Understanding The GOP's Proposed Student Loan Changes: Pell Grants, Repayment, And Beyond

Table of Contents

Proposed Changes to Pell Grants

The Pell Grant program, a cornerstone of federal student aid for low-income students, is a key target of the GOP's proposed student loan changes. Understanding these potential alterations is crucial for assessing their impact on college affordability and access.

Funding Levels and Eligibility Requirements

The GOP has floated several proposals aiming to modify Pell Grant funding and eligibility. These proposals often center around tightening eligibility criteria and potentially reducing the maximum award amount.

-

Proposed Changes: Some proposals suggest implementing stricter income caps, effectively limiting eligibility to a smaller percentage of low-income students. Others advocate for reducing the maximum Pell Grant award, thus decreasing the amount of financial aid available to eligible students. There's also discussion about linking Pell Grant amounts more directly to program completion rates at individual institutions.

-

Impact on Low-Income Students: These changes would undeniably impact access to higher education for low-income students. Reduced funding and stricter eligibility would make college unaffordable for many, potentially widening the existing educational inequality gap.

-

Bipartisan Support/Opposition: While some within the GOP support these proposals as a means of fiscal responsibility, they have faced significant opposition from Democrats and student advocacy groups who highlight the detrimental effect on educational equity.

Program Structure and Use Restrictions

Beyond funding levels, the GOP has also considered changes to how Pell Grants can be used. This includes potential limitations on the types of institutions eligible to receive Pell Grant funds.

-

Proposed Restrictions: Proposals include stricter limitations on the use of Pell Grants at for-profit colleges, aiming to address concerns about the high cost and questionable outcomes of some for-profit institutions. This could involve stricter accreditation requirements or outright bans for certain types of institutions.

-

Consequences for Students: Such restrictions would significantly limit students' choices of colleges and programs, potentially forcing them into less desirable or more expensive options.

-

Effect on For-Profit Colleges: The proposed changes would likely have a significant negative impact on the for-profit college industry, potentially leading to closures and job losses within the sector.

Repayment Plan Reforms under the GOP

The GOP's student loan reform proposals also encompass significant changes to student loan repayment plans, impacting millions of borrowers.

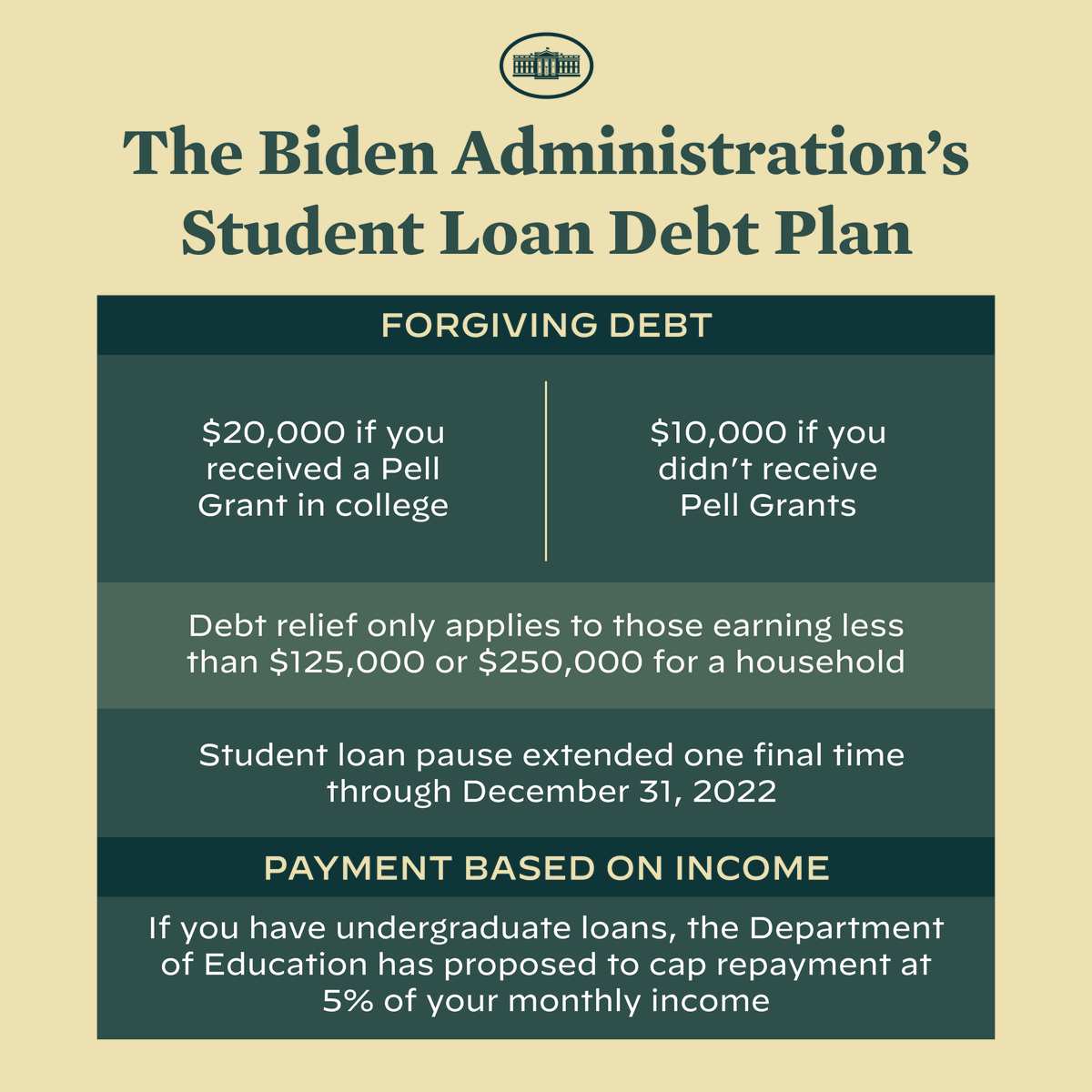

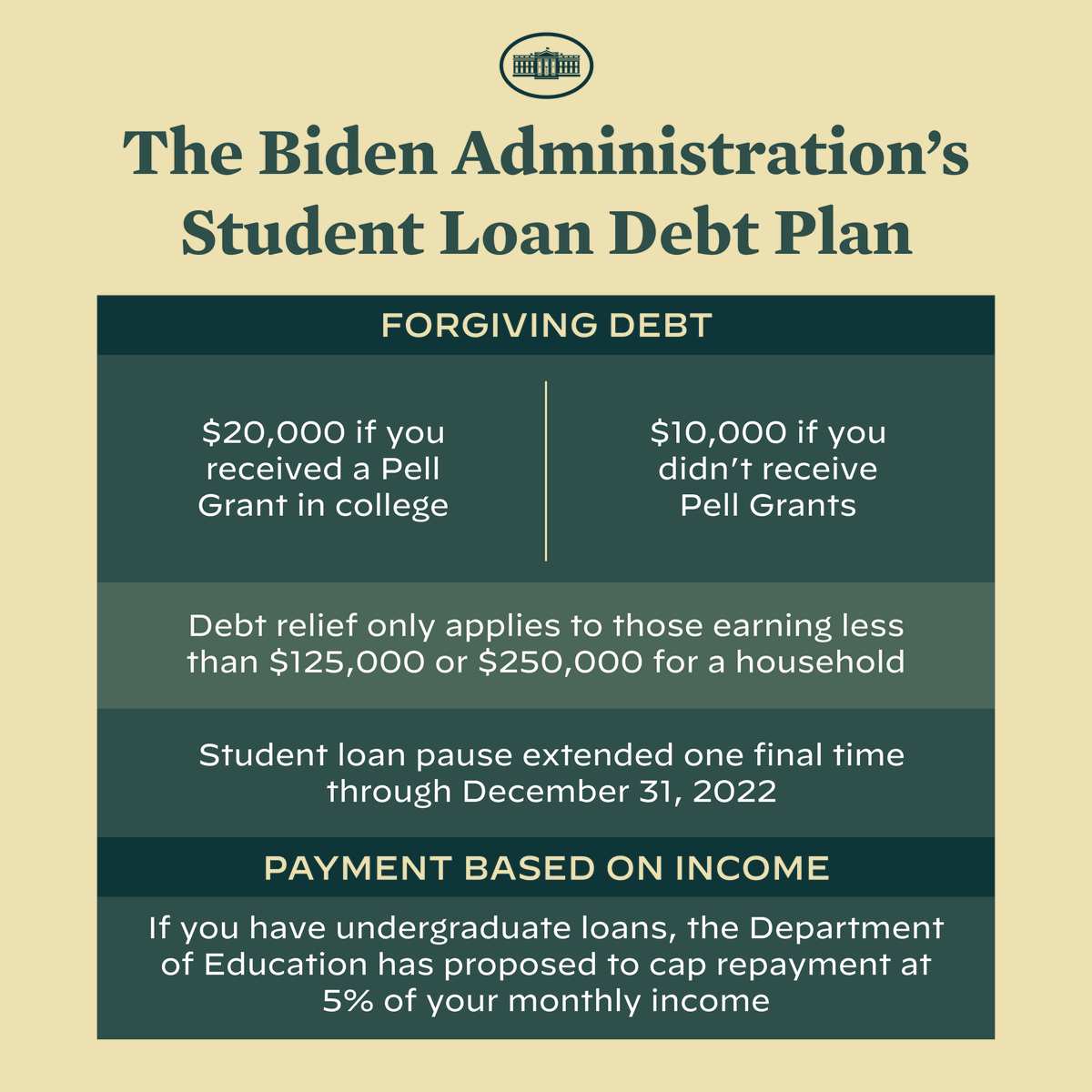

Income-Driven Repayment (IDR) Plans

IDR plans are designed to make repayment more manageable based on income. The GOP's proposals aim to reform these plans, potentially making them less beneficial for borrowers.

-

Potential Changes: Proposed modifications might include altering the payment calculation formulas, shortening repayment periods, and tightening the eligibility criteria for loan forgiveness under IDR plans.

-

Impact on Borrowers: These changes could significantly increase monthly payments for many borrowers, leading to increased financial strain and potentially higher default rates. Borrowers with lower incomes and larger loan balances would be disproportionately affected.

-

Impact on Overall Student Loan Debt: While proponents argue that these reforms could encourage responsible borrowing, critics fear they could actually increase the overall student loan debt burden by making repayment more difficult.

Loan Forgiveness Programs

The GOP has shown a consistent reluctance to support widespread student loan forgiveness programs. Existing and future forgiveness initiatives are likely targets for significant changes or complete elimination.

-

Proposed Changes/Eliminations: The GOP might propose eliminating or significantly scaling back existing loan forgiveness programs, arguing that they are fiscally irresponsible and unfair to taxpayers who did not attend college.

-

Impact on Borrowers: This would be devastating for borrowers who were relying on loan forgiveness to manage their debt, potentially pushing them into financial hardship.

-

Political and Economic Arguments: The debate around loan forgiveness is highly politicized, with arguments focusing on fairness, economic stimulus, and the overall cost to taxpayers.

Other Key Aspects of the GOP's Student Loan Proposals

Beyond Pell Grants and repayment plans, the GOP's proposals touch upon other key areas of the student loan system.

Interest Rates and Fees

The GOP's proposals may include changes to interest rates charged on student loans and associated fees.

-

Proposed Changes: These could involve increasing interest rates or adding new fees, making borrowing more expensive for students.

-

Impact on Borrowing Costs: Higher interest rates and fees would significantly increase the overall cost of borrowing, leading to greater debt accumulation over the life of the loan.

-

Impact on Student Loan Debt Accumulation: Such changes would exacerbate the already substantial student loan debt crisis, creating a heavier financial burden for borrowers.

Impact on Higher Education Institutions

The proposed changes could have a significant ripple effect on colleges and universities, particularly those dependent on federal student aid.

-

Potential Impacts: Reduced Pell Grant funding and stricter repayment plans could lead to decreased enrollment, pressure to increase tuition, and potential financial instability for certain institutions, especially those serving a large low-income student population.

-

Impact on Access to Higher Education: These ripple effects could ultimately limit access to higher education, particularly for students from disadvantaged backgrounds.

-

Institutional Responses: Colleges and universities may respond by increasing tuition, reducing financial aid offerings, or implementing other cost-cutting measures, further burdening students.

Conclusion

The GOP's proposed student loan changes represent a significant shift in federal student aid policy. The proposed modifications to Pell Grants, repayment plans, interest rates, and loan forgiveness programs have the potential to dramatically reshape the landscape of higher education financing. While some proposals aim to promote fiscal responsibility and responsible borrowing, others raise concerns about reduced access to higher education and increased financial burden for borrowers. Understanding the GOP's proposed student loan changes is crucial for navigating the future of higher education financing. Stay informed and advocate for policies that best serve your needs. For more information, refer to resources from the U.S. Department of Education and reputable news sources covering student loan reform.

Featured Posts

-

Tenis Te Djokovic Doenemi Zirvenin Yenilmez Ustasi

May 17, 2025

Tenis Te Djokovic Doenemi Zirvenin Yenilmez Ustasi

May 17, 2025 -

De Xuat Phoi Canh Cong Vien Dien Anh Tai Thu Thiem

May 17, 2025

De Xuat Phoi Canh Cong Vien Dien Anh Tai Thu Thiem

May 17, 2025 -

Rune U Finalu Barcelone Alcaraz Van Igre Zbog Povrede

May 17, 2025

Rune U Finalu Barcelone Alcaraz Van Igre Zbog Povrede

May 17, 2025 -

Reakcije Na Prosvjed U Teslinom Izlozbenom Prostoru U Berlinu

May 17, 2025

Reakcije Na Prosvjed U Teslinom Izlozbenom Prostoru U Berlinu

May 17, 2025 -

Berlin Prosvjednici U Teslinom Izlozbenom Prostoru Sto Se Dogodilo

May 17, 2025

Berlin Prosvjednici U Teslinom Izlozbenom Prostoru Sto Se Dogodilo

May 17, 2025