US Debt Limit Could Reach Critical Point In August: Bessent

Table of Contents

Understanding the US Debt Ceiling and its Implications

What is the debt ceiling?

The US debt ceiling, also known as the federal borrowing limit, is the total amount of money the US government is legally allowed to borrow to meet its existing obligations. This isn't about setting new spending; it's about paying for what Congress has already authorized. Think of it like a credit limit on a credit card – once the limit is reached, further borrowing is impossible. Understanding the "debt ceiling explained" is vital to grasping the current crisis. The government uses this borrowed money to fund previously approved spending, including Social Security, Medicare, and national defense.

Consequences of Reaching the Debt Ceiling

Failing to raise the debt ceiling before the projected August deadline would have catastrophic consequences:

- Government Default: The US could default on its Treasury obligations, shaking global financial markets and potentially triggering a global recession. This "government default" would severely damage the US's creditworthiness.

- Government Shutdowns: Essential government services could be significantly curtailed or even shut down, impacting everything from national security to social welfare programs.

- Economic Instability: Uncertainty surrounding the debt ceiling creates "economic instability," eroding consumer and business confidence, leading to decreased investment and potential job losses.

- Increased Interest Rates: The risk of default could drive up interest rates, making borrowing more expensive for individuals, businesses, and the government itself, increasing the "recession risk." "Financial market volatility" is almost guaranteed.

Historical Precedents

While the US has faced debt ceiling showdowns before, the potential consequences this time are arguably more severe. Examining the "debt ceiling history" shows that past crises, although resolved eventually, have led to significant market uncertainty and economic disruption. A thorough "economic impact analysis" of previous instances highlights the urgent need for a solution.

Bessent's Warnings and Predictions for August

Bessent's Statements

Bessent, a leading [mention Bessent's title/affiliation], has issued strong warnings about the potential for a crisis in August. [Insert direct quotes from Bessent, if available, highlighting their concerns about the August deadline and the potential severity of the situation]. Their analysis emphasizes the need for immediate action to prevent a potentially catastrophic economic outcome. Understanding "Bessent's analysis" is crucial for comprehending the urgency of the situation.

Analysis of Bessent's Perspective

Bessent's warnings carry significant weight due to their [mention Bessent's expertise and experience]. Their "expert opinion," backed by [mention any supporting data or evidence], underscores the real possibility of a major economic crisis if the debt ceiling isn't addressed promptly. The "economic forecasting" models often employed by such experts suggest significant negative repercussions.

Potential Solutions and Political Implications

Possible Solutions

Several potential solutions exist to avert a crisis:

- Raising the Debt Limit: The most straightforward solution is a simple increase in the debt ceiling, allowing the government to continue meeting its obligations.

- Short-Term Extensions: A temporary extension could buy time for further negotiations, but this approach only delays the inevitable.

- Budget Negotiations: Meaningful budget negotiations to reduce spending and increase revenue could address the underlying causes of the debt crisis. However, achieving a "bipartisan compromise" on fiscal policy is a significant challenge.

Political Gridlock and Negotiations

The political landscape is currently fraught with challenges. Reaching a "bipartisan compromise" on the debt ceiling is far from guaranteed. The potential for "political gridlock" and "congressional action" delays is significant. Effective "bipartisan negotiations" are essential but highly unlikely without significant concessions from both sides. The possibility of a "political stalemate" resulting in catastrophic economic consequences is a serious concern.

Conclusion

The US is facing a critical juncture. The looming "US debt limit" crisis, with its potential August deadline, demands immediate attention. Failing to address the debt ceiling could trigger a government default, economic instability, and a potential global recession. Bessent's warnings, along with the analysis of historical precedents and potential solutions, paint a clear picture of the urgency of the situation. The potential for "political gridlock" further complicates the path to a resolution.

Call to Action: Stay informed about the crucial US debt limit debate and its potential impact. Learn more about the US debt ceiling crisis and contact your elected officials to express your concerns. Demand action to prevent a potentially catastrophic outcome for the US economy.

Featured Posts

-

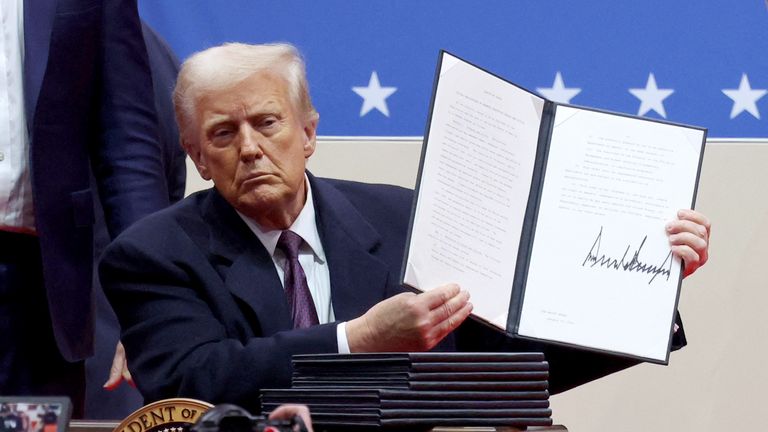

Impact Of Trumps Executive Orders On The Transgender Community A Call For Your Experiences

May 10, 2025

Impact Of Trumps Executive Orders On The Transgender Community A Call For Your Experiences

May 10, 2025 -

Beyond The Monkey Anticipation Builds For Stephen Kings Upcoming Films

May 10, 2025

Beyond The Monkey Anticipation Builds For Stephen Kings Upcoming Films

May 10, 2025 -

Nottingham Attack Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 10, 2025

Nottingham Attack Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 10, 2025 -

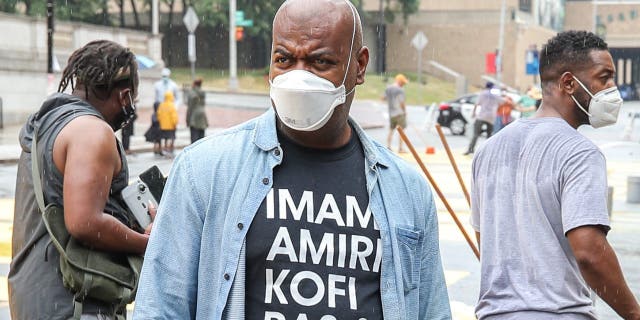

Newark Mayor Ras Baraka Arrested Details On Ice Detention Center Protest

May 10, 2025

Newark Mayor Ras Baraka Arrested Details On Ice Detention Center Protest

May 10, 2025 -

Us Ipo Filing Omada Health Backed By Andreessen Horowitz Seeks Public Listing

May 10, 2025

Us Ipo Filing Omada Health Backed By Andreessen Horowitz Seeks Public Listing

May 10, 2025

Latest Posts

-

Ryan Reynolds Mntn Ipo Launch Imminent

May 12, 2025

Ryan Reynolds Mntn Ipo Launch Imminent

May 12, 2025 -

Aaron Judges 2025 Goal The Push Up Revelation

May 12, 2025

Aaron Judges 2025 Goal The Push Up Revelation

May 12, 2025 -

Mntn Ipo Ryan Reynolds Company Eyes Next Week Launch

May 12, 2025

Mntn Ipo Ryan Reynolds Company Eyes Next Week Launch

May 12, 2025 -

Landmark Agreement Ottawa And Indigenous Capital Group Partner For A Decade

May 12, 2025

Landmark Agreement Ottawa And Indigenous Capital Group Partner For A Decade

May 12, 2025 -

Ottawa Indigenous Group Signs Historic 10 Year Agreement

May 12, 2025

Ottawa Indigenous Group Signs Historic 10 Year Agreement

May 12, 2025