UK Households: Urgent Action Needed On New HMRC Letters

Table of Contents

Understanding the Reasons Behind HMRC Letters

HMRC correspondence can stem from various issues. Understanding the reason behind your letter is the first step in formulating a proper response. Common reasons for receiving an HMRC enquiry include:

- Tax Return Errors: A simple mistake on your self-assessment tax return, such as an incorrect income figure or overlooked expense, can trigger an HMRC letter. Even a small error can result in an underpayment of tax and subsequent correspondence.

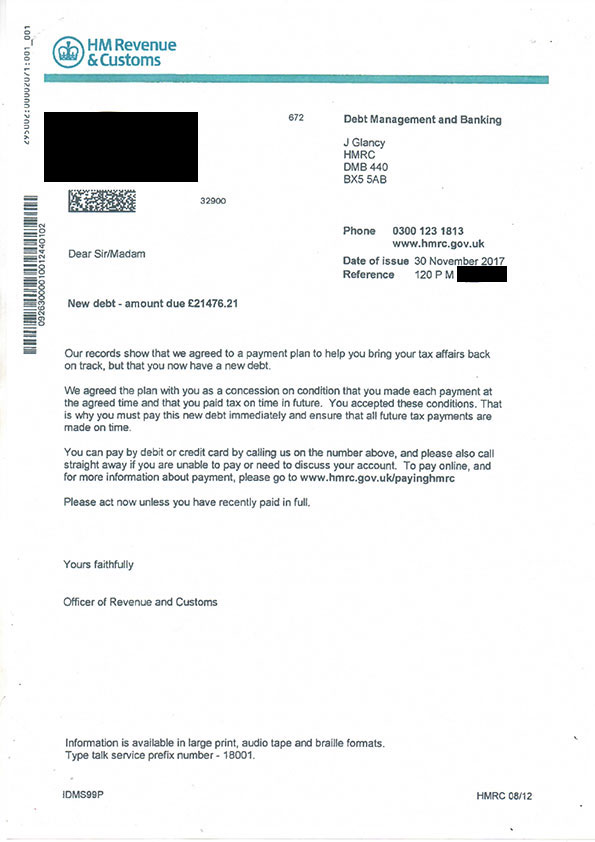

- Underpayment of Tax: If HMRC believes you owe additional tax, you'll receive a letter outlining the amount due and the payment deadline. This could be due to various factors, including incorrect tax codes or unreported income.

- Tax Avoidance Investigations: HMRC investigates suspected tax avoidance schemes rigorously. If your tax affairs are under scrutiny, you'll receive formal notification detailing the nature of the investigation. This is a serious matter requiring immediate professional advice.

- Changes to Tax Code: HMRC may send a letter to inform you of a change to your tax code, affecting your tax deductions at source. This could be due to a change in your employment status or other relevant circumstances.

- Missing Tax Returns: Failure to submit your self-assessment tax return by the deadline will inevitably lead to an HMRC letter, prompting you to file the missing return and potentially incurring penalties.

Understanding the difference between a routine enquiry, such as a query about a minor error on your tax return, and a more serious investigation into potential tax avoidance is crucial. A routine enquiry usually requires a simple correction or clarification, while a tax investigation demands a thorough and carefully considered response, often with professional guidance.

Identifying Legitimate HMRC Correspondence

Before responding to any letter, it's essential to verify its authenticity. Scammers often impersonate HMRC to obtain personal and financial information. Here's how to identify legitimate HMRC correspondence:

- Verify the sender: Check the letterhead for official HMRC branding, including the HMRC logo and address. Be suspicious of poorly printed or unprofessional-looking letters.

- Be wary of suspicious emails: HMRC rarely contacts taxpayers via unsolicited email. If you receive an email supposedly from HMRC requesting personal or financial information, do not click on any links or respond. Report it to [email protected].

- Check your online account: Log in to your secure HMRC online account to verify the information in the letter. This is a safe way to confirm the legitimacy of the correspondence.

- Contact HMRC directly: If you're unsure, contact HMRC using the official contact details found on the gov.uk website. Never use contact details provided in a suspicious letter or email.

Fraudulent HMRC letters often contain grammatical errors, generic greetings, and threats of immediate legal action. Legitimate HMRC correspondence is formal, professional, and clearly explains the reason for contact.

Essential Actions to Take Upon Receiving an HMRC Letter

Receiving an HMRC letter requires prompt and careful action. Here's what you should do:

- Read the letter carefully: Thoroughly review the letter to understand the reason for contact, the specific issues raised, and any deadlines for response. Note all key details and reference numbers.

- Respond promptly: Failing to respond within the specified timeframe can result in significant penalties. Even if you need time to gather information, acknowledge receipt and request an extension if necessary.

- Gather relevant documents: Collect all necessary documents, such as payslips, bank statements, and supporting evidence related to the issues raised in the letter. Accurate record-keeping is crucial in these situations.

- Seek professional advice: If you're unsure how to proceed, consider consulting a qualified tax advisor in the UK. They can provide expert guidance and represent you in your dealings with HMRC.

- Understand potential penalties: Be aware of the potential penalties for non-compliance, which can significantly increase with delays. This includes late payment penalties and potentially more serious consequences for tax evasion.

Responding effectively involves providing clear and accurate information within the stipulated deadlines. Don't hesitate to seek professional help if you feel overwhelmed or unsure about the process.

Preventing Future HMRC Correspondence

Proactive tax management is key to avoiding future problems with HMRC. Here are some preventative measures:

- Keep accurate records: Maintain thorough and organized financial records throughout the year. This makes it significantly easier to complete your tax return accurately and efficiently.

- File your tax return on time: Meet the self-assessment deadline each year. This avoids late filing penalties and ensures your tax affairs remain up-to-date.

- Use reputable tax software: Utilize reputable tax software to help complete your tax returns accurately. This reduces the risk of errors and simplifies the process.

- Seek professional tax planning: Consider engaging a professional tax advisor for advice on tax planning and optimization. They can help you understand your tax obligations and identify potential savings opportunities.

Conclusion

Receiving an HMRC letter can be concerning, but prompt and appropriate action is crucial. Understanding the reasons for the correspondence, verifying its legitimacy, and responding within the given timeframe are vital steps. Seeking professional advice when necessary can significantly mitigate potential problems and penalties. Don't ignore those important HMRC letters! Take immediate action to avoid penalties and ensure your tax affairs are in order. If you're unsure about your next steps, seek advice from a qualified tax advisor today. Protect yourself from potential HMRC tax investigations and avoid unnecessary HMRC penalties by acting now.

Featured Posts

-

La Famille Schumacher Accueille Une Petite Fille

May 20, 2025

La Famille Schumacher Accueille Une Petite Fille

May 20, 2025 -

March 13 2025 Nyt Mini Crossword Complete Answers And Clues

May 20, 2025

March 13 2025 Nyt Mini Crossword Complete Answers And Clues

May 20, 2025 -

Scrutinizing Trumps Aerospace Projects A Deep Dive Into Reported Figures

May 20, 2025

Scrutinizing Trumps Aerospace Projects A Deep Dive Into Reported Figures

May 20, 2025 -

Talisca Ve Tadic Fenerbahce Nin Transfer Operasyonu Ve Saha Tartismasi

May 20, 2025

Talisca Ve Tadic Fenerbahce Nin Transfer Operasyonu Ve Saha Tartismasi

May 20, 2025 -

Dzhennifer Lourens I Ee Vtoroy Malysh

May 20, 2025

Dzhennifer Lourens I Ee Vtoroy Malysh

May 20, 2025