Ukraine-U.S. Rare Earth Mineral Deal: A New Economic Partnership

Table of Contents

Strategic Importance of Rare Earth Minerals

Rare earth minerals are a group of seventeen elements crucial for countless high-tech applications. These critical minerals are essential components in smartphones, wind turbines, electric vehicles, military hardware, and numerous other advanced technologies. Currently, China dominates the global production of rare earth minerals, controlling a significant portion of the global supply chain. This over-reliance on a single source creates significant vulnerabilities. Supply chain disruptions, whether due to geopolitical instability or other factors, can lead to price volatility, technological bottlenecks, and even national security risks.

- Examples of rare earth mineral applications: Neodymium magnets in wind turbines and electric vehicle motors; dysprosium in military guidance systems; lanthanum in hybrid car batteries.

- Consequences of supply chain disruptions: Increased costs for manufacturers; delays in technological advancements; potential shortages impacting critical industries.

- Geopolitical implications of reliance on a single supplier: Increased leverage for the dominant producer; potential for political pressure and trade disputes; vulnerability to supply chain manipulation.

Details of the Ukraine-U.S. Rare Earth Mineral Deal

The Ukraine-U.S. rare earth mineral deal aims to diversify the global supply of these critical minerals by tapping into Ukraine's significant reserves. The agreement involves joint exploration, investment in extraction technologies, and the development of processing infrastructure within Ukraine. Specific details remain subject to ongoing negotiations, but the partnership is expected to focus on minerals such as neodymium and dysprosium, vital for clean energy technologies and defense applications.

- Specific minerals targeted: Neodymium, dysprosium, and other rare earth elements found in Ukrainian deposits.

- Investment amounts: While precise figures haven't been publicly released, significant investment from both public and private sectors is anticipated.

- Timeline for project implementation: The timeline is dependent on various factors, including geological surveys, environmental impact assessments, and securing necessary permits. However, the partnership anticipates a phased approach with initial exploration and development followed by full-scale production.

Economic Benefits for Ukraine

The economic benefits for Ukraine from this rare earth mineral deal are substantial. The partnership promises to generate significant foreign investment, create numerous jobs across various sectors (mining, processing, transportation, and related industries), and boost government revenue. This influx of capital and economic activity will play a crucial role in Ukraine's post-conflict recovery and help diversify its economy beyond traditional industries.

- Projected job creation: Thousands of jobs are expected to be created directly and indirectly within the mining and processing sectors, as well as supporting industries.

- Estimated increase in GDP and government revenue: The economic impact will be significant, contributing to Ukraine's overall GDP growth and generating substantial revenue for the government through taxes and royalties.

- Opportunities for skill development and technological transfer: The partnership will provide opportunities for Ukrainians to develop new skills and expertise in advanced mining and processing technologies.

Geopolitical Implications and Global Impact

The Ukraine-U.S. rare earth mineral deal holds profound geopolitical implications. By diversifying the supply chain away from China's dominance, the partnership enhances global energy security and reduces reliance on a single geopolitical actor. This strengthens the U.S.-Ukraine relationship and has broader ramifications for global trade and alliances. The success of this partnership could also inspire similar collaborations between other resource-rich nations and Western partners.

- Strengthened U.S.-Ukraine relations and strategic alliance: The deal solidifies the strategic partnership between the two countries, demonstrating a commitment to mutual economic growth and security.

- Reduced vulnerability to supply chain disruptions from China: The diversification of rare earth mineral sources reduces global vulnerability to potential supply chain disruptions originating from China.

- Potential for similar collaborations with other mineral-rich countries: The success of this partnership could serve as a model for similar initiatives in other regions of the world.

Conclusion

The Ukraine-U.S. rare earth mineral deal represents a landmark agreement with far-reaching economic and geopolitical consequences. By diversifying the supply of critical minerals, the partnership enhances global energy security, strengthens the U.S.-Ukraine relationship, and offers significant economic opportunities for Ukraine. The successful implementation of this initiative will have a lasting impact on global supply chains and international relations. Stay informed about the progress of this crucial economic alliance and its impact on the future of rare earth mineral production. Learn more about the development of this vital Ukraine-U.S. rare earth mineral deal and its contributions to global economic stability.

Featured Posts

-

Christina Aguileras Appearance Changes Spark Online Discussion

May 03, 2025

Christina Aguileras Appearance Changes Spark Online Discussion

May 03, 2025 -

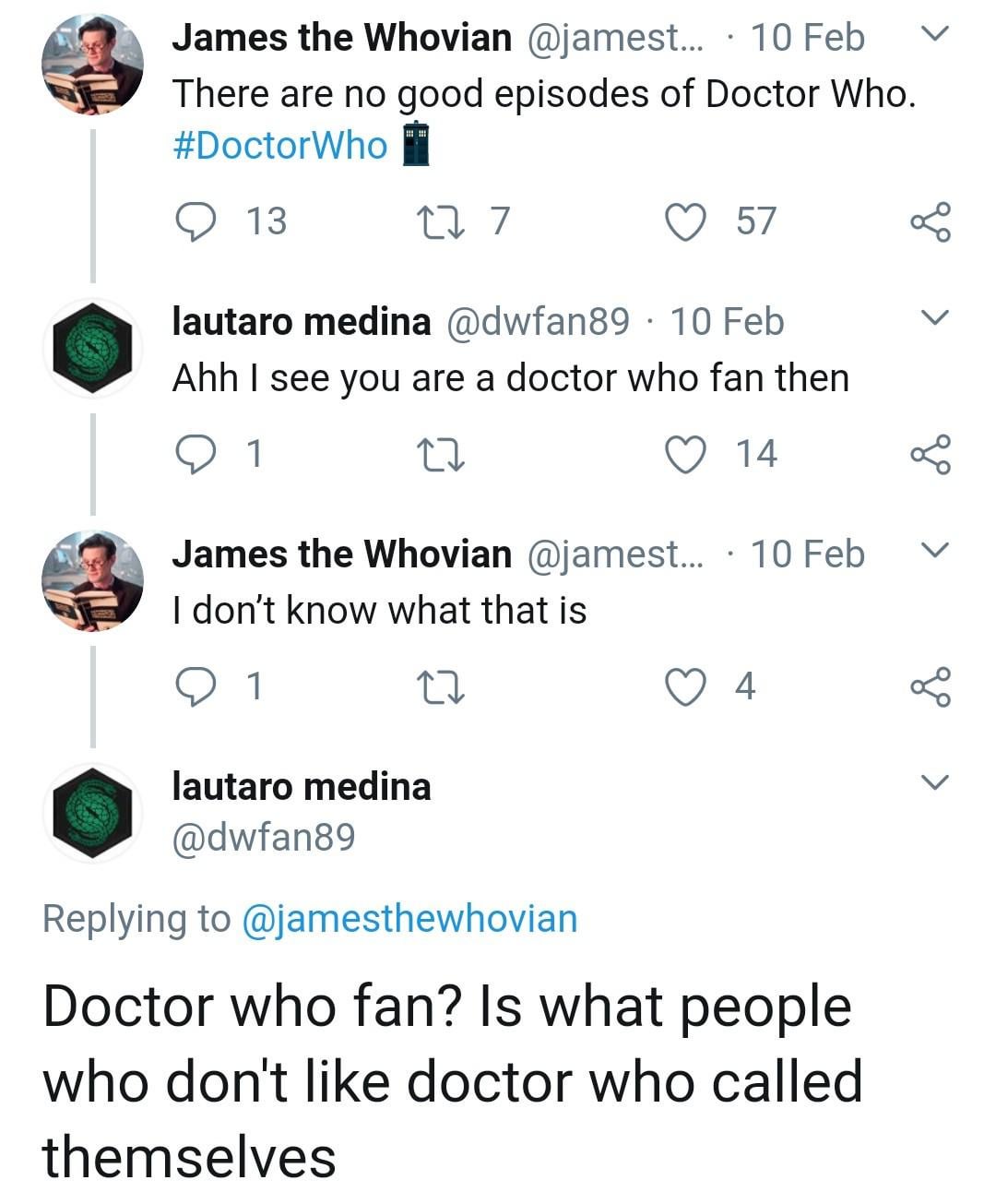

Doctor Who On Hold Showrunners Pause Remarks Spark Fan Outcry

May 03, 2025

Doctor Who On Hold Showrunners Pause Remarks Spark Fan Outcry

May 03, 2025 -

The Urgent Need To Invest In Childhood Mental Health

May 03, 2025

The Urgent Need To Invest In Childhood Mental Health

May 03, 2025 -

Intelligence Artificielle Macron Et Le Patriotisme Economique Europeen

May 03, 2025

Intelligence Artificielle Macron Et Le Patriotisme Economique Europeen

May 03, 2025 -

Orta Afrika Cumhuriyeti Ile Bae Arasindaki Ticaret Anlasmasinin Ayrintilari

May 03, 2025

Orta Afrika Cumhuriyeti Ile Bae Arasindaki Ticaret Anlasmasinin Ayrintilari

May 03, 2025