Understanding The Dynamics Of Negative Inflation In Thailand

Table of Contents

H2: Causes of Negative Inflation in Thailand

Negative inflation, or deflation, is a sustained decrease in the general price level of goods and services in an economy. While inflation is a more common occurrence, deflation in Thailand is relatively rare and presents unique challenges. Several factors can contribute to deflationary pressures within the Thai economy:

H3: Reduced Consumer Demand

Decreased consumer spending is a significant driver of deflation. Factors like:

- High unemployment rates leading to reduced disposable income.

- Stagnant wage growth failing to keep pace with the cost of living.

- Economic uncertainty and a lack of consumer confidence leading to delayed purchases.

- The impact of global economic slowdowns reducing export demand and impacting domestic consumption.

For example, a downturn in the global tourism sector – a major contributor to the Thai economy – can directly impact consumer spending in related industries like hospitality and retail, exacerbating deflationary pressures.

H3: Increased Supply and Lower Prices

An oversupply of goods relative to demand can push prices down. This can be caused by:

- Increased domestic production exceeding consumer demand.

- A surge in imports due to a strong Thai baht making foreign goods cheaper.

- Technological advancements leading to lower production costs and increased efficiency.

This surplus can be observed in specific sectors, such as agricultural products experiencing bumper harvests or manufactured goods facing increased competition from imports.

H3: Currency Appreciation

A strong Thai baht (THB) can make imported goods cheaper, leading to lower prices for consumers. This appreciation can result from:

- Increased foreign investment flowing into Thailand.

- Global currency fluctuations impacting the value of the THB relative to other currencies.

- Government policies aimed at maintaining a strong currency.

While beneficial for consumers in terms of lower import prices, a persistently strong baht can negatively impact Thai exporters, making their goods less competitive on the global market.

H3: Deflationary Expectations

The anticipation of further price drops can create a self-fulfilling prophecy. Consumers and businesses may delay purchases, hoping for even lower prices in the future. This behavior further reduces demand and reinforces deflationary trends. This psychological factor plays a significant role in perpetuating the deflationary spiral.

H2: Consequences of Negative Inflation in Thailand

Deflation, while seemingly beneficial due to lower prices, can have severe negative consequences for the Thai economy:

H3: Impact on Businesses

Falling prices squeeze profit margins, making it difficult for businesses to remain profitable. This can lead to:

- Reduced investment in expansion and innovation.

- Job losses and increased unemployment.

- Difficulties in servicing debt as revenue declines.

Businesses may be forced to cut costs, potentially impacting quality and competitiveness in the long run.

H3: Impact on Consumers

While lower prices seem attractive, deflation can discourage spending. Consumers may delay purchases anticipating further price drops, leading to:

- Reduced economic activity and lower overall demand.

- Lower returns on savings and investments.

- Increased risk of a deflationary spiral, where falling prices lead to lower wages and further decreased spending.

H3: Impact on the Government

Deflation presents significant challenges for the Thai government's economic policies:

- Monetary policy becomes less effective as interest rates near zero.

- Fiscal policy faces limitations as government spending may not be enough to counteract deflationary pressures.

- Increased government debt can become a larger burden as economic growth slows.

H2: Government Responses to Negative Inflation in Thailand

The Thai government employs various measures to combat deflationary pressures:

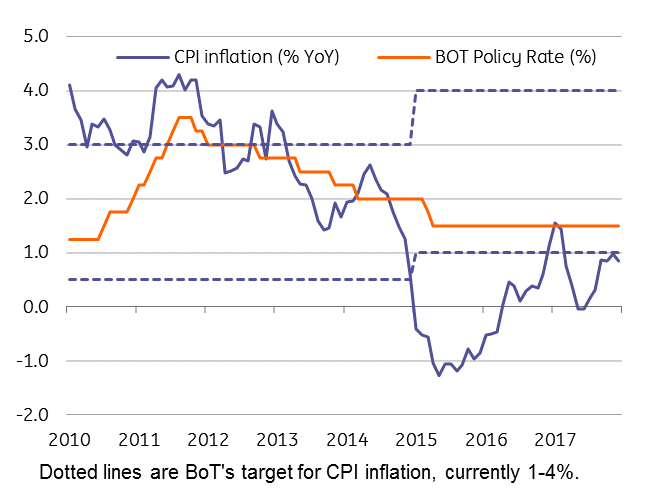

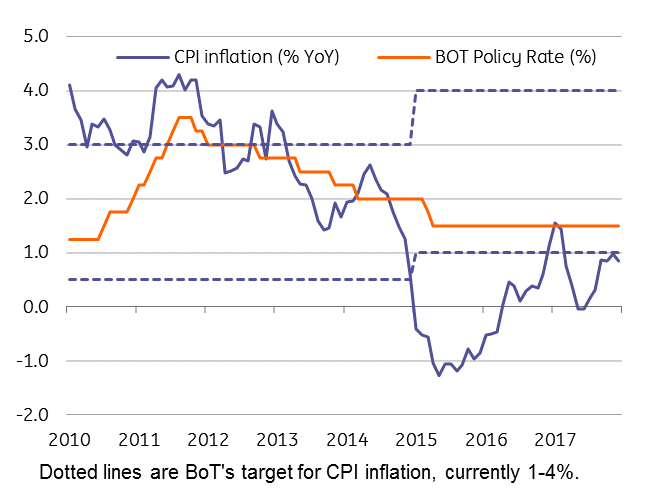

H3: Monetary Policy

The Bank of Thailand (BOT) uses monetary policy tools such as:

- Interest rate adjustments to encourage borrowing and spending.

- Quantitative easing to increase the money supply.

- However, the effectiveness of monetary policy is limited when deflationary expectations are deeply entrenched.

H3: Fiscal Policy

The government utilizes fiscal policy instruments to stimulate demand:

- Increased government spending on infrastructure projects.

- Implementation of social welfare programs to boost consumer spending.

- Targeted tax cuts to encourage investment and consumption.

Balancing fiscal responsibility with the need for economic stimulation remains a significant challenge.

3. Conclusion: Understanding and Addressing Negative Inflation in Thailand

Understanding the dynamics of negative inflation in Thailand is crucial for policymakers, businesses, and consumers alike. The causes, ranging from reduced consumer demand to currency appreciation, can have significant and interconnected consequences, affecting businesses, consumers, and the government's ability to manage the economy. Proactive government policies, encompassing both monetary and fiscal measures, are necessary to mitigate the negative impacts of deflation and maintain economic stability. Further research into the specific indicators and trends impacting the Thai economy is essential to prepare for and address future instances of negative inflation in Thailand. We encourage you to share your thoughts and insights in the comments section below and stay informed about economic developments in Thailand to better understand this complex phenomenon.

Featured Posts

-

100 Tys Zl Kary Panstwowa Spolka Pozwala Dziennikarzy Onetu

May 07, 2025

100 Tys Zl Kary Panstwowa Spolka Pozwala Dziennikarzy Onetu

May 07, 2025 -

Pogreb Zrtev Pozara V Nocnem Klubu Kocani In Sirse Obmocje

May 07, 2025

Pogreb Zrtev Pozara V Nocnem Klubu Kocani In Sirse Obmocje

May 07, 2025 -

Clippers Late Game Push Not Enough In Loss To Cavaliers

May 07, 2025

Clippers Late Game Push Not Enough In Loss To Cavaliers

May 07, 2025 -

John Wick Franchise Unraveling The Mystery Of The One True Appearance

May 07, 2025

John Wick Franchise Unraveling The Mystery Of The One True Appearance

May 07, 2025 -

The Young And The Restless Full Recap Of Friday March 7ths Episode

May 07, 2025

The Young And The Restless Full Recap Of Friday March 7ths Episode

May 07, 2025