US Debt Limit: Potential August Crisis, According To Treasury

Table of Contents

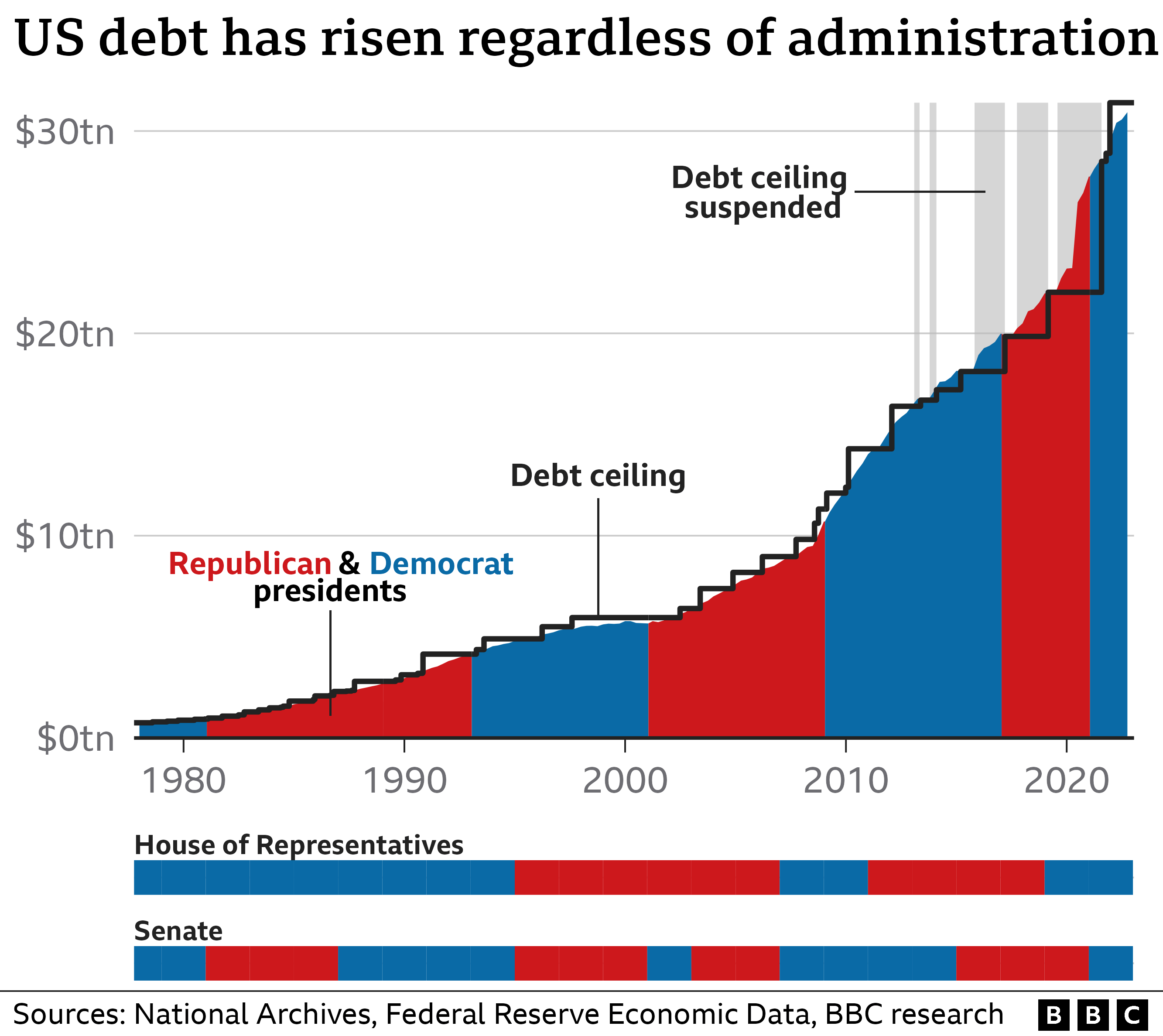

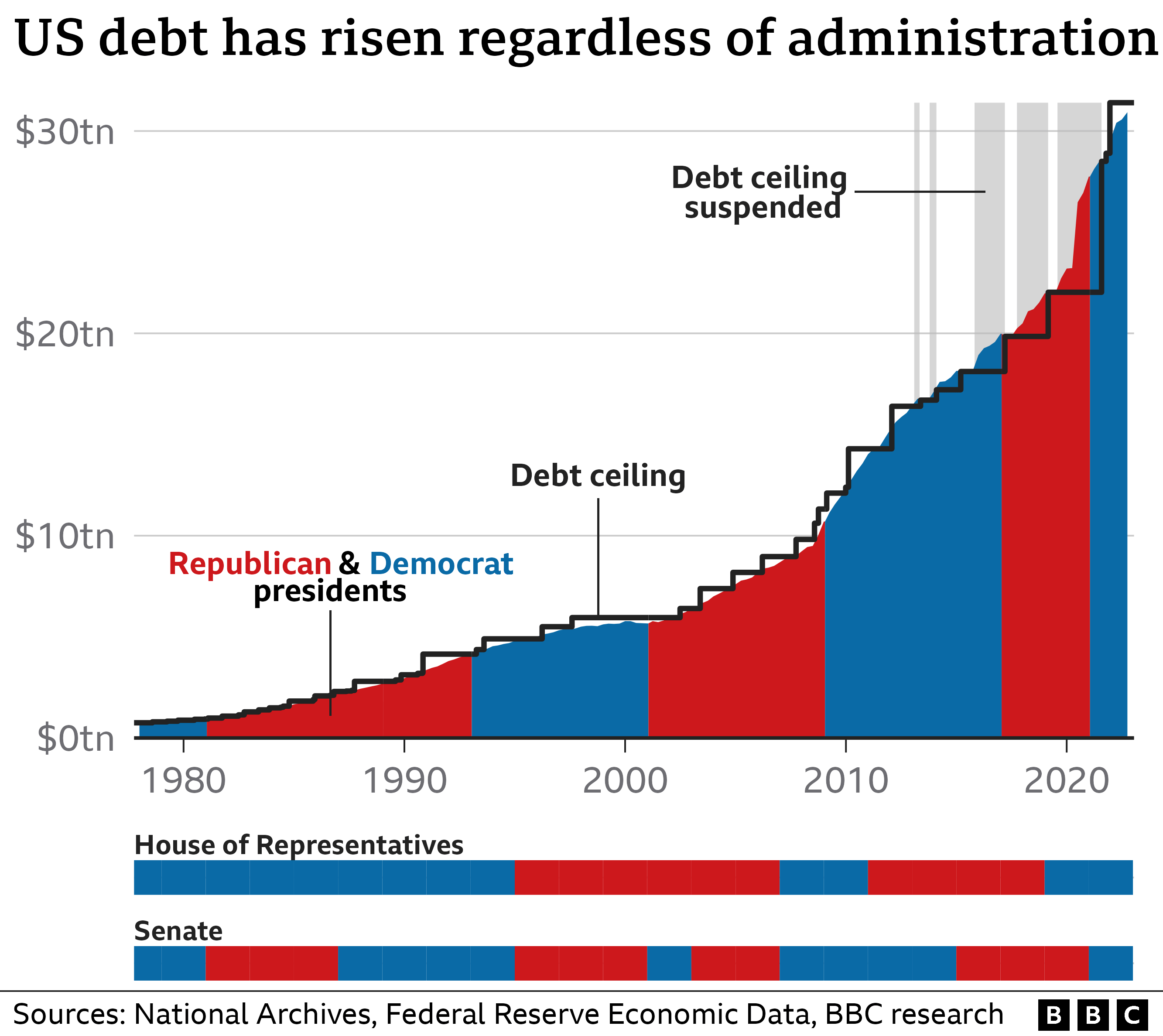

Understanding the US Debt Limit

The US debt limit, also known as the debt ceiling, is the total amount of money the US government is legally allowed to borrow to meet its existing obligations. It's not a limit on spending; rather, it's a limit on the government's ability to finance already-authorized spending. Think of it as a credit limit on a credit card – the government can spend up to a certain amount, but it needs to increase its credit limit to spend more.

-

Bullet Point 1: The debt ceiling is set by Congress and is designed to control the national debt. However, the process of reaching and exceeding the debt ceiling has become increasingly politicized in recent years.

-

Bullet Point 2: Raising or suspending the debt limit requires Congressional action. This involves passing a bill that either increases the current limit or suspends it temporarily. The process can be lengthy and often fraught with political disagreements.

-

Bullet Point 3: Historically, the debt limit has been raised or suspended numerous times without major incident. However, near-misses and political brinkmanship in recent years have increased market volatility and uncertainty. These past debates highlight the potential for severe economic consequences if a resolution isn't reached.

-

Bullet Point 4: The role of Congress in the debt ceiling process is paramount. Both the House of Representatives and the Senate must approve any legislation to raise or suspend the debt limit. This often leads to protracted negotiations and potential government shutdowns.

The Treasury's August Warning and its Implications

Treasury Secretary Janet Yellen recently warned Congress that the US government could default on its debt as early as August if the debt ceiling isn't raised or suspended. This statement has heightened concerns about a potential financial crisis.

-

Bullet Point 1: Failing to raise the debt ceiling would have severe economic consequences. This could lead to market volatility, a potential credit rating downgrade (which would increase borrowing costs), and a significant increase in interest rates across the board.

-

Bullet Point 2: The impact would extend beyond US borders. A US default could trigger a global financial crisis, impacting international markets and potentially leading to a global recession. Foreign investors holding US Treasury bonds would face substantial losses.

-

Bullet Point 3: Social implications are equally concerning. Delayed government payments, including Social Security and Medicare benefits, would severely impact millions of Americans. Federal employees might face pay delays, further destabilizing the economy.

-

Bullet Point 4: The political ramifications are significant. A failure to address the debt ceiling could severely damage the credibility of the US government and further deepen political divisions. The handling of this crisis will undoubtedly influence the upcoming election cycle.

Potential Solutions and Negotiations

Several solutions are being discussed to avoid a debt ceiling crisis. However, the political climate presents significant challenges to finding a swift resolution.

-

Bullet Point 1: A short-term debt ceiling increase could provide temporary relief, allowing for further negotiations on long-term budget agreements. However, this approach merely postpones the problem.

-

Bullet Point 2: Long-term budget agreements, addressing underlying fiscal issues like spending cuts and tax increases, offer a more sustainable solution. Reaching such agreements requires bipartisan cooperation and difficult political compromises.

-

Bullet Point 3: The President and Congress both have crucial roles to play in finding a solution. The President's leadership and ability to negotiate with Congress are vital. Congress needs to prioritize finding common ground and avoid political gridlock.

-

Bullet Point 4: The potential for bipartisan cooperation remains uncertain. The highly polarized political environment makes finding a compromise difficult, increasing the likelihood of continued political gridlock.

The Role of the Federal Reserve

The Federal Reserve (the Fed) plays a crucial role in managing the economic consequences of a potential debt ceiling crisis. Its tools include manipulating interest rates and managing the money supply to mitigate the impact on financial markets. However, the Fed's ability to fully counteract the effects of a default is limited.

Monitoring the Situation and Preparing for Uncertainty

Staying informed and preparing for potential economic uncertainty is crucial for individuals and businesses.

-

Bullet Point 1: Reliable sources for information include the US Treasury Department website, reputable financial news outlets (like the Wall Street Journal, Bloomberg, and Reuters), and Congressional reports.

-

Bullet Point 2: Businesses should monitor market conditions closely, assess potential cash flow impacts, and consider diversification strategies to mitigate risks. Developing contingency plans for potential supply chain disruptions is also vital.

-

Bullet Point 3: Individuals should review their personal finances, build emergency funds, and prioritize essential expenses. Understanding the potential impact on investments and retirement accounts is also crucial.

Conclusion

The US debt limit is a critical issue with potentially severe consequences. The Treasury's warning of an August crisis underscores the urgency for Congress to act and find a solution. Understanding the intricacies of the US debt limit, its potential ramifications, and the ongoing negotiations is paramount. Stay informed about developments concerning the US Debt Limit by following reliable news sources and actively monitoring the situation. Failure to address the debt ceiling could trigger a financial crisis with far-reaching implications for the US and the global economy. Don't wait – stay informed about this critical issue that could impact your financial future. The potential for a crisis related to the US debt ceiling necessitates vigilance and proactive preparation.

Featured Posts

-

Realistic Concerns Truckie Advocates For Keeping Key Tasman Road Open

May 11, 2025

Realistic Concerns Truckie Advocates For Keeping Key Tasman Road Open

May 11, 2025 -

Ace The Private Credit Job Hunt 5 Dos And Don Ts To Follow

May 11, 2025

Ace The Private Credit Job Hunt 5 Dos And Don Ts To Follow

May 11, 2025 -

Pandemic Fraud Lab Owner Convicted Of Fake Covid Tests

May 11, 2025

Pandemic Fraud Lab Owner Convicted Of Fake Covid Tests

May 11, 2025 -

Boston Celtics Playoff Success Payton Pritchards Contribution To Game 1 Victory

May 11, 2025

Boston Celtics Playoff Success Payton Pritchards Contribution To Game 1 Victory

May 11, 2025 -

American Golf Fans Divided Over Shane Lowrys Viral Video Clip

May 11, 2025

American Golf Fans Divided Over Shane Lowrys Viral Video Clip

May 11, 2025