Unexpected Drop In PBOC Yuan Support: Analysis And Outlook

Table of Contents

Analyzing the Reasons Behind the PBOC Yuan Support Decline

The decrease in PBOC intervention to prop up the Yuan's value against the US dollar is a multifaceted issue stemming from both internal and external pressures.

Reduced Foreign Exchange Intervention

The PBOC's reduced foreign exchange intervention signifies a shift in its monetary policy. This move suggests several underlying factors:

- Shifting Economic Priorities: The PBOC might be prioritizing other economic objectives, such as managing inflation or stimulating domestic growth, over maintaining a specific Yuan exchange rate. This reflects a move away from strict currency controls.

- Managing Capital Outflows: A decrease in intervention could be a strategy to manage potential capital flight. By allowing some depreciation, the PBOC might aim to reduce the incentive for investors to move their assets out of China.

- Allowing Market Forces to Play a Larger Role: The PBOC may be increasingly comfortable allowing market forces to determine the Yuan's value, believing that a more flexible exchange rate could improve the efficiency of the Chinese economy in the long term. This indicates a gradual move towards a more market-determined exchange rate system.

The reduction in intervention is evident in the declining use of foreign exchange reserves. [Insert Chart or Graph illustrating the reduction in foreign exchange reserves here]. This data clearly shows a trend towards less active management of the Yuan's exchange rate by the PBOC. Keywords associated with this include "foreign exchange reserves," "capital controls," and "monetary policy."

Impact of Global Economic Factors

External factors have also played a crucial role in weakening the Yuan and influencing the PBOC's response.

- US Dollar Strength: The persistent strength of the US dollar, fueled by aggressive interest rate hikes by the Federal Reserve, puts significant downward pressure on most global currencies, including the Yuan.

- Global Inflation: High global inflation rates erode the purchasing power of currencies worldwide, making it challenging for central banks to maintain stable exchange rates.

- Geopolitical Tensions: Escalating geopolitical risks, including the ongoing conflict in Ukraine and rising US-China tensions, create uncertainty in global markets, further impacting currency valuations.

The correlation between these global factors and the reduced PBOC support for the Yuan is undeniable. The strengthening US dollar, in particular, has been a major driver of the recent Yuan depreciation. Relevant keywords are "US dollar strength," "global inflation," "geopolitical risk," and "trade war."

Domestic Economic Conditions in China

Internal economic challenges within China have also contributed to the PBOC's decision to lessen its support for the Yuan.

- Slowing Economic Growth: China's economic growth has slowed in recent years, impacting investor confidence and putting downward pressure on the currency.

- Property Market Issues: The ongoing crisis in China's real estate sector poses significant risks to the overall economy, further weakening the Yuan.

- Potential Debt Concerns: High levels of corporate and local government debt continue to be a concern, potentially limiting the PBOC's ability and willingness to aggressively support the Yuan.

These domestic factors significantly influence the PBOC's strategy. The interplay between slowing economic growth, the property market downturn, and debt concerns necessitates a more cautious approach to currency intervention. Key terms here include "Chinese economy," "GDP growth," "real estate market," and "debt levels."

Outlook for the PBOC Yuan and Investment Strategies

Predicting the future trajectory of the Yuan requires careful consideration of the factors discussed above.

Short-Term Forecast

In the short term, the Yuan is likely to remain volatile. The ongoing impact of US interest rate hikes and global economic uncertainty suggests further potential depreciation. However, the PBOC's potential interventions to prevent excessive volatility cannot be ruled out. We might see a range of scenarios, from a gradual depreciation to periods of relative stability, depending on how global and domestic economic conditions unfold. Keywords include "currency forecast," "exchange rate prediction," and "market volatility."

Long-Term Implications

The decreased PBOC support for the Yuan signals a potential shift towards a more market-oriented exchange rate regime. This could lead to increased volatility in the short term but may foster greater efficiency and resilience in the long run. The long-term implications for China's economy and its role in global trade are significant, requiring careful monitoring of monetary policy adjustments. Relevant keywords here are "long-term investment," "China's economic future," and "monetary policy adjustments."

Investment Strategies for Navigating Yuan Volatility

Navigating the increased volatility of the Yuan requires a robust investment strategy.

- Diversification: Diversifying investments across different asset classes and currencies is crucial to mitigate risks.

- Hedging: Employing currency hedging techniques can help protect against losses stemming from Yuan fluctuations.

- Risk Management: Implementing thorough risk management strategies is paramount in this uncertain environment.

Investors should carefully consider these strategies and seek professional advice to develop a tailored approach. Keywords include "risk management," "investment strategy," "currency hedging," and "portfolio diversification."

Conclusion: Navigating the Future of PBOC Yuan Support

The recent decline in PBOC Yuan support is a complex issue driven by a confluence of global and domestic factors. Understanding these factors is crucial for navigating the evolving landscape of the Chinese currency. The Yuan's future trajectory will depend on the interplay between the PBOC's policy choices, global economic conditions, and the evolution of China's domestic economy. Stay updated on the latest developments in PBOC Yuan support and adjust your investment strategies accordingly. Continue your research into PBOC monetary policy for a deeper understanding of the Chinese Yuan's future.

Featured Posts

-

Declassified The Untold Story Of The U S Nuclear Facility Under Greenlands Ice

May 15, 2025

Declassified The Untold Story Of The U S Nuclear Facility Under Greenlands Ice

May 15, 2025 -

Private Equity Acquires Celtics For 6 1 Billion Impact On The Franchise

May 15, 2025

Private Equity Acquires Celtics For 6 1 Billion Impact On The Franchise

May 15, 2025 -

Paddy Pimblett Vs Michael Chandler A Ufc Veterans Perspective

May 15, 2025

Paddy Pimblett Vs Michael Chandler A Ufc Veterans Perspective

May 15, 2025 -

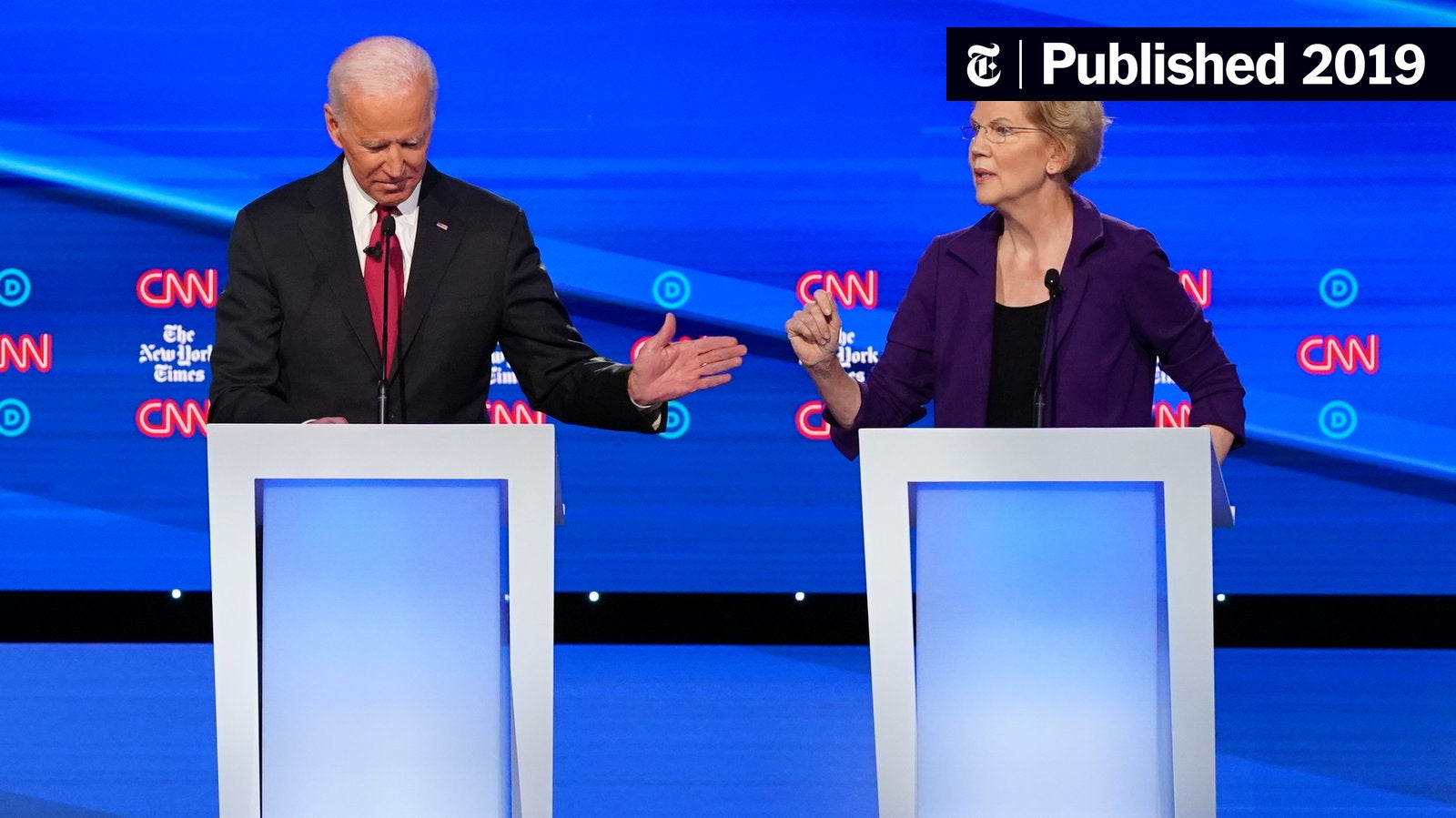

Analysis Of Elizabeth Warrens Defense Of Joe Bidens Mental Health

May 15, 2025

Analysis Of Elizabeth Warrens Defense Of Joe Bidens Mental Health

May 15, 2025 -

Trump Attacks Biden Sleepy Joe And The Question Of Patriotism

May 15, 2025

Trump Attacks Biden Sleepy Joe And The Question Of Patriotism

May 15, 2025