Understanding High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Current Market Outlook & Valuation Metrics

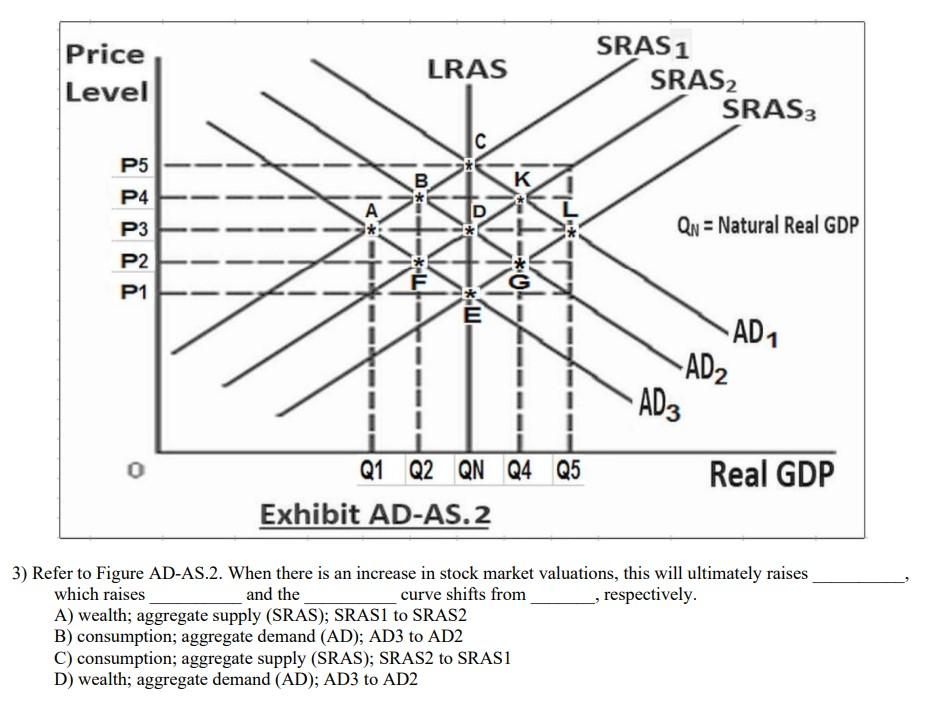

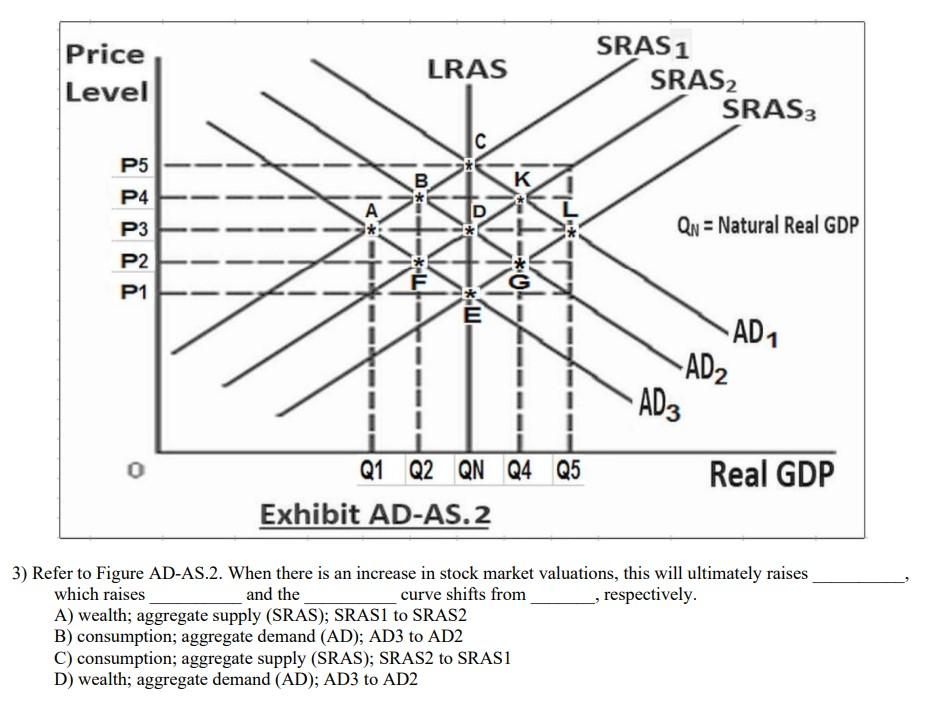

BofA's current stance on the market often fluctuates, reflecting the dynamic nature of global economics. While pinpointing their exact position as strictly "bullish," "bearish," or "neutral" at any given moment requires consulting their most recent reports, their analysis consistently incorporates key valuation metrics to gauge market health. These reports are frequently available on their website and through financial news outlets.

-

Key Valuation Metrics: BofA, like other financial institutions, utilizes various metrics to assess stock market valuation. These include:

- Price-to-Earnings Ratio (P/E Ratio): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating overvaluation.

- Shiller PE Ratio (CAPE Ratio): This is a cyclically adjusted price-to-earnings ratio that uses average inflation-adjusted earnings over the past 10 years. It aims to smooth out short-term earnings volatility and provide a more stable valuation measure.

- Cyclically Adjusted Price-to-Earnings Ratio (CAPE): As mentioned above, this metric adjusts for economic cycles, providing a longer-term perspective on valuation compared to the standard P/E ratio.

-

BofA's Assessment: BofA's assessment of current market valuations relative to historical averages varies depending on the specific metric used and the time period considered. Their analysts often highlight discrepancies between current valuations and historical norms, providing context for investors.

-

Divergences: BofA frequently points out potential divergences between valuation metrics and underlying economic fundamentals. For example, high valuations might not be fully justified by strong earnings growth or economic expansion, suggesting a potential risk of a market correction.

-

Sector-Specific Analysis: BofA's reports often highlight specific sectors or asset classes that are deemed overvalued or undervalued based on their analysis. This granular approach helps investors make more informed decisions about portfolio allocation.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the currently elevated stock market valuations. Understanding these is critical for navigating the market effectively.

Low Interest Rates and Monetary Policy

Low interest rates significantly impact stock valuations. When interest rates are low, the return on bonds and other fixed-income investments diminishes, making equities a relatively more attractive investment.

- Quantitative Easing (QE): QE programs implemented by central banks inject liquidity into the market, further driving up asset prices, including stocks.

- Central Bank Influence: Central bank actions, such as interest rate cuts and QE, significantly influence market sentiment and valuations. These actions can create a positive feedback loop, boosting investor confidence and driving up stock prices.

- Future Rate Hikes: The prospect of future interest rate hikes can dampen market enthusiasm and potentially lead to a decline in valuations as investors seek safer, higher-yielding alternatives.

Strong Corporate Earnings and Profitability

Robust corporate earnings and profitability play a vital role in supporting high stock prices, even when valuations appear elevated.

- Earnings Reports: Positive corporate earnings reports generally fuel market optimism and contribute to higher stock prices. BofA closely monitors these reports to assess the health of the corporate sector.

- Profitability Drivers: Factors driving corporate profitability, such as technological advancements, supply chain improvements, and efficient cost management, help justify higher valuations.

- Strong Balance Sheets: Companies with strong balance sheets are better positioned to withstand economic downturns and maintain profitability, making them attractive investment targets even in a high-valuation environment.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation significantly influence stock market valuations. Periods of heightened optimism can lead to inflated prices, potentially creating bubbles.

- Sentiment Indicators: BofA analyzes investor sentiment indicators like consumer confidence surveys and investor polls to gauge market psychology.

- Speculative Bubbles: The potential for speculative bubbles and subsequent corrections is a constant risk in markets with high valuations. BofA's analysts assess this risk carefully.

- Retail Investor Participation: Increased participation from retail investors can amplify market trends, both positive and negative, adding to the volatility and potentially impacting valuations.

Risks Associated with High Stock Market Valuations

High stock market valuations inherently carry increased risks. Understanding these potential downsides is crucial for responsible investing.

- Market Corrections/Crashes: High valuations increase the likelihood of significant market corrections or even crashes. These corrections can lead to substantial losses for investors.

- Economic/Geopolitical Sensitivity: Markets with high valuations are often more vulnerable to negative economic news or geopolitical events, leading to sharp price declines.

- Lower Future Returns: Investing in a market with high valuations generally implies lower potential for future returns compared to periods of lower valuations.

- BofA's Risk Assessment: BofA's reports regularly assess the likelihood and potential impact of these risks, providing investors with valuable insights for risk management.

Conclusion

BofA's analysis of high stock market valuations highlights the interplay of factors such as low interest rates, strong corporate earnings, and heightened investor sentiment. While these factors contribute to the current market conditions, BofA also emphasizes the inherent risks associated with high valuations, including the potential for market corrections and lower future returns. Key valuation metrics like the P/E ratio, Shiller PE ratio, and CAPE ratio are instrumental in their analysis.

Understanding high stock market valuations is crucial for making informed investment decisions. Utilize BofA's analysis and this article to develop a robust investment strategy that accounts for these valuations and potential risks. Continue researching the market, diversify your portfolio, and consult with financial advisors to navigate these complex market conditions. Stay informed on the latest insights regarding high stock market valuations and adapt your strategy accordingly.

Nine Home Runs In One Game Aaron Judge And The Yankees Make History

Nine Home Runs In One Game Aaron Judge And The Yankees Make History

Athletics Defeat Brewers 3 1 Game Recap And Highlights

Athletics Defeat Brewers 3 1 Game Recap And Highlights

Microsoft Activision Merger Ftcs Appeal And Future Uncertainty

Microsoft Activision Merger Ftcs Appeal And Future Uncertainty

Conges Scolaires 2025 Wallonie Bruxelles Dates Officielles Et Conseils Pour Vos Vacances

Conges Scolaires 2025 Wallonie Bruxelles Dates Officielles Et Conseils Pour Vos Vacances

Canadas Growing Oil Exports To China A Response To Us Trade Disputes

Canadas Growing Oil Exports To China A Response To Us Trade Disputes