Understanding The Surge In The Venture Capital Secondary Market

Table of Contents

Increased Demand for Liquidity

Limited partners (LPs) are increasingly seeking liquidity from their venture capital investments, significantly fueling the demand in the secondary market. This isn't simply a matter of needing cash; it's a strategic move driven by several factors. The increased demand for liquidity within the venture capital secondary market is directly related to the evolving needs and strategies of LPs. This means a higher volume of secondary market transactions.

- Growing need for cash among LPs: Unforeseen circumstances, such as the need to meet unexpected capital calls from other investments or personal financial obligations, can necessitate the sale of VC assets.

- Increased pressure on general partners (GPs): GPs often face pressure to provide liquidity solutions to their LPs, particularly in older funds where the initial investment period has concluded. This is especially crucial for managing LP expectations and maintaining strong relationships.

- Sophisticated LPs actively managing portfolios: More sophisticated LPs are proactively using secondaries to manage their fund portfolios more efficiently. This allows them to rebalance their asset allocation and reduce concentration risk.

- Opportunities for portfolio diversification and improved risk management: Secondary transactions offer opportunities to diversify holdings and mitigate risk by selling less-performing assets and reinvesting in more promising ventures. This aspect of the venture capital secondary market is critical for long-term portfolio health.

Strategic Reasons for Secondary Transactions

Beyond the immediate need for liquidity, both LPs and GPs utilize secondary transactions for strategic portfolio optimization. These transactions are not simply about cash; they’re about enhancing overall portfolio health and efficiency within the venture capital secondary market.

- Portfolio diversification: Secondary transactions allow LPs to diversify their investments across various stages, sectors, and geographies, reducing exposure to concentrated risks. This diversification strategy is a core benefit of the secondary market.

- Risk management: Selling underperforming assets through secondary sales helps mitigate portfolio-level risk and improve overall return profiles.

- Tax optimization: Strategic sales of assets can help LPs and GPs optimize their tax liabilities through capital gains management and tax planning strategies. This is particularly relevant for long-term holdings.

- Succession planning: Secondary transactions can facilitate smoother transitions during fund manager succession planning, allowing for a more orderly transfer of assets and responsibilities.

- Fund restructuring: GPs may use secondaries to restructure their fund portfolios, focusing on high-growth opportunities and divesting from less promising ventures. This improves overall fund performance.

The Role of Technology and Increased Market Efficiency

Technological advancements have revolutionized the venture capital secondary market, dramatically increasing its efficiency and transparency. This has made the market more accessible to a broader range of participants and improved the overall transaction process. The improvements within the VC secondary market have significantly boosted its accessibility and efficiency.

- Online platforms: The emergence of online platforms connecting buyers and sellers has reduced transaction costs and significantly shortened timelines. These platforms improve liquidity within the venture capital secondary market.

- Improved data analytics: Sophisticated data analytics tools offer better valuation models and risk assessment, leading to more informed decision-making. This also minimizes information asymmetry.

- Increased transparency: Enhanced transparency fosters trust and confidence, attracting more participants to the venture capital secondary market.

- Streamlined due diligence: Technology has streamlined due diligence processes, accelerating transaction timelines and making the entire process more efficient.

- Global access: Online platforms enable access to a wider pool of potential buyers and sellers globally, expanding the market's depth and liquidity.

Impact on the Venture Capital Ecosystem

The growth of the secondary market is significantly impacting the broader venture capital ecosystem. It influences investment strategies, market dynamics, and the overall landscape of private equity. The venture capital secondary market is having a significant ripple effect throughout the ecosystem.

- Market valuation: Increased secondary market activity can contribute to more accurate valuations of private companies, providing better benchmarks for primary market investments.

- Increased competition: Competition among buyers and sellers in the secondary market drives more favorable terms for both parties, enhancing market efficiency.

- Fund performance: Secondary transactions can impact fund performance metrics, influencing overall investor returns and shaping investment strategies.

- Investment strategies: The growth of the secondary market influences the investment strategies of GPs, both in the primary and secondary markets.

- Early-stage investing: The increased availability of capital through the secondary market can potentially improve access to capital for early-stage startups.

Conclusion

The surge in the venture capital secondary market is a multifaceted phenomenon driven by increased liquidity demands, strategic portfolio management needs, and technological advancements. Understanding the dynamics of this market is critical for both limited partners and general partners to navigate the evolving landscape of private equity investments successfully. To stay informed about the latest trends and opportunities in this rapidly growing market, continue to explore resources dedicated to venture capital secondary market analysis and strategies. Further research into secondary market transactions and understanding how to leverage VC secondary market opportunities can significantly enhance your investment performance.

Featured Posts

-

Hagia Sophia From Byzantine Glory To Ottoman Grandeur And Beyond

Apr 29, 2025

Hagia Sophia From Byzantine Glory To Ottoman Grandeur And Beyond

Apr 29, 2025 -

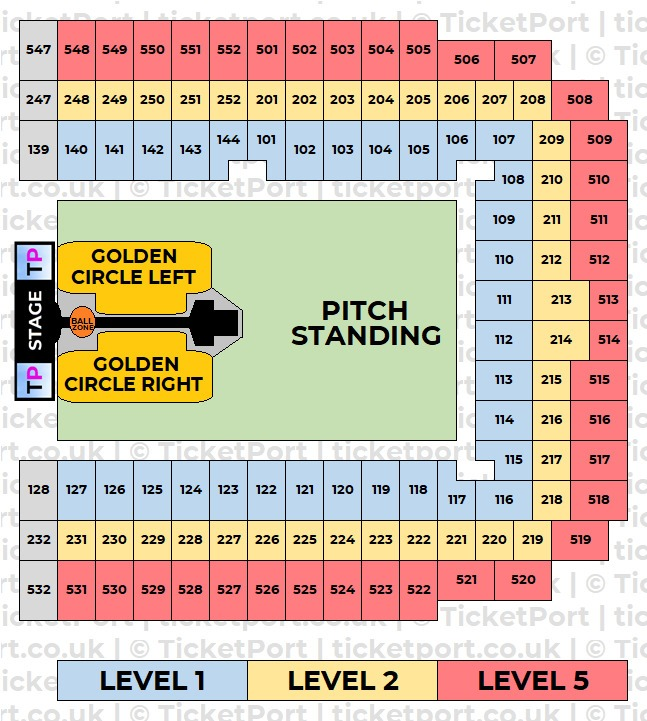

Your Guide To Obtaining Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Your Guide To Obtaining Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Get Tickets To The Capital Summertime Ball 2025 The Ultimate Guide

Apr 29, 2025

Get Tickets To The Capital Summertime Ball 2025 The Ultimate Guide

Apr 29, 2025 -

Canoe Awakening Highlights From The Culture Departments Annual Event

Apr 29, 2025

Canoe Awakening Highlights From The Culture Departments Annual Event

Apr 29, 2025 -

Higher Earning Potential Minnesota Immigrant Job Market Trends Revealed

Apr 29, 2025

Higher Earning Potential Minnesota Immigrant Job Market Trends Revealed

Apr 29, 2025