Understanding Live Now, Pay Later Services: A Comprehensive Overview

Table of Contents

How Live Now, Pay Later Services Work

Live now, pay later services, also known as buy now, pay later (BNPL) options, operate on a simple principle: you purchase an item now and pay for it in installments over a predetermined period. This differs significantly from traditional credit cards, often offering shorter repayment terms and simpler application processes.

-

Application Process: Most LNPL providers offer quick and easy online applications, often requiring only basic personal information and a linked bank account or debit card. The entire process can frequently be completed within minutes.

-

Credit Checks: The credit check requirements vary widely among LNPL providers. Some perform only soft credit checks, which don't impact your credit score, while others may conduct hard credit checks, potentially affecting your creditworthiness.

-

Payment Schedules: LNPL services typically offer flexible payment schedules, ranging from weekly or bi-weekly installments to monthly payments. The repayment period and schedule are usually clearly outlined at the time of purchase.

-

Interest and Fees: While many LNPL services advertise "interest-free" payments, this often comes with conditions. Late payments can incur significant fees, and missing payments can severely damage your credit score and potentially lead to further charges. Always understand the total cost before committing.

-

Popular LNPL Providers: Several popular LNPL providers operate globally, including Klarna, Afterpay, Affirm, and PayPal's Pay in 4. Each provider might have slightly different terms, fees, and eligibility criteria, so comparison is crucial.

Benefits of Using Live Now, Pay Later Services

LNPL services offer several compelling advantages for consumers, especially those needing short-term financial flexibility:

-

Improved Budgeting Flexibility: Spreading payments over time can make larger purchases more manageable and prevent budget overextension. This allows for better expense planning and control.

-

Access to Essential Goods and Services: LNPL services can provide access to needed items or services when you might not have the full amount readily available. This can be particularly beneficial for unexpected expenses like medical bills or car repairs.

-

Building Credit (Potentially): For some services, responsible use of LNPL can contribute positively to your credit score, particularly if the provider reports payment activity to credit bureaus. This can be a valuable tool for building credit history.

-

Convenient Online and In-Store Shopping Experience: LNPL is seamlessly integrated into online and in-store checkout processes, making it a very convenient payment option for many shoppers.

-

Protection Against Unexpected Expenses: LNPL can act as a safety net for unforeseen costs, allowing you to manage those expenses without resorting to high-interest loans or credit card debt.

Potential Drawbacks and Risks of Live Now, Pay Later Services

While offering convenience, LNPL services also present potential downsides that consumers must carefully consider:

-

High Interest Rates and Late Payment Fees: Missing payments can lead to escalating interest charges and substantial late fees, quickly increasing your overall debt burden. These fees can significantly outweigh the initial convenience.

-

Impact on Credit Score: Late or missed payments are reported to credit bureaus, negatively affecting your credit score and making it harder to obtain loans or credit in the future. This can have long-term financial consequences.

-

Debt Accumulation: The ease of access to credit through LNPL can lead to overspending and debt accumulation if not managed carefully. It's crucial to only use these services for necessary purchases within your budget.

-

Hidden Fees and Charges: Always read the terms and conditions thoroughly to avoid unexpected fees and charges. Some providers may have hidden fees associated with late payments, returns, or other circumstances.

-

Potential for Scams and Fraudulent Activities: Be wary of unofficial LNPL providers. Always use established and reputable services to protect your financial information.

Responsible Use of Live Now, Pay Later Services

To maximize the benefits and minimize the risks of LNPL services, follow these best practices:

-

Only Use for Necessary Purchases: Avoid using LNPL for non-essential items or impulse buys. Only utilize these services for purchases you truly need.

-

Stick to Your Budget and Repayment Plan: Create a realistic budget that incorporates your LNPL payments, and make every effort to stick to your repayment schedule.

-

Compare Different LNPL Providers: Research and compare different providers to find the best terms and fees for your needs. Don't just settle for the first option you encounter.

-

Read the Terms and Conditions Carefully: Thoroughly review the terms and conditions before using any LNPL service. Understand all fees, interest rates, and repayment requirements.

-

Set Reminders to Avoid Late Payments: Use calendar reminders or automated payment systems to ensure timely payments and avoid late fees. A missed payment can rapidly escalate your costs.

-

Monitor Your Credit Score Regularly: Keep an eye on your credit score to ensure responsible use of LNPL services doesn't negatively affect your creditworthiness.

Alternatives to Live Now, Pay Later Services

Before opting for LNPL, consider these alternatives:

-

Traditional Credit Cards: Credit cards offer more flexibility but often carry higher interest rates and require responsible management to avoid accumulating debt. They can also help build credit history.

-

Personal Loans: Personal loans are suitable for larger purchases, offering fixed interest rates and repayment schedules. However, they typically involve a more rigorous application process.

-

Saving Up Before Making a Purchase: The most responsible approach is to save enough money before making a purchase, avoiding any debt entirely. This eliminates interest and fees.

Conclusion

Live now, pay later services offer a convenient way to access goods and services, but responsible use is crucial. Understanding the benefits and drawbacks, along with practicing mindful spending habits, is key to avoiding potential financial pitfalls. The ease of access should not overshadow the importance of responsible financial planning.

Call to Action: Before using a live now, pay later service, carefully research available options, compare fees, and ensure you can comfortably manage your repayment plan. Make informed decisions and use live now, pay later services responsibly to maximize their benefits and avoid the risks.

Featured Posts

-

Bayernliga Torwart Garteig Verlaesst Ingolstadt Fuer Augsburg

May 30, 2025

Bayernliga Torwart Garteig Verlaesst Ingolstadt Fuer Augsburg

May 30, 2025 -

Harvards Response To Trumps America First Presidency

May 30, 2025

Harvards Response To Trumps America First Presidency

May 30, 2025 -

Bts V And Jungkooks Post Military Physiques Fan Reactions To Viral Gym Photos

May 30, 2025

Bts V And Jungkooks Post Military Physiques Fan Reactions To Viral Gym Photos

May 30, 2025 -

Measles Cases In The Us Rise To 1 046 Indiana Outbreak Concludes

May 30, 2025

Measles Cases In The Us Rise To 1 046 Indiana Outbreak Concludes

May 30, 2025 -

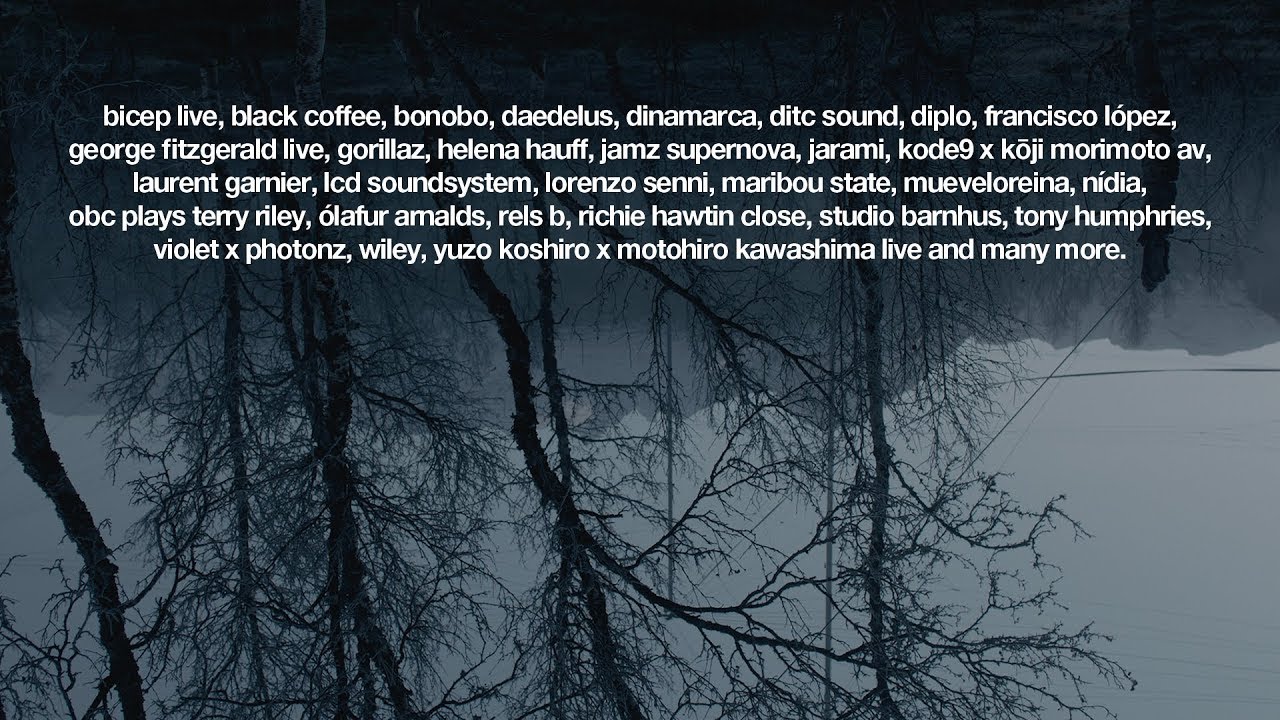

Gorillazs 25th Anniversary A Look At The House Of Kong Exhibition And London Shows

May 30, 2025

Gorillazs 25th Anniversary A Look At The House Of Kong Exhibition And London Shows

May 30, 2025