Understanding High Stock Market Valuations: BofA's Viewpoint

Table of Contents

BofA's Assessment of Current Market Conditions

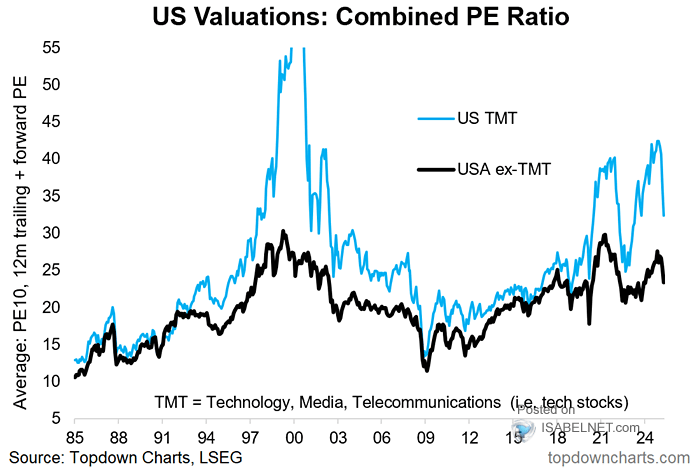

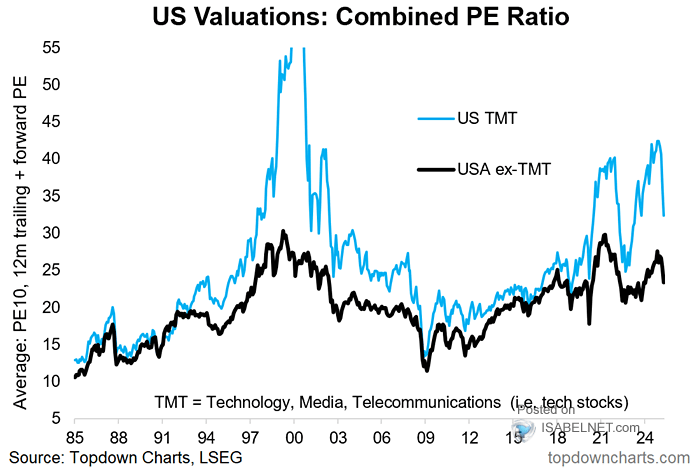

BofA's assessment of the current market environment tends to be cautiously optimistic, though acknowledging the elevated valuation levels. While not explicitly stating a wholly bullish or bearish stance, their reports consistently highlight the risks associated with sustained high valuations. Their analysts often reference the historically high price-to-earnings (P/E) ratios and other valuation metrics as key indicators of potential risk. You can find detailed analyses in their regularly published market commentaries and research reports (links to specific reports would be inserted here if available).

- Key Arguments: BofA emphasizes the importance of considering the interplay between earnings growth, interest rates, and investor sentiment when evaluating high valuations. They often caution against blindly chasing high returns in an already elevated market.

- Valuation Metrics: BofA frequently utilizes the cyclically adjusted price-to-earnings ratio (CAPE ratio or Shiller PE), alongside traditional P/E ratios, to gauge market valuations relative to historical averages. They also analyze other key metrics like price-to-sales ratios and dividend yields.

- Sectoral Analysis: BofA's reports often identify specific sectors they deem overvalued (e.g., certain technology sub-sectors during periods of rapid growth) and others that appear undervalued based on their fundamental analysis and projected earnings.

Factors Contributing to High Stock Market Valuations (According to BofA)

BofA attributes the current high stock market valuations to a confluence of factors:

- Low Interest Rates: Historically low interest rates have pushed investors towards higher-yielding assets, including stocks, thereby increasing demand and driving up prices. This makes bonds less attractive relative to equities.

- Strong Corporate Earnings (and Expectations): Strong corporate earnings, particularly in certain sectors, have supported higher valuations. However, BofA analysts often caution about the sustainability of these earnings levels. Future earnings projections play a crucial role in their valuation models.

- Increased Market Liquidity: Abundant liquidity, fueled by central bank actions and government stimulus programs, has provided ample capital for investment, further inflating asset prices.

- Government Stimulus and Macroeconomic Factors: Government stimulus packages and broader macroeconomic conditions influence investor confidence and risk appetite, thereby affecting stock valuations.

- Investor Sentiment and Speculation: High investor sentiment and speculative trading can contribute to price bubbles and unsustainable market increases, a factor BofA carefully monitors.

BofA's Predictions and Recommendations

BofA's predictions for future market performance are often nuanced and dependent on various economic and geopolitical factors. While they may express some optimism about certain sectors, they usually advise caution due to the existing high stock market valuations.

- Short-Term vs. Long-Term Outlook: BofA's short-term outlook often involves a degree of uncertainty, given the inherent volatility in the market. Their long-term projections are typically more positive but still acknowledge the risks associated with currently elevated valuations.

- Investment Strategies: BofA may suggest a diversified portfolio approach, incorporating a mix of asset classes to mitigate risk. Specific sector recommendations often vary based on their ongoing research and analysis.

- Risk Management: BofA frequently stresses the importance of robust risk management strategies in a high-valuation environment, recommending careful position sizing and diversification.

- Potential Downsides: BofA acknowledges the potential for market corrections or even significant downturns if certain key factors (like interest rate hikes or economic slowdown) materialize.

Alternative Perspectives on High Stock Market Valuations

It's crucial to consider perspectives beyond BofA's analysis. Other financial institutions and experts may hold differing viewpoints on current market valuations. Some may be more bullish, anticipating continued growth, while others might be more bearish, predicting a market correction.

- Contrasting Opinions: Some analysts might argue that current earnings growth justifies the high valuations, while others may emphasize the risks associated with stretched valuations and potential future interest rate increases.

- Disagreements with BofA: Differences in valuation methodologies, economic forecasts, and risk tolerance levels can lead to contrasting interpretations of the market.

- Multiple Perspectives: Considering multiple perspectives is essential for informed investment decision-making. It's vital to conduct independent research and possibly seek advice from a qualified financial advisor.

Conclusion: Understanding High Stock Market Valuations – Key Takeaways and Next Steps

BofA's analysis highlights the complexities of navigating high stock market valuations. They emphasize the need for careful consideration of various factors, including interest rates, earnings growth, and investor sentiment. Their recommendations often revolve around diversification, risk management, and a cautious approach to investment decisions in this environment.

By carefully considering BofA's insights and conducting your own thorough analysis, you can better navigate the complexities of high stock market valuations and make informed investment decisions. Learn more about managing your portfolio in a high-valuation market today! Consult with a financial advisor to develop a strategy tailored to your individual risk tolerance and financial goals. Remember that understanding the nuances of high stock market valuations is crucial for long-term investment success.

Featured Posts

-

Germany To Basel Abor And Tynnas Travel Plans

May 04, 2025

Germany To Basel Abor And Tynnas Travel Plans

May 04, 2025 -

Nyc Filming Bradley Cooper And Will Arnett On The Set Of Is This Thing On

May 04, 2025

Nyc Filming Bradley Cooper And Will Arnett On The Set Of Is This Thing On

May 04, 2025 -

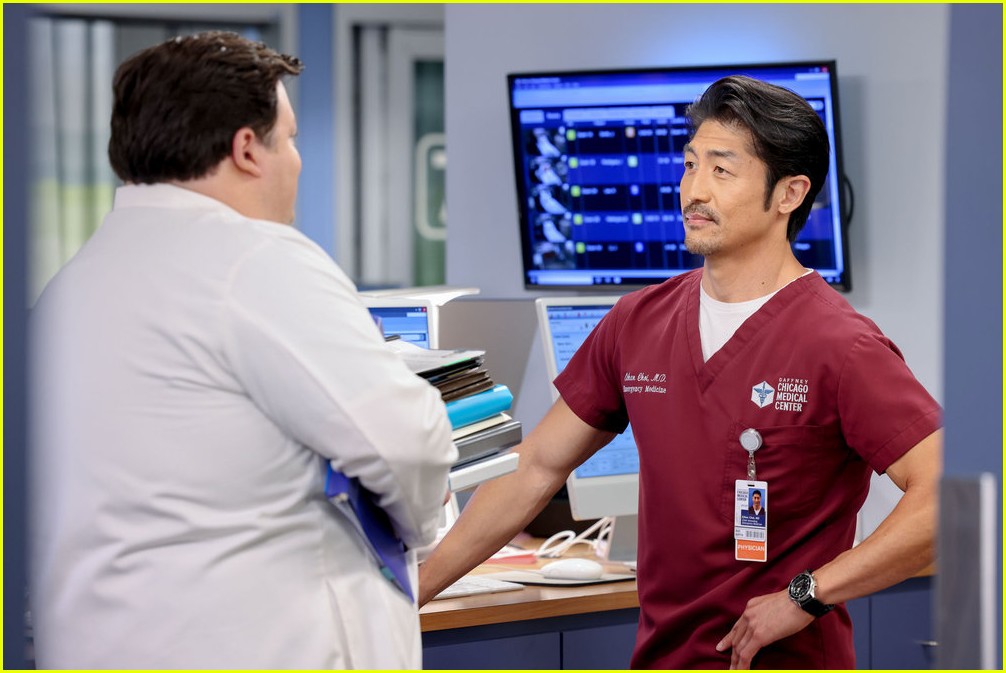

Brian Tee Returns To Chicago Med Season 10 Episode 14

May 04, 2025

Brian Tee Returns To Chicago Med Season 10 Episode 14

May 04, 2025 -

Australia Election 2023 Voting Begins Labor Holds Lead

May 04, 2025

Australia Election 2023 Voting Begins Labor Holds Lead

May 04, 2025 -

Tournage De L Age D Or Premier Film Realise Par Berenger Thouin

May 04, 2025

Tournage De L Age D Or Premier Film Realise Par Berenger Thouin

May 04, 2025