Understanding The BigBear.ai (BBAI) Stock Market Drop In 2025

Table of Contents

- Macroeconomic Factors Contributing to the BBAI Stock Decline

- Overall Market Sentiment and the Tech Sector

- Geopolitical Events and Their Impact

- Company-Specific Factors Affecting BBAI Stock Performance

- Financial Performance and Earnings Reports

- Contract Wins and Losses

- Internal Company Developments

- Investor Sentiment and Market Speculation

- Analyst Ratings and Price Targets

- Social Media and News Coverage

- Conclusion: Navigating the Future of BigBear.ai (BBAI) Stock

Macroeconomic Factors Contributing to the BBAI Stock Decline

Several macroeconomic factors played a significant role in the BBAI stock decline of 2025. Understanding these broader economic forces is crucial to grasping the full picture.

Overall Market Sentiment and the Tech Sector

2025, let's imagine, began with a bearish market sentiment. A combination of high inflation, rising interest rates, and persistent recessionary fears created a climate of uncertainty. This negatively impacted the entire technology sector, and the AI stock market was particularly vulnerable. Many tech stocks, including those involved in AI and big data analytics like BBAI, experienced substantial losses.

- High Inflation: Eroded investor confidence and reduced spending.

- Rising Interest Rates: Increased borrowing costs for companies, impacting growth and profitability.

- Recessionary Fears: Led to decreased investor appetite for riskier assets like tech stocks.

- Market Volatility: Created significant price swings and increased uncertainty.

The tech stock downturn was far-reaching, and BBAI, being a growth stock in a volatile sector, was particularly susceptible to these macroeconomic headwinds. Keywords: Market volatility, tech stock downturn, macroeconomic indicators, interest rate hikes.

Geopolitical Events and Their Impact

Geopolitical instability also contributed significantly to the negative market sentiment in 2025. Let's hypothesize a scenario where escalating international tensions and unforeseen global events led to increased uncertainty in the global economy.

- Global Uncertainty: Investor confidence waned due to unpredictable geopolitical events.

- Government Spending Cuts: In response to global instability, hypothetical government spending cuts in defense and technology impacted companies reliant on government contracts, such as BBAI.

- Supply Chain Disruptions: Global events may have caused further disruptions in the supply chain, impacting production and profits.

These geopolitical risks directly affected investor confidence and negatively impacted the AI and government contracting sectors, which are heavily influenced by global stability. Keywords: Geopolitical risk, global uncertainty, government spending cuts.

Company-Specific Factors Affecting BBAI Stock Performance

In addition to macroeconomic headwinds, several company-specific factors contributed to BBAI's stock performance in 2025. Understanding these internal factors is crucial for a comprehensive analysis.

Financial Performance and Earnings Reports

Let's assume that BBAI’s financial reports for 2025 revealed disappointing results. Missed earnings expectations and slower-than-anticipated revenue growth would understandably cause investor concern.

- Missed Earnings Expectations: A significant shortfall in reported earnings compared to analyst forecasts.

- Slower Revenue Growth: A decline in the rate of revenue growth compared to previous years.

- Decreased Profitability: Lower profit margins due to increased costs or reduced revenue.

Negative financial performance is a significant factor affecting investor sentiment and stock prices. Keywords: BBAI earnings, revenue growth, profit margin, financial performance.

Contract Wins and Losses

The success of companies like BBAI relies heavily on securing government and commercial contracts. Hypothetically, a failure to win anticipated contracts, or the loss of existing ones, would have significantly impacted the company's financial outlook.

- Loss of Major Contracts: The failure to renew or secure major contracts led to a decrease in future revenue streams.

- Increased Competition: Fierce competition in the AI and government contracting sectors may have made it harder for BBAI to win new business.

- Contract Delays: Delays in securing or completing contracts negatively impacted revenue forecasts.

The competitive landscape and the ability to secure lucrative contracts are critical to BBAI’s success. Keywords: Government contracts, commercial contracts, competitive landscape, contract awards.

Internal Company Developments

Internal factors within BBAI itself might have also played a role. Let’s imagine that negative news or internal challenges further impacted investor confidence.

- Leadership Changes: Unexpected leadership changes could create uncertainty and negatively affect investor confidence.

- Restructuring Challenges: Internal restructuring efforts, if poorly managed, could disrupt operations and impact performance.

- Negative Publicity: Negative news or controversies surrounding the company could damage its reputation and deter investors.

Internal challenges can significantly impact a company’s stability and overall performance. Keywords: Leadership changes, internal restructuring, company news, scandals.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation played a significant role in exacerbating the BBAI stock drop.

Analyst Ratings and Price Targets

Financial analysts' opinions heavily influence investor decisions. Hypothetically, if a significant number of analysts downgraded their ratings for BBAI stock or lowered their price targets, it would create a negative feedback loop, pushing the stock price down further.

- Downgrade in Ratings: Several analysts downgraded BBAI from "buy" or "hold" to "sell" ratings.

- Lowered Price Targets: Analysts reduced their price targets for BBAI stock, signaling lower expectations for future growth.

Analyst ratings and price targets are crucial signals that influence overall investor sentiment. Keywords: Analyst ratings, price target, sell-off, buy rating.

Social Media and News Coverage

Negative sentiment expressed on social media and in news articles can quickly spread and amplify existing concerns about BBAI stock.

- Negative Social Media Sentiment: Social media platforms saw a surge in negative comments and discussions about BBAI.

- Unfavorable News Coverage: News articles highlighting the company’s challenges further fueled negative sentiment.

- Market Speculation: Rumors and speculation can drive short-term price fluctuations and create volatility.

The role of social media and news coverage in shaping investor perceptions is undeniable. Keywords: Social media sentiment, news coverage, market speculation, investor confidence.

Conclusion: Navigating the Future of BigBear.ai (BBAI) Stock

The BBAI stock drop in 2025 resulted from a confluence of macroeconomic headwinds, company-specific challenges, and negative investor sentiment. Analyzing these factors – from broader market conditions like interest rate hikes and geopolitical instability, to specific company issues such as contract wins and losses and internal restructuring – is essential for understanding the complexities of the BBAI stock market. While a cautious outlook might be warranted, BBAI’s future performance depends on its ability to navigate these challenges and adapt to the evolving market landscape. Before investing in BBAI stock or any other stock, thorough research is crucial. Understanding the risks involved in the BBAI stock market, analyzing BigBear.ai stock price trends, and conducting in-depth BBAI stock analysis are paramount to making informed investment decisions.

Juergen Klopp Bir Efsanenin Yeniden Dogusu Mu

Juergen Klopp Bir Efsanenin Yeniden Dogusu Mu

Vanja Mijatovic Novo Ime Novi Pocetak

Vanja Mijatovic Novo Ime Novi Pocetak

Rtl Group On Track For Streaming Profitability In 2024

Rtl Group On Track For Streaming Profitability In 2024

Peppa Pigs Family Grows Gender Reveal Sparks Online Discussion

Peppa Pigs Family Grows Gender Reveal Sparks Online Discussion

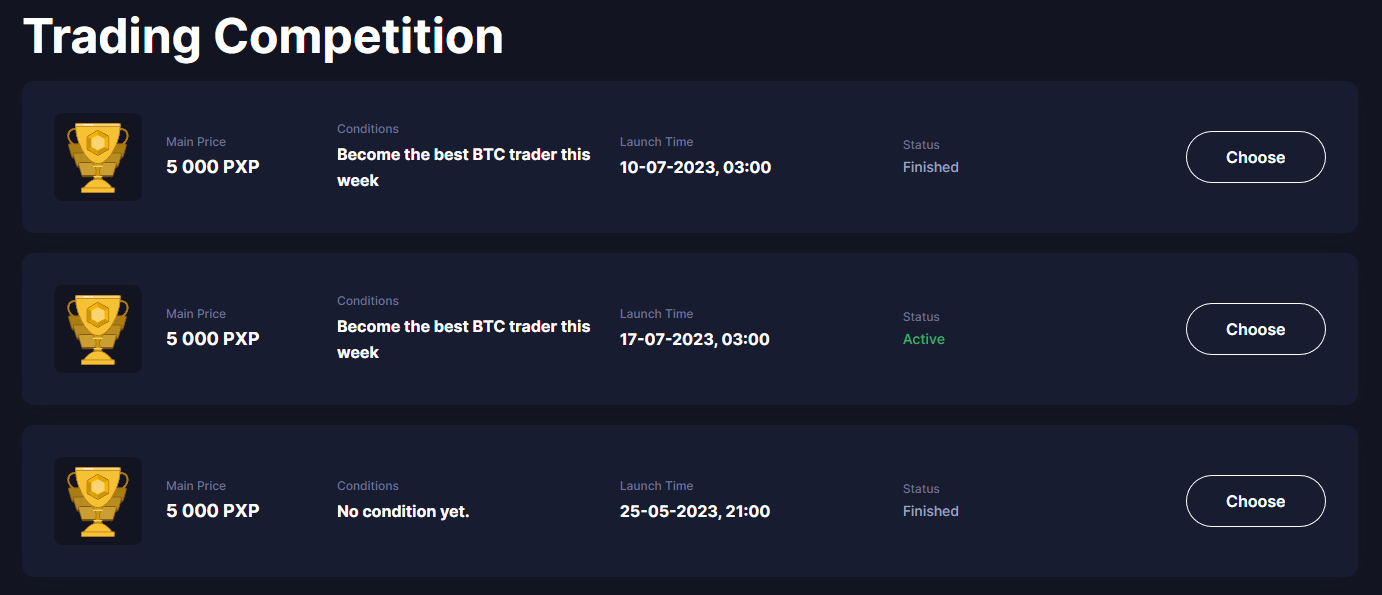

Analyzing Aimscaps Participation In The World Trading Tournament Wtt

Analyzing Aimscaps Participation In The World Trading Tournament Wtt