Understanding The D-Wave Quantum (QBTS) Stock Decline On Thursday

Table of Contents

On Thursday, shares of D-Wave Quantum (QBTS) experienced a notable decline, leaving many investors wondering about the cause. This article delves into the potential reasons behind this drop, examining market-wide factors, company-specific news, and the long-term outlook for this exciting but volatile sector of the stock market. We'll analyze the contributing factors to help investors navigate the complexities of investing in quantum computing stocks like QBTS.

Market-Wide Factors Influencing QBTS Stock Performance

Several macroeconomic and market-specific factors could have contributed to Thursday's QBTS stock decline.

Broad Market Trends

The overall market sentiment plays a crucial role in individual stock performance. Thursday's market performance needs to be examined within this context.

- Nasdaq Performance: The Nasdaq Composite, a technology-heavy index, often reflects the performance of tech stocks like QBTS. A negative day for the Nasdaq could easily drag down QBTS shares.

- Rising Interest Rates: Increasing interest rates can impact investor behavior, often leading to a shift away from riskier assets, including stocks in emerging technology sectors like quantum computing.

- Inflation Concerns: Persistent inflation can create economic uncertainty, impacting investor confidence and potentially triggering a sell-off in growth stocks. Any negative economic news on Thursday would likely contribute to general market anxiety.

- Geopolitical Events: Unforeseen geopolitical events can also ripple through the market, creating volatility and affecting investor sentiment. A negative headline from abroad could trigger a broad market downturn.

Sector-Specific Pressures

The quantum computing sector itself can experience periods of downturn. This is typical for emerging technologies.

- Competitor Performance: The performance of competitors in the quantum computing space can impact investor perception of D-Wave Quantum. If a competitor announced significant progress or funding, it could lead to investors shifting their focus and resources.

- Funding Rounds: The success or failure of funding rounds for other quantum computing companies can influence the overall investor sentiment within the sector. A lack of funding for other companies could signal a cooling of the market's enthusiasm.

- Regulatory Uncertainty: Regulatory changes or uncertainties within the quantum computing space could lead to investor hesitancy. Any news regarding potential government regulations could create fear and uncertainty among investors.

Company-Specific News and Developments Affecting D-Wave Quantum

In addition to broad market factors, company-specific news can significantly affect QBTS stock.

Recent Announcements or Earnings Reports

Any recent news from D-Wave Quantum itself could have impacted the share price.

- Earnings Reports: Disappointing earnings reports, lower-than-expected revenue, or negative guidance from management can trigger a sell-off. A poor quarterly report is usually a major catalyst for stock price fluctuations.

- Partnerships and Contracts: The announcement of new partnerships or significant contracts can positively or negatively affect stock price, depending on market perception. A failed partnership or missed contract could have led to the decline.

- Product Launches: New product launches, or delays in product launches, can influence investor confidence. Negative feedback about a new product launch can trigger investors to sell off their shares.

- Insider Selling: Significant insider selling (employees selling off their shares) can sometimes signal a lack of confidence within the company, prompting investors to follow suit.

Analyst Ratings and Price Target Changes

Changes in analyst ratings and price targets can significantly influence investor sentiment and stock price.

- Downgrades: A downgrade from a prominent analyst firm can lead to a sell-off, as investors adjust their expectations based on expert opinion.

- Price Target Reductions: A reduction in the price target for QBTS stock by multiple analyst firms can signal a bearish outlook and trigger further selling pressure.

Analyzing the Long-Term Implications for D-Wave Quantum (QBTS) Stock

Despite short-term volatility, the long-term outlook for D-Wave Quantum and the quantum computing sector remains promising.

Quantum Computing Sector Growth Potential

The quantum computing market is expected to experience significant growth over the next decade.

- Market Research Forecasts: Numerous market research reports project substantial growth for the quantum computing market, highlighting the vast potential of this technology across various industries.

- Technological Advancements: Continuous technological advancements promise to unlock new capabilities and applications, driving further market expansion.

D-Wave's Competitive Position

D-Wave Quantum's position within the competitive quantum computing landscape is a key factor to consider.

- Technological Advantages: Evaluating D-Wave's technological advantages and disadvantages compared to competitors is crucial. Assessing their unique strengths in specific applications is key for investors.

- Market Penetration: Assessing D-Wave Quantum’s market penetration and strategies for expansion into new markets is key for understanding their long-term potential.

Conclusion

The D-Wave Quantum (QBTS) stock decline on Thursday was likely a result of a combination of broad market trends, sector-specific pressures, and company-specific news. While short-term volatility is inherent in investing in emerging technologies like quantum computing, the long-term growth potential of the sector remains compelling. Understanding these contributing factors and conducting thorough due diligence is critical for investors considering exposure to QBTS stock. Continue monitoring the QBTS stock and the quantum computing sector for further updates, and always conduct comprehensive research before making any investment decisions related to D-Wave Quantum or other quantum computing stocks.

Featured Posts

-

Huizenmarkt Nederland Kloof Tussen Abn Amro En Geen Stijl

May 21, 2025

Huizenmarkt Nederland Kloof Tussen Abn Amro En Geen Stijl

May 21, 2025 -

Paris Nouvelle Etape Pour La Chanteuse Suisse Stephane

May 21, 2025

Paris Nouvelle Etape Pour La Chanteuse Suisse Stephane

May 21, 2025 -

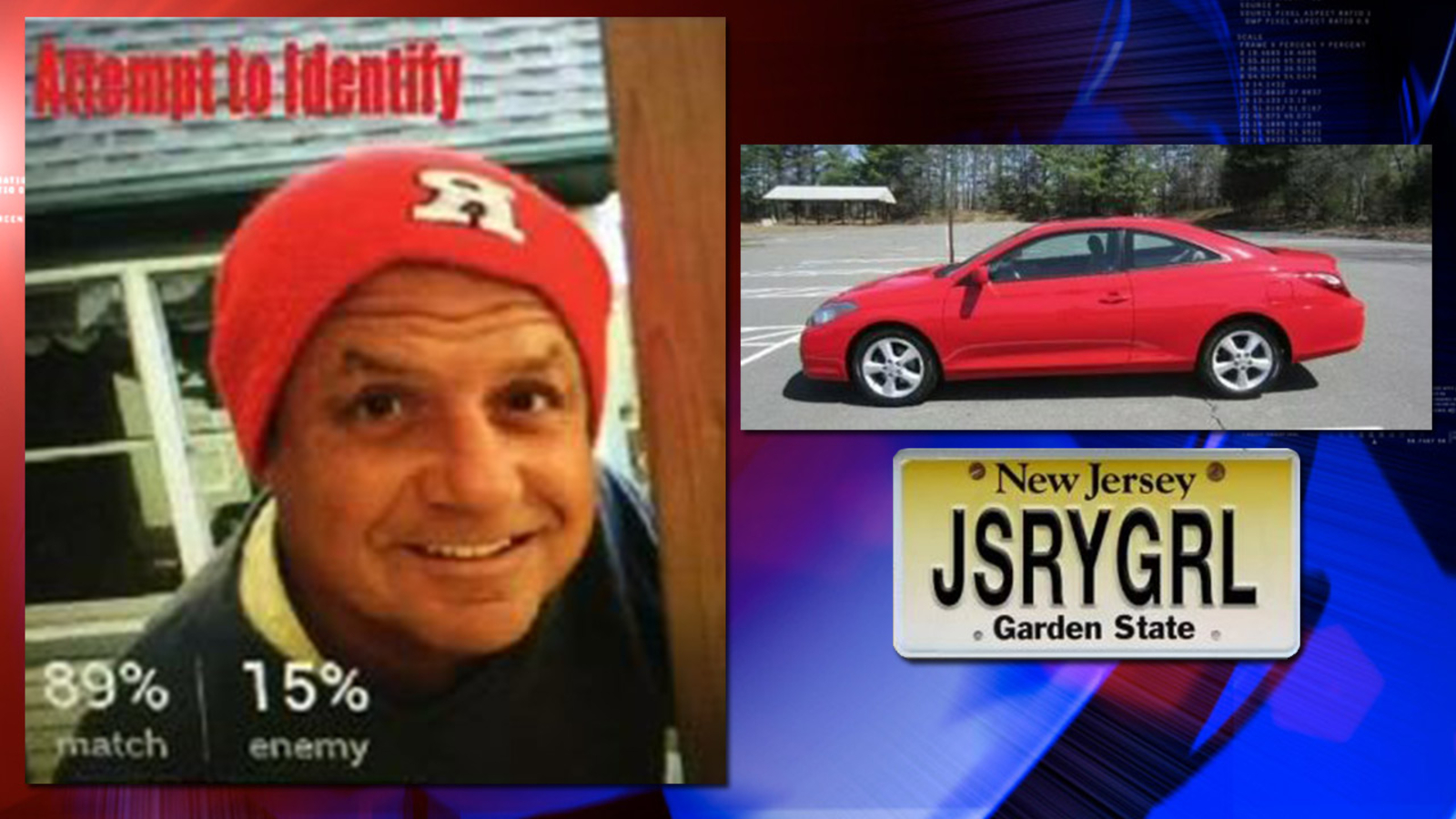

Couple Arrested Following Antiques Roadshow Appraisal Of Stolen Goods

May 21, 2025

Couple Arrested Following Antiques Roadshow Appraisal Of Stolen Goods

May 21, 2025 -

Unexpected Interruption Bbc Breakfast Guests Live Broadcast Disruption

May 21, 2025

Unexpected Interruption Bbc Breakfast Guests Live Broadcast Disruption

May 21, 2025 -

Daftar Lengkap Juara Premier League Sepuluh Tahun Terakhir

May 21, 2025

Daftar Lengkap Juara Premier League Sepuluh Tahun Terakhir

May 21, 2025