US-China Trade War: Bill Ackman's Perspective On The Long Game

Table of Contents

Ackman's Assessment of the Geopolitical Risks

The escalating tensions between the US and China represent a significant geopolitical risk, according to many experts, including Bill Ackman. His commentary, while not always explicitly stated in detail, reveals a deep concern about the implications for national security and global trade. The increasing decoupling between the two economic superpowers is a central element of this risk.

-

Analysis of Ackman's statements regarding the strategic competition between the US and China: While Ackman hasn't explicitly laid out a detailed, public analysis of the US-China trade war, his investment decisions and public statements reflect a cautious approach towards China's growing economic and technological influence. This suggests a recognition of the strategic competition between the two nations.

-

Discussion of the implications for supply chains and global manufacturing: The trade war has highlighted the vulnerabilities of global supply chains heavily reliant on China. Ackman likely views this reliance as a risk factor, potentially leading to disruptions and increased costs for businesses. The shift towards diversification and nearshoring reflects a concern about this vulnerability.

-

Examination of Ackman's perspective on the potential for further escalation: The ongoing tensions suggest the potential for further escalation, and Ackman's investment choices likely reflect this possibility. He likely considers various scenarios, including intensified tariffs, further restrictions on technology transfers, and even potential conflict.

-

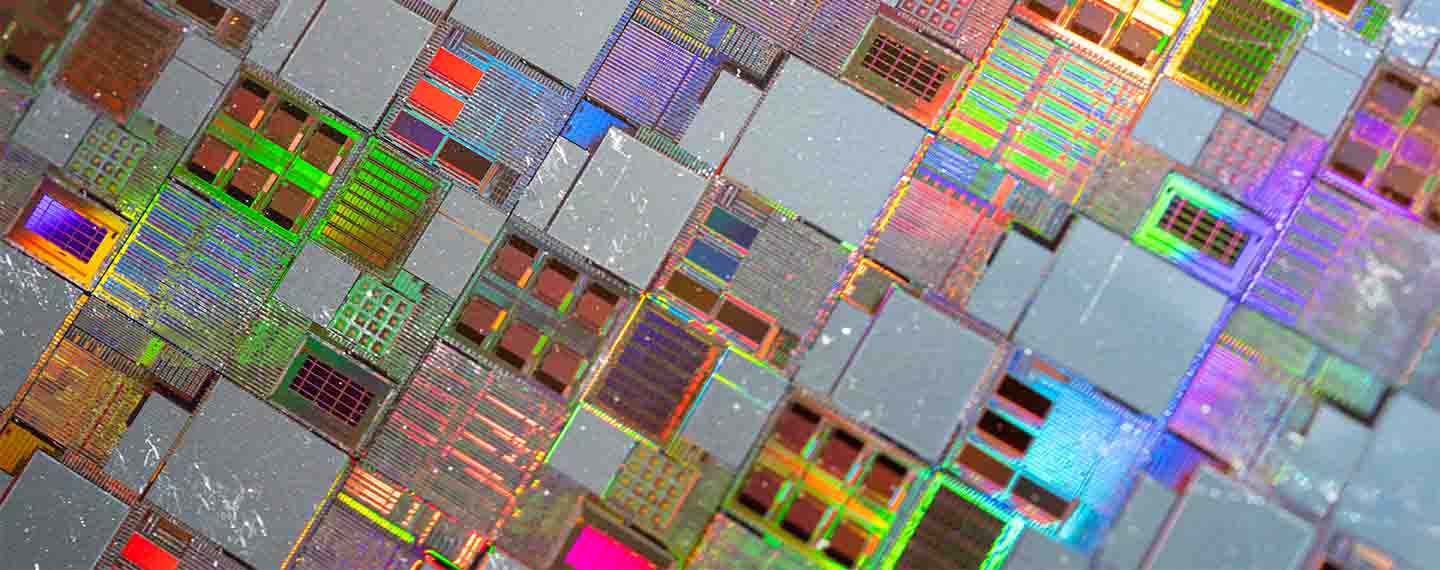

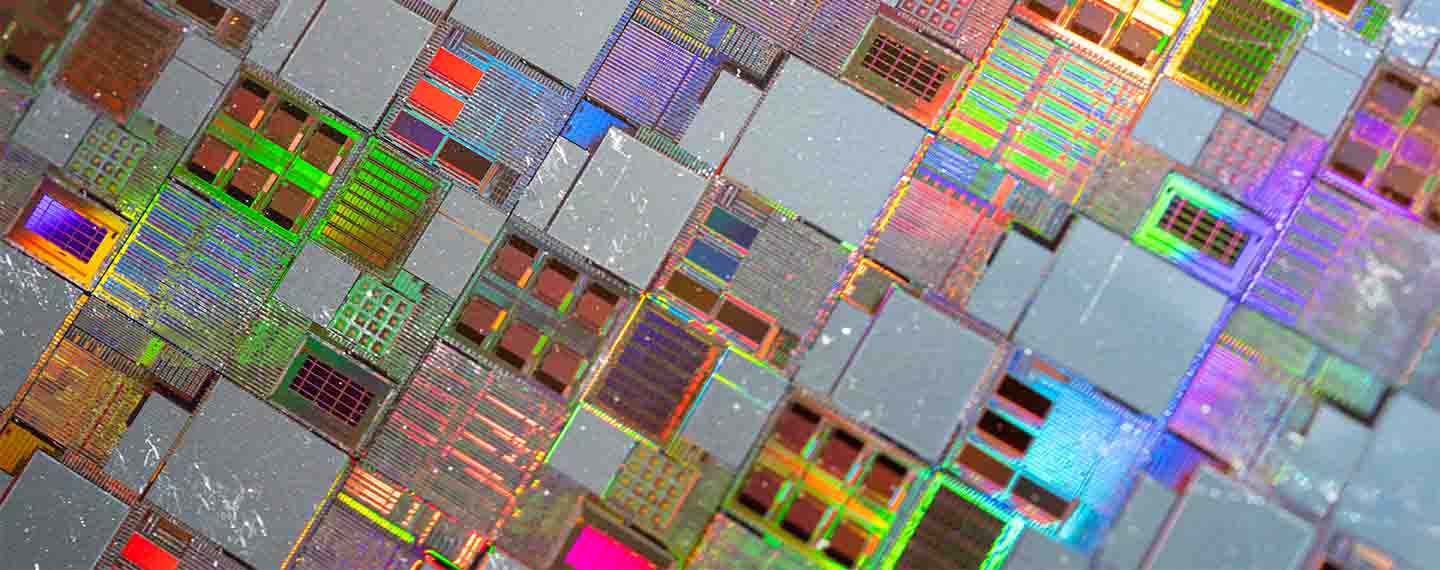

Consideration of the role of technology in the trade war: Technological competition is a core component of the US-China trade war. Ackman likely recognizes the critical role of technology in the future of both economies and the strategic importance of maintaining a technological edge. This shapes his investment choices and overall outlook.

Investment Strategies in a Time of Trade War

Ackman's long-term investment philosophy is characterized by a focus on thorough due diligence and risk management. How this philosophy guides his decisions during the trade war is crucial to understanding his approach.

-

Discussion of Ackman's approach to diversification in the face of geopolitical uncertainty: Diversification is key to mitigating risk in a volatile environment. Ackman likely maintains a diversified portfolio, reducing his exposure to sectors most vulnerable to the trade war's impacts.

-

Analysis of his potential investment choices, focusing on sectors less vulnerable to trade war disruptions: Sectors less reliant on trade between the US and China are likely favored. This could include domestic-focused US companies, or those with diversified global supply chains, minimizing exposure to disruptions.

-

Examination of his risk management strategies, such as hedging against potential market downturns: Hedging strategies are crucial for mitigating downside risk. This might involve options trading, or investments in assets that tend to perform well during market uncertainty.

-

Exploration of his outlook on investing in either the US or Chinese markets in the long term: Ackman’s long-term perspective on investing in either the US or Chinese markets likely reflects a careful assessment of the risks and opportunities presented by each. He might favor specific sectors within each market, based on their vulnerability to trade tensions.

The Long Game: Decoupling and its Consequences

The long-term impact of economic decoupling between the US and China is a significant concern. This section explores the potential consequences from Ackman's likely perspective.

-

Analysis of Ackman's implicit or explicit statements regarding the implications of decoupling for global trade: While not explicitly stated, the underlying implications of decoupling likely inform his strategic decisions. A complete decoupling would fundamentally reshape global trade, impacting supply chains, manufacturing, and the flow of capital.

-

Discussion of the potential impact on various sectors (e.g., technology, manufacturing): Sectors heavily reliant on trade between the US and China are especially vulnerable. The technology sector, in particular, faces profound implications due to the competition for technological dominance. Manufacturing might see a reshoring trend, impacting costs and efficiency.

-

Examination of the potential for regionalization of supply chains: Decoupling might lead to the regionalization of supply chains, with businesses seeking alternatives to reliance on a single country. This could result in a more fragmented and potentially less efficient global economy.

-

Consideration of the long-term economic consequences for both the US and China: Both the US and China would experience significant economic consequences from decoupling. The extent of these consequences would depend on the speed and nature of the decoupling process.

Conclusion

This article explored Bill Ackman's insights into the US-China trade war, focusing on his long-term perspective on geopolitical risks, investment strategies, and the implications of decoupling. His approach highlights the importance of strategic thinking and risk management in navigating this complex and evolving situation. Understanding the long-term implications of the US-China trade war is crucial for informed investment decisions. Learn more about navigating the complexities of the US-China trade war and develop a robust long-term investment strategy. Stay informed on Bill Ackman's perspectives and other expert analyses to refine your approach to this evolving global economic landscape.

Featured Posts

-

Ariana Grandes Transformation The Impact Of Professional Hair And Tattoo Artists

Apr 27, 2025

Ariana Grandes Transformation The Impact Of Professional Hair And Tattoo Artists

Apr 27, 2025 -

Car Dealerships Intensify Pressure Against Ev Sales Quotas

Apr 27, 2025

Car Dealerships Intensify Pressure Against Ev Sales Quotas

Apr 27, 2025 -

Grand National An Analysis Of Horse Mortality Before The 2025 Race

Apr 27, 2025

Grand National An Analysis Of Horse Mortality Before The 2025 Race

Apr 27, 2025 -

Love Triangle Sam Carraros Quick And Unexpected Appearance On Stan

Apr 27, 2025

Love Triangle Sam Carraros Quick And Unexpected Appearance On Stan

Apr 27, 2025 -

Canada The New Hotspot For International Travelers

Apr 27, 2025

Canada The New Hotspot For International Travelers

Apr 27, 2025

Latest Posts

-

Pirates Walk Off Win Ends Yankees Extra Innings Rally

Apr 28, 2025

Pirates Walk Off Win Ends Yankees Extra Innings Rally

Apr 28, 2025 -

Aaron Judge Paul Goldschmidt Yankees Avoid Series Loss

Apr 28, 2025

Aaron Judge Paul Goldschmidt Yankees Avoid Series Loss

Apr 28, 2025 -

Key Contributions From Judge And Goldschmidt Secure Yankees Win

Apr 28, 2025

Key Contributions From Judge And Goldschmidt Secure Yankees Win

Apr 28, 2025 -

Free Live Stream Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025

Free Live Stream Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025 -

New Data On Musks X Debt Sale A Look At The Companys Transformation

Apr 28, 2025

New Data On Musks X Debt Sale A Look At The Companys Transformation

Apr 28, 2025