Understanding XRP: Ripple's Cryptocurrency Explained

Table of Contents

What is XRP and How Does it Work?

XRP is a cryptocurrency designed to facilitate fast and efficient cross-border payments. Unlike Bitcoin or Ethereum, which function as decentralized ledgers for general-purpose transactions, XRP's primary purpose is to enable real-time gross settlement (RTGS) of funds across different currencies. It achieves this primarily through its integration with RippleNet, a global payment network used by banks and financial institutions. It's vital to understand that XRP and RippleNet are distinct entities. RippleNet is the network, and XRP is the cryptocurrency that powers many of its transactions.

- XRP's role in facilitating transactions on RippleNet: XRP acts as a bridge currency, allowing near-instantaneous conversions between different fiat currencies. This significantly reduces transaction times and costs.

- The speed and low cost of XRP transactions: XRP transactions are known for their speed (a few seconds) and low transaction fees, compared to other cryptocurrencies.

- The consensus mechanism used by XRP: XRP uses a unique consensus mechanism called the Ripple Protocol Consensus Algorithm (RPCA), designed for speed and efficiency.

- How XRP differs from Bitcoin and Ethereum: Unlike Bitcoin's proof-of-work and Ethereum's proof-of-stake consensus mechanisms, XRP prioritizes speed and efficiency for payment processing. Its functionality is more focused on facilitating cross-border transactions within a network than on general-purpose smart contract execution.

Ripple and XRP: The Relationship Explained

While often used interchangeably, Ripple (the company) and XRP (the cryptocurrency) are distinct entities. Ripple Labs developed XRP, but it doesn't directly control its price or overall supply. This distinction is important. Ripple uses XRP to power its On-Demand Liquidity (ODL) product, a solution that enables near-instantaneous cross-border payments with significantly reduced costs and complexity.

- Ripple's role in promoting and developing XRP: Ripple has played a significant role in promoting and developing XRP's infrastructure and adoption within its payment solutions.

- The independence of XRP from Ripple's actions: While Ripple's actions can influence XRP's price and adoption, XRP operates independently as a decentralized digital asset.

- How Ripple uses XRP in its On-Demand Liquidity (ODL) product: ODL allows financial institutions to bypass traditional correspondent banking, improving speed and lowering costs using XRP as a bridge currency.

The Advantages and Disadvantages of XRP

XRP offers several advantages, but it also faces certain challenges. Understanding both sides is crucial before considering an investment.

Advantages:

- Speed and efficiency: XRP transactions are incredibly fast and efficient compared to other cryptocurrencies.

- Low transaction fees: Transaction fees on the XRP Ledger are generally very low.

- Potential for high transaction volume: The XRP Ledger is designed to handle a high volume of transactions per second.

Disadvantages:

- Regulatory challenges and potential legal risks: XRP has faced regulatory scrutiny in some jurisdictions, creating uncertainty for investors.

- Concerns about the degree of decentralization: Some critics argue that XRP is not as decentralized as other cryptocurrencies, raising concerns about control.

Investing in XRP: Risks and Considerations

Investing in XRP, like any cryptocurrency, involves significant risk. The price of XRP is highly volatile, influenced by various factors including market sentiment, regulatory developments, and Ripple's activities.

- Factors affecting XRP price: Market sentiment, regulatory announcements, partnerships, and technological advancements significantly impact XRP's price.

- Strategies for managing risk in XRP investments: Diversification, dollar-cost averaging, and setting stop-loss orders are common risk management strategies.

- Where to buy and store XRP: XRP can be bought and traded on various cryptocurrency exchanges. Always use reputable exchanges and secure wallets. (Note: We do not endorse any specific exchange or wallet).

- Importance of diversification in a crypto portfolio: Never invest more than you can afford to lose and always diversify your crypto portfolio to mitigate risk.

Conclusion: Understanding XRP's Role in the Future of Finance

XRP is a unique cryptocurrency designed for fast and efficient cross-border payments. Its integration with RippleNet offers a compelling alternative to traditional financial systems. While it offers speed and low costs, regulatory uncertainty and decentralization concerns remain. Understanding the relationship between XRP and Ripple, along with the advantages and disadvantages, is vital for anyone considering an investment. Further research into XRP and Ripple is encouraged to help you make informed decisions about this fascinating digital asset and its role in the future of financial technology and cryptocurrency investment. Remember to conduct thorough due diligence before investing in any cryptocurrency, including XRP.

Featured Posts

-

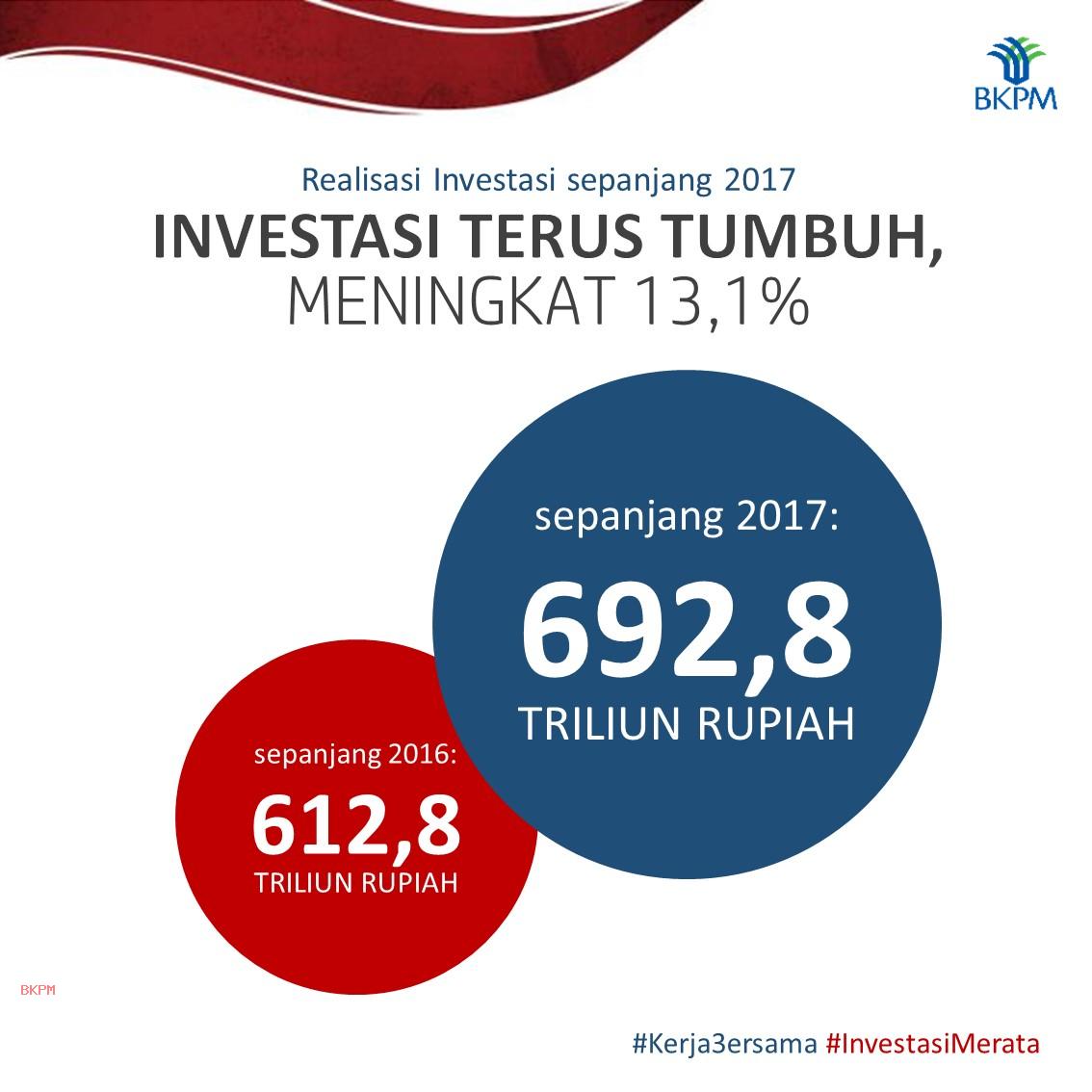

Investasi Pekanbaru Target Bkpm Rp 3 6 Triliun Tahun 2024

May 01, 2025

Investasi Pekanbaru Target Bkpm Rp 3 6 Triliun Tahun 2024

May 01, 2025 -

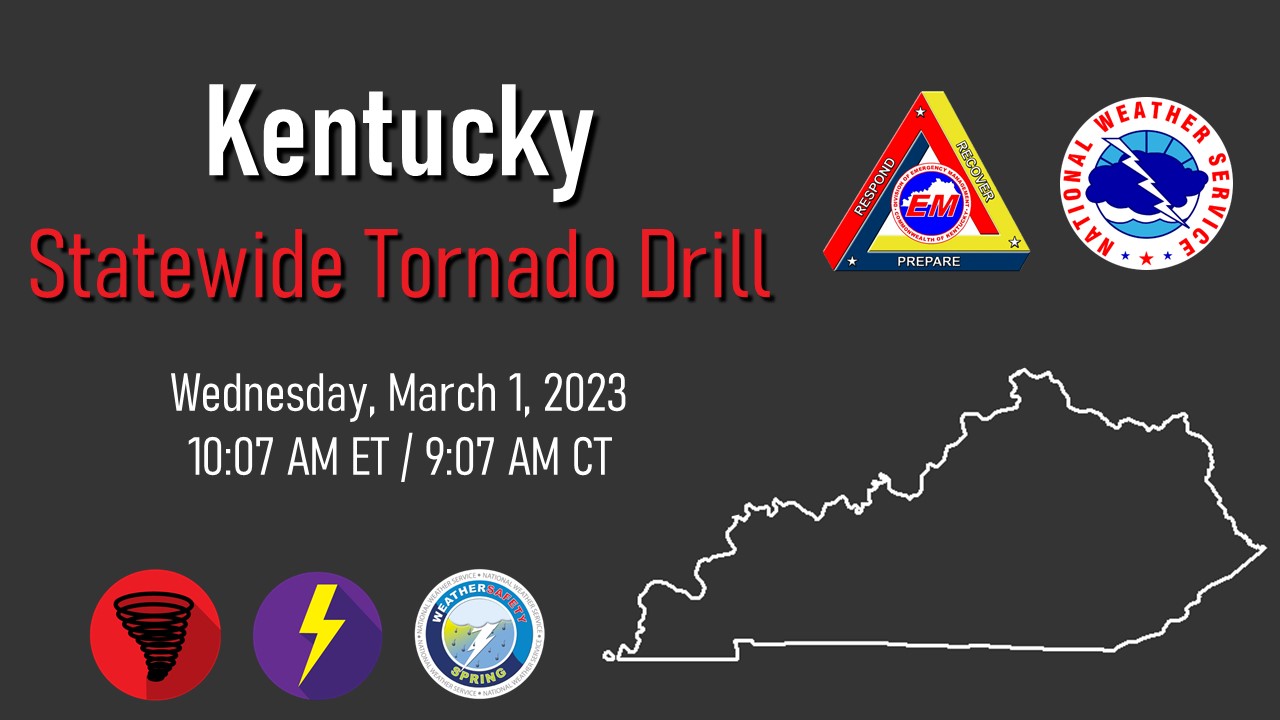

National Weather Service Prepares For Kentuckys Severe Weather Awareness Week

May 01, 2025

National Weather Service Prepares For Kentuckys Severe Weather Awareness Week

May 01, 2025 -

Agha Syd Rwh Allh Mhdy Ka Mqbwdh Kshmyr Pr Bharty Palysy Ky Shdyd Mdhmt

May 01, 2025

Agha Syd Rwh Allh Mhdy Ka Mqbwdh Kshmyr Pr Bharty Palysy Ky Shdyd Mdhmt

May 01, 2025 -

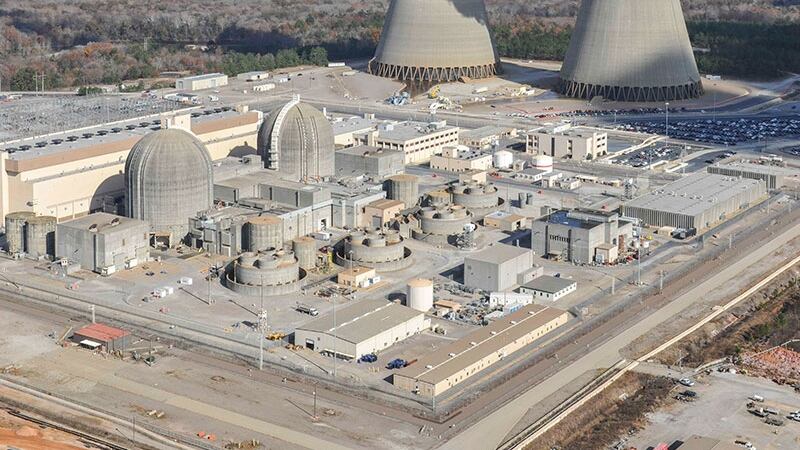

Reactor Power Uprate Your Guide To Nrc Approval

May 01, 2025

Reactor Power Uprate Your Guide To Nrc Approval

May 01, 2025 -

Cdu Csu And Spd Enter Coalition Negotiations Key Issues And Potential Outcomes

May 01, 2025

Cdu Csu And Spd Enter Coalition Negotiations Key Issues And Potential Outcomes

May 01, 2025