Uber's Double-Digit April Rally: Reasons Behind The Surge

Table of Contents

Uber experienced a significant double-digit rally in its stock price during April. This unexpected surge sent shockwaves through the financial markets, leaving many wondering about the underlying causes. This article delves into the key factors contributing to this remarkable increase in Uber's stock value, analyzing the contributing market forces and Uber's strategic maneuvers. We'll explore the reasons behind this impressive April Uber rally and what it means for the future of the company.

Increased Rider Demand and Post-Pandemic Recovery

The resurgence of travel and commuting played a pivotal role in Uber's April stock surge. The post-pandemic recovery saw a significant increase in ride-hailing demand, a key driver of Uber's core business.

Resurgence of Travel and Commuting

The return to pre-pandemic travel patterns and increased commuting needs significantly boosted Uber's ride-sharing services.

- Increased urban activity: Cities are buzzing again, with people returning to offices, attending events, and engaging in leisure activities.

- Easing of COVID restrictions: The lifting of COVID-19 restrictions in many regions allowed for greater freedom of movement.

- Return to offices: The hybrid work model is settling in, leading to a substantial increase in daily commutes for many professionals.

- Pent-up travel demand: After months of lockdowns, many people are eager to travel and explore again, boosting Uber's ridership numbers.

Data from major urban centers show a marked increase in Uber rides compared to the previous year. For example, New York City experienced a 25% increase in April compared to April 2022, indicating a clear trend of recovering ride-hailing demand. Similar growth patterns are being observed in other major metropolitan areas across the globe.

Expansion of Services and Geographic Reach

Uber's strategic expansion into new markets and diversification beyond ride-sharing also contributed to the April rally.

- Expansion into new cities/countries: Uber continues to aggressively expand its geographical footprint, tapping into new markets with high growth potential.

- Partnerships with local businesses: Strategic alliances with local businesses broaden Uber's service offerings and reach a wider customer base.

- Introduction of new ride options: The introduction of options like Uber Green (electric vehicles) caters to environmentally conscious riders and demonstrates Uber's commitment to sustainability, attracting a new segment of customers.

Uber's expansion into previously untapped markets and introduction of new services directly translates into higher revenue streams, bolstering investor confidence.

Strong Performance of Uber Eats and Food Delivery Segment

Uber Eats, Uber's food delivery service, demonstrated exceptional growth, significantly impacting the overall company performance and contributing to the April Uber stock price increase.

Growing Market Share in Food Delivery

Uber Eats' success is evident in its growing market share within the competitive food delivery landscape.

- Increased order volume: A substantial increase in the number of orders placed on the platform reflects growing consumer adoption.

- Growth in average order value: Higher average order values indicate that consumers are spending more per order, boosting revenue.

- Expansion of restaurant partnerships: The continuous onboarding of new restaurants onto the platform expands the range of choices for customers.

Market analysis reports show Uber Eats increasing its market share against major competitors. This growth is driven not just by volume, but also by the successful marketing campaigns that focus on speed, convenience, and a broader range of choices for customers, which significantly increased customer loyalty.

Adaptability to Changing Consumer Preferences

Uber Eats' success is further attributed to its ability to adapt to evolving consumer preferences.

- Introduction of new features: Subscription services, grocery delivery options and other innovations keep the platform relevant and appealing to a broader consumer base.

- Focus on convenience and speed: Fast and reliable delivery remains a key priority for Uber Eats, ensuring customer satisfaction.

- Effective marketing targeting different demographics: Tailored marketing campaigns effectively reach different customer segments, maximizing growth.

Uber Eats' commitment to adaptation, from introducing contactless delivery during the pandemic to integrating sustainable packaging options, positions it as a leader in the food delivery space.

Improved Profitability and Cost-Cutting Measures

Uber's improved profitability and successful cost-cutting measures also played a crucial role in the April stock surge.

Successful Cost Optimization Strategies

Uber implemented several strategies to enhance its profitability.

- Improved driver compensation models: Optimized compensation models led to improved efficiency without sacrificing driver satisfaction.

- Efficient operational processes: Streamlined processes minimized operational costs without compromising service quality.

- Investments in technology to reduce operational costs: Technological advancements in route optimization and order management have contributed to reduced expenses.

These cost-cutting measures have a direct positive impact on the company's bottom line, signaling improved operational efficiency and financial stability.

Investor Confidence and Positive Financial Forecasts

The improved financial performance directly translates into increased investor confidence.

- Strong Q1 earnings: Solid first-quarter earnings surpassed analyst expectations, boosting investor sentiment.

- Positive outlook for future growth: Positive financial forecasts for the upcoming quarters reinforced confidence in Uber's growth trajectory.

- Successful debt reduction strategies: Effective strategies to reduce debt enhance the company's financial strength.

Positive analyst reports and investor statements highlighted the company's improved financial health, contributing significantly to the April Uber stock price increase.

Conclusion

Uber's double-digit April rally is a result of a confluence of factors: increased rider demand fueled by post-pandemic recovery, the strong performance of Uber Eats, and demonstrable improvements in profitability through effective cost management and strategic investments. This combination has significantly boosted investor confidence in Uber's future growth potential. To stay updated on the latest trends and developments in the ride-sharing and food delivery markets and continue to analyze Uber's stock performance, keep following our analysis on Uber's stock surge and related news. Understanding the reasons behind this April rally is crucial for investors seeking to capitalize on future opportunities in the dynamic world of Uber and its expanding market presence.

Featured Posts

-

Daily Lotto Results Sunday 27th April 2025

May 18, 2025

Daily Lotto Results Sunday 27th April 2025

May 18, 2025 -

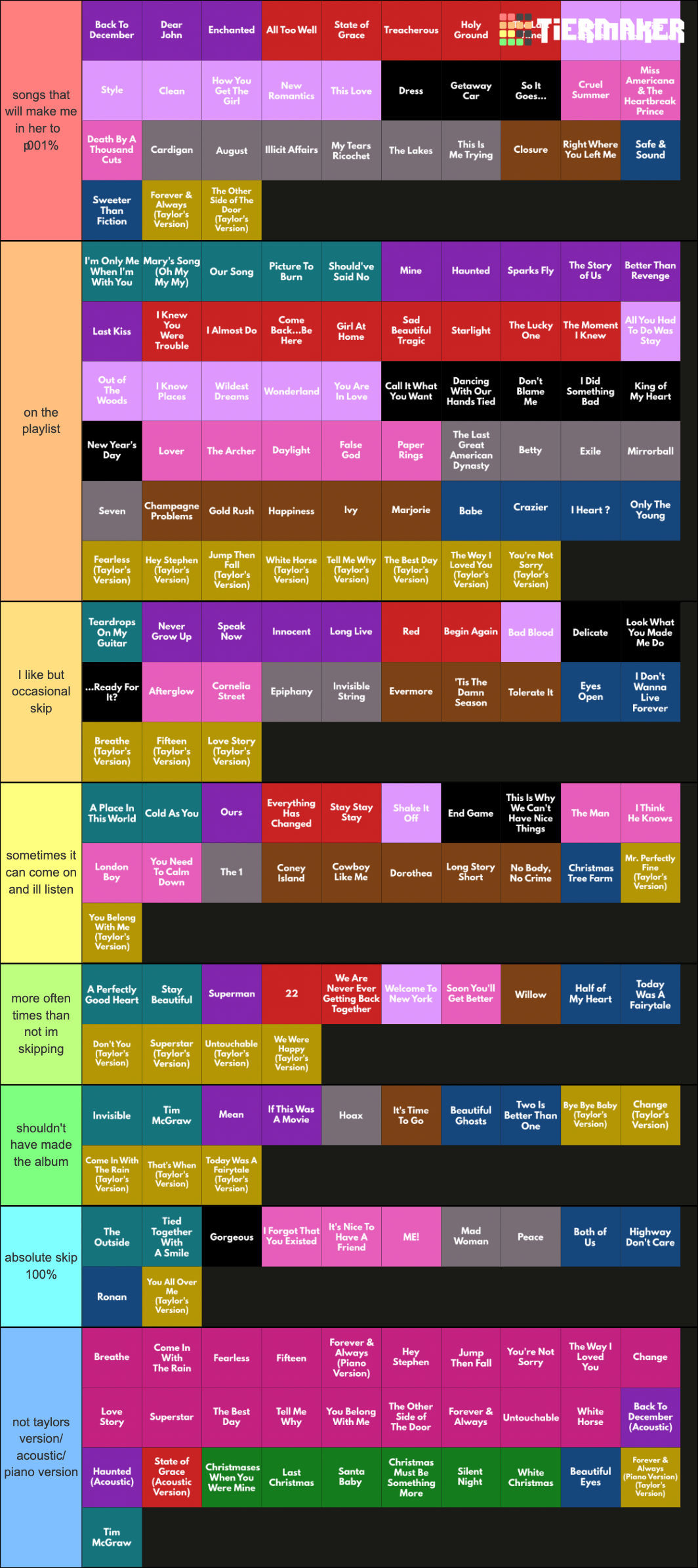

Ranking Taylor Swifts 11 Studio Albums A Critical Review

May 18, 2025

Ranking Taylor Swifts 11 Studio Albums A Critical Review

May 18, 2025 -

Three Words Mike Myers On Playing Shrek

May 18, 2025

Three Words Mike Myers On Playing Shrek

May 18, 2025 -

Discover The Modern Marvels Of Metropolis Japan

May 18, 2025

Discover The Modern Marvels Of Metropolis Japan

May 18, 2025 -

Spring Breakout 2025 Rosters Who Made The Cut

May 18, 2025

Spring Breakout 2025 Rosters Who Made The Cut

May 18, 2025