US Credit Rating Downgraded By Moody's; White House Responds

Table of Contents

Moody's Downgrade: Fiscal Challenges and Political Polarization

Moody's decision to downgrade the US credit rating wasn't taken lightly. Their rationale centers on several key concerns regarding the nation's fiscal strength and political climate. The agency pointed to a deteriorating fiscal trajectory characterized by:

- Rising National Debt: The US national debt continues its upward trajectory, reaching unsustainable levels. The debt-to-GDP ratio, a key indicator of a nation's fiscal health, is projected to worsen in the coming years.

- Fiscal Policy Challenges: A lack of consensus on effective long-term fiscal policy contributes to the problem. Repeated short-term solutions, such as debt ceiling increases, only postpone addressing the underlying issues.

- Political Gridlock Hindering Solutions: Deep political polarization prevents the bipartisan cooperation necessary to implement meaningful fiscal reforms. This political stalemate hampers the ability to tackle the mounting debt.

- Increased Likelihood of Debt Ceiling Breaches: The recurring battles over raising the debt ceiling highlight the fragility of the US fiscal system and increase the risk of a default.

Moody's explicitly cited the increasing likelihood of debt ceiling breaches, highlighting the significant risk this poses to the nation's creditworthiness. The agency's report included projections showing a continued increase in the federal deficit and a concerning rise in the debt-to-GDP ratio, emphasizing the urgency of addressing these fiscal challenges. The keywords "fiscal strength," "debt ceiling," "political stalemate," and "creditworthiness" accurately reflect the core concerns driving Moody's assessment.

White House Response and Counterarguments

The White House responded swiftly to Moody's downgrade, issuing a statement that rejected the agency's assessment. The administration argued that the downgrade was unwarranted and did not accurately reflect the strength of the US economy. The Treasury Department further emphasized the administration's commitment to fiscal responsibility, citing several key initiatives:

- Focus on Targeted Spending: The White House highlighted its focus on targeted spending initiatives designed to stimulate economic growth while controlling costs.

- Emphasis on Infrastructure Investment: Investments in infrastructure were presented as a long-term strategy to boost economic productivity and competitiveness.

- Negotiations to Raise the Debt Ceiling: The administration's efforts to negotiate a responsible increase in the debt ceiling were presented as evidence of its commitment to avoiding a default.

These counterarguments, while emphasizing the administration's economic policies, did not directly address the core concerns raised by Moody's regarding political gridlock and the long-term sustainability of the nation's fiscal path. Keywords like "White House statement," "Treasury Department response," "economic policy," and "fiscal responsibility" aptly describe this section's focus.

Market Reactions and Global Implications

The announcement of the US credit rating downgrade immediately triggered market volatility. Stock markets experienced significant fluctuations, and interest rates saw noticeable shifts. The impact was felt globally, affecting international trade and investment patterns. Key observations include:

- Market Volatility: Stock markets reacted negatively to the news, reflecting investor uncertainty about the future economic outlook.

- Interest Rate Changes: Increased uncertainty led to adjustments in interest rates, potentially impacting borrowing costs for businesses and consumers.

- Global Impact: The downgrade cast a shadow on the global economy, potentially impacting international trade and investment flows, particularly in relation to the US dollar.

- Investor Confidence: Investor confidence in US Treasury securities and the broader US economy declined.

The "US dollar," a key component of the global financial system, saw its value fluctuate in response to the downgrade, further emphasizing the global implications of this event. The keywords "market volatility," "global impact," "US dollar," "investor confidence," and "international trade" aptly summarize the market reaction.

Long-Term Economic Outlook and Potential Consequences

The long-term economic consequences of the downgraded credit rating could be significant. The increased uncertainty could lead to:

- Increased Borrowing Costs for the Government: The US government will likely face higher borrowing costs, requiring larger budget allocations for interest payments.

- Impact on Inflation: Increased borrowing costs could contribute to inflationary pressures.

- Effect on Consumer Confidence: Uncertainty about the future may dampen consumer spending and slow down economic growth.

- Potential for Slower Economic Growth: The combined effect of higher borrowing costs, inflation, and decreased consumer confidence could lead to slower economic growth.

Depending on the government's response and the evolution of the political landscape, several scenarios are possible, ranging from a relatively mild economic slowdown to a more significant crisis. The keywords "economic growth," "inflation," "interest rates," "long-term outlook," and "economic stability" encapsulate the potential consequences.

Conclusion: Understanding the Impact of the US Credit Rating Downgrade

Moody's downgrade of the US credit rating is a significant event with profound implications for the US economy and global markets. The White House's response, while emphasizing its economic policies, did not fully address the underlying fiscal and political challenges highlighted by Moody's. The market reactions and potential long-term economic consequences underscore the gravity of this situation. The "US Credit Rating Downgraded" event demands close monitoring, and understanding its implications is crucial for both individuals and businesses. Stay updated on the US credit rating situation by following our coverage of the US economic outlook. Learn more about the impact of the US credit downgrade and subscribe to our newsletter for the latest updates.

Featured Posts

-

Stream Damiano Davids Next Summer Today

May 18, 2025

Stream Damiano Davids Next Summer Today

May 18, 2025 -

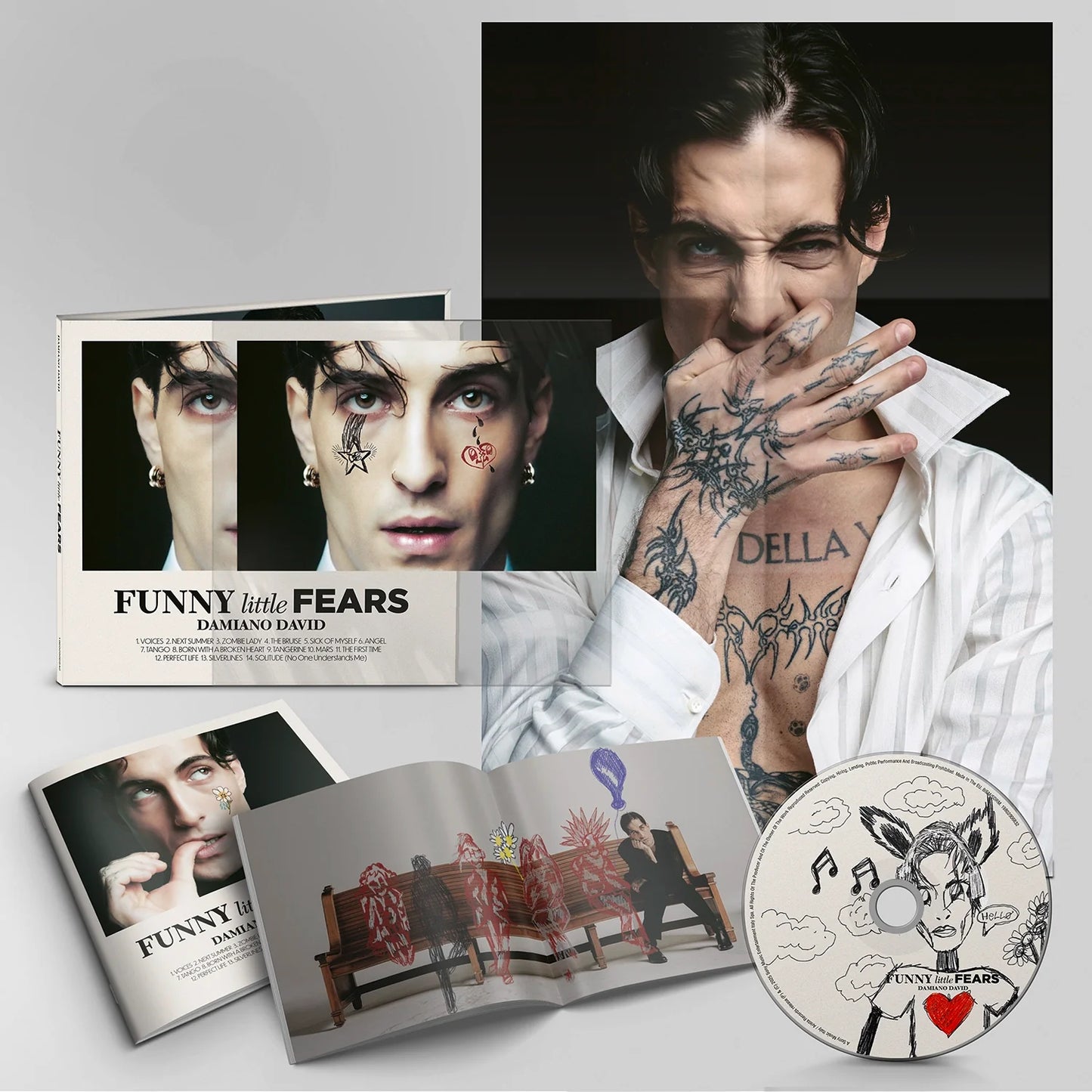

Damiano Davids Funny Little Fears Strengths Weaknesses And Overall Impression

May 18, 2025

Damiano Davids Funny Little Fears Strengths Weaknesses And Overall Impression

May 18, 2025 -

Find The Best No Deposit Bonus Codes April 2025

May 18, 2025

Find The Best No Deposit Bonus Codes April 2025

May 18, 2025 -

Active No Deposit Bonus Codes April 2025

May 18, 2025

Active No Deposit Bonus Codes April 2025

May 18, 2025 -

I Eyropaiki Naytilia Arithmoi Poy Entyposiazoyn

May 18, 2025

I Eyropaiki Naytilia Arithmoi Poy Entyposiazoyn

May 18, 2025