Understanding Stock Market Valuations: BofA's Investor Guidance

Table of Contents

Key Valuation Metrics Used by BofA

Bank of America, a leading financial institution, employs a range of valuation metrics to analyze stocks and provide investor guidance. Understanding these metrics is crucial for interpreting their recommendations and forming your own investment strategy.

Price-to-Earnings Ratio (P/E)

The Price-to-Earnings ratio (P/E) is a fundamental valuation metric that compares a company's stock price to its earnings per share (EPS).

-

Definition and Calculation: The P/E ratio is calculated by dividing the market value per share by the earnings per share (P/E = Market Price per Share / Earnings per Share). For example, if a company's stock price is $50 and its EPS is $5, the P/E ratio is 10.

-

Interpreting High vs. Low P/E Ratios: A high P/E ratio suggests investors expect higher earnings growth in the future, potentially indicating a higher valuation. Conversely, a low P/E ratio might signal that the market views the company as less attractive or undervalues its potential. However, comparing P/E ratios across different industries is crucial, as some sectors naturally command higher valuations.

-

BofA's Approach: BofA likely uses P/E ratios as a starting point in its valuation analysis. They probably compare a company's P/E to its industry peers and historical averages to determine if it's overvalued or undervalued. They would also consider factors like growth prospects and industry trends when interpreting the P/E ratio.

Price-to-Book Ratio (P/B)

The Price-to-Book ratio (P/B) compares a company's market capitalization to its book value of equity. It offers a different perspective on valuation than the P/E ratio.

-

Definition and Calculation: The P/B ratio is calculated by dividing the market price per share by the book value per share (P/B = Market Price per Share / Book Value per Share). Book value is essentially the net asset value of a company.

-

Interpreting High vs. Low P/B Ratios: A high P/B ratio might indicate that the market values the company's intangible assets (brand, intellectual property) highly. A low P/B ratio could suggest the company's assets are undervalued or that the market is pessimistic about its future prospects. However, the P/B ratio can be less useful for companies with significant intangible assets.

-

BofA's Approach: BofA likely utilizes the P/B ratio in conjunction with other metrics, understanding its limitations, particularly for companies with substantial intangible assets. It provides a useful comparison when assessing companies within the same industry with similar asset compositions.

Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) analysis is a more sophisticated valuation method that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value.

-

Core Principles of DCF: DCF analysis involves estimating future free cash flows, selecting an appropriate discount rate (reflecting the risk associated with the investment), and discounting those future cash flows to arrive at a present value.

-

Advantages and Disadvantages: DCF analysis offers a comprehensive approach, considering a company's long-term growth potential. However, it relies heavily on estimations and assumptions about future cash flows and the discount rate, making it susceptible to inaccuracies.

-

BofA's Likely Use of DCF: BofA likely employs DCF analysis for more in-depth valuation of companies, particularly those with stable cash flows and predictable future growth. This method allows for a more nuanced understanding of a company's intrinsic worth compared to simpler metrics like P/E or P/B.

Interpreting BofA's Market Outlook and Sector Analysis

Beyond individual stock valuations, BofA provides broader market analysis and sector-specific insights that are vital for creating a diversified investment portfolio.

Identifying BofA's Top Picks

BofA's analysts constantly evaluate economic trends, industry dynamics, and company-specific performance to identify promising sectors and stocks.

-

Factors Influencing BofA's Recommendations: Macroeconomic factors (interest rates, inflation), industry-specific trends (technological advancements, regulatory changes), and company-specific factors (earnings growth, management quality) all play a crucial role in shaping BofA's investment recommendations.

-

Examples of BofA's Recent Recommendations: (Note: This section would require updating with current BofA recommendations. One would need to reference recent BofA reports and publications to fill this section.)

Understanding BofA's Risk Assessment

BofA's recommendations always include a thorough assessment of potential risks.

-

Identifying Potential Downside Risks: BofA analysts identify potential risks like economic downturns, increased competition, regulatory changes, and operational challenges that could impact a company's performance.

-

Risk Mitigation Strategies: BofA might suggest diversifying investments across different sectors and asset classes to mitigate risk. They may also recommend strategies like hedging or using stop-loss orders to limit potential losses.

Applying BofA's Insights to Your Investment Strategy

BofA's insights should be integrated into your own investment plan, but they shouldn't dictate it entirely.

Aligning BofA's Guidance with Your Investment Goals

Successfully using BofA's guidance requires aligning their recommendations with your own financial goals and risk tolerance.

-

Matching Investment Style with BofA's Recommendations: If you are a growth investor, you might focus on BofA's recommendations for companies with high growth potential, even if they have high P/E ratios. Value investors would likely prefer companies with low P/E or P/B ratios.

-

Developing a Diversified Portfolio: BofA's sector analysis helps you build a diversified portfolio, reducing your overall risk by spreading investments across different sectors.

Monitoring Your Investments and Adjusting Your Strategy

The market is dynamic; consistent monitoring and adaptation are vital.

-

Responding to Market Volatility: BofA's ongoing insights help you understand market movements and react appropriately to volatility. You might adjust your portfolio based on changing economic conditions or new information affecting specific companies.

-

Regular Portfolio Review: Regular portfolio reviews, informed by BofA's updates and your own analysis, ensure your investments remain aligned with your goals and risk tolerance.

Conclusion

Understanding stock market valuations is crucial for successful investing. By leveraging insights from reputable sources like BofA, and employing a variety of valuation methods such as P/E ratios, P/B ratios, and DCF analysis, investors can make more informed decisions. BofA's market outlook and sector analyses provide valuable guidance, but remember to align their recommendations with your personal investment goals and risk tolerance. Continuously monitor the market and adjust your strategy as needed. Start improving your understanding of stock market valuations today—your financial future depends on it!

Featured Posts

-

Apple Stock Suffers As Tariffs Bite Into Profits

May 25, 2025

Apple Stock Suffers As Tariffs Bite Into Profits

May 25, 2025 -

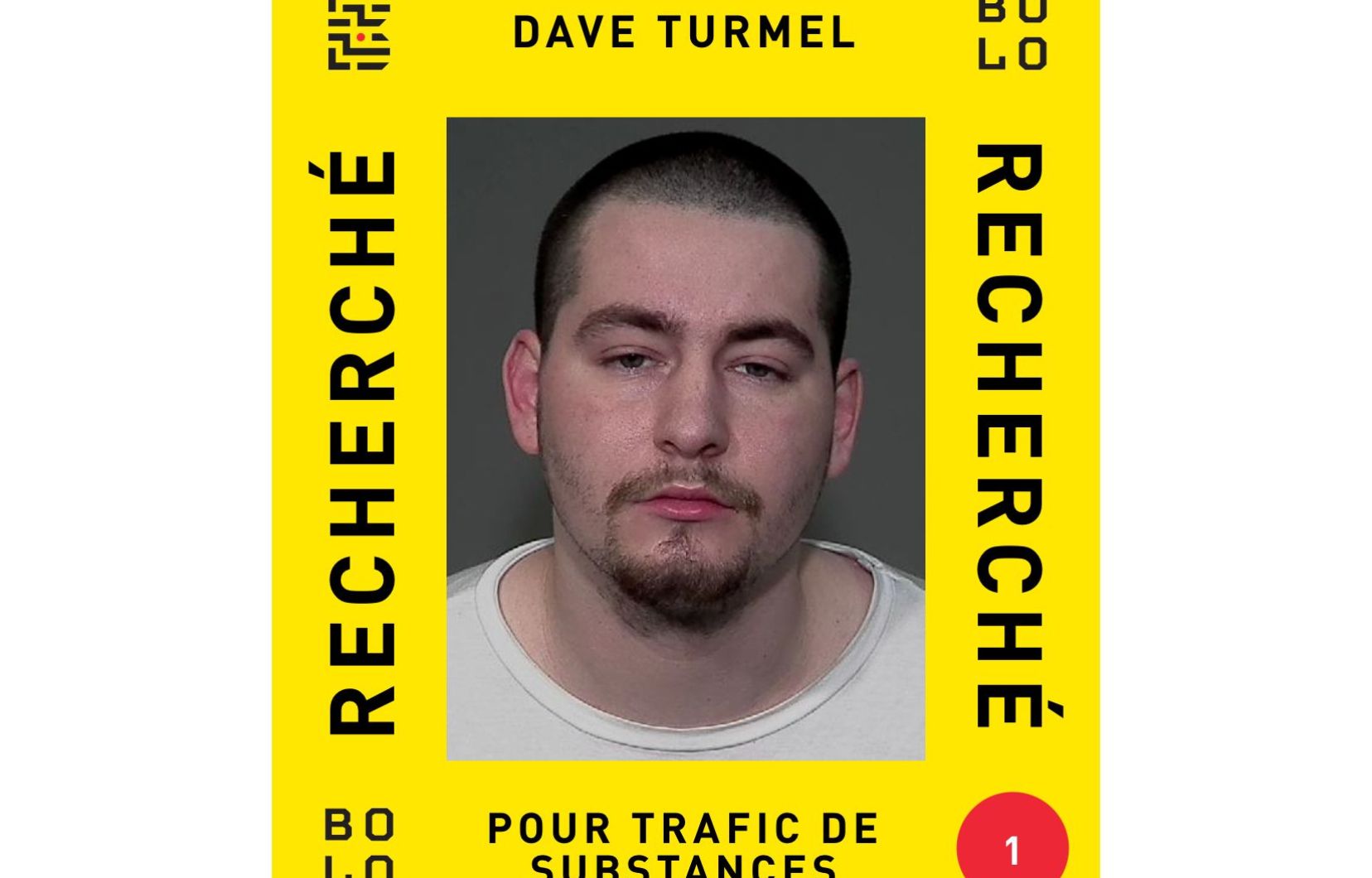

Dave Turmel Canadas Top Fugitive Captured In Italy

May 25, 2025

Dave Turmel Canadas Top Fugitive Captured In Italy

May 25, 2025 -

Buffetts Apple Investment Threatened By Trump Tariffs

May 25, 2025

Buffetts Apple Investment Threatened By Trump Tariffs

May 25, 2025 -

The Hells Angels An Examination Of Their Influence And Power

May 25, 2025

The Hells Angels An Examination Of Their Influence And Power

May 25, 2025 -

When To Fly Around Memorial Day 2025 Avoiding Crowds And High Prices

May 25, 2025

When To Fly Around Memorial Day 2025 Avoiding Crowds And High Prices

May 25, 2025