US Dollar Weakness Fuels Euro And European Futures Gains: Swissquote Bank Report

Table of Contents

The Weakening US Dollar: Underlying Causes and Implications

The decline in the US dollar's value is a complex phenomenon driven by several interconnected factors. Understanding these underlying causes is crucial for grasping the broader impact on global markets.

Inflationary Pressures in the US

Soaring inflation in the US is a primary driver of the dollar's weakness. The Federal Reserve (Fed) has been aggressively raising interest rates to combat this inflation, but the effects have been mixed.

- Recent Inflation Figures: Inflation has remained stubbornly high, exceeding expectations in recent months. [Insert relevant data and cite source].

- Fed's Interest Rate Decisions: The Fed's rate hikes, while aimed at curbing inflation, can also weaken the dollar in the long run by impacting investor confidence and potentially slowing economic growth. [Insert details on recent interest rate changes and their market impact].

- Market Expectations: Market participants are closely watching the Fed's actions and future projections. Disappointments regarding inflation control can trigger further dollar weakness.

Geopolitical Uncertainty and its Effect on the Dollar

Geopolitical instability plays a significant role in influencing currency values. The current global climate is fraught with uncertainty, affecting investor sentiment towards the US dollar.

- War in Ukraine: The ongoing conflict in Ukraine has created significant economic uncertainty, impacting global supply chains and energy prices, negatively affecting the dollar.

- US-China Relations: Strained relations between the US and China add to the overall uncertainty, making investors hesitant to hold large dollar positions.

- Reduced Investor Confidence: The combination of these geopolitical factors erodes investor confidence in the dollar's stability, prompting them to seek safer havens or diversify their investments.

Relative Strength of Other Currencies

The weakness of the US dollar is relative to the strength of other major currencies. The Euro, in particular, has seen a significant rise against the dollar.

- Euro's Strength: The Euro's resilience is partly due to strong European economic growth in some sectors and the European Central Bank's (ECB) monetary policy. [Insert data on Eurozone economic growth and ECB policies].

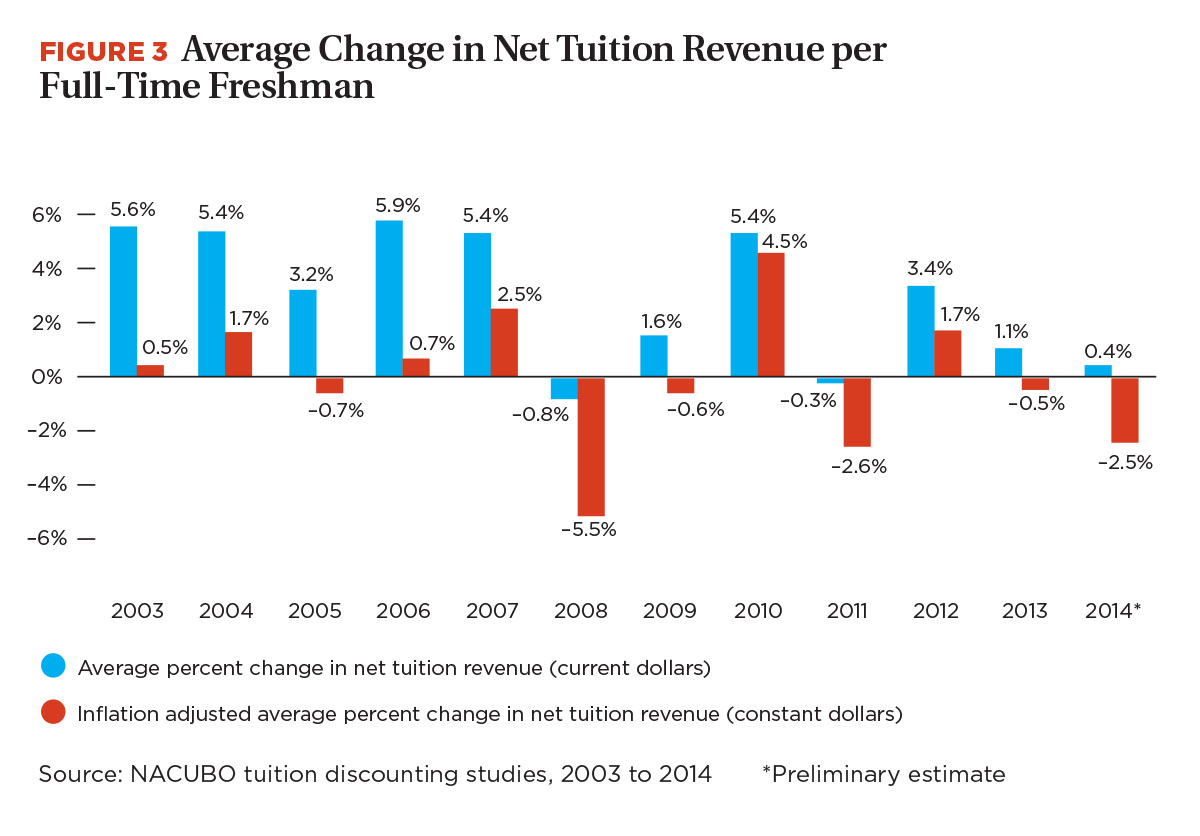

- Currency Movements: [Include a chart or graph illustrating the USD/EUR exchange rate over the relevant period, citing the source]. This visual representation clearly demonstrates the dollar's weakening trend against the Euro.

Impact on European Futures Markets: A Swissquote Perspective

Swissquote Bank's recent report offers valuable insights into the impact of the weakening US dollar on European futures markets.

Swissquote Bank's Report Findings

The Swissquote Bank report highlights a significant increase in trading activity and price appreciation in several European futures contracts.

- Direct Quotes: "[Insert direct quotes from the Swissquote Bank report supporting the analysis of European futures market impact]".

- Specific Examples: The report specifically mentions increased activity and gains in [mention specific examples of European futures contracts affected, e.g., energy futures, agricultural futures].

Increased Investment in European Assets

The weaker dollar makes European assets more attractive to international investors.

- Attractiveness to International Investors: A weaker dollar effectively lowers the price of European assets for investors holding other currencies. This increased affordability boosts demand.

- Potential Risks and Opportunities: While the weaker dollar presents opportunities, investors should also be aware of potential risks such as inflation and geopolitical instability within the Eurozone.

Outlook for European Markets Based on Swissquote's Analysis

Swissquote Bank's analysis suggests a positive outlook for European markets in the short to medium term, but cautions against complacency.

- Potential Challenges and Opportunities: The report acknowledges potential challenges such as rising energy prices and supply chain disruptions but also highlights growth opportunities in certain sectors.

- Future Currency Movements: The report suggests a continuation of the current trend, with the Euro potentially strengthening further against the dollar, but emphasizes the inherent uncertainty in forex markets. [Insert forecast from the Swissquote report].

Conclusion: Navigating the Shifting Landscape with US Dollar Weakness

The weakening US dollar, driven by inflation, geopolitical uncertainty, and the relative strength of other currencies like the Euro, is significantly impacting European futures markets. Swissquote Bank's report provides a comprehensive analysis of these trends, highlighting both opportunities and challenges for investors. Understanding these dynamics is crucial for making informed investment decisions. Stay ahead of the curve by regularly checking Swissquote Bank's reports and other reliable financial news sources for the latest updates on US dollar weakness and its impact on your investments. Monitoring currency fluctuations and geopolitical events is essential for navigating this evolving landscape.

Featured Posts

-

Legal Challenge Succeeds Brockwell Park Use Restrictions Upheld

May 19, 2025

Legal Challenge Succeeds Brockwell Park Use Restrictions Upheld

May 19, 2025 -

Forsopling Av Bekk Et Lokalsamfunns Respons

May 19, 2025

Forsopling Av Bekk Et Lokalsamfunns Respons

May 19, 2025 -

Eurovision 2023 Host Withdraws Last Minute Due To Unforeseen Circumstances

May 19, 2025

Eurovision 2023 Host Withdraws Last Minute Due To Unforeseen Circumstances

May 19, 2025 -

The Trial Finale Explained Teas Crime Her Parents Fate And The Aftermath

May 19, 2025

The Trial Finale Explained Teas Crime Her Parents Fate And The Aftermath

May 19, 2025 -

The Positive Economic Ripple Effect Of Large Raves

May 19, 2025

The Positive Economic Ripple Effect Of Large Raves

May 19, 2025