US Economic Growth To Slow Considerably: Deloitte's Prediction

Table of Contents

Deloitte's Key Findings and Methodology

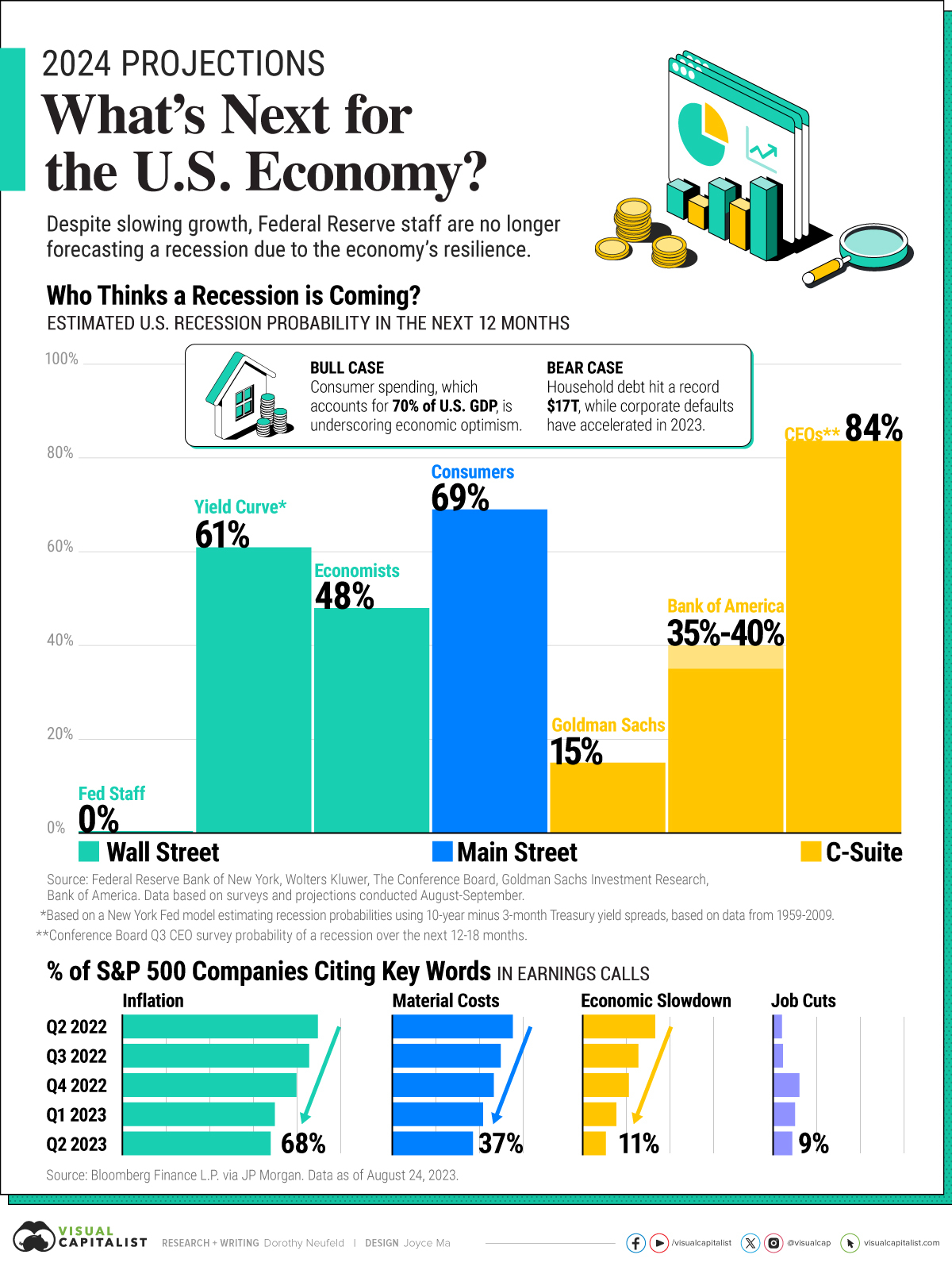

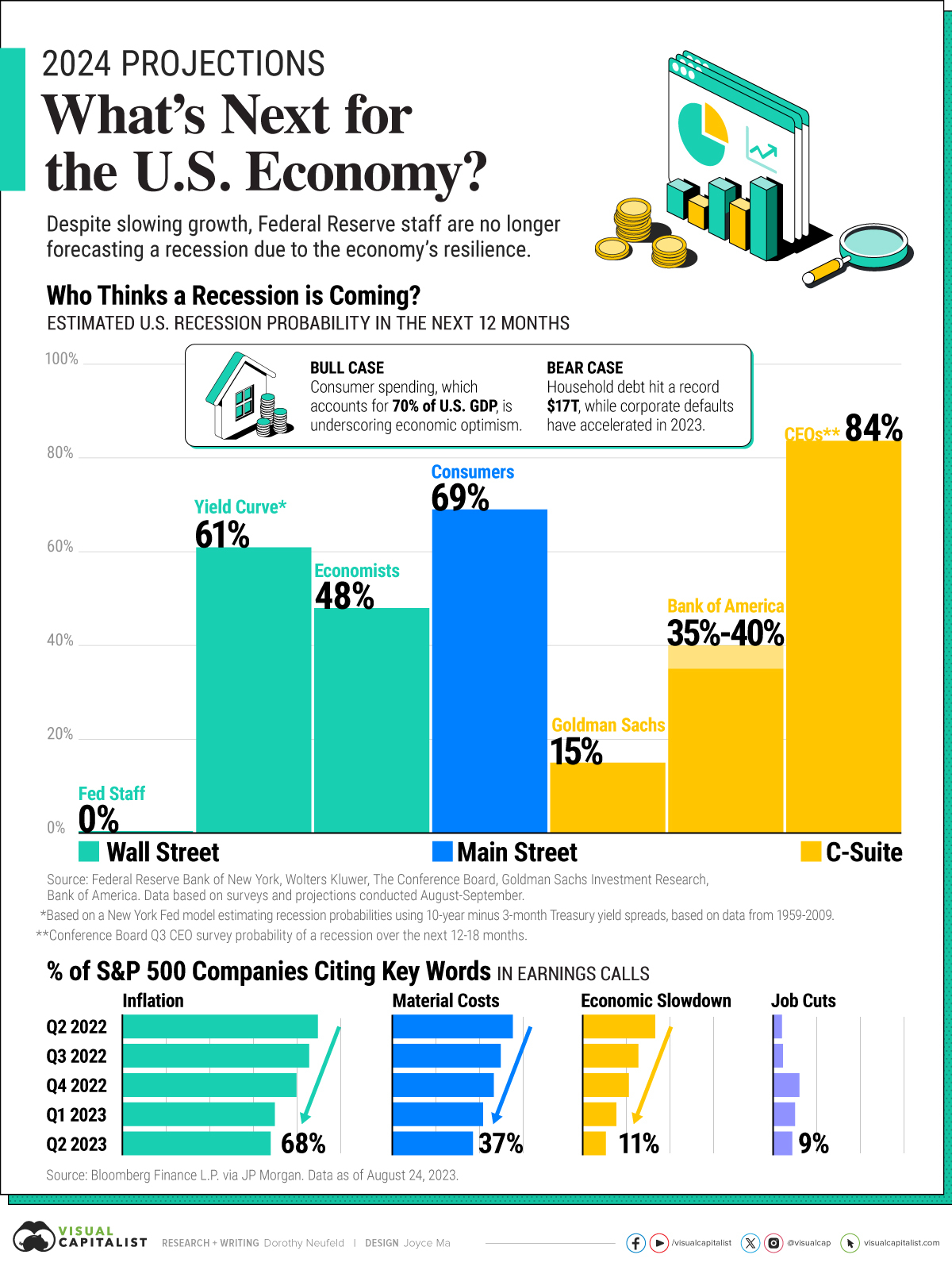

Deloitte's prediction forecasts a significant decrease in US GDP growth. Their analysis, incorporating various economic models and indicators, points to a challenging economic outlook. While the exact percentage decrease varies depending on the model used and underlying assumptions, their projections consistently indicate a substantial slowdown compared to recent years.

- Specific percentage decrease in GDP growth: Deloitte projects a decrease in GDP growth ranging from [Insert Deloitte's projected range here, e.g., 1.5% to 2.5%]. This represents a considerable drop from the previous year's growth rate.

- Timeframe of the predicted slowdown: This slowdown is projected to occur primarily over the next [Insert timeframe here, e.g., 12-18 months], potentially extending into [Insert further timeframe projection here, if applicable].

- Key economic indicators considered: Deloitte's analysis incorporates a wide range of indicators, including inflation rates (CPI and PCE), consumer spending, business investment, unemployment figures, and housing market data.

- Sectors expected to be most affected: Sectors particularly vulnerable to this slowdown include housing, manufacturing, and potentially technology, although the severity of the impact will vary across sectors.

Inflationary Pressures and the Federal Reserve's Response

Persistent inflationary pressures are a primary driver of the projected economic slowdown. High inflation erodes purchasing power, dampens consumer spending, and increases uncertainty for businesses, leading to reduced investment. The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, further contribute to the slowdown by increasing borrowing costs for businesses and consumers.

- Current inflation rate and its projected trajectory: The current inflation rate remains elevated, exceeding the Federal Reserve's target of 2%. Deloitte's forecast suggests that while inflation might gradually cool, it will likely remain above target for some time.

- The Federal Reserve's current monetary policy stance: The Federal Reserve is committed to its policy of tightening monetary policy to bring inflation down, even at the risk of slowing economic growth. This includes continued interest rate hikes and quantitative tightening.

- The impact of higher interest rates on borrowing costs: Higher interest rates translate directly into higher borrowing costs for businesses and consumers, making it more expensive to finance investments, purchases, and expansion projects. This directly impacts economic activity.

- The potential for a "soft landing" versus a recession: The possibility of achieving a "soft landing"—a slowdown in economic growth without a full-blown recession—remains uncertain. Deloitte's forecast suggests a heightened risk of a recession, though the severity and duration are still subject to considerable uncertainty.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical instability, particularly the war in Ukraine, and ongoing supply chain disruptions are exacerbating the challenges facing the US economy. These factors contribute to higher energy prices, increased input costs for businesses, and heightened uncertainty, further dampening economic activity.

- Specific examples of geopolitical events affecting the US economy: The war in Ukraine significantly impacted energy prices, contributing to inflation. Other geopolitical events, such as trade tensions and political instability in various regions, also create economic uncertainty.

- The continuing challenges of global supply chain disruptions: While some supply chain bottlenecks have eased, significant disruptions remain, contributing to higher prices and limiting economic output.

- How these factors contribute to higher prices and reduced economic activity: Geopolitical instability and supply chain issues lead to shortages, increased transportation costs, and higher input costs, all of which contribute to inflation and reduced economic activity.

- Potential long-term impacts of these disruptions: The long-term consequences of these disruptions are still unfolding, potentially reshaping global supply chains and trade patterns.

Impact on Specific Sectors

The predicted economic slowdown will differentially impact various sectors. The housing market, already facing higher interest rates, is particularly vulnerable to a significant downturn. Manufacturing faces challenges from higher energy prices and supply chain disruptions. The technology sector, while relatively resilient, may also experience a cooling of investment and hiring due to reduced overall economic growth.

Conclusion

Deloitte's prediction of a considerable slowdown in US economic growth underscores the complex interplay of inflation, monetary policy, geopolitical instability, and supply chain disruptions. These factors present significant challenges for businesses and consumers in the coming months and years. Understanding the potential for a US economic slowdown is crucial for businesses and investors. Stay informed about the evolving economic landscape and Deloitte's ongoing economic forecasts to make informed decisions and navigate this period of uncertainty. Follow Deloitte's insights on future US economic growth projections and prepare your business for the challenges ahead. Learn more about mitigating the risks of a potential slowdown and preparing your financial strategy for navigating this challenging economic climate. Proactive planning and a keen understanding of the factors driving this potential slowdown are essential for navigating the changing economic landscape.

Featured Posts

-

Controversial Autism Study Head An Anti Vaxxers Appointment

Apr 27, 2025

Controversial Autism Study Head An Anti Vaxxers Appointment

Apr 27, 2025 -

New Pushback From Car Dealers Against Electric Vehicle Regulations

Apr 27, 2025

New Pushback From Car Dealers Against Electric Vehicle Regulations

Apr 27, 2025 -

Grand National Horse Fatality Statistics Updated Before The 2025 Race

Apr 27, 2025

Grand National Horse Fatality Statistics Updated Before The 2025 Race

Apr 27, 2025 -

Revealed Patrick Schwarzeneggers Missing Part In Ariana Grandes White Lotus

Apr 27, 2025

Revealed Patrick Schwarzeneggers Missing Part In Ariana Grandes White Lotus

Apr 27, 2025 -

Russia Blames Ukraine For Generals Death Near Moscow In Attack

Apr 27, 2025

Russia Blames Ukraine For Generals Death Near Moscow In Attack

Apr 27, 2025

Latest Posts

-

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Center Of The Case

Apr 28, 2025

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Center Of The Case

Apr 28, 2025 -

Open Ai Facing Ftc Probe Concerns Regarding Chat Gpts Data Practices

Apr 28, 2025

Open Ai Facing Ftc Probe Concerns Regarding Chat Gpts Data Practices

Apr 28, 2025 -

Cassidy Hutchinsons Upcoming Memoir Details January 6th Testimony

Apr 28, 2025

Cassidy Hutchinsons Upcoming Memoir Details January 6th Testimony

Apr 28, 2025 -

Cassidy Hutchinson Key Witness To Publish Memoir On January 6th Hearings

Apr 28, 2025

Cassidy Hutchinson Key Witness To Publish Memoir On January 6th Hearings

Apr 28, 2025 -

Hollywood Production Halted Writers And Actors Strikes Combine

Apr 28, 2025

Hollywood Production Halted Writers And Actors Strikes Combine

Apr 28, 2025