Understanding Stock Market Valuations: BofA's Take For Investors

Table of Contents

Stock market valuation refers to the process of determining the intrinsic value of a company's stock. This involves analyzing various financial metrics and market conditions to gauge whether a stock is overvalued, undervalued, or fairly priced. Accurate valuation is paramount for making informed investment decisions, maximizing returns, and minimizing potential losses. This article will explore BofA's insights into current stock market valuations, providing investors with a clearer understanding of the market landscape and potential investment opportunities.

BofA's Current Market Outlook and Valuation Metrics

BofA's current market outlook (as of [Insert date – this needs to be updated regularly for accuracy]) can be characterized as [Insert BofA's current market outlook – bullish, bearish, or neutral, citing the source]. This outlook significantly influences their valuation analysis and subsequent investment recommendations.

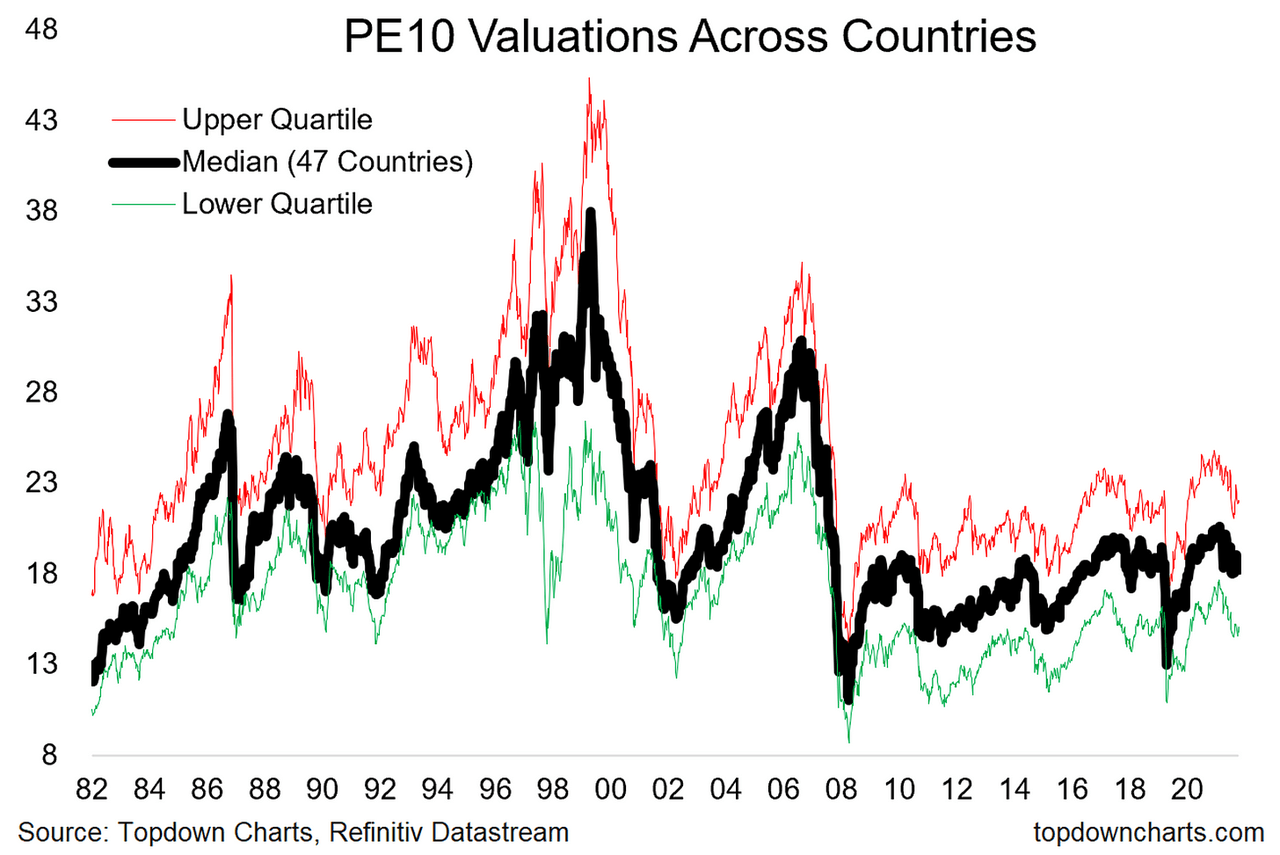

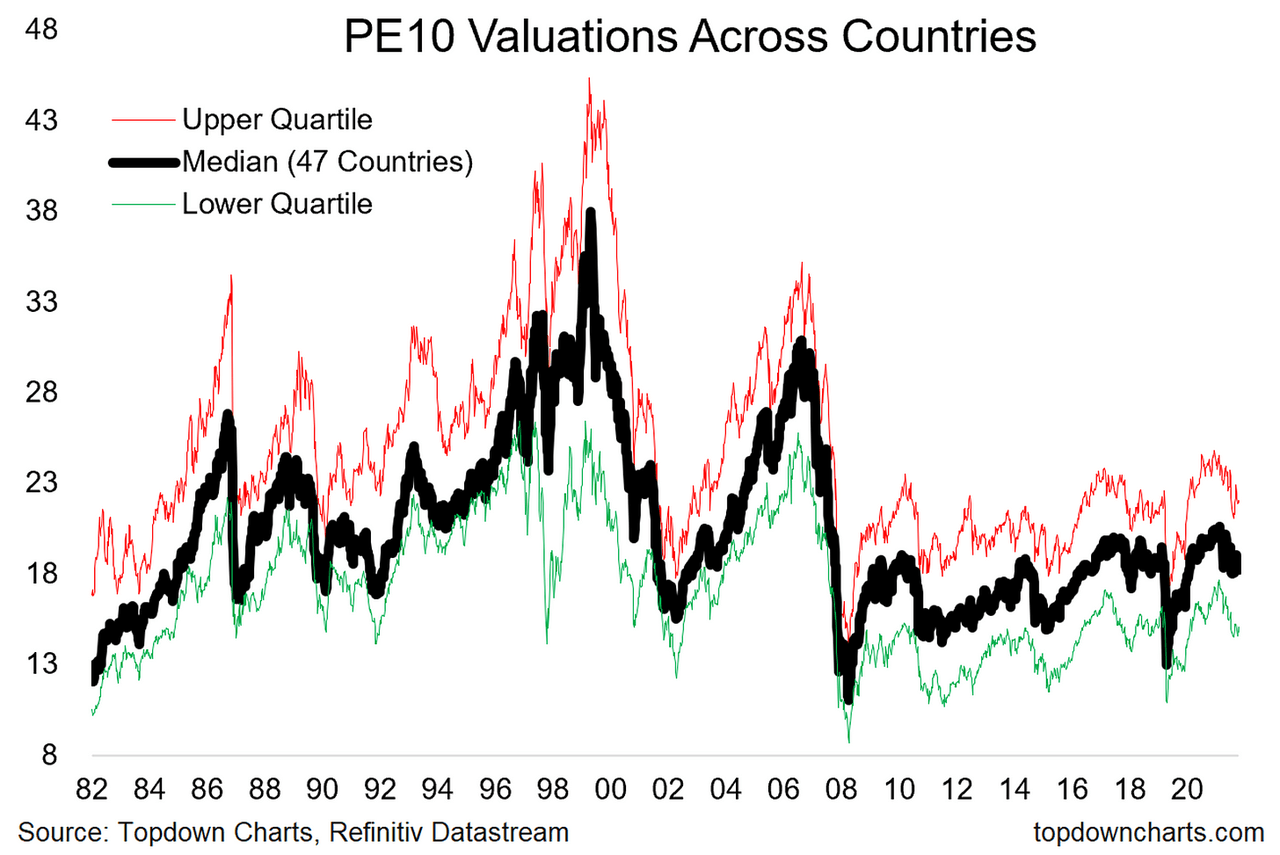

BofA, like many other financial institutions, employs various valuation metrics to assess the attractiveness of different stocks and sectors. Some key metrics they utilize include:

-

Price-to-Earnings Ratio (P/E Ratio): This compares a company's stock price to its earnings per share (EPS). A high P/E ratio might suggest the stock is overvalued, while a low P/E ratio could indicate undervaluation. However, it's important to consider industry benchmarks and growth prospects.

-

Price-to-Sales Ratio (P/S Ratio): This compares a company's market capitalization to its revenue. It's particularly useful for evaluating companies with negative earnings or those in high-growth sectors.

-

Price-to-Book Ratio (P/B Ratio): This ratio compares a company's market value to its book value (assets minus liabilities). A low P/B ratio can sometimes signal undervaluation, but it's crucial to consider factors affecting book value.

-

PEG Ratio: This metric adjusts the P/E ratio for the company's expected earnings growth rate. It aims to provide a more comprehensive valuation picture than the P/E ratio alone.

Examples of BofA's Application:

- BofA might analyze the technology sector using the P/S ratio, given the high growth and often-negative earnings of some tech companies.

- They may compare the P/E ratio of a specific company to its historical average and industry peers to assess its relative valuation.

- BofA's predictions are often based on their analysis of these metrics combined with macroeconomic forecasts and industry trends. For example, they may predict a rotation from growth stocks to value stocks based on their valuation analysis and interest rate expectations.

- Potential risks, such as rising interest rates or geopolitical instability, are factored into their analysis and communicated to investors.

Identifying Overvalued and Undervalued Stocks (BofA's Approach)

BofA's methodology for identifying overvalued and undervalued stocks is multifaceted. They utilize a blend of quantitative and qualitative factors. Quantitatively, they rely heavily on the valuation metrics discussed above, often comparing them to historical data, industry averages, and projections based on discounted cash flow (DCF) analysis.

However, BofA also emphasizes the importance of qualitative factors:

- Management Quality: A strong management team can significantly impact a company's long-term prospects.

- Competitive Landscape: Analyzing a company's competitive position within its industry is vital.

- Industry Trends: Understanding future industry growth and disruptions is crucial for accurate valuation.

Examples:

- BofA might identify certain sectors (e.g., energy) as undervalued due to their analysis of P/E ratios relative to historical data and projected earnings growth.

- Conversely, they might flag specific companies in the tech sector as overvalued based on high P/S ratios and concerns about slowing revenue growth.

- Factors such as rising interest rates might influence BofA's valuation judgments by affecting discount rates used in DCF analysis. Economic growth forecasts also play a large role.

- Mitigating risks associated with overvalued stocks often involves diversification, hedging strategies, or selectively choosing companies with strong fundamentals despite high valuations.

Investment Strategies Based on BofA's Valuation Analysis

BofA's valuation analysis informs various investment strategies. Based on their market outlook, they might suggest:

- Sector Rotation: Shifting investments from overvalued to undervalued sectors based on valuation metrics and economic forecasts.

- Value Investing: Focusing on stocks trading below their intrinsic value, as identified through BofA's valuation analysis.

- Growth Investing: Investing in companies with high growth potential, while still considering valuation metrics.

- Combined Approaches: A balanced approach that incorporates both value and growth investing, tailoring the mix based on market conditions and BofA's insights.

Examples:

- If BofA anticipates slowing economic growth, they may advise a shift towards defensive sectors (e.g., consumer staples) considered undervalued by their metrics.

- If they identify undervalued companies within a particular sector, they might recommend a concentrated investment in those specific stocks.

- Diversification across different asset classes and sectors remains a crucial element of any investment strategy, regardless of BofA's recommendations.

- A long-term investment horizon is essential to ride out market fluctuations and benefit from long-term growth.

Understanding the Limitations of BofA's Analysis

While BofA's analysis provides valuable insights, it's vital to understand its inherent limitations:

- All market analysis is inherently forward-looking and subject to uncertainty. Unexpected events (e.g., geopolitical crises, pandemics) can significantly alter market dynamics and invalidate initial predictions.

- BofA's analysis, while sophisticated, cannot predict the future with certainty. Their valuations are based on assumptions and models that might not perfectly reflect reality.

Important Considerations:

- Factors such as unforeseen technological breakthroughs or regulatory changes could render BofA's predictions inaccurate.

- Conducting independent research is crucial. Don't rely solely on any single source, including BofA.

- Your personal risk tolerance and investment objectives play a significant role in determining the appropriateness of any investment strategy. Always seek professional financial advice tailored to your specific circumstances.

Conclusion: Making Informed Investment Decisions with Stock Market Valuations

Understanding stock market valuations is fundamental to successful investing. BofA's analysis offers a valuable perspective, emphasizing the use of multiple valuation metrics, a balanced consideration of quantitative and qualitative factors, and the importance of acknowledging market uncertainty. Remember that BofA's analysis should be considered one piece of the puzzle. Conduct thorough research, diversify your portfolio, and consider seeking professional financial advice to develop an investment strategy that aligns with your goals and risk tolerance. By actively engaging in the process of understanding stock market valuations and incorporating various viewpoints into your investment decisions, you can increase your chances of achieving long-term financial success. Remember to consult reliable financial resources and seek expert guidance when needed to make informed decisions about stock market valuations and investment strategies.

Featured Posts

-

Analyst Predicts Bitcoin Rally Chart Analysis May 6th

May 08, 2025

Analyst Predicts Bitcoin Rally Chart Analysis May 6th

May 08, 2025 -

Prelista De Brasil Incluye A Neymar Jugara Contra Argentina

May 08, 2025

Prelista De Brasil Incluye A Neymar Jugara Contra Argentina

May 08, 2025 -

Dwp Hardship Payment Review Are You Due A Refund

May 08, 2025

Dwp Hardship Payment Review Are You Due A Refund

May 08, 2025 -

Istoriya Matchey Arsenal Ps Zh V Lige Chempionov

May 08, 2025

Istoriya Matchey Arsenal Ps Zh V Lige Chempionov

May 08, 2025 -

Uber Kenya Improves Earnings For Drivers And Couriers While Offering Customers Cashback

May 08, 2025

Uber Kenya Improves Earnings For Drivers And Couriers While Offering Customers Cashback

May 08, 2025