US-China Trade Optimism Fuels Gold Price Decline: Traders Book Profits

Table of Contents

The Impact of US-China Trade Optimism on Global Markets

Positive developments in US-China trade significantly ease investor anxieties. The potential for escalating trade wars, with their damaging effects on global supply chains and economic growth, has been a major source of uncertainty for some time. A thaw in tensions reduces this uncertainty, leading to a more positive market outlook.

- Reduced trade war uncertainty leads to increased investor confidence: With the threat of new tariffs and trade restrictions diminishing, investors feel more confident about future economic prospects. This confidence translates into increased investment in various asset classes.

- Stronger global economic growth projections: Improved trade relations generally lead to forecasts of stronger global economic growth. This is because smoother trade flows facilitate production, consumption, and overall economic activity.

- Increased appetite for riskier assets (stocks, etc.): As confidence rises, investors are more willing to take on risk, shifting their portfolios towards assets like equities that offer potentially higher returns but also greater volatility. This reduced demand for safe havens like gold contributes to its price decline.

- Decreased demand for safe-haven assets like gold: Gold is often seen as a safe-haven asset, meaning its value tends to increase during times of economic uncertainty. When uncertainty diminishes, the demand for gold falls, putting downward pressure on its price.

Profit-Taking in the Gold Market

The decline in gold prices is significantly driven by profit-taking. Many investors purchased gold as a hedge against the risks associated with the US-China trade war. With those risks receding, they are now selling their gold holdings to secure profits and re-allocate capital elsewhere.

- Investors who bought gold as a hedge against trade war risks are now selling to secure profits: This represents a significant shift in investment strategy. The initial motivation for buying gold—protection against uncertainty—is no longer as pressing.

- Increased selling pressure contributes to the price decline: A surge in gold selling creates increased supply, outweighing demand and pushing prices lower. This is a classic example of supply and demand influencing market prices.

- Technical analysis signals may also trigger profit-taking: Traders often utilize technical analysis to identify optimal entry and exit points for trades. Certain technical indicators might have signaled a good time to sell gold, contributing to the price decline.

- The role of institutional investors in the price decline: Large institutional investors, with their substantial gold holdings, can significantly influence market dynamics. Their decisions to sell can exacerbate a price decline.

Alternative Investments Gaining Traction

The shift in investor sentiment away from gold is mirrored in a growing interest in alternative investments. As the global economic outlook brightens, investors are seeking higher returns than those currently offered by gold.

- Higher returns from equities and other riskier assets: The expectation of stronger economic growth makes equities and other higher-risk, higher-reward assets more appealing. Investors are willing to accept greater volatility for potentially greater returns.

- Increased interest in emerging markets: Improved global trade relations often translate to increased investment in emerging markets, which may offer higher growth potential than mature economies.

- The role of interest rates and their impact on gold's appeal: Interest rates play a role; rising interest rates often reduce the attractiveness of gold, which doesn't offer interest payments. This makes other investment options more compelling.

- Diversification strategies impacting gold holdings: Investors often adjust their portfolios to maintain a balanced level of risk and return. This may lead them to reduce their gold holdings in favor of other asset classes, further impacting its price.

Analyzing the Volatility of Gold Prices

Gold prices are inherently volatile, reacting swiftly to shifts in market sentiment and global events. Understanding this volatility is crucial for effective gold investment strategies.

- Factors contributing to gold price fluctuations: Geopolitical events, inflation expectations, currency fluctuations, and changes in investor sentiment are all key factors that affect gold prices.

- Short-term vs. long-term outlook for gold: While short-term price fluctuations can be dramatic, the long-term outlook for gold often depends on factors like inflation and overall economic conditions.

- The importance of monitoring market indicators: Keeping a close eye on key economic indicators, such as inflation rates and interest rate changes, is essential for understanding potential future price movements.

Conclusion

The recent decline in gold prices is largely attributable to the positive developments in US-China trade relations, leading to decreased market uncertainty and widespread profit-taking among investors. This shift highlights the dynamic interplay between geopolitical events, investor sentiment, and the performance of precious metals like gold. Understanding the influence of US-China trade dynamics on gold prices is crucial for investors seeking to effectively manage risk and capitalize on market fluctuations. Stay informed on the latest developments in US-China trade and their impact on the gold price to make informed decisions about your gold investments and overall portfolio management.

Featured Posts

-

Reaktioner Pa Pedro Pascals Tystnad Om J K Rowling Kontroversen

May 18, 2025

Reaktioner Pa Pedro Pascals Tystnad Om J K Rowling Kontroversen

May 18, 2025 -

Absence De La Solution A Deux Etats Dans La Declaration Du G7 Sur Le Conflit Israelo Palestinien

May 18, 2025

Absence De La Solution A Deux Etats Dans La Declaration Du G7 Sur Le Conflit Israelo Palestinien

May 18, 2025 -

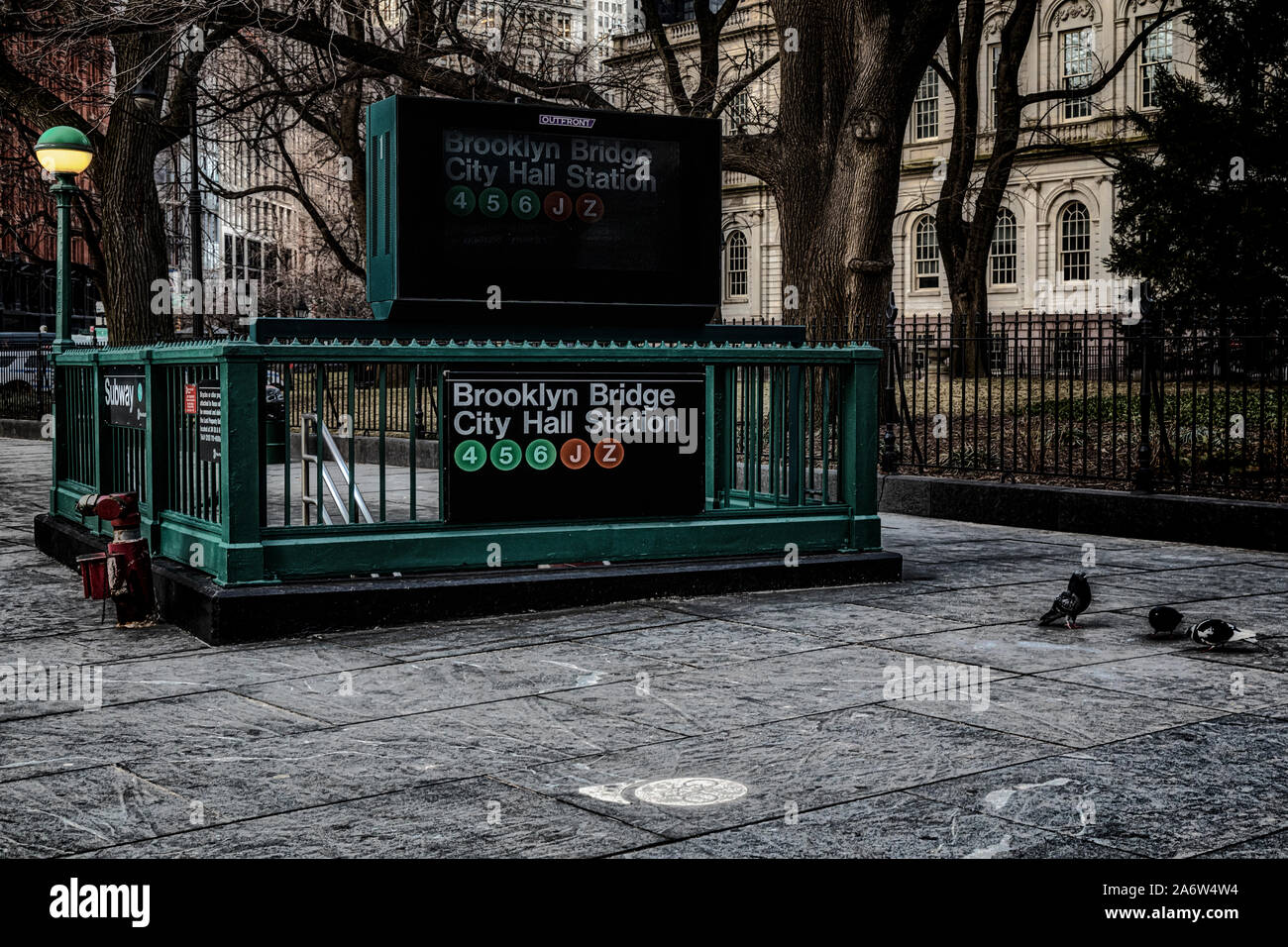

Nyc Subway Stabbing Details On Brooklyn Bridge City Hall Incident

May 18, 2025

Nyc Subway Stabbing Details On Brooklyn Bridge City Hall Incident

May 18, 2025 -

Russias Failed Peace Overture Analyzing Putins Diplomatic Defeat

May 18, 2025

Russias Failed Peace Overture Analyzing Putins Diplomatic Defeat

May 18, 2025 -

Taylor Swifts Reputation Taylors Version The Long Awaited Teaser Is Here

May 18, 2025

Taylor Swifts Reputation Taylors Version The Long Awaited Teaser Is Here

May 18, 2025