Understanding The Impact Of Front-Loading On Malaysian Ringgit (MYR) For Exporters

Table of Contents

What is Front-Loading in the Context of MYR Exchange Rates?

Front-loading, in the context of MYR exchange rates, refers to the practice of accelerating the invoicing and collection of payments from export transactions in anticipation of a predicted weakening of the Malaysian Ringgit (MYR) against other currencies. Exporters utilize this strategy to lock in a more favorable exchange rate before the MYR potentially depreciates further. This proactive approach aims to mitigate potential losses stemming from future currency fluctuations.

-

Example: Imagine a Malaysian exporter expecting to receive USD 100,000 in three months' time. If they anticipate the MYR weakening against the USD during that period, they might attempt to front-load the transaction, perhaps by negotiating an earlier payment schedule with the buyer. By receiving the payment sooner, they secure a better exchange rate and ultimately receive more MYR.

-

Benefits: Front-loading can offer significant benefits, primarily securing a favorable exchange rate and mitigating the risk of currency losses. This provides greater certainty in export revenue projections.

-

Risks: However, the strategy isn't without risks. If the MYR unexpectedly strengthens against the target currency, front-loading could result in missing out on a potentially even more favorable exchange rate. Furthermore, aggressive front-loading could strain cash flow if not properly managed.

Factors Influencing Front-Loading Decisions for MYR Exporters

Several key factors influence a Malaysian exporter's decision to employ front-loading strategies. Careful consideration of these factors is critical for successful implementation.

Exchange Rate Forecasting

Accurate exchange rate forecasting plays a vital role. The reliability of the forecast significantly impacts the decision to front-load.

-

Importance of reliable forecasting tools: Exporters rely on various tools, including economic models and expert opinions, to predict future exchange rate movements. However, these predictions are not foolproof.

-

Limitations of predictions: Currency markets are inherently volatile and influenced by numerous unpredictable factors, making accurate long-term forecasts challenging.

-

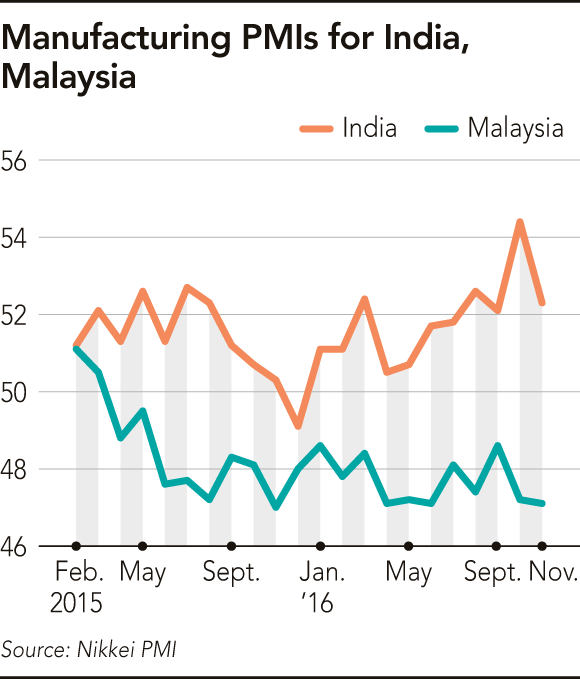

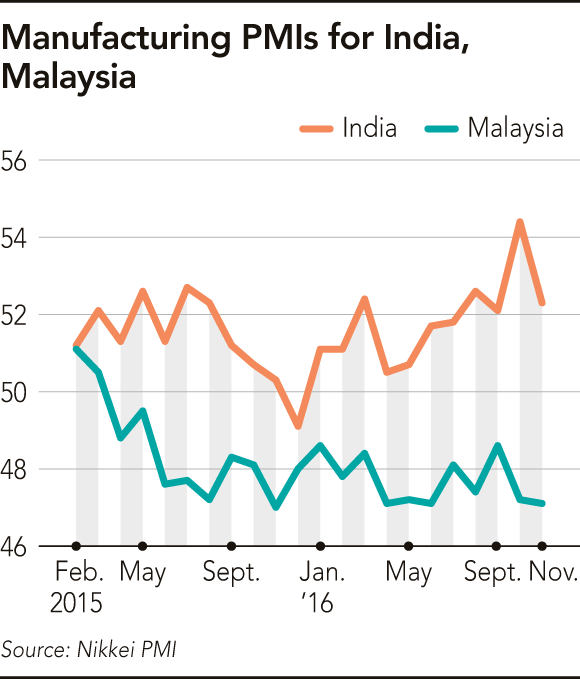

Reliance on economic indicators: Factors such as inflation rates, interest rate differentials between Malaysia and trading partners, and global economic sentiment heavily influence MYR exchange rates. Careful monitoring of these indicators is crucial.

Order Book and Sales Pipeline

The timing and volume of export orders significantly impact front-loading decisions.

-

Managing cash flow: Front-loading requires careful cash flow management, as early payment collection may temporarily boost cash reserves but could lead to shortfalls later if not properly planned.

-

Hedging strategies: Combining front-loading with hedging strategies (discussed later) can further mitigate risk and improve cash flow predictability.

-

Impact of seasonal demand: Seasonal variations in demand influence export volumes, impacting the feasibility and desirability of front-loading at different times of the year.

Competitor Analysis

Market dynamics and competitor actions are also influential.

-

Competitive pressures: If competitors are aggressively front-loading, a Malaysian exporter might feel compelled to follow suit to remain competitive.

-

Market share considerations: Front-loading might be strategically employed to secure a larger market share by offering more competitive pricing due to a locked-in exchange rate.

Strategies to Mitigate Risks Associated with Front-Loading MYR

While front-loading can be beneficial, it's essential to mitigate potential risks.

Hedging Techniques

Several hedging techniques can reduce the impact of unfavorable exchange rate fluctuations.

-

Forward contracts: These lock in a specific exchange rate for a future transaction, eliminating uncertainty. However, they involve fees and may limit potential gains if the MYR strengthens unexpectedly.

-

Options contracts: These provide the right, but not the obligation, to buy or sell currency at a specific rate within a defined period. This offers more flexibility than forward contracts but involves premium costs.

-

Suitability for different risk profiles: The choice of hedging strategy depends on the exporter's risk tolerance and the specific circumstances of the transaction.

Diversification of Currency Exposure

Reducing reliance on a single currency is crucial.

-

Reducing risk: Diversifying export markets and currencies spreads the risk associated with exchange rate fluctuations.

-

Improving overall profitability: A diversified approach can enhance overall profitability by capitalizing on opportunities in multiple markets.

-

Expanding market reach: Diversification naturally expands market reach and reduces dependence on any single economic region.

Professional Financial Advice

Seeking expert guidance is paramount.

-

Personalized strategies: Financial advisors specializing in foreign exchange can develop personalized strategies tailored to the exporter's specific needs and risk profile.

-

Tailored risk management: They provide expertise in implementing risk management techniques, ensuring optimal protection against currency fluctuations.

-

Access to specialized knowledge: Professionals provide access to up-to-date market intelligence and insights, enhancing decision-making.

Conclusion

Front-loading the Malaysian Ringgit presents both opportunities and challenges for exporters. Understanding the factors influencing exchange rates, employing effective forecasting methods, and utilizing appropriate hedging strategies are crucial for mitigating risk and maximizing profitability. By carefully considering these factors and seeking professional advice, Malaysian exporters can make informed decisions about when to utilize front-loading techniques to optimize their export revenue. Don't let unpredictable MYR fluctuations hinder your success – learn more about effectively managing front-loading of the Malaysian Ringgit for your export business.

Featured Posts

-

Randles Struggles Why Its Good News For The Timberwolves

May 07, 2025

Randles Struggles Why Its Good News For The Timberwolves

May 07, 2025 -

Zrownowazony Rozwoj W Polsce Argumenty Nawrockiego Za Budowa S8 I S16

May 07, 2025

Zrownowazony Rozwoj W Polsce Argumenty Nawrockiego Za Budowa S8 I S16

May 07, 2025 -

Will There Be A John Wick 5 Keanu Reeves Future In The Franchise

May 07, 2025

Will There Be A John Wick 5 Keanu Reeves Future In The Franchise

May 07, 2025 -

Epic April Fools Day Pranks That Will Make You Laugh

May 07, 2025

Epic April Fools Day Pranks That Will Make You Laugh

May 07, 2025 -

Steelers Draft Strategy Finding The Next George Pickens At The Combine

May 07, 2025

Steelers Draft Strategy Finding The Next George Pickens At The Combine

May 07, 2025