Understanding CoreWeave's (CRWV) Recent Stock Market Success

Table of Contents

CoreWeave's (CRWV) Business Model and Competitive Advantage

CoreWeave (CRWV) provides cloud computing services specializing in GPU-accelerated computing, a critical component for AI, machine learning, and high-performance computing applications. Its unique selling proposition lies in its ability to deliver unparalleled performance and scalability, leveraging sustainable and energy-efficient infrastructure. This contrasts sharply with some of the larger cloud providers like AWS, Azure, and GCP, who may not prioritize the same level of customization and specific performance for GPU-heavy workloads.

- Sustainability and Energy Efficiency: CoreWeave (CRWV) prioritizes sustainable practices, using renewable energy sources and efficient cooling systems, a growing advantage in the environmentally conscious tech sector.

- Strategic Partnerships: Collaborations with leading technology companies enhance CoreWeave (CRWV)'s reach and provide access to new technologies and markets. These partnerships are crucial in building a robust ecosystem around its services.

- Flexible Pricing Model: CoreWeave (CRWV) offers flexible pricing plans tailored to diverse customer needs, ranging from small startups to large enterprises, maximizing market penetration.

Market Demand and Growth Potential for CRWV

The cloud computing market is experiencing explosive growth, fueled by the increasing adoption of AI and machine learning. CoreWeave (CRWV) is perfectly positioned to capitalize on this trend, given its specialization in GPU-accelerated computing, a critical resource for these technologies.

- Market Statistics: Reports project substantial growth in the GPU-accelerated computing market over the next few years, suggesting a significant runway for CoreWeave (CRWV)'s expansion. (Insert relevant statistics and market research data here).

- Industry Trends: The growing need for advanced analytics, real-time data processing, and complex simulations is driving demand for CoreWeave (CRWV)'s high-performance computing services.

- New Market Opportunities: CoreWeave (CRWV) has the potential to expand into new markets and service offerings, further broadening its revenue streams and solidifying its position in the cloud computing industry. This includes potential expansions into new geographic regions and applications.

Financial Performance and Investor Sentiment towards CRWV

CoreWeave (CRWV)'s financial reports demonstrate impressive revenue growth, indicating strong market traction and customer adoption. While profitability may still be developing, the rapid growth signals a healthy trajectory. Investor sentiment towards CRWV has generally been positive, reflecting confidence in the company's future prospects.

- Financial Comparisons: Analyzing CoreWeave (CRWV)'s key financial ratios in comparison to its competitors highlights its strong performance and growth potential within the market.

- Analyst Ratings: Positive analyst ratings and upward revisions of price targets suggest a positive outlook for CoreWeave (CRWV)'s stock price. (Insert relevant analyst information here).

- Risk Assessment: It's important to acknowledge potential risks, such as competition from established cloud providers and the cyclical nature of the technology sector.

CRWV's Strategic Initiatives and Future Outlook

CoreWeave (CRWV) is actively pursuing strategic initiatives to fuel its future growth, including investments in research and development, strategic acquisitions, and expansion into new geographical markets.

- Strategic Initiatives: CoreWeave (CRWV) is consistently innovating and expanding its product offerings to cater to evolving customer needs, strengthening its competitive position.

- Sustainability Commitment: Its dedication to environmentally friendly practices and sustainable infrastructure development sets it apart and appeals to a growing segment of environmentally conscious clients.

- Long-Term Outlook: The long-term outlook for CoreWeave (CRWV) appears positive, given the continued growth of the cloud computing market and its strategic position within this rapidly expanding sector.

Conclusion: Investing in the Future of Cloud Computing with CoreWeave (CRWV)

CoreWeave (CRWV)'s success stems from a combination of factors: its innovative business model focused on GPU-accelerated computing, the explosive growth of the cloud computing market, its strong financial performance, and a clear vision for the future. While risks exist in any investment, CoreWeave (CRWV)'s potential for continued growth in the rapidly expanding cloud computing sector is compelling. Learn more about CoreWeave (CRWV) and its offerings to better understand its potential. Consider adding CRWV to your watchlist for further research. Remember to conduct your own thorough due diligence before making any investment decisions.

Featured Posts

-

Metallicas M72 Tour 2026 Uk And Europe Dates Revealed

May 22, 2025

Metallicas M72 Tour 2026 Uk And Europe Dates Revealed

May 22, 2025 -

Clisson L Administration Du College Face Au Nombre De Croix Portees Par Les Eleves

May 22, 2025

Clisson L Administration Du College Face Au Nombre De Croix Portees Par Les Eleves

May 22, 2025 -

Blake Lively And Justin Baldoni Lawsuit Taylor Swift And Hugh Jackman Subpoenaed

May 22, 2025

Blake Lively And Justin Baldoni Lawsuit Taylor Swift And Hugh Jackman Subpoenaed

May 22, 2025 -

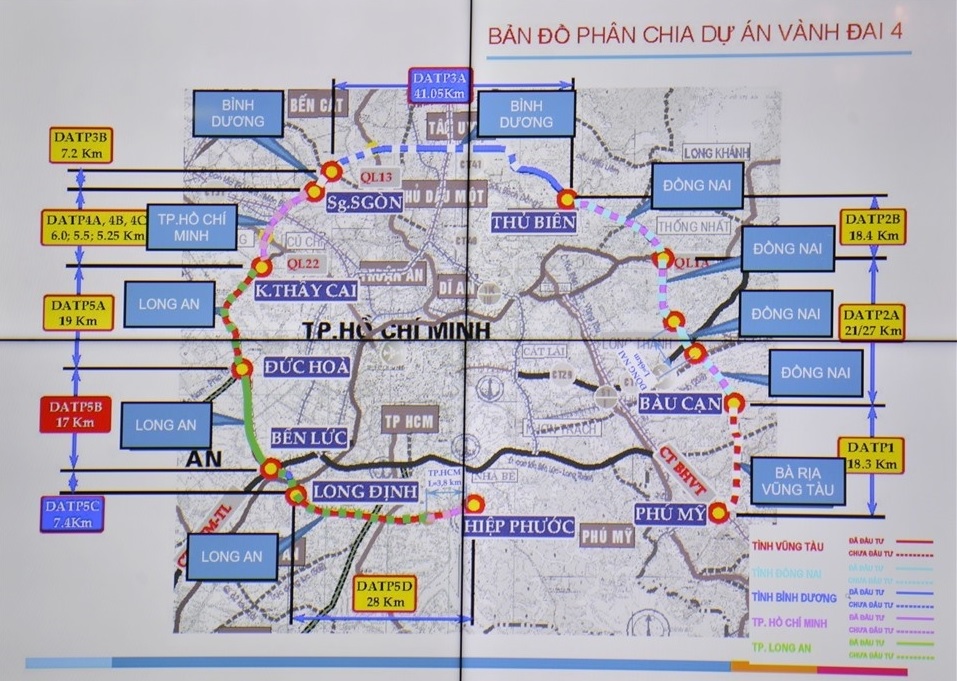

Dong Nai Kien Nghi Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Noi Binh Phuoc

May 22, 2025

Dong Nai Kien Nghi Xay Dung Duong 4 Lan Xe Xuyen Rung Ma Da Noi Binh Phuoc

May 22, 2025 -

Unexplained Red Lights In France Analysis Of Recent Aerial Events

May 22, 2025

Unexplained Red Lights In France Analysis Of Recent Aerial Events

May 22, 2025