Uber's Potential: Evaluating The Investment Case For UBER Stock

Table of Contents

Uber's Core Business and Market Position

H3: Ride-Sharing Dominance: Uber's ride-sharing service remains its flagship offering. While its market share varies geographically, Uber maintains a significant presence globally. In many major cities, it's synonymous with ride-hailing, giving it a powerful brand advantage. However, competition from Lyft and other regional players poses a constant threat.

- Market share statistics: While precise global figures fluctuate, Uber consistently holds a leading position in numerous markets. Analyzing regional data is crucial for a comprehensive understanding.

- Geographical reach: Uber operates in countless countries, showcasing a vast network and substantial reach. This extensive network offers significant scale advantages.

- Brand recognition: The Uber brand enjoys high recognition worldwide, translating into ease of customer acquisition and strong brand loyalty. However, this could be challenged by competitors employing aggressive marketing strategies.

- Technological advantages: Uber’s sophisticated ride-matching algorithm and user-friendly app contribute to its competitive edge. Continuous innovation is crucial for maintaining this advantage.

- Regulatory hurdles: Navigating diverse regulatory landscapes presents a significant challenge. Licensing issues and labor disputes can impact operations and profitability in different regions.

H3: Eats and Delivery Services Growth: Uber Eats has emerged as a key growth driver, competing with established players like DoorDash and Grubhub. Its integration with the existing Uber platform provides a synergistic advantage. However, intense competition and high customer acquisition costs are significant challenges.

- Market share data: Uber Eats holds a notable market share, though it varies regionally. Growth rates are crucial to assess its future potential in the competitive food delivery landscape.

- Revenue growth: Tracking revenue growth in Uber Eats is essential for evaluating its contribution to the overall financial health of Uber. Sustained growth is vital for justifying the investment.

- Customer acquisition costs: The cost of attracting new customers is substantial in the crowded food delivery market, impacting overall profitability. Careful management of these costs is vital.

- Profitability: Achieving profitability in the delivery sector is a major challenge for many companies. Uber's progress in this area is an important factor to consider when analyzing UBER stock.

- Strategic partnerships: Partnerships with restaurants and other businesses can enhance Uber Eats’ market reach and appeal. Strategic collaborations can influence market share.

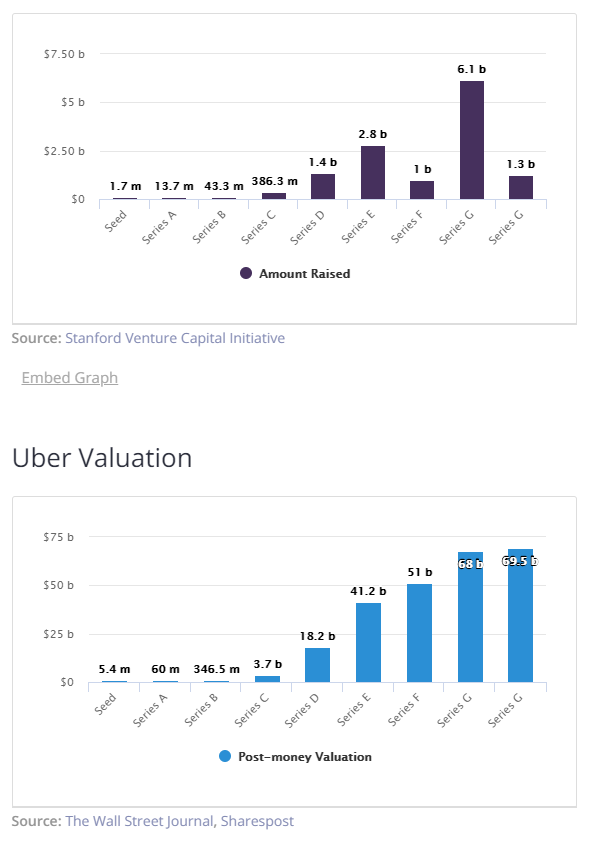

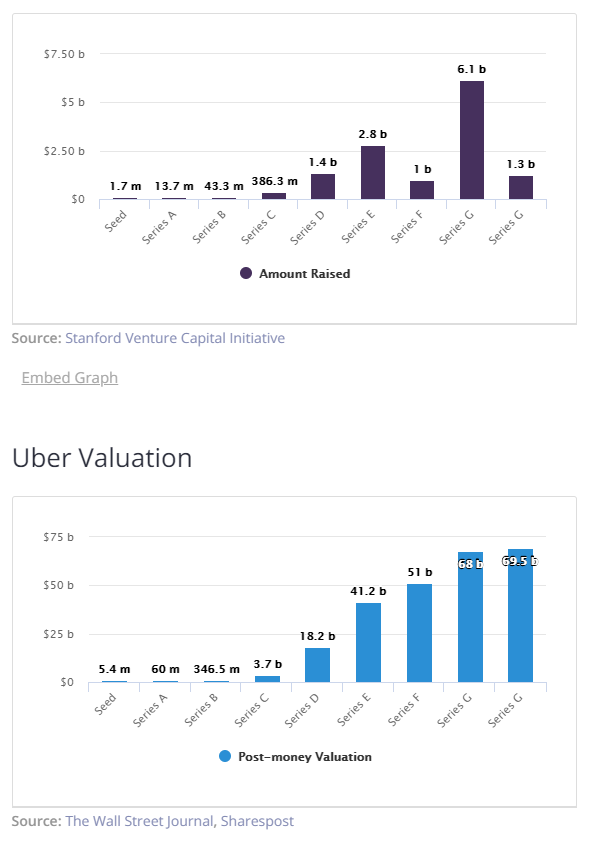

Financial Performance and Valuation of UBER Stock

H3: Revenue and Profitability Analysis: Analyzing Uber's financial statements is crucial for evaluating its financial health. Focus on revenue growth across its core segments (ride-sharing and delivery), profitability margins, and operating expenses to gain a comprehensive understanding of its financial performance.

- Revenue figures (past and projected): Reviewing past revenue figures and examining projected revenue growth rates provides insight into the company's financial trajectory. Analyst predictions offer valuable data points.

- Profitability margins: Understanding profit margins, both gross and operating, is vital for assessing the profitability of Uber's business model. Trends in profit margins will demonstrate efficiency.

- Key expense drivers: Identifying key expense drivers—such as driver payments, marketing costs, and research and development—helps determine areas for cost optimization and improvement.

- Debt levels: Assessing Uber's debt levels and its ability to service that debt is crucial for evaluating its financial risk. High debt levels could negatively impact the stock’s valuation.

H3: Valuation Metrics: Several valuation metrics can help determine if UBER stock is currently overvalued or undervalued. Comparing these metrics to industry peers provides valuable context.

- P/E ratio: The price-to-earnings ratio provides a measure of how much investors are willing to pay for each dollar of Uber's earnings. A high P/E ratio can suggest overvaluation.

- Price-to-sales ratio: The price-to-sales ratio compares Uber's market capitalization to its revenue. This is a useful metric when analyzing companies that are not yet profitable.

- Comparisons to industry averages: Benchmarking Uber's valuation metrics against industry averages provides valuable context for determining if its valuation is justified.

- Discounted cash flow analysis: A discounted cash flow (DCF) analysis can project the intrinsic value of UBER stock, providing an independent valuation assessment.

Growth Opportunities and Future Outlook for Uber Stock

H3: Technological Advancements: Uber's investments in autonomous vehicles, drone delivery, and other technologies hold immense potential for future growth. However, the timeline and success of these initiatives are uncertain.

- Autonomous vehicle progress: The development and implementation of autonomous vehicles could drastically reduce operational costs and increase efficiency, significantly impacting profitability.

- Drone delivery initiatives: Drone delivery could revolutionize the delivery sector, offering speed and efficiency improvements, though regulatory hurdles and technological challenges remain.

- AI and machine learning applications: Utilizing AI and machine learning can optimize various aspects of Uber's operations, improving efficiency and customer experience.

- Potential return on investment: The potential return on investment from these technological advancements is significant but highly speculative. Careful assessment of risk is paramount.

H3: International Expansion: Uber's global expansion strategy provides significant growth potential. However, navigating diverse regulatory environments and adapting to local cultures pose substantial challenges.

- Market penetration in key regions: Identifying and penetrating new markets is crucial for continued growth. Understanding market dynamics in various regions is essential.

- Regulatory landscape in different countries: Navigating different regulatory requirements across countries is a complex and potentially costly endeavor.

- Cultural adaptation strategies: Adapting services to local cultural preferences and norms is vital for successful market penetration.

Risks and Challenges Associated with Investing in Uber Stock

H3: Competition and Market Saturation: The ride-sharing and food delivery markets are highly competitive. Market saturation in established markets poses a threat to Uber's growth.

- Major competitors: Intense competition from Lyft, DoorDash, Grubhub, and other players poses a significant challenge.

- Pricing wars: Pricing wars can erode profit margins, putting downward pressure on Uber's financial performance.

- Potential for reduced market share: Aggressive competition can lead to a reduction in market share, impacting revenue and profitability.

H3: Regulatory and Legal Risks: Uber faces significant regulatory and legal challenges globally, including licensing issues, labor disputes, and safety concerns.

- Ongoing legal battles: Ongoing legal battles relating to worker classification and other issues can be costly and disruptive.

- Regulatory changes: Changes in regulations can significantly impact Uber’s operations and profitability.

- Impact on profitability and operations: Regulatory and legal challenges can negatively influence Uber’s profitability and operational efficiency.

Conclusion

Investing in UBER stock presents both exciting opportunities and considerable risks. While Uber's dominant market position in ride-sharing and the growth potential of Uber Eats are compelling, intense competition, regulatory hurdles, and the uncertainties surrounding technological investments must be carefully considered. Based on our analysis, a balanced approach is recommended, potentially considering UBER stock as a part of a diversified portfolio, but only after careful individual research and risk assessment. Ultimately, the decision of whether to invest in Uber stock rests with you. However, by carefully considering the factors outlined in this analysis, you can make a more informed decision about the potential of UBER stock in your portfolio. Conduct thorough due diligence before making any investment decisions related to UBER stock.

Featured Posts

-

Dutch Politics Growing Tensions Within Wilders Pvv

May 18, 2025

Dutch Politics Growing Tensions Within Wilders Pvv

May 18, 2025 -

Pokhorony Po Kane Instruktsiya Vdokhnovlyonnaya Pashey Tekhnikom

May 18, 2025

Pokhorony Po Kane Instruktsiya Vdokhnovlyonnaya Pashey Tekhnikom

May 18, 2025 -

View The Daily Lotto Results For Friday 18th April 2025

May 18, 2025

View The Daily Lotto Results For Friday 18th April 2025

May 18, 2025 -

Your Guide To Easy A On Bbc Three Hd

May 18, 2025

Your Guide To Easy A On Bbc Three Hd

May 18, 2025 -

Canterbury Castle Acquisition 705 499 Sale Confirmed

May 18, 2025

Canterbury Castle Acquisition 705 499 Sale Confirmed

May 18, 2025