Understanding The Net Asset Value Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

What is the Net Asset Value (NAV) and How is it Calculated?

The Net Asset Value (NAV) represents the net value of an ETF's assets per share. In simple terms, it's the total value of everything the ETF owns, minus its liabilities, divided by the number of outstanding shares. This figure reflects the intrinsic worth of each share. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, understanding the NAV is particularly important because it tracks a diverse portfolio of global equities, hedged against fluctuations in the US dollar.

-

Components of NAV:

- Total Assets: This includes the market value of all the underlying securities (stocks, bonds, etc.) held by the ETF. The Amundi MSCI World II UCITS ETF USD Hedged Dist holds a broad range of global equities, so its total assets fluctuate based on global market performance.

- Total Liabilities: These are the ETF's expenses, including management fees, administrative costs, and any outstanding debts.

-

NAV Calculation Formula: NAV = (Total Assets - Total Liabilities) / Number of Outstanding Shares

-

Daily Calculation and Publication: The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is calculated and published daily, typically at the close of market trading. This provides investors with an up-to-date measure of the ETF's value.

-

Impact of Currency Fluctuations: The "USD Hedged" aspect of this ETF means that the fund manager employs strategies to mitigate the impact of currency fluctuations between the USD and other currencies represented in the underlying assets. However, it's crucial to remember that this hedging is not perfect and some currency exposure may remain, influencing the NAV.

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors can influence the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist on a daily and long-term basis.

Market Performance of Underlying Assets

The performance of the underlying global stocks significantly impacts the ETF's NAV.

- Positive market movement: A rise in the value of the underlying stocks generally leads to an increase in the ETF's NAV.

- Negative market movement: Conversely, a decline in the value of the underlying assets results in a decrease in the NAV.

- Sector-specific performance: Performance variations across different sectors within the global market can also affect the NAV. If technology stocks perform well, while energy stocks decline, the overall impact on the NAV will depend on the ETF's sector allocation.

- Currency fluctuations impact: Even with the USD hedging strategy, fluctuations in exchange rates between the USD and other currencies represented in the underlying assets can still affect the NAV, albeit to a lesser extent.

Expense Ratio and Management Fees

The expense ratio and management fees charged by the Amundi MSCI World II UCITS ETF USD Hedged Dist are deducted from the ETF's assets, impacting the NAV over time. These fees are usually expressed as a percentage of the assets under management.

Dividend Distributions

Dividend payouts from the underlying assets are typically reinvested within the ETF or distributed to shareholders. Dividend distributions affect the NAV, generally causing a slight decrease on the ex-dividend date, reflecting the payment of dividends.

Impact of the USD Hedged Strategy

The USD Hedged strategy implemented by the Amundi MSCI World II UCITS ETF USD Hedged Dist aims to reduce the impact of currency fluctuations between the USD and other currencies on the NAV. However, it’s not a perfect hedge, and residual currency exposure may still cause some variations in the NAV. The effectiveness of the hedging strategy will depend on several market factors and should be considered when evaluating the ETF's performance.

Why is Understanding the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist Important?

Understanding the NAV of your Amundi MSCI World II UCITS ETF USD Hedged Dist investment is crucial for several reasons:

- Performance Tracking: The NAV allows you to track the performance of your investment over time, comparing it to benchmarks and other investment options.

- Share Price Determination: The NAV is a key factor in determining the ETF's trading price. While the market price may deviate slightly from the NAV due to supply and demand, the NAV serves as a fundamental valuation indicator.

- Buy/Sell Decisions: While you don’t buy or sell at the exact NAV (due to the bid-ask spread), understanding the NAV helps you make informed buy and sell decisions.

- Long-Term Investment Strategies: Monitoring the NAV over the long term is essential for assessing the success of your investment strategy and making any necessary adjustments.

- Tax Purposes and Reporting: The NAV is also relevant for tax reporting and calculating capital gains or losses.

Conclusion: Mastering the Net Asset Value of Your Amundi MSCI World II UCITS ETF USD Hedged Dist Investment

In conclusion, understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for effective investment management. We've covered how the NAV is calculated, the factors influencing it, and why regularly monitoring the NAV is vital for informed decision-making. Stay informed about your Amundi MSCI World II UCITS ETF USD Hedged Dist NAV and consider consulting a financial advisor for personalized investment guidance. Regularly monitor the NAV of your Amundi MSCI World II UCITS ETF USD Hedged Dist investment to optimize your portfolio performance.

Featured Posts

-

Konchita Vurst Togava I Sega Neynata Evolyutsiya

May 25, 2025

Konchita Vurst Togava I Sega Neynata Evolyutsiya

May 25, 2025 -

Escape To The Country A Realistic Look At Rural Living

May 25, 2025

Escape To The Country A Realistic Look At Rural Living

May 25, 2025 -

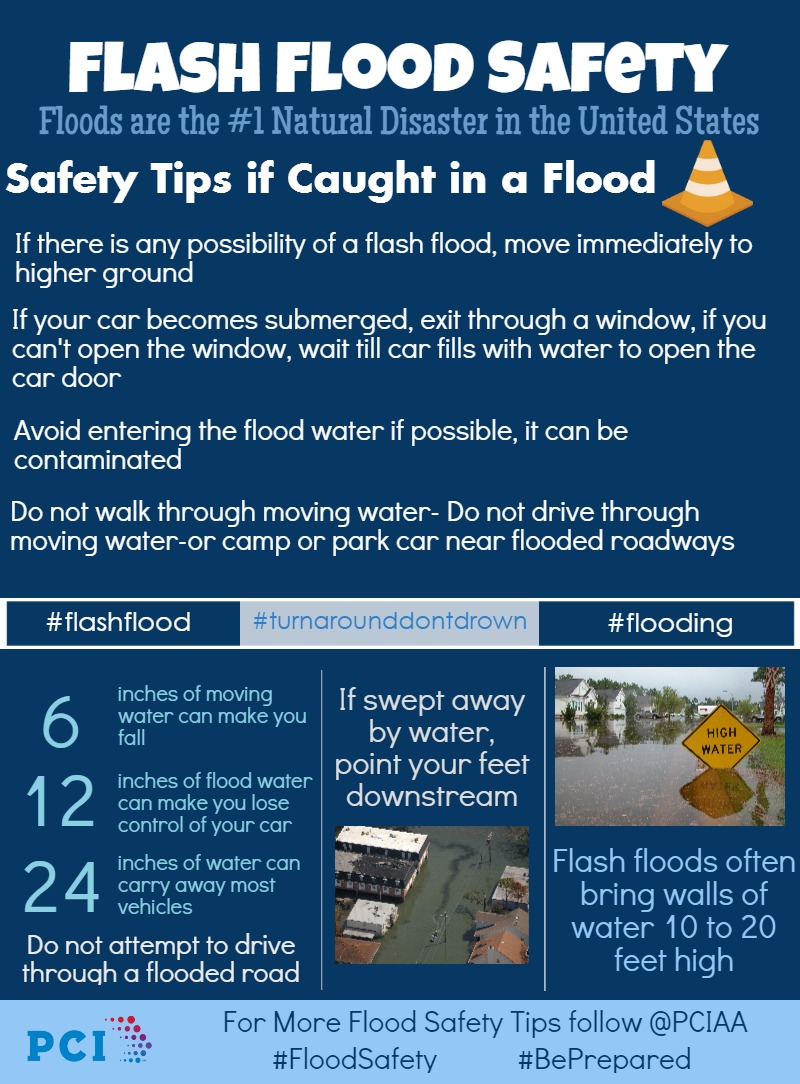

What Is A Flash Flood Emergency A Guide To Preparedness And Response

May 25, 2025

What Is A Flash Flood Emergency A Guide To Preparedness And Response

May 25, 2025 -

Naomi Kempbell 55 Rokiv Foto Zirki U Vsiy Krasi

May 25, 2025

Naomi Kempbell 55 Rokiv Foto Zirki U Vsiy Krasi

May 25, 2025 -

Frances Next Election Jordan Bardella And The Rise Of A New Political Force

May 25, 2025

Frances Next Election Jordan Bardella And The Rise Of A New Political Force

May 25, 2025