Understanding Bitcoin's Golden Cross: Is It A Buy Signal?

Table of Contents

What is a Golden Cross in Bitcoin?

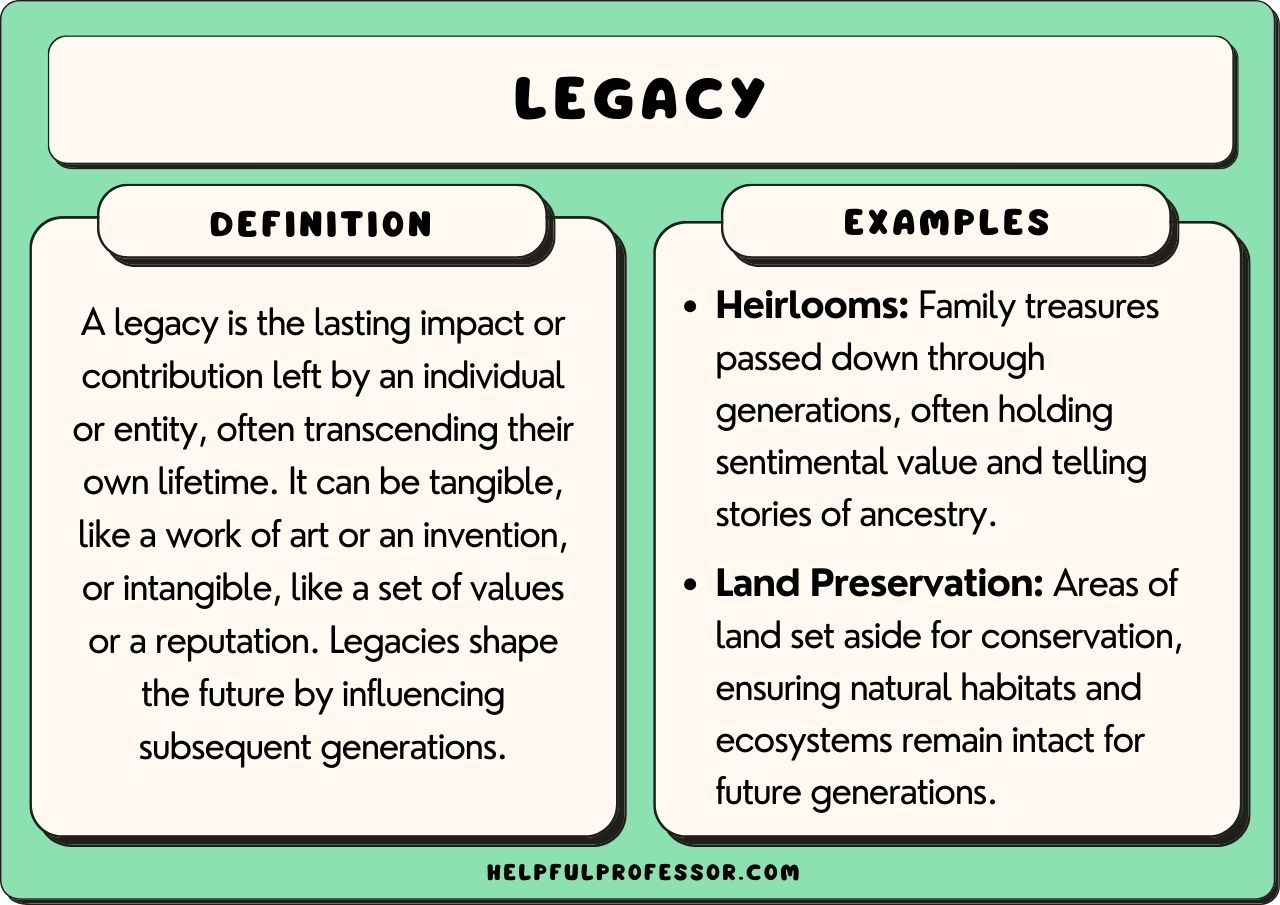

The Golden Cross is a bullish technical indicator formed by the intersection of two moving averages: the 50-day moving average (MA) and the 200-day MA. Moving averages smooth out price fluctuations, providing a clearer picture of price trends. The 50-day MA represents shorter-term price trends, while the 200-day MA reflects longer-term trends. A Golden Cross occurs when the 50-day MA crosses above the 200-day MA, suggesting a potential shift from a bearish to a bullish market sentiment.

[Insert a simple chart or graph visually depicting a Golden Cross formation in Bitcoin's price chart here.]

- 50-day MA: Represents short-term price momentum and trends.

- 200-day MA: Represents long-term price direction and overall market trend.

- Golden Cross: The point where the 50-day MA crosses above the 200-day MA. This intersection often indicates a potential upward trend.

- Bullish Signal: While not guaranteed, a Golden Cross is often interpreted as a bullish signal, suggesting a potential price increase.

How Reliable is the Bitcoin Golden Cross as a Buy Signal?

The reliability of the Bitcoin Golden Cross as a buy signal is a complex issue. While historically, many instances show a price increase following a Golden Cross, it's crucial to remember that past performance is not indicative of future results. There have been instances where a Golden Cross was followed by a period of consolidation or even a further price drop – what traders refer to as a "false signal."

- Past Performance is Not a Guarantee: The Golden Cross has shown positive correlations with price increases in the past, but it's not a foolproof predictor.

- Market Sentiment: Consider the overall market sentiment. Is there significant positive news or hype surrounding Bitcoin? Are there wider macroeconomic factors at play?

- On-Chain Metrics: Analyze on-chain data, such as transaction volume and active addresses, to gauge genuine market activity.

- Macroeconomic Factors: Global economic conditions, regulatory changes, and general investor confidence significantly impact Bitcoin's price.

- Holistic Strategy: The Golden Cross should be just one piece of a broader trading strategy. Relying solely on this indicator is risky.

Alternative Indicators to Complement the Golden Cross

While the Bitcoin Golden Cross can be insightful, relying on it alone is unwise. Combining it with other technical indicators provides a more comprehensive analysis. This reduces reliance on any single indicator and minimizes the impact of false signals.

- Relative Strength Index (RSI): Helps assess whether Bitcoin is overbought or oversold, providing insights into potential price reversals.

- Moving Average Convergence Divergence (MACD): Identifies changes in momentum, confirming or contradicting the signal from the Golden Cross.

- Volume Analysis: High volume accompanying a Golden Cross strengthens the signal, indicating strong buying pressure. Low volume suggests weak momentum.

- Support and Resistance Levels: Identifying support and resistance levels on the price chart helps assess the potential for price movement following a Golden Cross.

Risk Management When Using the Golden Cross

Even with a combination of technical indicators, risk management is paramount in cryptocurrency trading. Bitcoin's volatility demands a cautious approach.

- Never invest more than you can afford to lose. Crypto investments are inherently risky.

- Use stop-loss orders: These orders automatically sell your Bitcoin if the price drops to a predetermined level, limiting your potential losses.

- Diversify your portfolio: Don't put all your eggs in one basket. Diversify across different cryptocurrencies to reduce risk.

- Regularly review and adjust your trading strategy: Market conditions change constantly. Regularly assess your strategy's effectiveness and make adjustments accordingly.

Conclusion

The Bitcoin Golden Cross is a valuable technical indicator, but it's not a foolproof buy signal. It should be used in conjunction with other indicators and a sound risk management strategy. Relying solely on the Golden Cross to guide Bitcoin trading is unwise. Thorough research, a comprehensive strategy, and a deep understanding of market dynamics are crucial before making investment decisions. While understanding the Bitcoin Golden Cross is crucial for informed decision-making, remember to conduct thorough research and develop a comprehensive strategy before investing in Bitcoin or any other cryptocurrency. Learn more about utilizing the Bitcoin Golden Cross and other technical analysis tools to enhance your crypto trading journey.

Featured Posts

-

13 More Strikeouts Angels Hitters Shut Down By Twins In Series Sweep

May 08, 2025

13 More Strikeouts Angels Hitters Shut Down By Twins In Series Sweep

May 08, 2025 -

Luis Enrique Largoi Pese Yje Nga Psg

May 08, 2025

Luis Enrique Largoi Pese Yje Nga Psg

May 08, 2025 -

Secret Service Investigation Closed Cocaine Found At White House

May 08, 2025

Secret Service Investigation Closed Cocaine Found At White House

May 08, 2025 -

Exclusive Ex Goldman Sachs Partner Targeted In Malaysias 1 Mdb Extradition Bid

May 08, 2025

Exclusive Ex Goldman Sachs Partner Targeted In Malaysias 1 Mdb Extradition Bid

May 08, 2025 -

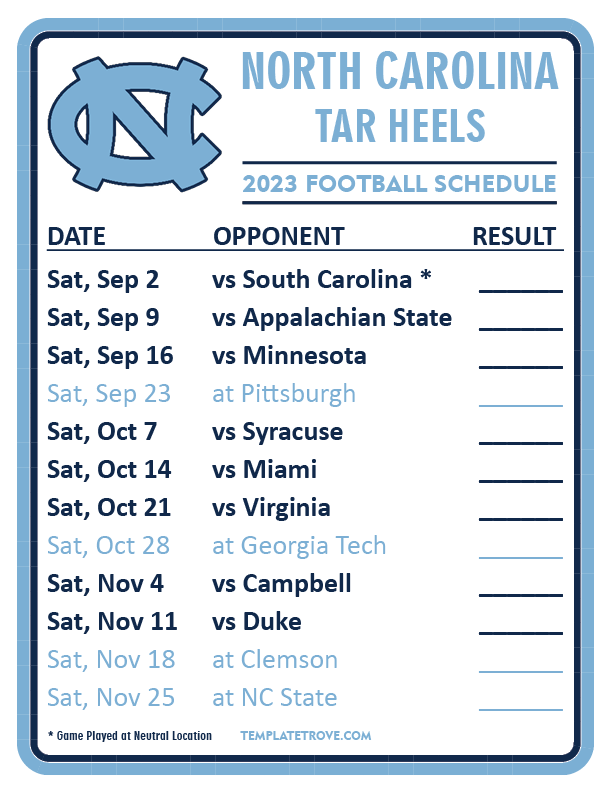

Rogues Legacy Gambits Emotional New Weapon

May 08, 2025

Rogues Legacy Gambits Emotional New Weapon

May 08, 2025

Latest Posts

-

Updated Nc State Football Roster Changes

May 08, 2025

Updated Nc State Football Roster Changes

May 08, 2025 -

Nc State Running Back Kendrick Raphael Transfers

May 08, 2025

Nc State Running Back Kendrick Raphael Transfers

May 08, 2025 -

Shreveport Police Crack Multi Vehicle Theft Ring Suspects Apprehended

May 08, 2025

Shreveport Police Crack Multi Vehicle Theft Ring Suspects Apprehended

May 08, 2025 -

Raphaels Departure A Blow To Nc State Football

May 08, 2025

Raphaels Departure A Blow To Nc State Football

May 08, 2025 -

Quiz Nba Playoffs Triple Doubles Challenge Your Basketball Iq

May 08, 2025

Quiz Nba Playoffs Triple Doubles Challenge Your Basketball Iq

May 08, 2025