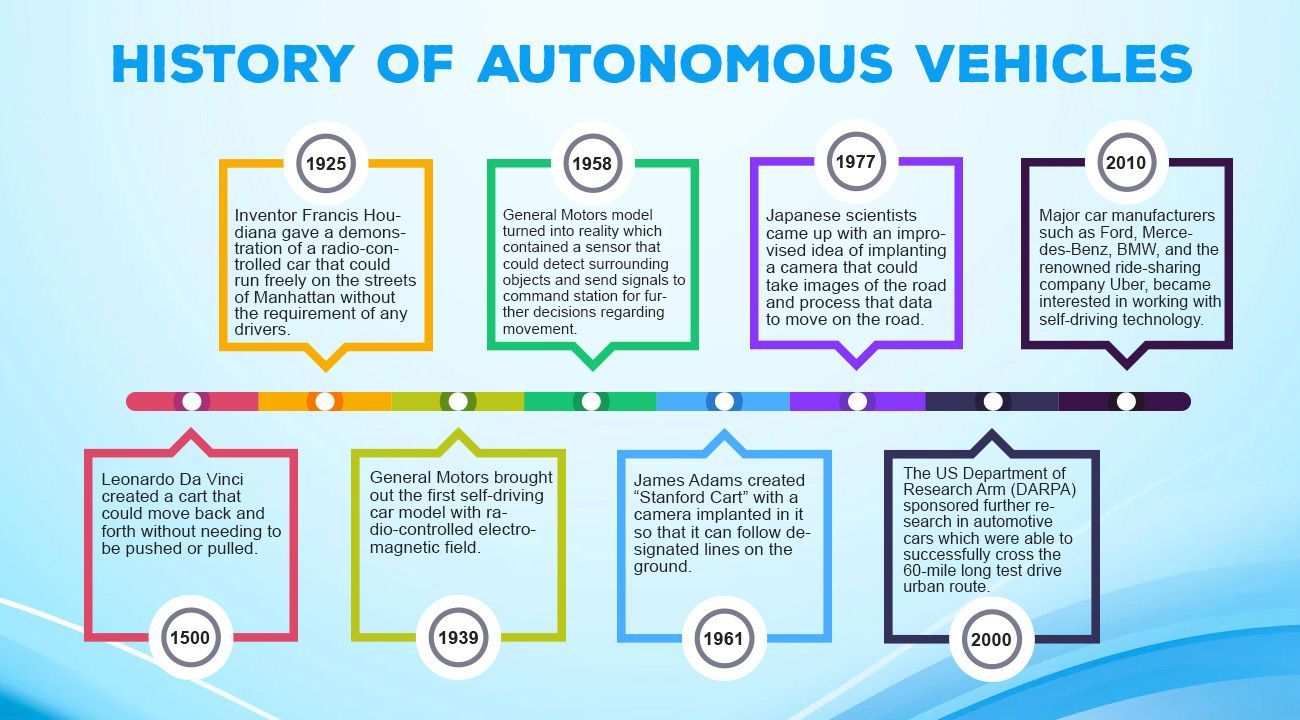

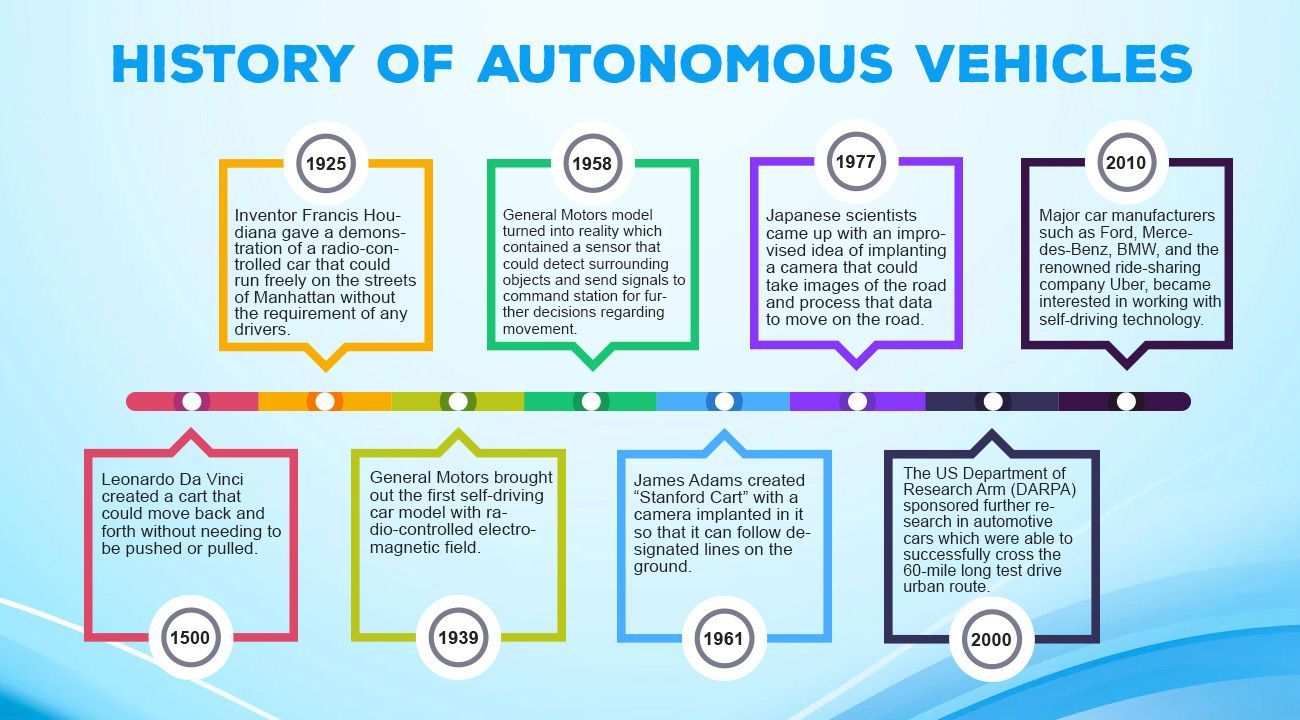

- Safety Concerns: Addressing public concerns about the safety and reliability of self-driving technology.

- Intense Competition: Competing with other tech giants and startups in the autonomous vehicle race.

The Long-Term Vision for Autonomous Vehicles in Transportation

The long-term impact of autonomous vehicles extends far beyond ride-sharing:

- Revolutionizing Logistics: Autonomous trucks and delivery vehicles can optimize supply chains and reduce transportation costs.

- Transforming Public Transportation: Self-driving buses and shuttles could improve accessibility and efficiency in public transit systems.

- Enhancing Delivery Services: Faster, more cost-effective delivery of goods, impacting e-commerce and other industries.

The economic growth potential is substantial, with job creation in areas like software development, engineering, and maintenance. Furthermore, widespread adoption of autonomous vehicles could significantly reduce carbon emissions and improve environmental sustainability.

Understanding Exchange Traded Funds (ETFs) and Their Role in Investing

What are ETFs and how do they work?

ETFs are investment funds traded on stock exchanges, offering a diversified portfolio of assets in a single investment. They are designed to track a specific index or sector, providing investors with easy access to a range of companies without the need for individual stock picking. Unlike investing in individual stocks, ETFs offer built-in diversification, reducing the risk associated with relying on a single company's performance.

Identifying ETFs with Exposure to the Autonomous Vehicle Sector

Several ETFs offer exposure to the autonomous vehicle sector by holding stocks of companies involved in various aspects of the technology:

- Technology ETFs: Many broad technology ETFs include companies developing crucial technologies like AI, sensor technology, and mapping systems vital for autonomous vehicles.

- Robotics and Automation ETFs: These ETFs focus on companies involved in robotics and automation, which are key components of autonomous driving systems.

- Specific Company ETFs: Some ETFs may directly hold shares of companies like Uber or other key players in the autonomous vehicle industry.

Remember to thoroughly research the specific holdings of any ETF before investing to ensure alignment with your investment goals and risk tolerance. All investments carry risk, and ETF investments are no exception. Market fluctuations can impact the value of your investment.

Strategies for Investing in Uber's Autonomous Vehicle Push Through ETFs

Direct vs. Indirect Exposure to Uber

Investors can gain exposure to Uber's autonomous vehicle push in two primary ways:

- Direct Exposure: Invest in ETFs that hold Uber stock directly. This provides a direct stake in Uber's success but limits diversification within the broader autonomous vehicle sector.

- Indirect Exposure: Invest in ETFs focused on the broader autonomous vehicle ecosystem. This strategy provides diversification across various companies contributing to the industry's growth, mitigating risk associated with a single company's performance.

Diversification and Risk Management in ETF Portfolios

Diversification is crucial for mitigating risk. Instead of concentrating investments in a single ETF, consider spreading investments across several ETFs targeting different aspects of the autonomous vehicle sector (e.g., AI, sensor technology, mapping).

Long-Term vs. Short-Term Investment Strategies

Investing in emerging technologies like autonomous vehicles is generally considered a long-term strategy. While the potential rewards are high, the development and market adoption of this technology will likely take time. Be prepared for market volatility and potential short-term fluctuations.

Conclusion: Capitalizing on Uber's Autonomous Vehicle Push with ETFs

Investing in the autonomous vehicle sector through ETFs offers diversification, accessibility, and the potential for significant long-term returns. Uber's commitment to autonomous driving technology positions it as a key player in this transformative market. However, remember that thorough research and a clear understanding of investment risks are crucial. Start exploring investment opportunities in Uber's Autonomous Vehicle Push and the broader autonomous vehicle market by researching suitable ETFs aligned with your risk tolerance and financial goals. [Link to ETF Research Resource 1] [Link to ETF Research Resource 2]

Featured Posts

-

Free Live Stream Ny Knicks Vs La Clippers Nba Game March 26 2025

May 17, 2025

Free Live Stream Ny Knicks Vs La Clippers Nba Game March 26 2025

May 17, 2025 -

Vf B Stuttgart Stiller Gata Pentru Finala Cupei Germaniei

May 17, 2025

Vf B Stuttgart Stiller Gata Pentru Finala Cupei Germaniei

May 17, 2025 -

Knicks Vs Blazers Live Score And Updates 77 77 03 13 2025

May 17, 2025

Knicks Vs Blazers Live Score And Updates 77 77 03 13 2025

May 17, 2025 -

Resultado Final Everton Vina 0 0 Coquimbo Unido Reporte Completo

May 17, 2025

Resultado Final Everton Vina 0 0 Coquimbo Unido Reporte Completo

May 17, 2025 -

Mariners Bryce Miller 15 Day Il Stint Due To Elbow Problem

May 17, 2025

Mariners Bryce Miller 15 Day Il Stint Due To Elbow Problem

May 17, 2025