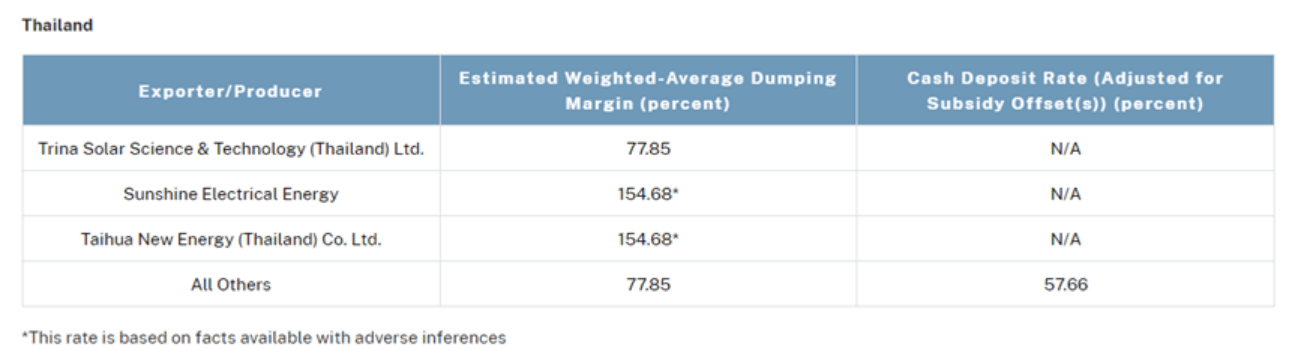

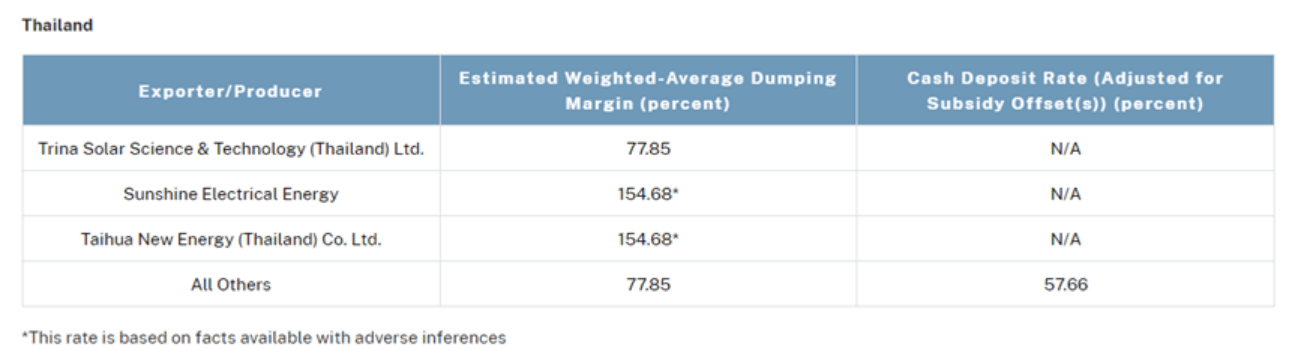

US Slaps 3,521% Tariffs On Some Southeast Asian Solar Products: Industry Implications

Table of Contents

Impact on Solar Panel Prices and Consumer Costs

The immediate and most significant impact of the 3,521% tariff is a dramatic increase in the cost of solar panels imported from Southeast Asia. These countries are major suppliers of solar cells and panels to the US market, and this tariff directly translates to higher prices for consumers and businesses looking to adopt solar energy. The increased cost per watt of solar panel installations will likely lead to a noticeable price hike for residential and commercial projects.

- Increased cost per watt of solar panel installations: Expect a substantial increase in the overall cost, potentially making solar energy less competitive against traditional energy sources.

- Potential slowdown in residential and commercial solar adoption: Higher prices may discourage consumers and businesses from investing in solar, hindering the growth of the renewable energy sector.

- Impact on the overall affordability of renewable energy: The tariff undermines the affordability of solar energy, potentially delaying the transition to cleaner energy sources.

- Comparison of price increases to inflation rates and general energy cost increases: The tariff-induced price increases will exacerbate existing inflationary pressures and add to the already high cost of energy, placing a greater burden on consumers.

This substantial increase in cost will likely affect the competitiveness of solar energy against other energy sources, potentially slowing down the adoption rate in the near future.

Disruptions to the Global Solar Supply Chain

The US heavily relies on Southeast Asia for crucial components in the solar panel manufacturing process. The 3,521% tariff will severely disrupt the established supply chain, leading to significant challenges for US-based solar installation companies. Reduced supply will translate to potential shortages of solar panels in the US market, causing delays in project completion and impacting the overall efficiency of the solar energy sector.

- Potential shortages of solar panels in the US market: This will create a bottleneck in the supply chain, potentially leading to project delays and unmet demands.

- Increased lead times for solar installations: Customers may experience longer waiting times for their solar installations to be completed.

- Challenges for companies managing inventory and fulfilling contracts: Businesses will struggle to meet existing commitments and secure future supplies due to the unpredictable market conditions.

- Exploration of alternative supply chain solutions: Companies will be forced to explore alternative sources for solar panels, potentially increasing costs and logistical complexities.

The instability caused by the tariff will necessitate a thorough re-evaluation of existing supply chain strategies and a shift towards more diversified sourcing options.

Shifting Landscape of the Renewable Energy Market

The tariff could inadvertently spur a renewed focus on domestic solar panel manufacturing within the US. This might lead to increased investment in US-based solar manufacturing facilities and potentially accelerate the development of the domestic solar industry. However, the immediate impact will likely be a shift towards alternative renewable energy sources, like wind power, until the supply chain issues are resolved.

- Investment opportunities in US-based solar manufacturing: The tariff may encourage investments in domestic manufacturing, creating jobs and boosting economic activity.

- Government incentives and policies aimed at boosting domestic production: We might see increased government support for domestic solar manufacturers through subsidies, tax breaks, and other incentives.

- Potential for increased competition among solar panel manufacturers: The shift in sourcing could lead to increased competition amongst both domestic and international manufacturers.

- Geopolitical implications of shifting sourcing strategies: The US may seek to diversify its solar panel imports from other regions, leading to new geopolitical alliances and trade relationships.

This shift, while potentially beneficial in the long run, will require significant investment and policy changes to achieve a smooth transition.

Political and Trade Implications

The imposition of such high tariffs is bound to have significant political and trade implications. Southeast Asian nations may retaliate with tariffs on US goods, escalating trade tensions. Furthermore, the legal basis of these tariffs could be challenged under WTO rules, leading to potential international trade disputes and legal battles.

- Potential impact on broader trade relations between the US and Southeast Asia: The tariffs could strain existing trade relationships and damage diplomatic ties.

- Analysis of the legal basis for the tariffs: The justification and legality of the tariffs will be subject to scrutiny, leading to potential legal challenges.

- Possibility of international trade negotiations and resolutions: The situation may necessitate international negotiations to find a mutually acceptable resolution.

- Long-term economic consequences for both regions: The tariff war could have long-term negative economic consequences for both the US and Southeast Asian nations involved.

The ramifications extend beyond the solar energy sector, impacting broader US foreign policy and international trade relations.

Conclusion: Navigating the Implications of the 3,521% Tariffs on Southeast Asian Solar Products

The 3,521% tariff on Southeast Asian solar products represents a significant development with far-reaching implications. The impact on solar panel prices, the disruption of the global supply chain, the shifting landscape of the renewable energy market, and the potential for international trade disputes are all substantial. The long-term effects of this decision remain to be seen, but it highlights the complexities of global trade and energy policy. Stay informed about developments related to the "US Slaps 3,521% Tariffs on Some Southeast Asian Solar Products" and its impact on the solar energy industry through further research and engagement with industry organizations. Proactive strategies from businesses and policymakers are crucial to navigate this challenging period and ensure a sustainable and secure energy future.

Featured Posts

-

Integrale Europe 1 Soir Edition Du 19 03 2025

May 30, 2025

Integrale Europe 1 Soir Edition Du 19 03 2025

May 30, 2025 -

Festival Axe Ceremonia 2025 Cancelado Reclama Tu Reembolso En Ticketmaster

May 30, 2025

Festival Axe Ceremonia 2025 Cancelado Reclama Tu Reembolso En Ticketmaster

May 30, 2025 -

Kehadiran Kawasaki Z H2 197 Hp Di Indonesia Kapan

May 30, 2025

Kehadiran Kawasaki Z H2 197 Hp Di Indonesia Kapan

May 30, 2025 -

Analyzing The Impact Of Trump Tariffs On Indian Solar Energy Exports To Southeast Asia

May 30, 2025

Analyzing The Impact Of Trump Tariffs On Indian Solar Energy Exports To Southeast Asia

May 30, 2025 -

Limited Time Deal R45 000 Discount On Kawasaki Ninja Models

May 30, 2025

Limited Time Deal R45 000 Discount On Kawasaki Ninja Models

May 30, 2025