Understanding Elevated Economic Uncertainty: The Impact Of Inflation And Unemployment

Table of Contents

The Inflationary Spiral and its Contribution to Economic Uncertainty

Defining Inflation

Inflation, a sustained increase in the general price level of goods and services in an economy over a period of time, erodes purchasing power. It can stem from demand-pull inflation (excessive demand exceeding supply) or cost-push inflation (rising production costs). Different types exist, including creeping inflation (slow and steady price increases) and hyperinflation (rapid, uncontrollable price increases).

- Erosion of Purchasing Power: High inflation means each unit of currency buys fewer goods and services. This reduces the real value of wages and savings, leading to decreased consumer spending.

- Impact on Consumer Confidence and Spending: Uncertainty about future prices discourages consumers from making large purchases, dampening economic growth. This uncertainty is a major contributor to elevated economic uncertainty.

- Challenges for Businesses: Inflation forces businesses to grapple with rising input costs, making it difficult to plan investments and set prices competitively. This can lead to reduced profitability and even business closures.

- Interest Rate Hikes and Their Consequences: Central banks often respond to inflation by raising interest rates. While this can curb inflation, it also increases borrowing costs for businesses and consumers, potentially slowing economic growth and exacerbating inflationary pressures. This creates a delicate balance, contributing to economic instability.

Unemployment's Role in Heightening Economic Uncertainty

Understanding Unemployment

Unemployment, defined as the state of being economically active and available for work but without a job, is a key indicator of economic health. Different types exist, including frictional (temporary unemployment between jobs), structural (mismatch between worker skills and job requirements), and cyclical (unemployment due to economic downturns). The unemployment rate, typically expressed as a percentage of the labor force, provides a measure of the extent of unemployment.

- Decreased Consumer Spending: Job losses directly impact household income, leading to reduced consumer spending and a weakening demand for goods and services. This fuels economic downturn.

- Impact on Government Budgets: High unemployment strains government budgets due to increased spending on social welfare programs like unemployment benefits.

- Psychological Impact: Job loss can lead to stress, anxiety, and depression for individuals and families. The resulting social consequences contribute significantly to economic instability.

- Social and Political Instability: High unemployment rates can lead to social unrest, political instability, and increased social inequality.

The Interplay Between Inflation and Unemployment: The Phillips Curve

Explaining the Phillips Curve

The Phillips curve illustrates the historical inverse relationship between inflation and unemployment. In the short run, policymakers may face a trade-off: lower unemployment might lead to higher inflation, and vice-versa. However, the curve's limitations are significant, especially concerning the phenomenon of stagflation.

- Short-Run Trade-off: The Phillips curve suggests a short-term inverse relationship: reducing unemployment may require accepting higher inflation, and controlling inflation might increase unemployment.

- Stagflation: Stagflation, a simultaneous occurrence of high inflation and high unemployment, challenges the traditional Phillips curve. It indicates that the relationship isn’t always inverse and highlights the complexity of economic management.

- Balancing Inflation and Unemployment: Policymakers strive to find the optimal balance between inflation and unemployment, using fiscal and monetary policies. This balancing act is central to mitigating elevated economic uncertainty.

Mitigating Elevated Economic Uncertainty

Government Policies

Governments employ fiscal policies (government spending and taxation) and monetary policies (interest rates and money supply) to stabilize the economy. These policies aim to control inflation, stimulate economic growth, and create employment opportunities.

Business Strategies

Businesses can adapt to economic uncertainty through:

- Diversification: Expanding into new markets or product lines to reduce reliance on single sectors.

- Cost-Cutting: Improving efficiency and reducing unnecessary expenses to maintain profitability.

- Strategic Planning: Developing contingency plans to navigate potential economic downturns.

Individual Actions

Individuals can proactively manage their finances by:

- Diversifying Investments: Spreading investments across different asset classes to mitigate risk.

- Building an Emergency Fund: Saving enough money to cover living expenses for several months in case of job loss.

- Developing a Budget: Carefully tracking income and expenses to make informed financial decisions.

Conclusion

Elevated economic uncertainty is a significant challenge stemming from the complex interplay of inflation and unemployment. Understanding the individual impacts of each, and how they interact to create further economic instability, is crucial. High inflation erodes purchasing power, while high unemployment decreases consumer spending and increases social instability. Policy decisions aimed at controlling inflation can sometimes exacerbate unemployment, and vice versa, leading to the possibility of stagflation. Mitigating this uncertainty requires a multifaceted approach involving proactive government policies, adaptable business strategies, and responsible individual financial planning. Understanding elevated economic uncertainty is crucial for navigating today's complex economic landscape. Stay informed and prepare your financial strategy accordingly. Consult financial advisors and reputable economic sources for the latest updates and personalized guidance.

Featured Posts

-

Are Home Sales In Crisis A Realtors Perspective On The Current Market

May 30, 2025

Are Home Sales In Crisis A Realtors Perspective On The Current Market

May 30, 2025 -

Ti Tha Doyme Stin Tileorasi To Savvato 12 Aprilioy

May 30, 2025

Ti Tha Doyme Stin Tileorasi To Savvato 12 Aprilioy

May 30, 2025 -

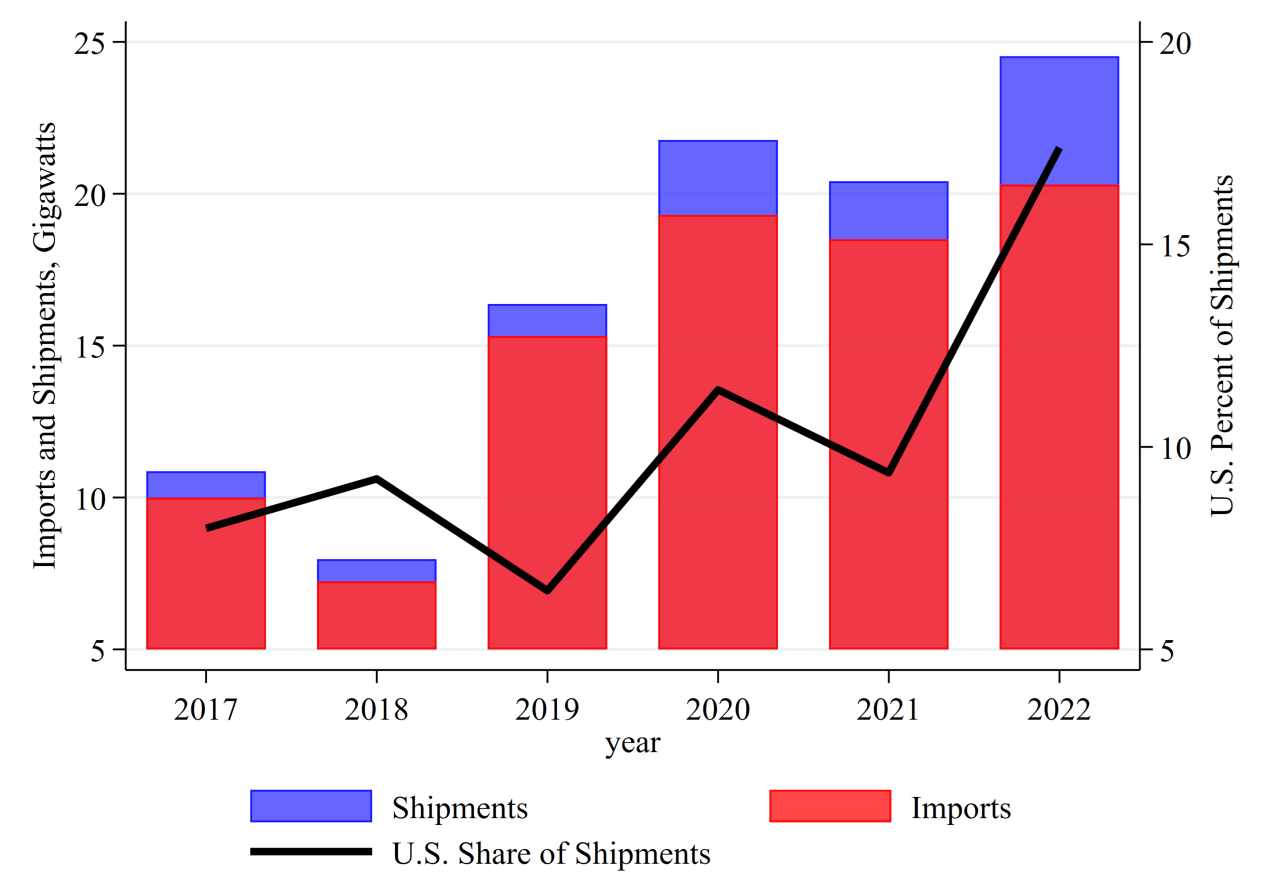

Increased Market Share Sought By Hanwha And Oci Following Us Solar Tariffs

May 30, 2025

Increased Market Share Sought By Hanwha And Oci Following Us Solar Tariffs

May 30, 2025 -

Droits De Douane Votre Manuel De Reference Complet

May 30, 2025

Droits De Douane Votre Manuel De Reference Complet

May 30, 2025 -

Udstilling Ditte Okman Praesenterer Kare Quist Han Taler Udenom

May 30, 2025

Udstilling Ditte Okman Praesenterer Kare Quist Han Taler Udenom

May 30, 2025