Understanding Trump's Support For The Nippon Steel Transaction

Table of Contents

Economic Rationale Behind Trump's Stance

Trump's support for the transaction stemmed from a complex interplay of economic considerations, primarily focused on bolstering the American steel industry and addressing perceived national security risks.

Promoting American Steel Industry

Trump's "America First" policy prioritized revitalizing American manufacturing, particularly the steel industry. The Nippon Steel transaction was viewed, at least by some, as a means to achieve this goal. The argument posited that by supporting the deal (the specifics of which would need to be defined based on the actual transaction being referenced), the administration aimed to increase domestic steel production, leading to job creation and a reduction in reliance on foreign steel imports.

- Increased domestic steel production: The transaction could potentially have shifted some steel production back to the US, reducing reliance on imports.

- Job creation in the steel sector: Increased domestic production could have theoretically created jobs in American steel mills and related industries.

- Reduced reliance on foreign steel imports: By strengthening domestic production, the transaction aimed to lessen dependence on foreign steel suppliers.

However, critics argued that the benefits to the American steel industry were overstated or non-existent, potentially leading to higher steel prices and harming industries reliant on steel as a raw material. Empirical data on the actual effects of the transaction on American steel production and employment would be necessary for a definitive assessment.

National Security Concerns

Another key factor driving Trump's support may have been national security concerns. The acquisition of companies within the steel sector by a foreign entity raises questions about the control of strategic resources and the potential vulnerability of critical infrastructure. The Committee on Foreign Investment in the United States (CFIUS), responsible for reviewing foreign investments for national security implications, likely played a role in evaluating the transaction.

- Control over strategic resources: Access to steel is crucial for various industries, including defense. Foreign control over key steel production could raise concerns about supply chain disruptions.

- Impact on defense industry: The availability and cost of domestically produced steel directly affect the defense industry's capability to produce weapons and equipment.

- Potential vulnerabilities in the supply chain: Dependence on foreign steel suppliers could create vulnerabilities in the event of geopolitical tensions or disruptions.

Political Considerations and Public Perception

Beyond the economic rationale, political factors and public opinion significantly influenced the perception of Trump's support for the Nippon Steel transaction.

Political Alliances and Trade Negotiations

The transaction's impact on US-Japan relations was a critical political consideration. While fostering stronger bilateral ties was a potential benefit, the decision could also have been perceived as a concession or a bargaining chip in broader trade negotiations. Trump's actions could have been influenced by political pressures from various stakeholders, including lobbyists representing the steel industry and his own political advisors.

- Strengthening bilateral trade relationships: A positive outcome from the transaction could improve diplomatic relations and enhance trade between the US and Japan.

- Leveraging the transaction for political gain: Trump's support may have served as a strategic move in broader trade negotiations with other countries.

- Impact on international trade agreements: The transaction could have influenced the negotiations and outcomes of existing or future international trade agreements.

Public Opinion and Media Coverage

Public and media reaction to Trump's stance varied widely. Proponents highlighted the potential for job creation and strengthened national security, while critics argued against potential negative impacts on consumers and smaller businesses. Media bias likely played a role in shaping public perception, with differing news outlets presenting the transaction from various viewpoints.

- Public support/opposition for the deal: Public opinion was divided, reflecting diverse perspectives on the economic and geopolitical implications.

- Media portrayal of the transaction: Media coverage presented different narratives, influencing public perception and contributing to the controversy.

- Impact on Trump's approval ratings: The transaction's success or failure likely influenced Trump's approval ratings, especially amongst those with a vested interest in the steel or manufacturing industries.

Long-Term Economic Implications

The long-term implications of the Nippon Steel transaction extended beyond the immediate effects on the US steel industry and encompassed the global steel market and American consumers.

Impact on Global Steel Market

The transaction’s ripple effects were felt across the global steel market. It impacted market competition and steel pricing, potentially leading to industry consolidation and shifting market shares among global players. The long-term effects on steel producers worldwide depended heavily on the specifics of the transaction and its subsequent influence on production capacities and trading relationships.

- Changes in market share: The transaction may have altered the market share distribution among global steel producers.

- Price fluctuations: Changes in supply and demand could have led to price fluctuations in the global steel market.

- Consolidation within the steel industry: The transaction could have encouraged mergers and acquisitions within the steel industry, leading to a more concentrated market.

Consequences for US Consumers

The ultimate consequences for US consumers depended largely on the net impact on steel prices. While increased domestic production could potentially benefit some, higher steel prices could negatively affect various industries reliant on steel and increase the prices of steel-related products for consumers. This, in turn, could influence consumer spending and overall economic activity.

- Price changes for steel products: Changes in steel prices directly translated into price adjustments for a wide array of consumer goods.

- Impact on manufacturing costs: Increased steel costs impacted manufacturing costs across various industries.

- Consumer spending: Fluctuations in prices of steel-related products affected consumer purchasing power and overall spending patterns.

Understanding Trump's Support for the Nippon Steel Transaction: Key Takeaways and Future Implications

Trump's support for the Nippon Steel transaction was driven by a complex interplay of economic, political, and strategic factors. The motivations included boosting the domestic steel industry, addressing national security concerns, and leveraging the deal for political advantage. However, the long-term economic implications for the global steel market and American consumers remained a topic of ongoing debate. Analyzing the actual effects of this transaction requires access to specific details of the deal and subsequent economic data.

To fully grasp the ramifications of this pivotal decision, further research into the specifics of "Trump's support for the Nippon Steel transaction" and its consequences is crucial. This includes examining CFIUS reports, analyzing relevant economic data, and considering various expert opinions. It begs the question: Did the purported benefits of this transaction outweigh its potential drawbacks, and what lessons can be learned for future trade negotiations and national security considerations?

Featured Posts

-

Defaites Ameres Pour L Asec Et L Usma En Coupe De La Caf

May 27, 2025

Defaites Ameres Pour L Asec Et L Usma En Coupe De La Caf

May 27, 2025 -

Flight From Tokyo Diverted After Passenger Tries To Open Emergency Exit

May 27, 2025

Flight From Tokyo Diverted After Passenger Tries To Open Emergency Exit

May 27, 2025 -

Man Receives 30 Year Sentence For Longview Waffle House Killing

May 27, 2025

Man Receives 30 Year Sentence For Longview Waffle House Killing

May 27, 2025 -

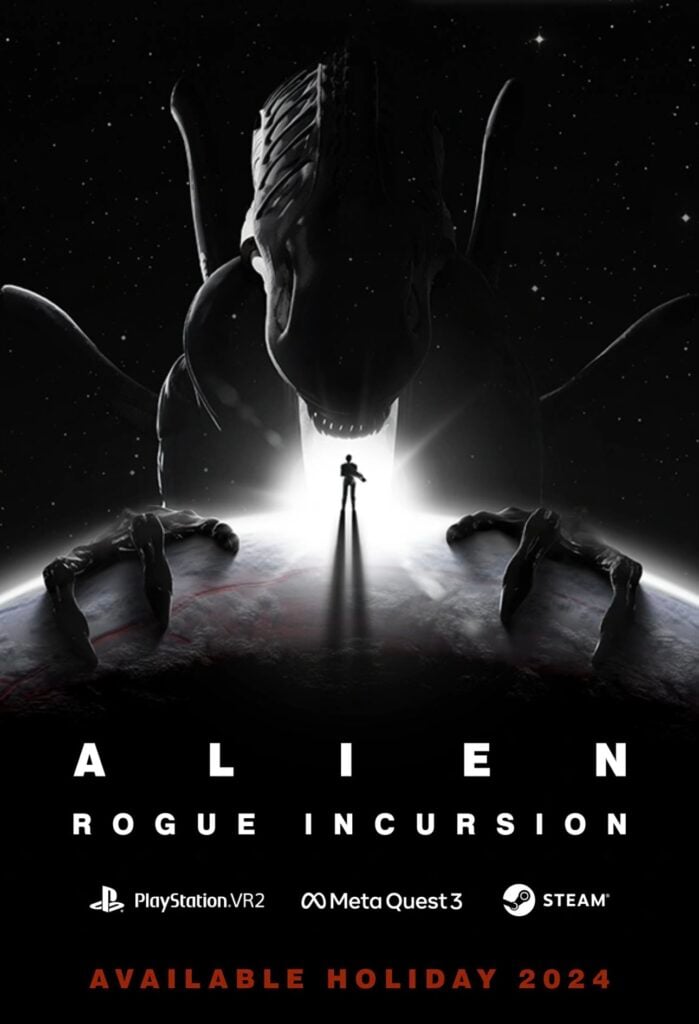

Alien Rogue Incursion Enhanced Edition Escaping Vr

May 27, 2025

Alien Rogue Incursion Enhanced Edition Escaping Vr

May 27, 2025 -

The Mona Gucci Controversy Tik Tok Fame Vs True Celebrity Status Asantewaa Efia Odo Example

May 27, 2025

The Mona Gucci Controversy Tik Tok Fame Vs True Celebrity Status Asantewaa Efia Odo Example

May 27, 2025