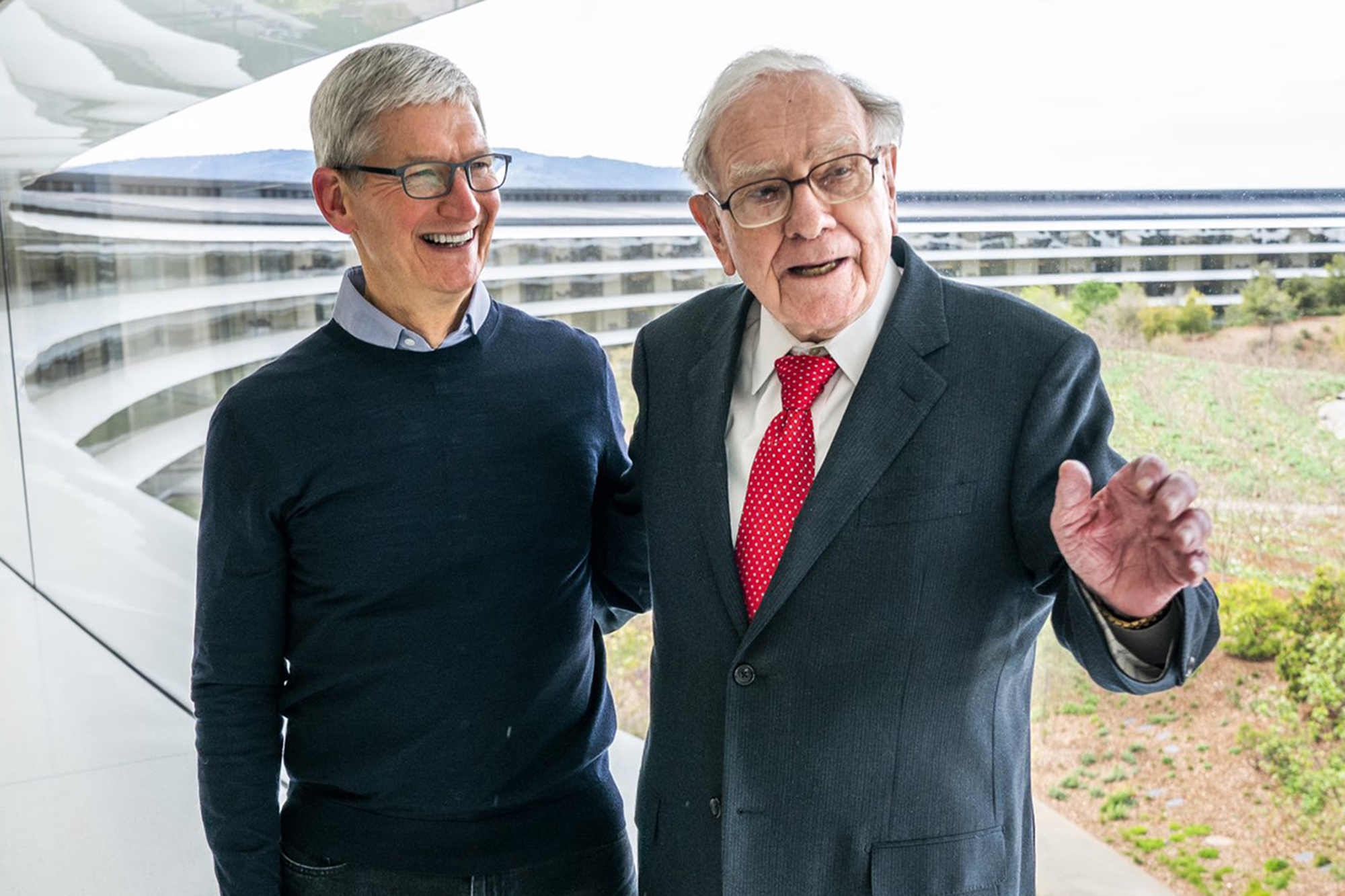

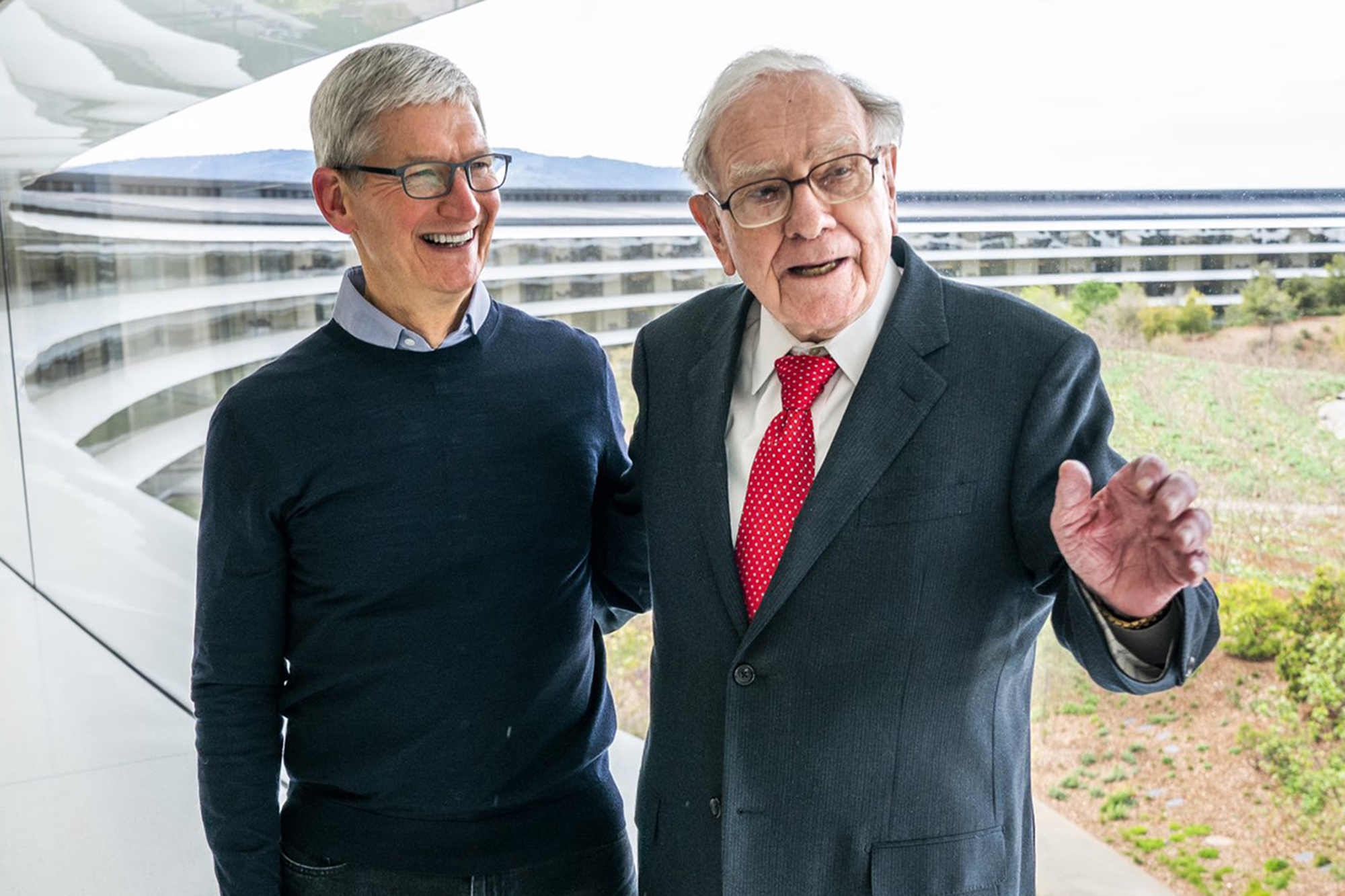

Understanding Warren Buffett's Apple Strategy: A Guide For Beginners And Experts

Table of Contents

2.1. The Initial Investment: Why Apple?

Berkshire Hathaway's initial investment in Apple began in 2016, a period when Apple's stock price was significantly lower than its current valuation. While Buffett is famously known for his value investing philosophy, focusing on undervalued companies with strong fundamentals, his Apple investment represents a fascinating case study of adapting to evolving market dynamics. Several factors likely contributed to this decision:

-

Strong Brand Recognition and Consumer Loyalty (Brand Moat): Apple boasts an unparalleled brand reputation, fostering immense customer loyalty. This powerful brand moat protects Apple from intense competition and ensures consistent demand for its products.

-

Recurring Revenue Streams: Apple generates substantial recurring revenue through its services, including iCloud storage, the App Store, Apple Music, and AppleCare+. This predictable income stream provides a strong foundation for consistent profitability.

-

High Profit Margins and Strong Cash Flow Generation: Apple consistently delivers high profit margins, indicating efficient operations and superior pricing power. Its robust cash flow allows for significant reinvestment in research and development, as well as substantial shareholder returns.

-

High Customer Lifetime Value: Apple's loyal customer base translates into high customer lifetime value. Customers tend to remain within the Apple ecosystem, upgrading to newer devices and subscribing to various services over time.

-

Growth Potential in Emerging Markets: Apple continues to see substantial growth potential in expanding markets worldwide, presenting opportunities for significant future expansion.

This investment marked a departure from Buffett's usual preference for "value stocks," highlighting his willingness to adapt his investment strategy in response to the changing landscape of the tech industry and the unique attributes of a "wonderful business" like Apple.

2.2. Buffett's Investment Philosophy and its Application to Apple

Buffett's investment philosophy centers on several core principles:

- Value Investing: Identifying companies trading below their intrinsic value.

- Long-Term Perspective: Holding investments for extended periods, allowing for compounding returns.

- Focus on Company Fundamentals: Analyzing key financial metrics like revenue growth, profit margins, and debt levels.

- Understanding Management Quality: Assessing the competence and integrity of a company's management team.

While Apple's high valuation initially seemed at odds with traditional value investing, Buffett recognized Apple's exceptional brand strength, consistent profitability, and recurring revenue streams as crucial elements aligned with his "wonderful businesses" criteria. This represents a shift towards recognizing the enduring power of strong brands and robust ecosystems in a rapidly changing tech landscape. Compared to other Berkshire Hathaway holdings, which often reflect the classic value investing approach, the Apple investment stands out as a significant bet on a high-growth technology company.

2.3. Berkshire Hathaway's Apple Holdings and Strategy

Berkshire Hathaway's Apple holdings have grown significantly since the initial investment, becoming one of the largest positions in its portfolio. The investment strategy adopted has been largely passive, with no active involvement in Apple's management. Berkshire Hathaway has benefited considerably from Apple's dividend policy, receiving substantial returns through dividend payouts. Future strategies for Berkshire Hathaway regarding its Apple shares remain uncertain, but the size of the holding suggests a long-term commitment. The potential for either increasing the stake further or maintaining the current position, or even slightly reducing it, remains dependent on market conditions and Apple's continued performance.

2.4. Lessons for Investors from Buffett's Apple Strategy

Warren Buffett's Apple investment offers several valuable lessons for investors of all experience levels:

- Identify High-Quality Companies: Focus on companies with strong fundamentals, consistent profitability, and a sustainable competitive advantage.

- Long-Term Investment Horizon: Adopt a long-term perspective, allowing investments to grow over time through compounding returns.

- Brand Strength Matters: Recognize the importance of strong brand recognition and customer loyalty in creating durable competitive advantages.

- Recurring Revenue is King: Favor companies with predictable and growing recurring revenue streams.

- Diversification, Even with a Large Position: Even a concentrated holding like Apple within a broader portfolio can be part of a well-diversified strategy.

- Adaptability is Key: Be prepared to adjust your investment strategy to reflect changing market dynamics and emerging opportunities.

Conclusion: Understanding the Enduring Power of Warren Buffett's Apple Strategy

Warren Buffett's Apple investment demonstrates that even the most established investors can adapt their strategies to capitalize on unique opportunities in evolving markets. By understanding Buffett's investment philosophy and its application to Apple, investors can glean invaluable insights into identifying and evaluating high-quality companies with long-term growth potential. Mastering Warren Buffett's Apple strategy involves not just mimicking his actions but understanding the underlying principles of value investing, long-term vision, and adaptability. Apply Warren Buffett's Apple strategy to your portfolio by focusing on identifying companies with strong fundamentals and a long-term growth outlook, and you might unlock significant returns over time.

Featured Posts

-

Demi Moores 1991 Body Paint Photoshoot Inspiration For Pooja Bhatts Bold Look

May 06, 2025

Demi Moores 1991 Body Paint Photoshoot Inspiration For Pooja Bhatts Bold Look

May 06, 2025 -

71 Yasindaki Guelsen Bubikoglu Nun Sosyal Medya Paylasimi Bueyuek Ses Getirdi

May 06, 2025

71 Yasindaki Guelsen Bubikoglu Nun Sosyal Medya Paylasimi Bueyuek Ses Getirdi

May 06, 2025 -

Patrick Schwarzenegger Responds To Nepotism Accusations After White Lotus Role

May 06, 2025

Patrick Schwarzenegger Responds To Nepotism Accusations After White Lotus Role

May 06, 2025 -

Elite Runner Deli Worker Dylan Beards Unique Balancing Act

May 06, 2025

Elite Runner Deli Worker Dylan Beards Unique Balancing Act

May 06, 2025 -

Piala Asia U 20 Analisis Kemenangan 6 0 Iran Atas Yaman

May 06, 2025

Piala Asia U 20 Analisis Kemenangan 6 0 Iran Atas Yaman

May 06, 2025