Urgent HMRC Child Benefit Update: Don't Ignore These Messages

Table of Contents

Identifying Legitimate HMRC Communications

Before responding to any communication, it's crucial to verify its authenticity. Many scams attempt to mimic official HMRC messages to steal personal information. Here's how to identify genuine HMRC communications regarding your Child Benefit or tax credits:

- Official Branding and Secure Websites: Legitimate HMRC emails will always use the official @gov.uk email address and link to secure websites beginning with "https://". Look for the official HMRC logo and branding.

- Matching Contact Details: The contact details in the communication should match the information you have on file with HMRC. If there are discrepancies, be extremely cautious.

- Unsolicited Requests: Never click on links or provide personal information (like your National Insurance number, bank details, or password) unless you initiated the contact through official HMRC channels.

- Suspicious Language and Tone: Be wary of messages with poor grammar, spelling errors, or overly aggressive or urgent demands. HMRC communications are usually professional and formal.

Phishing attempts often involve urgent requests for immediate action, threatening penalties if you don't respond quickly. Remember, HMRC will never ask for your bank details or password via email or text message.

Understanding Common HMRC Child Benefit Updates

You might receive an HMRC Child Benefit update for several reasons:

- Changes in Circumstances: Updates to your address, income, the number of children claiming Child Benefit, or other personal details will trigger a communication from HMRC.

- Annual Statements: You'll receive annual tax credit statements and confirmation of your Child Benefit payments.

- Information Requests: HMRC may request additional information or verification to ensure your details are accurate and you remain eligible for Child Benefit.

- Payment Discrepancies: You might receive notification of overpayments or underpayments, requiring you to take action.

- Policy Changes: HMRC will inform you of any significant policy changes affecting your Child Benefit eligibility.

For more detailed information, visit the official HMRC website: [Insert relevant HMRC link here].

How to Respond to HMRC Child Benefit Messages

Responding appropriately to different HMRC communications is vital:

- Online Account Access: The easiest way to manage your Child Benefit is through your online HMRC account. Log in to update your personal details, view payment information, and respond to any requests.

- Responding to Letters: If you receive a letter, respond promptly by post, ensuring you include all the requested information and keep a copy of your response for your records.

- Phone Calls: If you receive a call from HMRC, note down the agent's name and reference number. If you're unsure, hang up and call HMRC back using the official number found on their website.

- Email Responses: When replying to emails, only use the official HMRC email address and attach any necessary documents securely. Avoid sending sensitive information through unsecured methods.

Remember to respond promptly to all HMRC communications and keep detailed records of all correspondence.

Dealing with Overpayments and Underpayments of Child Benefit

Payment discrepancies can occur due to various reasons, including changes in circumstances or administrative errors. Here's how to handle them:

- Understanding the Reason: Carefully review the HMRC communication to understand why an overpayment or underpayment has occurred.

- Contacting HMRC: Contact HMRC to discuss repayment plans if you have an overpayment or to appeal if you believe an underpayment is incorrect.

- Supporting Documentation: Gather any supporting documentation, such as payslips or bank statements, to justify your position.

- Consequences of Inaction: Failure to address payment issues promptly can result in further penalties or debt collection actions.

For guidance on managing overpayments and underpayments, refer to the HMRC website: [Insert relevant HMRC link here].

Act Now on Your Urgent HMRC Child Benefit Update

In summary, verifying the authenticity of HMRC communications, understanding the reasons behind updates, and responding promptly are crucial steps to avoid potential problems with your Child Benefit payments. Ignoring urgent HMRC communications can lead to penalties, payment delays, and added stress. Check your HMRC Child Benefit account immediately. Respond to any outstanding messages without delay and seek assistance through official HMRC channels if needed. Proactive engagement with your HMRC Child Benefit updates and messages is essential for preventing future complications. Don't delay – act on those urgent HMRC communications today!

Featured Posts

-

Burke Faces Bribery Charges Navy Job Exchange Scandal

May 20, 2025

Burke Faces Bribery Charges Navy Job Exchange Scandal

May 20, 2025 -

Atkinsrealis Droit Inc Avocats Experimentes En Droit Commercial

May 20, 2025

Atkinsrealis Droit Inc Avocats Experimentes En Droit Commercial

May 20, 2025 -

The Typhon Missile System And Rising Tensions In The South China Sea

May 20, 2025

The Typhon Missile System And Rising Tensions In The South China Sea

May 20, 2025 -

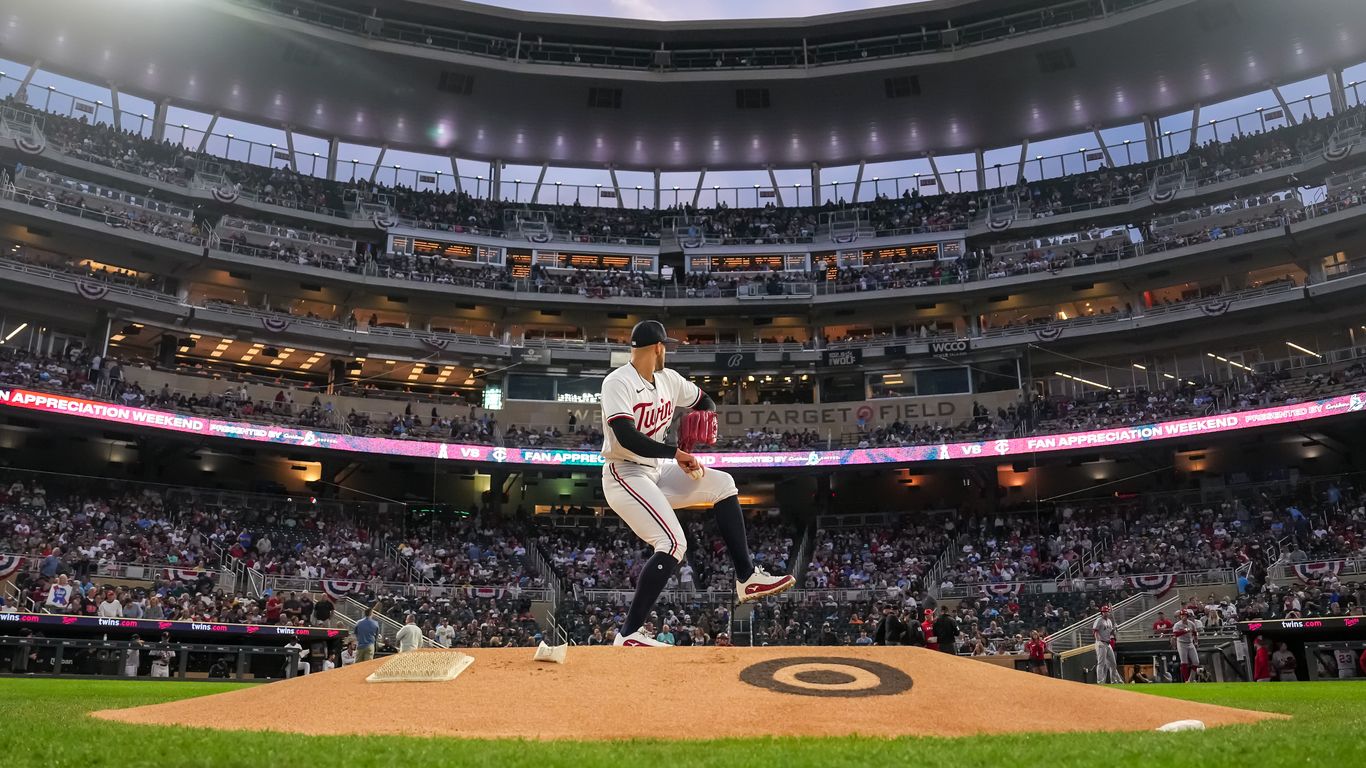

Kcrg Tv 9s Coverage Of 10 Minnesota Twins Games

May 20, 2025

Kcrg Tv 9s Coverage Of 10 Minnesota Twins Games

May 20, 2025 -

Faster Hmrc Call Response Times Thanks To Voice Recognition

May 20, 2025

Faster Hmrc Call Response Times Thanks To Voice Recognition

May 20, 2025