US-China Trade War Eases: S&P 500 Reacts With 3%+ Gain

Table of Contents

Easing Trade Tensions: The Catalyst for Market Growth

Recent developments suggest a de-escalation in the protracted US-China trade war. Specific events leading to this easing include renewed negotiations and a softening of rhetoric from both sides. While a comprehensive resolution remains elusive, the recent agreement to reduce tariffs on certain goods and increase market access for specific industries provided a significant catalyst for market growth. These concessions, while not a complete resolution, signaled a willingness to find common ground, boosting investor confidence.

- Reduced Tariffs: The agreement included a reduction in tariffs on a range of goods, lessening the financial burden on businesses and consumers impacted by the trade war.

- Increased Market Access: Both countries committed to opening their markets further, particularly benefiting sectors like technology and agriculture. This increased competition and lowered barriers to entry, fostering economic growth.

- Intellectual Property Protection: Stronger commitments to protect intellectual property rights were made, addressing a long-standing concern for US businesses operating in China.

- Technology Transfer Agreements: Negotiations focused on fair technology transfer practices, easing concerns about forced technology sharing and promoting innovation.

S&P 500's 3%+ Gain: A Deep Dive into Market Response

The S&P 500's 3%+ surge is a powerful testament to the positive market reaction to the easing of trade tensions. This significant gain reflects investor optimism and a shift towards a "risk-on" sentiment. The technology and consumer discretionary sectors experienced particularly significant gains, indicating a renewed appetite for growth stocks. This positive market response was fueled by several key factors:

- Increased Trading Volume: The market saw a considerable increase in trading volume, signifying heightened investor activity and confidence.

- Positive Investor Confidence: The easing of trade tensions boosted investor confidence, leading to increased investment in stocks and other assets.

- Improved Economic Forecasts: Analysts revised their economic forecasts upwards, reflecting the positive impact of reduced trade uncertainty on global economic growth.

- Shift in Market Sentiment: The market mood shifted from risk aversion—characteristic of the height of the trade war—to a risk-on environment, where investors are more willing to invest in higher-risk, higher-reward assets.

Long-Term Implications: Assessing the Future of US-China Trade Relations

While the recent easing of trade tensions is positive, the long-term implications for US-China trade relations remain uncertain. While increased global trade and boosted economic growth in affected countries are plausible outcomes, potential future disputes or escalations cannot be ruled out. The potential for shifts in global supply chains, increased competition, and unforeseen economic consequences requires careful consideration. Experts remain divided on the long-term outlook, with some expressing cautious optimism while others warn of lingering risks.

- Increased Global Trade: Reduced trade barriers could lead to a significant increase in global trade and economic activity.

- Boosted Economic Growth: Easing trade tensions can positively impact economic growth, particularly in countries heavily reliant on US-China trade.

- Potential Shifts in Global Supply Chains: Companies might adjust their supply chains in response to the changing trade landscape, potentially leading to both opportunities and challenges.

- Increased Competition: Increased market access could lead to intensified competition in various sectors, benefiting consumers but potentially affecting some businesses.

Conclusion: Navigating the Aftermath of the US-China Trade War

The easing of US-China trade tensions has resulted in a significant positive market reaction, as evidenced by the S&P 500's 3%+ gain. While this development offers a glimmer of hope for improved global economic growth, the long-term implications remain uncertain. Potential future trade disputes and the complexities of the global economic landscape require ongoing vigilance. Staying informed about further developments in US-China trade relations and their impact on the S&P 500 and other global market indicators is crucial for making informed investment decisions. Understanding the nuances of this evolving relationship is key to navigating the complexities of the global market.

Featured Posts

-

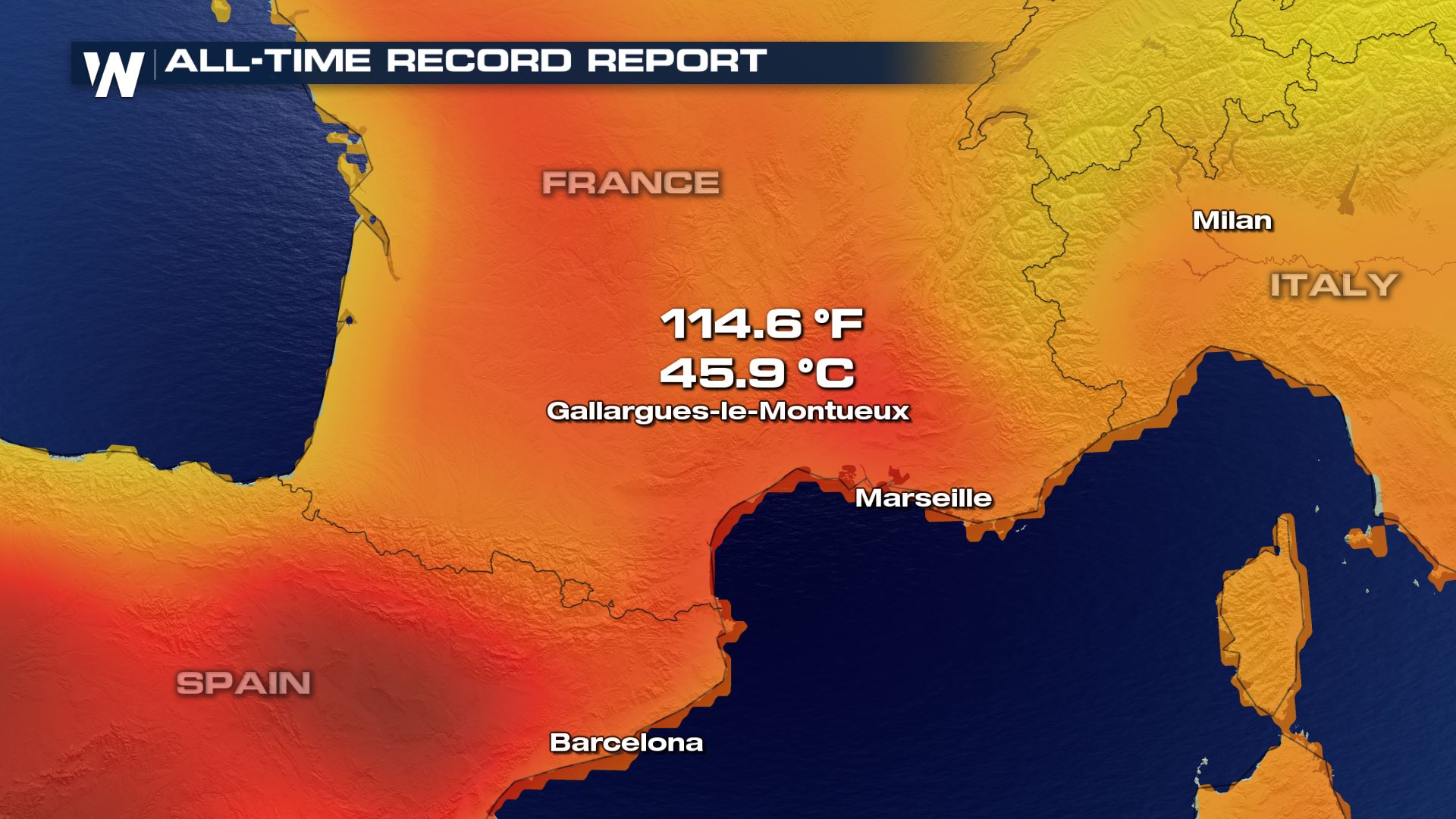

Record Heat Grips La And Orange Counties Safety Tips And Precautions

May 13, 2025

Record Heat Grips La And Orange Counties Safety Tips And Precautions

May 13, 2025 -

A Fathers Unwavering Support A Hostage Sons Story

May 13, 2025

A Fathers Unwavering Support A Hostage Sons Story

May 13, 2025 -

Amsterdam Bike Thefts Soar A New Record

May 13, 2025

Amsterdam Bike Thefts Soar A New Record

May 13, 2025 -

South Africa Emerges As Leading Apple Supplier Surpassing New Zealand

May 13, 2025

South Africa Emerges As Leading Apple Supplier Surpassing New Zealand

May 13, 2025 -

Aryna Sabalenkas Stuttgart Open Win Photo Evidence Challenges Umpire Call

May 13, 2025

Aryna Sabalenkas Stuttgart Open Win Photo Evidence Challenges Umpire Call

May 13, 2025