Understanding High Stock Market Valuations: A BofA Analysis

Table of Contents

Key Valuation Metrics: Assessing Market Overvaluation

Several key metrics help assess whether current stock market valuations are justified or represent an overvaluation. BofA's analysis utilizes a combination of these to paint a comprehensive picture.

Price-to-Earnings Ratio (P/E):

The P/E ratio is a fundamental valuation metric, calculated by dividing a company's stock price by its earnings per share (EPS). A high P/E ratio generally suggests investors expect higher future earnings growth.

- Variations Across Sectors: P/E ratios vary significantly across different sectors. Technology companies, for example, often command higher P/E ratios than utility companies due to perceived higher growth potential.

- Limitations of P/E: Relying solely on P/E can be misleading. It's essential to consider the company's growth prospects, industry benchmarks, and overall economic conditions. BofA's analysis likely considers these factors to avoid misinterpretations.

- BofA's P/E Analysis: BofA's research likely compares current P/E ratios to historical averages and industry benchmarks to determine if the market is overvalued relative to historical norms. They might also analyze P/E ratios across different market capitalization segments (large-cap, mid-cap, small-cap) to identify potential overvaluation in specific areas.

Shiller PE (CAPE):

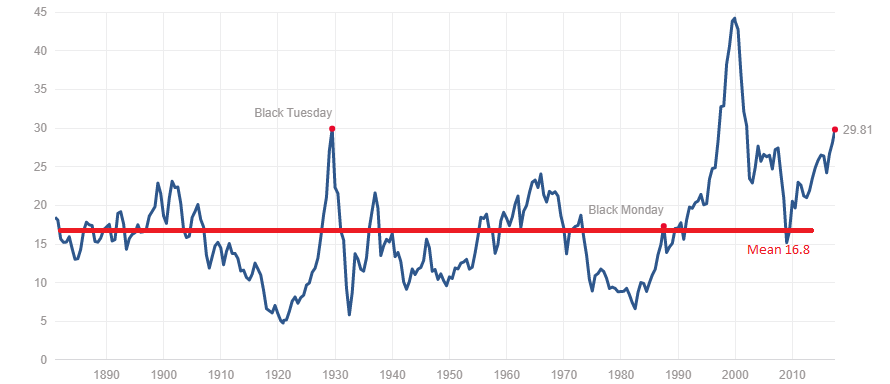

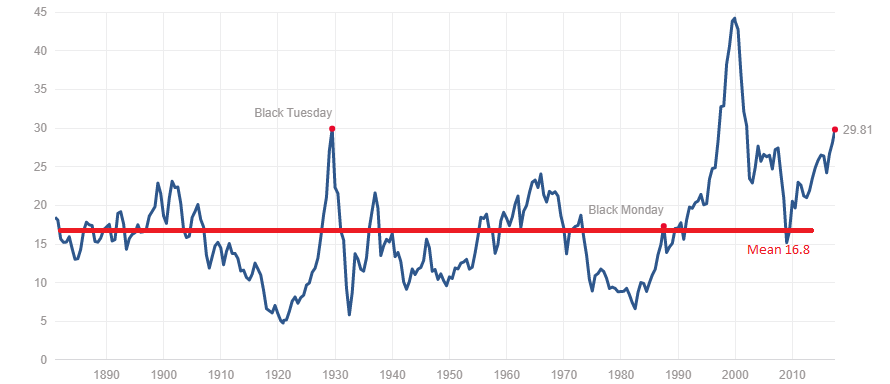

The cyclically adjusted price-to-earnings ratio (CAPE), also known as the Shiller PE, smooths out earnings fluctuations by using a 10-year average of inflation-adjusted earnings. This provides a longer-term perspective on market valuations.

- Historical CAPE Data: Comparing the current CAPE ratio to its historical average helps determine whether valuations are unusually high or low relative to long-term trends. Periods of high CAPE ratios have often been followed by periods of lower returns.

- Implications of High CAPE: A high CAPE ratio suggests the market may be overvalued, implying a potential for lower future returns or increased risk. However, it’s crucial to remember that CAPE is not a perfect predictor of market crashes.

- BofA's CAPE Interpretation: BofA's analysis likely incorporates the CAPE ratio to provide a more nuanced view of market valuations, comparing current levels to historical data and considering economic cycles.

Other Key Metrics:

BofA's comprehensive valuation assessment likely includes other important metrics:

- Price-to-Sales Ratio (P/S): This ratio compares a company's market capitalization to its revenue, useful for valuing companies with negative earnings or inconsistent profitability.

- Price-to-Book Ratio (P/B): This ratio compares a company's market value to its book value (assets minus liabilities), providing insights into the value of a company's net assets.

- BofA Findings: BofA's analysis likely considers these ratios in conjunction with P/E and CAPE to provide a more robust evaluation of the overall market valuation.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the elevated stock market valuations observed in the current market. BofA's analysis likely identifies and weighs the significance of these factors.

Low Interest Rates:

Historically low interest rates have played a significant role in boosting stock market valuations.

- Attractiveness of Stocks: Low interest rates make bonds and other fixed-income investments less attractive, driving investors towards higher-yielding assets like stocks. This increased demand pushes stock prices higher.

- Future Rate Hikes: The potential for future interest rate hikes could significantly impact stock valuations, potentially leading to lower prices as investors shift back to fixed income.

- BofA's Interest Rate Perspective: BofA's analysis will likely incorporate predictions for future interest rate changes and assess their potential impact on stock market valuations and investor behavior.

Quantitative Easing (QE):

Central banks' quantitative easing (QE) programs involve injecting liquidity into the market by purchasing assets, including government bonds.

- Impact on Stock Prices: QE increases the money supply, potentially leading to higher inflation and increased investment in riskier assets like stocks.

- Long-Term Consequences of QE: The long-term effects of QE are still being debated, with concerns about potential inflation and asset bubbles.

- BofA's QE Analysis: BofA's analysts likely consider the impact of past QE programs and assess potential future implications for stock market valuations.

Strong Corporate Earnings (and Expectations):

Robust corporate earnings and positive future earnings expectations contribute to supporting high stock valuations.

- Earnings Growth: Strong earnings growth validates higher stock prices, as investors are willing to pay more for companies with demonstrable profitability and growth potential.

- BofA's Earnings Predictions: BofA's research includes forecasts of future corporate earnings, which are a key factor influencing their assessment of market valuations.

- Earnings and Valuations: The relationship between earnings growth and stock valuations is crucial. BofA will likely analyze this relationship to assess whether current valuations are justified by expected future earnings.

Navigating High Stock Market Valuations: A BofA Strategy

Navigating a market with high valuations requires a well-defined strategy that emphasizes risk management and diversification.

Diversification:

Diversifying investments across different asset classes and sectors is crucial to mitigate risk.

- Asset Class Diversification: A diversified portfolio might include stocks, bonds, real estate, and other alternative investments to reduce overall portfolio volatility.

- Sector Diversification: Diversifying across different sectors can help reduce the impact of industry-specific downturns.

- BofA's Diversification Recommendations: BofA likely offers specific guidance on portfolio diversification, considering the current market conditions and risk tolerance of investors.

Value Investing:

Value investing focuses on identifying undervalued stocks based on fundamental analysis.

- Identifying Undervalued Stocks: Value investors look for companies trading below their intrinsic value, using metrics like P/E, P/B, and dividend yield.

- Challenges in High-Valuation Markets: Finding undervalued stocks can be challenging in a market with generally high valuations.

- BofA's Insights on Value Investing: BofA may provide insights on value investing strategies and suggest ways to identify undervalued opportunities within the current market environment.

Risk Management:

Risk management is critical during periods of high valuations to protect portfolios from potential losses.

- Risk Tolerance Assessment: Understanding an investor's risk tolerance is essential for building a suitable portfolio.

- Risk Mitigation Techniques: Techniques like stop-loss orders and hedging strategies can help limit potential losses.

- BofA's Risk Management Recommendations: BofA likely offers specific recommendations for managing risk, considering the high valuation environment.

Conclusion:

This analysis of high stock market valuations, informed by a BofA perspective, reveals a complex interplay of factors. Understanding key valuation metrics like P/E and CAPE ratios, alongside factors such as low interest rates and strong corporate earnings, is critical for informed investment decisions. BofA's analysis underscores the importance of diversification, value investing, and robust risk management strategies to navigate this challenging market environment successfully. By carefully considering these factors and incorporating a strategic approach, investors can better position themselves to manage risk and potentially capitalize on opportunities presented by these high stock market valuations. Remember to consult a financial advisor for personalized guidance on managing your investments in the face of high stock market valuations.

Featured Posts

-

Floridas Charm A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025

Floridas Charm A Cnn Anchors Favorite Vacation Spot

Apr 26, 2025 -

Analyzing The Language Used To Describe Gavin Newsom

Apr 26, 2025

Analyzing The Language Used To Describe Gavin Newsom

Apr 26, 2025 -

The Damen Csd 650 A New Chapter With Engineer Soltan Kazimov

Apr 26, 2025

The Damen Csd 650 A New Chapter With Engineer Soltan Kazimov

Apr 26, 2025 -

Restaurant Zuem Ysehuet Nouvelle Ere A Strasbourg Avec Guillaume Scheer

Apr 26, 2025

Restaurant Zuem Ysehuet Nouvelle Ere A Strasbourg Avec Guillaume Scheer

Apr 26, 2025 -

The Dude Who Stinks Identifying The Odorous Member Of Congress

Apr 26, 2025

The Dude Who Stinks Identifying The Odorous Member Of Congress

Apr 26, 2025