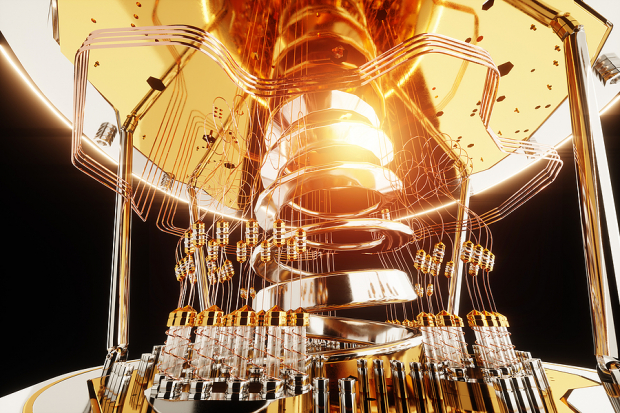

Understanding The Market Factors Contributing To D-Wave Quantum Inc.'s (QBTS) 2025 Stock Plunge

Table of Contents

Main Points: Dissecting the QBTS Stock Crash of 2025

2.1 Increased Competition in the Quantum Computing Market

The quantum computing landscape is rapidly evolving, and D-Wave's once-dominant position faced increasing pressure from a surge of powerful competitors.

H3: Emergence of Powerful Competitors:

The rise of companies like IBM, Google, and Rigetti presented a significant challenge to D-Wave's market share. These competitors were making substantial advancements in various quantum computing technologies, directly impacting D-Wave's potential for growth and profitability.

- IBM: Continuously improved its gate-based quantum computers, offering a different approach to quantum computation that appealed to a broader range of potential applications. Their aggressive scaling strategy and open-source initiatives significantly broadened their reach and influence.

- Google: Achieved "quantum supremacy" milestones, demonstrating the potential of their gate-based systems to outperform classical computers on specific tasks, attracting substantial attention and investment.

- Rigetti: Developed a modular quantum computing architecture that aimed for scalability and flexibility, offering a competitive alternative to D-Wave's annealing approach.

These advancements significantly impacted investor confidence in D-Wave's long-term prospects, as the market began to favor more versatile and widely applicable quantum computing technologies.

H3: Technological Advancements Outpacing D-Wave's Progress:

D-Wave's focus on quantum annealing, while pioneering, faced limitations compared to the versatility and scalability of gate-based approaches. This technological gap became increasingly apparent as competitors made strides in gate-based quantum computing.

- Limited Applicability: Quantum annealing is particularly well-suited for specific optimization problems but struggles with more general-purpose quantum computations.

- Scalability Challenges: Scaling up quantum annealing processors to achieve the same level of qubit count as gate-based systems proved to be a significant hurdle.

- Market Perception: The market increasingly perceived D-Wave's technology as less versatile and less likely to dominate the long-term quantum computing landscape.

This perception shift heavily contributed to the decline in investor confidence and the subsequent QBTS stock plunge.

2.2 Disappointing Financial Performance and Revenue Projections

D-Wave's financial performance in the lead-up to the 2025 stock crash played a crucial role in the dramatic downturn.

H3: Missed Revenue Targets and Profitability Challenges:

D-Wave consistently missed revenue targets, battling high research and development (R&D) costs while facing slow customer adoption of its technology. This combination of factors significantly impacted the company's financial stability and its ability to demonstrate a clear path to profitability.

- Declining Revenue: Financial reports showed a continuous decline in revenue growth year-over-year.

- High R&D Expenses: Substantial investments in R&D were not translating into comparable revenue streams.

- Slow Customer Acquisition: The market for quantum computing remained relatively nascent, resulting in slow commercialization and limited customer uptake.

This disappointing financial picture eroded investor confidence and negatively affected D-Wave's market valuation.

H3: Concerns Regarding Long-Term Sustainability:

Investor concerns regarding D-Wave's long-term financial sustainability intensified as the company continued to rely heavily on funding rounds and struggled to demonstrate a clear path to profitability.

- Funding Dependence: The company's continued dependence on external funding fueled concerns about its ability to operate independently in the long run.

- Slow Commercialization: The slow pace of commercialization and limited real-world applications raised questions about the viability of D-Wave's business model.

- Profitability Uncertainty: The lack of a clear path to profitability added to investor apprehension and uncertainty.

These concerns ultimately contributed to the significant sell-off in QBTS stock.

2.3 Macroeconomic Factors and Overall Market Sentiment

Beyond company-specific factors, the broader economic climate and shifts in investor sentiment also played a role in the QBTS stock plunge.

H3: The Impact of the Broader Economic Climate:

The 2025 economic downturn, characterized by increased inflation and recessionary fears, likely dampened investor appetite for high-risk investments like QBTS stock.

- Risk-Aversion: Investors often become more risk-averse during economic downturns, favoring established, less volatile investments.

- Reduced Investment: Reduced investor funding in the technology sector as a whole further exacerbated D-Wave's struggles.

- Market Volatility: The overall volatility in the stock market made investors more likely to divest from companies perceived as high-risk.

H3: Shifting Investor Preferences and Risk Aversion:

As the market shifted towards a more risk-averse approach, investors likely reduced their exposure to less mature technologies, such as quantum computing, preferring more established and less speculative investments.

- Shift to Established Tech: Investors favored well-established companies with a proven track record of profitability.

- Reduced Speculative Investment: The overall reduction in speculative investment in high-growth technology companies had a cascading effect on companies like D-Wave.

- Focus on Short-Term Returns: Investor focus shifted towards companies with immediate or near-term profit potential, leaving companies like D-Wave lagging.

Conclusion: Understanding the QBTS Stock Plunge and Future Implications

The D-Wave Quantum Inc. (QBTS) stock plunge of 2025 resulted from a confluence of factors: increased competition from companies with more versatile quantum computing technologies, disappointing financial performance and concerns about long-term sustainability, and a broader macroeconomic environment that favored less risky investments. Understanding the interplay of these elements provides valuable insights into the complexities of the quantum computing market and the challenges faced by early-stage technology companies. The QBTS stock plunge serves as a cautionary tale, highlighting the importance of technological innovation, financial stability, and market timing in the rapidly evolving world of quantum computing. Continue your research into D-Wave and other key players to make informed investment decisions in this rapidly evolving field, paying close attention to technological advancements, financial performance, and overall market sentiment surrounding D-Wave Quantum Inc. and other QBTS-like investments.

Featured Posts

-

Breite Ton Efimereyonta Iatro Stin Patra Savvatokyriako

May 21, 2025

Breite Ton Efimereyonta Iatro Stin Patra Savvatokyriako

May 21, 2025 -

Driving In A Wintry Mix Of Rain And Snow

May 21, 2025

Driving In A Wintry Mix Of Rain And Snow

May 21, 2025 -

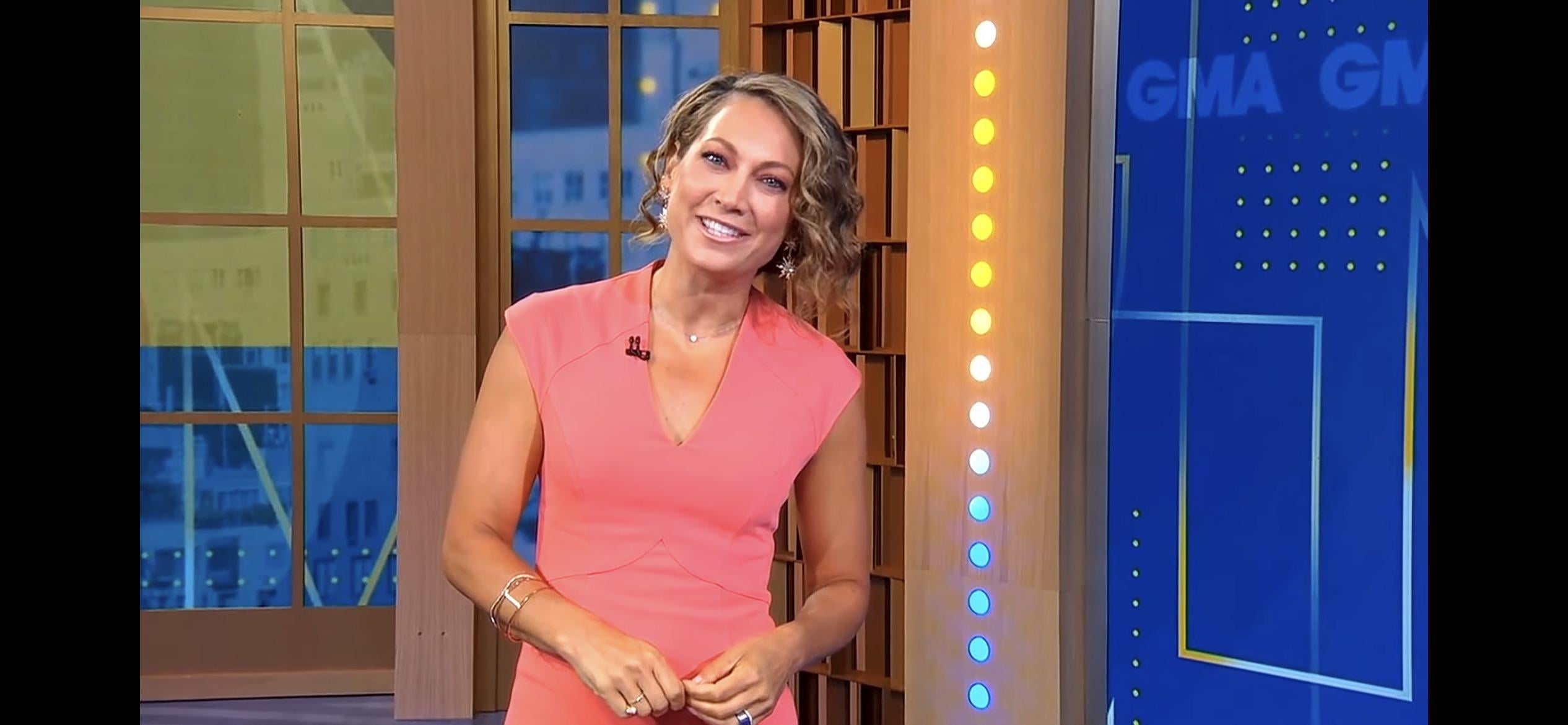

Ginger Zees Fiery Rebuttal To Ageist Comment

May 21, 2025

Ginger Zees Fiery Rebuttal To Ageist Comment

May 21, 2025 -

New Jersey Transit Strike Averted Tentative Deal With Engineers Union

May 21, 2025

New Jersey Transit Strike Averted Tentative Deal With Engineers Union

May 21, 2025 -

Freepoint Eco Systems Secures Project Finance From Ing

May 21, 2025

Freepoint Eco Systems Secures Project Finance From Ing

May 21, 2025