Understanding The D-Wave Quantum (QBTS) Stock Crash On Monday

Table of Contents

Pre-Crash Market Sentiment and QBTS Performance

Before Monday's dramatic plunge, the D-Wave Quantum stock performance showed a mixed bag. While QBTS had experienced periods of growth, fueled by increasing interest in quantum computing and the company's advancements in its technology, it wasn't immune to market volatility. Investor sentiment, while generally positive towards the potential of quantum computing, was likely influenced by several factors leading up to the crash.

- QBTS stock price trends in the weeks prior: The weeks leading up to the crash may have shown some signs of instability, with fluctuating prices and potentially increasing trading volume, hinting at underlying uncertainty. Analyzing these price charts is crucial for understanding the context of the crash.

- Analyst ratings and price targets: Pre-crash, analyst ratings and price targets for QBTS likely varied, reflecting differing opinions on the company's potential and the risks inherent in investing in a relatively young quantum computing company. A divergence in analyst opinions can sometimes be a precursor to significant market movements.

- Investor confidence levels: Gauging investor confidence in the period before the crash is challenging without access to specific investor surveys. However, examining trading volumes and price fluctuations could offer clues. High volatility might indicate wavering investor confidence.

Identifying Potential Triggers for the D-Wave Quantum Stock Crash

Pinpointing the exact cause of the D-Wave Quantum stock crash requires careful analysis of various potential catalysts. Several factors might have contributed to the sudden drop:

- Negative news releases or announcements: Disappointing earnings reports, setbacks in product development, or announcements of significant challenges could trigger a sell-off. Any negative news directly related to D-Wave's technology, financial performance, or market positioning could have spooked investors.

- Broader market downturns affecting the tech sector: A general downturn in the tech sector could negatively impact even promising companies like D-Wave. Market-wide corrections often affect high-growth stocks disproportionately.

- Specific industry news impacting quantum computing companies: News concerning competitors or shifts in market expectations within the quantum computing industry as a whole might have influenced investor sentiment toward QBTS. Competitive pressures and technological advancements by rivals could create negative sentiment.

- Analyst downgrades or sell-off recommendations: Negative analyst reports or recommendations from prominent financial institutions can substantially affect a company's stock price, leading to a sell-off as investors react to the revised outlook.

- Rumors or speculation affecting investor confidence: Unsubstantiated rumors or negative speculation circulating among investors could contribute to a rapid decrease in stock price, creating a self-fulfilling prophecy. Social media and online forums can play a significant role in spreading such speculation.

Analyzing the Impact of the D-Wave Quantum Stock Crash

The D-Wave Quantum stock crash has several short-term and long-term implications for the company and the broader quantum computing market.

- Impact on company valuation: The crash resulted in a significant reduction in D-Wave's market capitalization, impacting its overall value and potentially affecting its ability to secure future funding.

- Effect on future fundraising or investment opportunities: A stock crash can make it more challenging to raise capital, especially for a company that may already rely on external investment.

- Potential changes in company strategy or operations: The crash might force D-Wave to reassess its strategic direction, potentially leading to operational changes to improve financial performance and investor confidence.

- Impact on the broader quantum computing market: The crash may affect investor sentiment toward the entire quantum computing sector, causing a ripple effect on other companies in the field, highlighting inherent risks within the industry.

Post-Crash Market Reactions and Future Outlook for QBTS

The days following the D-Wave Quantum stock crash will be crucial in assessing the market's reaction and the company's future trajectory.

- Stock price recovery or continued decline: Whether the stock price recovers or continues to decline will depend on the company's response to the crash, market sentiment, and any new developments related to the company or the quantum computing sector.

- Analyst commentary and revised price targets: Analysts will likely revise their price targets based on the crash and the company's subsequent performance.

- Investor response and trading volume: Observing investor behavior and trading volume in the aftermath of the crash can help gauge market sentiment and provide insights into future price movements.

- Potential long-term implications for the company and the quantum computing sector: The long-term impact on D-Wave and the broader industry remains to be seen. The company's ability to recover and its technological advancements will significantly influence the outcome.

Understanding the Future of D-Wave Quantum (QBTS) After the Stock Crash

The D-Wave Quantum (QBTS) stock crash highlights the volatility inherent in the quantum computing market and the challenges faced by companies operating in this rapidly developing field. The crash was likely triggered by a combination of factors, including potentially negative news, broader market sentiment, and industry-specific concerns. The long-term impact on D-Wave Quantum and the quantum computing sector remains uncertain. The company's response to the crash, its technological advancements, and the overall market outlook will shape its future. Stay informed on the evolving situation of D-Wave Quantum (QBTS) stock and the quantum computing market. Continue researching and monitoring news related to QBTS to make informed investment decisions. Conduct thorough D-Wave Quantum stock analysis before making any investment choices.

Featured Posts

-

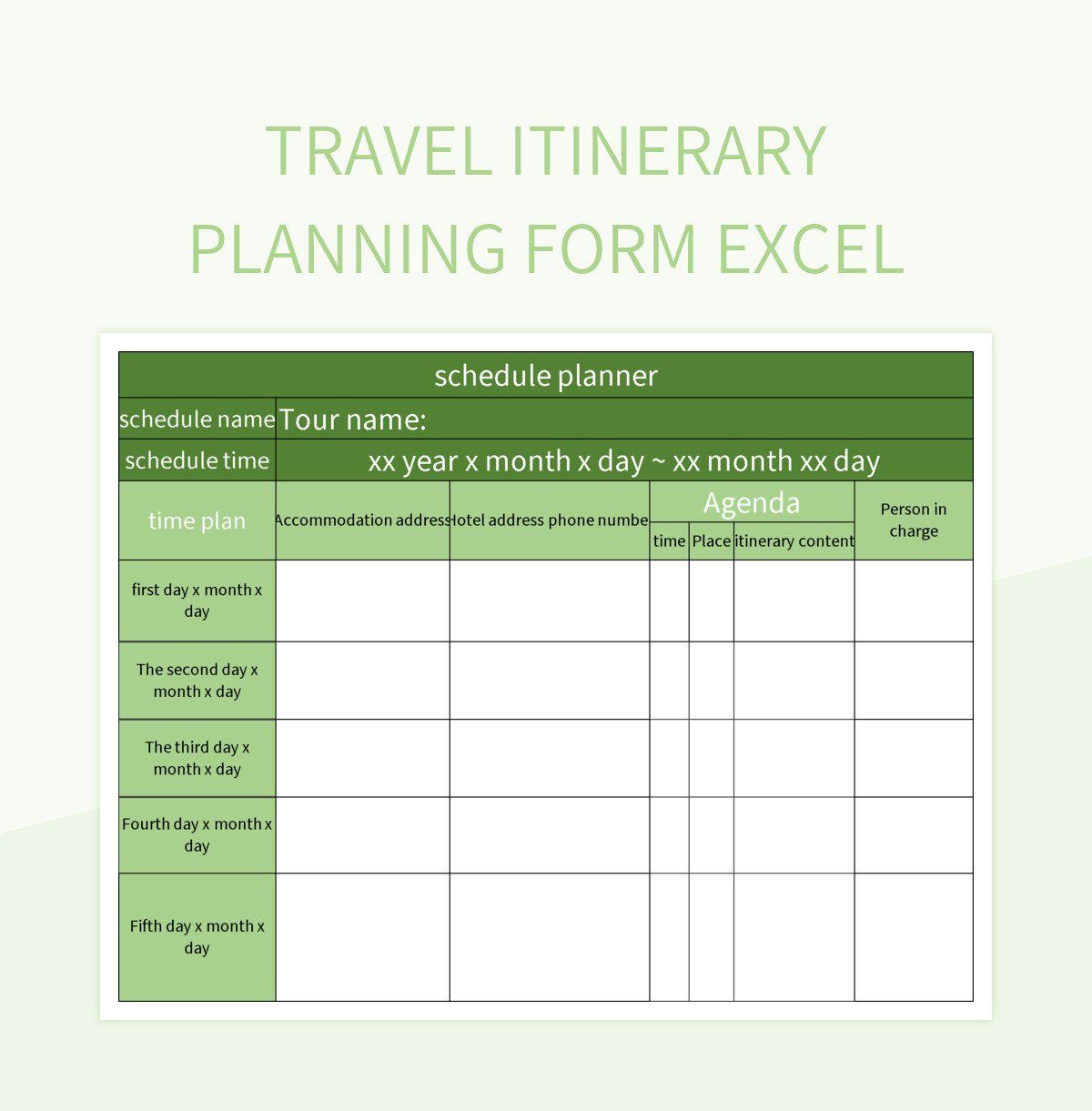

Solo Travel Safety Budget And Itinerary Planning

May 20, 2025

Solo Travel Safety Budget And Itinerary Planning

May 20, 2025 -

Wwe Raw Tyler Bate Returns Reuniting With Pete Dunne

May 20, 2025

Wwe Raw Tyler Bate Returns Reuniting With Pete Dunne

May 20, 2025 -

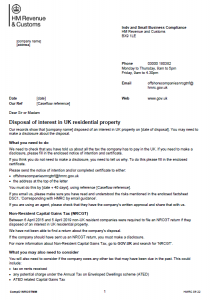

Hmrc Nudge Letters What Uk Households Need To Know

May 20, 2025

Hmrc Nudge Letters What Uk Households Need To Know

May 20, 2025 -

Incendio Na Escola Da Tijuca Preocupacao De Pais E Ex Alunos

May 20, 2025

Incendio Na Escola Da Tijuca Preocupacao De Pais E Ex Alunos

May 20, 2025 -

Kathigites Dimotikoy Odeioy Rodoy Synaylia Stin Dimokratiki

May 20, 2025

Kathigites Dimotikoy Odeioy Rodoy Synaylia Stin Dimokratiki

May 20, 2025