Understanding High Stock Market Valuations: A BofA Perspective

Table of Contents

BofA's Assessment of Current Market Conditions

Bank of America's stance on current market valuations is nuanced and typically avoids overly bullish or bearish pronouncements. Instead, they often emphasize a cautious optimism, acknowledging the high valuations while pointing to factors that could support continued, albeit potentially volatile, growth. Their assessments are frequently communicated through reports and research notes, which utilize a range of valuation metrics. While specific data points change frequently, their overall approach involves a careful consideration of both macroeconomic trends and company-specific fundamentals.

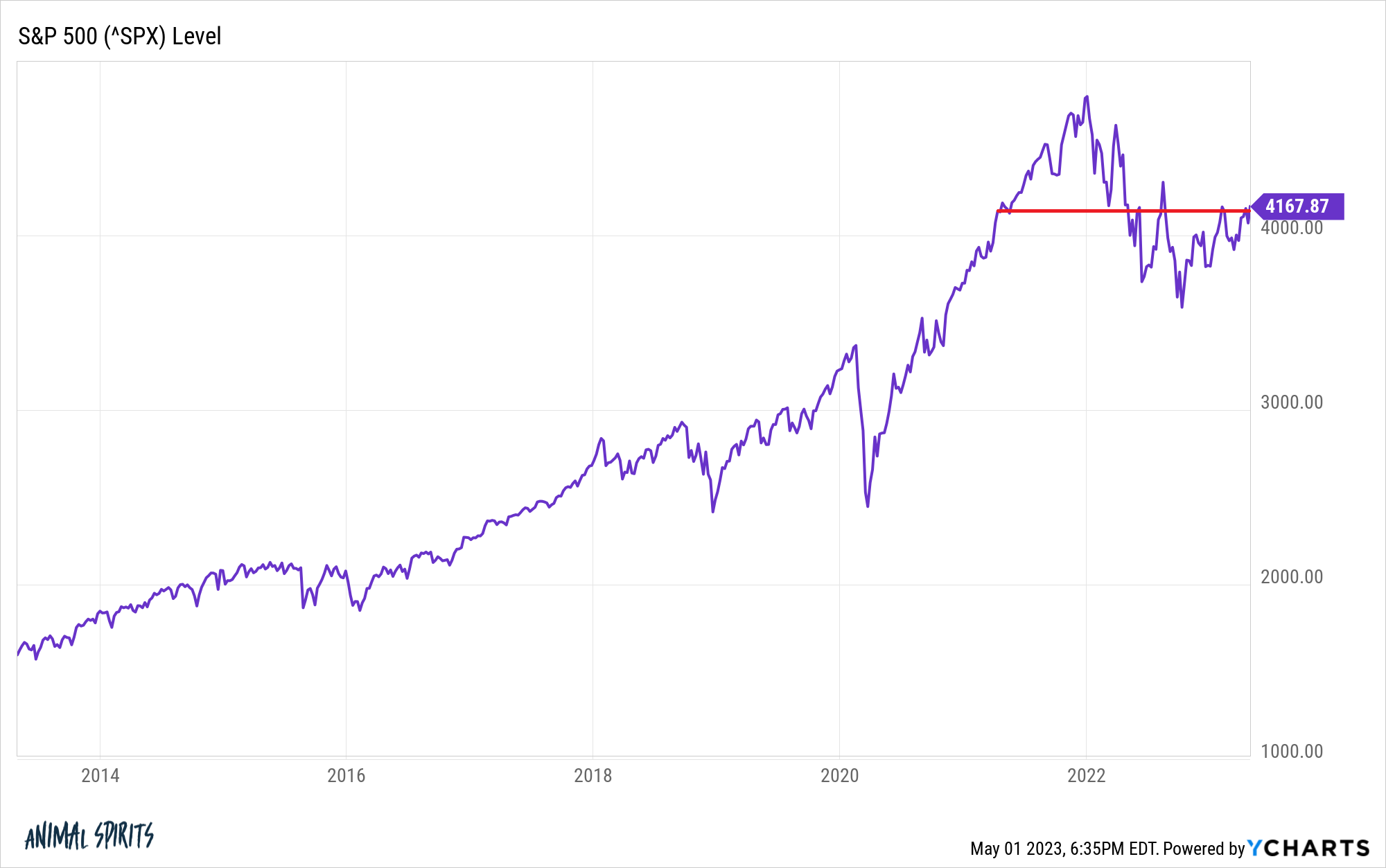

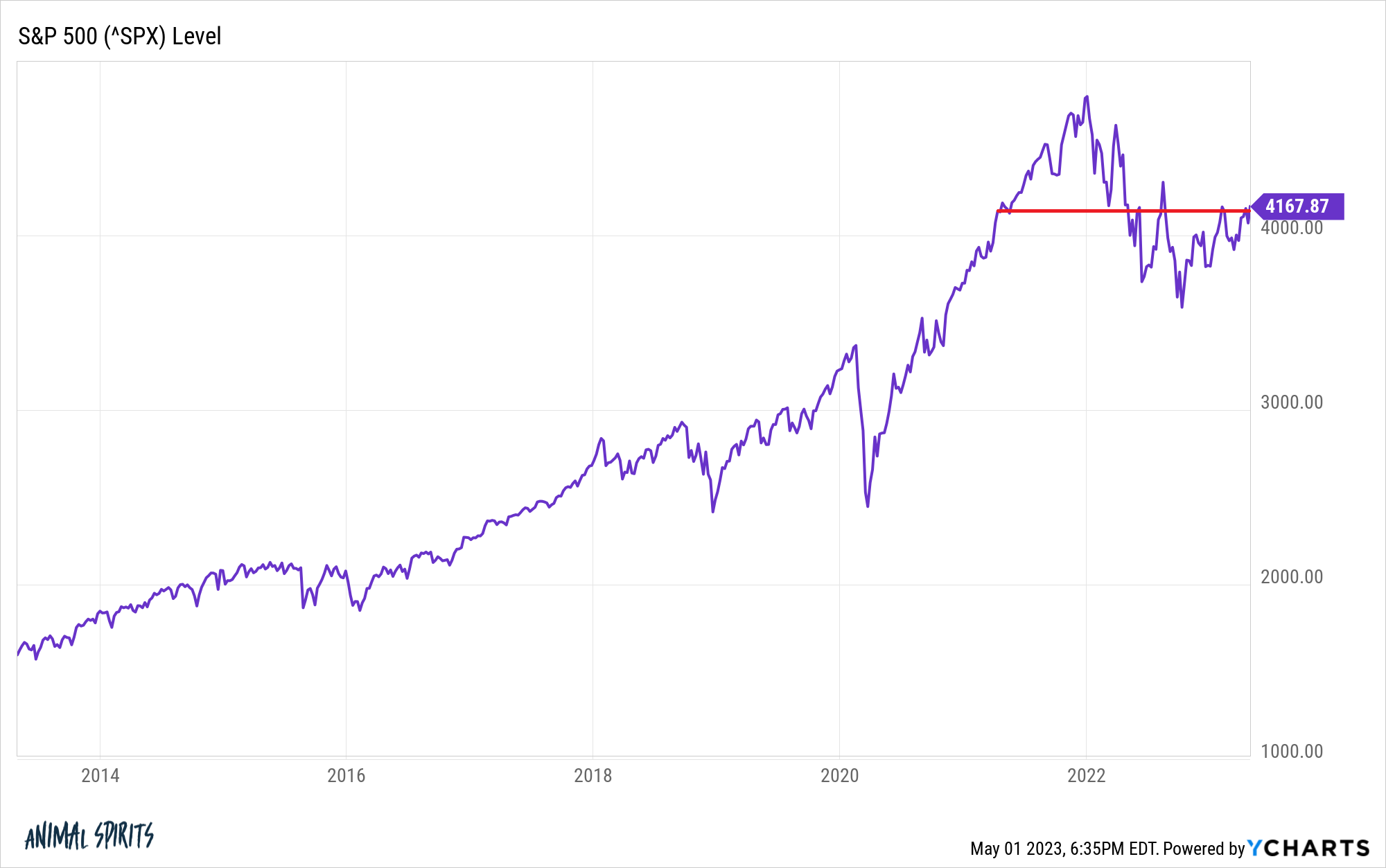

- Summary of BofA's key valuation metrics: BofA analysts typically analyze a variety of metrics including the Price-to-Earnings ratio (P/E), the Shiller PE ratio (also known as the cyclically adjusted price-to-earnings ratio or CAPE), and other forward-looking measures to gauge market valuation relative to historical averages and projected earnings. They frequently compare these metrics across different sectors and global markets.

- Sectors highlighted by BofA: BofA's research often identifies specific sectors that appear overvalued or undervalued based on their analysis. For example, certain technology stocks may be flagged as potentially overvalued in periods of high market exuberance, while others, such as energy or financials, may be deemed more attractive depending on the prevailing economic climate.

- BofA reports and publications: For the most up-to-date information, refer to BofA Global Research publications available to clients. These reports provide detailed breakdowns of valuation models and sector-specific analysis.

Factors Driving High Stock Market Valuations

Several interconnected macroeconomic factors contribute to the elevated stock market valuations. Understanding these factors is crucial for interpreting BofA's analysis and forming your own investment strategy.

- Low interest rates: Historically low interest rates have encouraged investors to seek higher returns in the stock market, driving up demand and prices. This “search for yield” phenomenon inflates valuations, particularly for growth stocks.

- Strong corporate earnings growth: Robust corporate earnings, or at least strong expectations for future earnings, often support higher stock prices. When companies consistently exceed profit expectations, investors are willing to pay a premium for shares.

- Government stimulus: Government fiscal stimulus packages, designed to boost economic activity, can inject liquidity into the market, indirectly supporting stock prices. This effect can be significant, particularly during periods of economic uncertainty.

- Inflation: Inflation impacts valuations in complex ways. While moderate inflation can be positive for earnings growth, high and persistent inflation can erode purchasing power and increase interest rates, potentially leading to market corrections. BofA's analysis carefully considers the inflation outlook.

- Geopolitical events: Global political events and geopolitical uncertainty can create both risk and opportunity. While uncertainty can lead to market volatility, some sectors may benefit from specific geopolitical developments, influencing valuations accordingly.

Risks Associated with High Stock Market Valuations

High stock market valuations inherently carry significant risks. While the market can remain elevated for extended periods, investors should be aware of potential downsides.

- Increased market volatility: High valuations often translate into increased market sensitivity to negative news. Corrections and sharp price declines become more likely when valuations are stretched.

- Risk of asset bubbles: Extreme valuations can indicate the formation of asset bubbles, which are characterized by unsustainable price increases followed by a dramatic collapse.

- Rising interest rates: A rise in interest rates, often a response to high inflation, can significantly impact stock valuations by increasing borrowing costs for companies and making bonds a more attractive investment alternative.

- Decreased investor returns: High valuations often mean lower future returns. Investors who buy at the peak of a valuation cycle may experience lower returns compared to those who invest when valuations are more modest.

- Implications of persistent inflation: Prolonged high inflation erodes the real value of investments, increasing the risks associated with holding stocks.

BofA's Recommendations for Investors

BofA's recommendations for investors navigating high stock market valuations emphasize a cautious yet opportunistic approach.

- Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to mitigate risk in a high-valuation market.

- Sector-specific recommendations: BofA's research often provides specific recommendations based on their valuation analysis. These recommendations are typically dynamic and adjusted according to market shifts.

- Portfolio risk management: Investors should carefully monitor their portfolio's risk exposure and adjust their holdings accordingly. This might involve rebalancing or reducing exposure to highly valued sectors.

- Long-term vs. short-term strategies: While short-term market fluctuations are unavoidable, a long-term investment horizon is often recommended to weather volatility and benefit from long-term growth.

- Individual risk tolerance: Investors should always consider their individual risk tolerance when making investment decisions. Conservative investors may prefer lower-risk investments, while others might be willing to accept greater risk for potentially higher returns.

Conclusion

Understanding high stock market valuations is crucial for informed investment decisions. BofA's perspective highlights the complex interplay of factors influencing current market conditions. While strong corporate earnings and low interest rates have supported high valuations, the risks associated with these elevated levels, including increased volatility and the potential for market corrections, cannot be ignored. BofA's recommendations emphasize the importance of diversification, risk management, and a well-defined investment strategy tailored to individual risk tolerance. Consult BofA's research for a deeper understanding of the current market dynamics and to develop a robust investment strategy. Remember to always conduct your own thorough research and consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

Declan Rice Souness Highlights Key Area For Improvement To Become World Class

May 02, 2025

Declan Rice Souness Highlights Key Area For Improvement To Become World Class

May 02, 2025 -

5 Practical Ways To Improve Mental Health Acceptance In Your Community

May 02, 2025

5 Practical Ways To Improve Mental Health Acceptance In Your Community

May 02, 2025 -

Check Out The Latest Play Station Plus Extra And Premium Game Additions

May 02, 2025

Check Out The Latest Play Station Plus Extra And Premium Game Additions

May 02, 2025 -

100 Year Old Dallas Star Dies

May 02, 2025

100 Year Old Dallas Star Dies

May 02, 2025 -

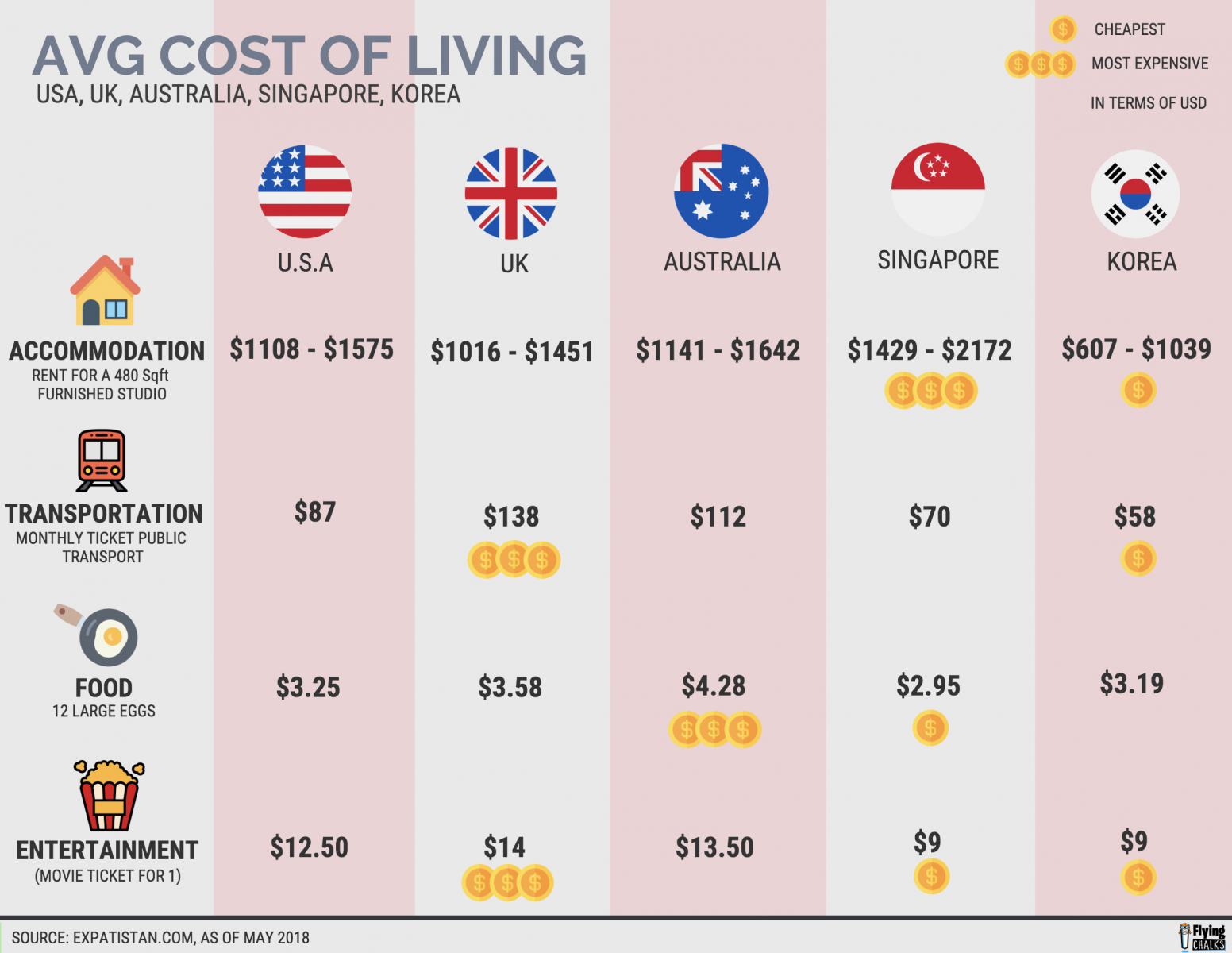

Exploring Modern And Traditional Housing In South Korea A New Exhibition

May 02, 2025

Exploring Modern And Traditional Housing In South Korea A New Exhibition

May 02, 2025