Understanding Investor Behavior During Market Corrections

Table of Contents

The Psychology of Market Corrections

Market corrections aren't just about numbers; they're deeply intertwined with human psychology. Understanding the emotional drivers behind investment decisions during these times is key to avoiding costly mistakes.

Fear and Panic Selling

Fear is a powerful motivator, and during market corrections, it can lead to widespread panic selling. This "herd mentality," where investors mimic each other's actions, often exacerbates the downturn.

- Fear of further losses: The instinct to protect capital can lead investors to sell assets at a loss, locking in their losses rather than waiting for a potential recovery.

- Influence of media narratives and social media: Negative news coverage and sensationalized social media posts can amplify fear and encourage hasty decisions. The constant stream of information can be overwhelming, leading to impulsive reactions.

- Regret aversion: Selling to avoid the regret of missing a potential opportunity to sell higher can lead to selling at a loss.

- Focus on short-term losses rather than long-term gains: During corrections, the focus shifts from long-term investment goals to short-term price movements, causing investors to lose sight of their overall strategy.

The Role of Greed and FOMO (Fear Of Missing Out)

While fear dominates the early stages of a correction, greed and FOMO can emerge during market rallies within the correction itself. This can lead to impulsive buying decisions.

- Chasing "bottom-fishing" opportunities: The attempt to buy at the absolute lowest point is risky and often unsuccessful. Timing the market perfectly is nearly impossible.

- Ignoring fundamental analysis in favor of speculation: Investors might prioritize short-term gains over sound investment principles, leading to poor investment choices.

- Overconfidence leading to excessive risk-taking: A belief that the market has bottomed out can encourage investors to take on more risk than they should.

- The impact of social media hype and market momentum: The hype surrounding certain stocks, fueled by social media, can create a false sense of security and encourage impulsive buying decisions.

Rational Responses to Market Corrections

While emotions can cloud judgment, a rational approach is crucial for navigating market corrections successfully. This involves sticking to your investment plan and seeing opportunities where others see only losses.

Sticking to a Long-Term Investment Strategy

A well-defined investment plan, based on your risk tolerance and long-term financial goals, is your anchor during market turbulence.

- Re-evaluating asset allocation based on long-term goals: Periodically review your portfolio to ensure it still aligns with your overall objectives. However, avoid making drastic changes based on short-term market fluctuations.

- Dollar-cost averaging to mitigate risk: This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. It helps mitigate the risk of buying high and reduces emotional decision-making.

- Ignoring short-term market fluctuations: Focus on the long-term picture and avoid making emotional decisions based on daily or weekly market movements.

- Diversification across asset classes: A diversified portfolio, spanning various asset classes like stocks, bonds, and real estate, can help reduce overall portfolio volatility during corrections.

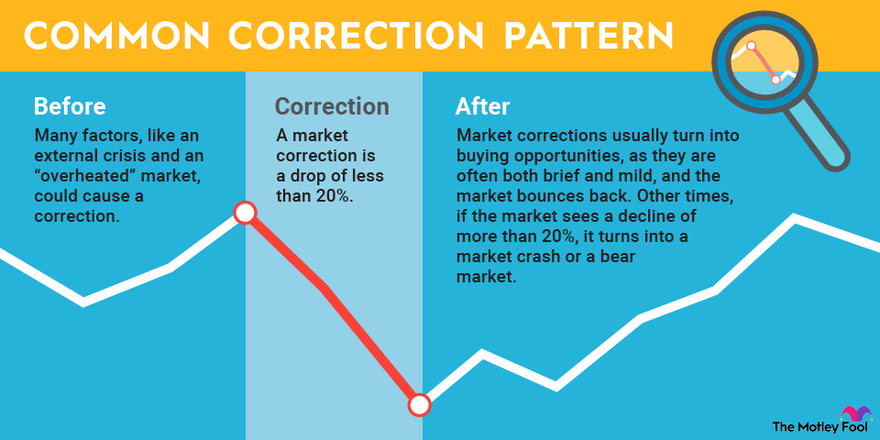

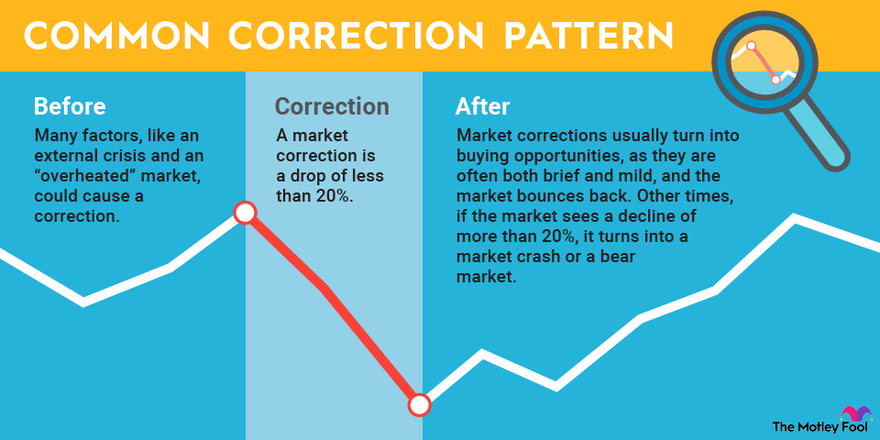

Utilizing Market Corrections as Buying Opportunities

Market corrections can present excellent opportunities to buy high-quality assets at discounted prices. This requires discipline and a long-term perspective.

- Identifying undervalued companies with strong fundamentals: Focus on companies with solid financial performance, strong competitive advantages, and a sustainable business model.

- Capitalizing on lower entry points for long-term growth: A correction can lower the entry point for stocks you've been wanting to acquire, potentially improving your long-term returns.

- Understanding the difference between a correction and a bear market: A correction is a temporary market decline, while a bear market is a more sustained and significant downturn. Knowing the difference is crucial for making informed investment decisions.

- Risk management strategies for buying during a correction: Even during a correction, prudent risk management is important. Don't invest more than you can afford to lose.

Analyzing Investor Behavior Data

Understanding how other investors are behaving can give you valuable insights during market corrections. Analyzing market data and sentiment can help inform your decisions.

Market Sentiment Indicators

Several indicators can gauge investor sentiment and potential market movements.

- Interpreting VIX levels to gauge fear and uncertainty: The VIX (Volatility Index) measures market volatility. High VIX levels often indicate high fear and uncertainty.

- Analyzing investor confidence surveys: Surveys of investor sentiment can provide valuable insights into market psychology.

- Using put/call ratios to assess investor sentiment: The ratio of put options (bets on price declines) to call options (bets on price increases) can reflect investor sentiment.

Historical Data and Market Cycles

Studying past market corrections provides invaluable context and lessons.

- Analyzing the duration and depth of previous corrections: Understanding the historical patterns of corrections can help you manage expectations and prepare for potential scenarios.

- Identifying recurring patterns in investor behavior: Analyzing past investor behavior can help predict potential future reactions during market corrections.

- Learning from historical mistakes and successes: Reviewing past market corrections and identifying successful and unsuccessful strategies can improve your future decision-making.

Conclusion

Understanding investor behavior during market corrections is crucial for navigating market volatility and achieving long-term investment success. By recognizing the psychological factors that drive emotional decision-making and adopting a rational, long-term approach, investors can mitigate risks and potentially capitalize on market opportunities. Remember to stick to your investment plan, diversify your portfolio, and consider market sentiment indicators to make informed decisions. Don't let fear dictate your actions; instead, utilize your understanding of investor behavior during market corrections to make strategic moves that align with your financial goals. Develop your own strategy for navigating these periods – your financial future depends on it.

Featured Posts

-

Austin Teens Find Inspiration In Bubba Wallace Ahead Of Cota

Apr 28, 2025

Austin Teens Find Inspiration In Bubba Wallace Ahead Of Cota

Apr 28, 2025 -

Wallaces Late Race Mishap Costs Him Second At Martinsville

Apr 28, 2025

Wallaces Late Race Mishap Costs Him Second At Martinsville

Apr 28, 2025 -

Kuxius Innovative Solid State Power Bank Durability And Cost Analysis

Apr 28, 2025

Kuxius Innovative Solid State Power Bank Durability And Cost Analysis

Apr 28, 2025 -

Gpu Price Hike Whats Driving The Cost Increase

Apr 28, 2025

Gpu Price Hike Whats Driving The Cost Increase

Apr 28, 2025 -

Aaron Judge And Samantha Bracksieck Welcome Their First Child

Apr 28, 2025

Aaron Judge And Samantha Bracksieck Welcome Their First Child

Apr 28, 2025