US Stock Market Today: Gold Soars, Dow Futures Track Tariff And Fed Developments

Table of Contents

Gold's Rally: A Safe Haven in Uncertain Times

Gold's price increase is a significant indicator of the current market sentiment. Its role as a safe haven asset during periods of economic uncertainty and geopolitical instability is once again evident. Investors are flocking to gold, viewing it as a hedge against potential losses in other asset classes. This flight to safety is driven by several factors:

-

Increased geopolitical tensions: Rising international tensions and unpredictable global events contribute significantly to safe-haven demand. Investors seek the stability of gold as a tangible asset, less susceptible to the fluctuations of the stock market.

-

Concerns about inflation and weakening dollar: Worries about inflation eroding purchasing power and a weakening US dollar are boosting gold's appeal. Gold is often considered an inflation hedge, maintaining its value even when fiat currencies decline.

-

Potential impact of central bank policies: Central bank policies, including interest rate decisions and quantitative easing measures, can significantly influence gold prices. Changes in monetary policy can impact the relative value of gold compared to other assets.

-

Analysis of recent gold price charts and technical indicators: A review of recent gold price charts shows a clear upward trend, supported by various technical indicators suggesting continued momentum in the near term. This reinforces the perception of gold as a reliable investment during volatile periods. Understanding these technical indicators is crucial for informed investment decisions.

Dow Futures and the Tariff Tightrope

The Dow Jones Industrial Average (DJIA) and its futures contracts are highly sensitive to ongoing trade negotiations and tariff disputes. These uncertainties create a volatile environment for investors. The impact is multifaceted:

-

Recent tariff announcements and their effect on market sentiment: Every new tariff announcement sends ripples through the market, impacting investor confidence and potentially leading to increased market volatility. The uncertainty surrounding future tariff policies adds further pressure.

-

Analysis of the impact on specific sectors (e.g., technology, manufacturing): Specific sectors, such as technology and manufacturing, are particularly vulnerable to the impact of tariffs. These sectors often experience direct effects on their supply chains and profitability, leading to stock price fluctuations.

-

Potential for escalation or de-escalation in trade disputes: The potential for escalation or de-escalation in trade disputes creates significant uncertainty for investors. Positive developments in trade negotiations could lead to a rally, while negative news might trigger a market downturn.

-

Expert opinions and predictions regarding future tariff implications: Market analysts and experts offer varying opinions and predictions regarding the future implications of tariffs. Staying informed about these expert viewpoints is crucial for developing a comprehensive understanding of the market outlook.

Federal Reserve's Influence on Market Sentiment

The Federal Reserve's actions and statements play a crucial role in shaping market sentiment and influencing investor behavior. Its monetary policy decisions, including interest rate adjustments, directly impact borrowing costs and investment decisions:

-

Recent statements and actions by the Federal Reserve: The Federal Reserve's recent statements and actions regarding monetary policy provide valuable insights into its future course of action. Investors closely monitor these announcements for clues about interest rate changes.

-

Market anticipation of future monetary policy decisions: Market participants eagerly anticipate the Federal Reserve's future monetary policy decisions, as these decisions can significantly impact the stock market and other asset classes. Any deviation from expectations can lead to significant market movements.

-

Analysis of the economic data influencing the Fed's decisions: The Federal Reserve's decisions are influenced by various economic data points, including inflation rates, employment figures, and economic growth indicators. Understanding these data points helps in predicting potential policy changes.

-

Impact of interest rate changes on borrowing costs and investment decisions: Changes in interest rates directly impact borrowing costs for businesses and consumers, influencing investment decisions and overall economic activity. Lower interest rates typically stimulate economic growth, while higher rates tend to curb inflation.

Navigating Market Volatility: Strategies for Investors

Navigating the current market volatility requires a well-defined investment strategy that emphasizes diversification and risk management:

-

Importance of a well-diversified investment portfolio: Diversification is crucial for mitigating risk. Spreading investments across various asset classes reduces the impact of losses in any single asset.

-

Strategies for mitigating risk during periods of market uncertainty: Several strategies can help mitigate risk during periods of uncertainty, including hedging, stop-loss orders, and adjusting portfolio allocations based on risk tolerance.

-

Long-term versus short-term investment approaches: A long-term investment horizon generally reduces the impact of short-term market fluctuations. Short-term trading strategies, however, can be more susceptible to market volatility.

-

Importance of seeking professional financial advice: Seeking advice from a qualified financial advisor is recommended, particularly during periods of high market volatility. A professional can offer personalized guidance based on individual risk tolerance and investment goals.

Conclusion

The US stock market today is a dynamic landscape shaped by several key factors: gold's surge as a safe-haven asset, the ongoing impact of tariffs on Dow Futures, and the Federal Reserve's influence on monetary policy and interest rates. Understanding these interconnected forces is crucial for making informed investment decisions. Stay informed about the ever-changing US stock market. Continue to monitor developments regarding tariffs, the Federal Reserve's actions, and the price of gold to make informed investment decisions. Understanding the dynamics of the US stock market today is crucial for successful investing. Regularly check back for updates on the latest US Stock Market news and analysis.

Featured Posts

-

Trumps Economic Claims Vs Reality A Data Driven Investigation

Apr 23, 2025

Trumps Economic Claims Vs Reality A Data Driven Investigation

Apr 23, 2025 -

Le Role De Pascal Boulanger A La Federation Des Promoteurs Immobiliers Fpi

Apr 23, 2025

Le Role De Pascal Boulanger A La Federation Des Promoteurs Immobiliers Fpi

Apr 23, 2025 -

Milwaukees Nine Stolen Bases A New Record Set

Apr 23, 2025

Milwaukees Nine Stolen Bases A New Record Set

Apr 23, 2025 -

Controversial Comment Yankee Broadcaster Takes Aim At Seattle Mariners

Apr 23, 2025

Controversial Comment Yankee Broadcaster Takes Aim At Seattle Mariners

Apr 23, 2025 -

Reds Losing Streak Extends To Three Games 1 0 Shutouts

Apr 23, 2025

Reds Losing Streak Extends To Three Games 1 0 Shutouts

Apr 23, 2025

Latest Posts

-

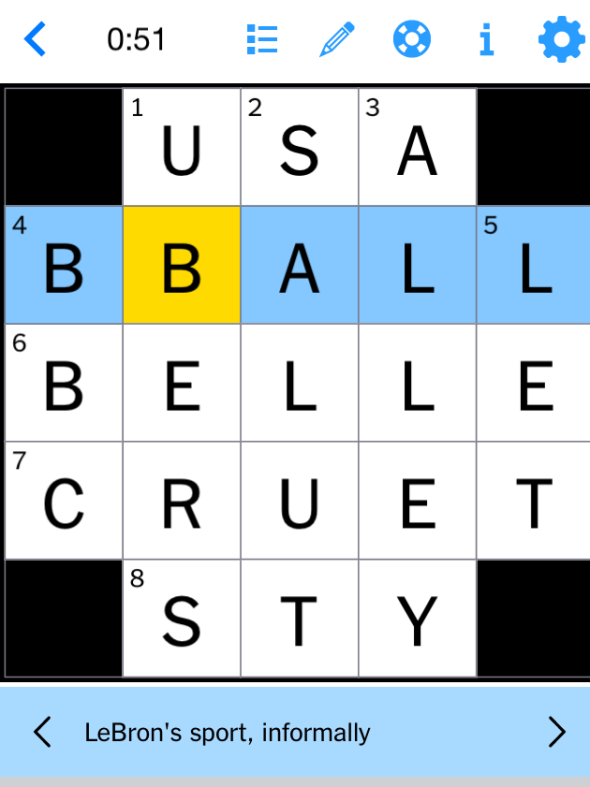

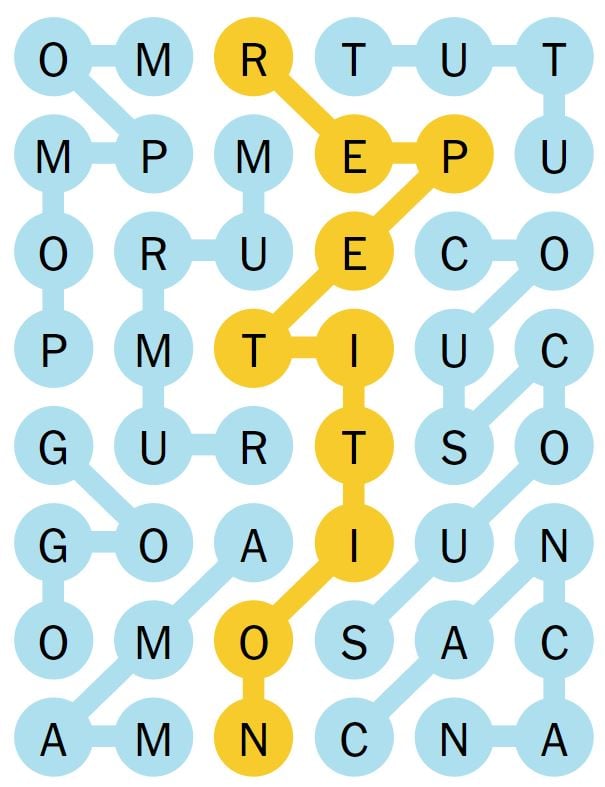

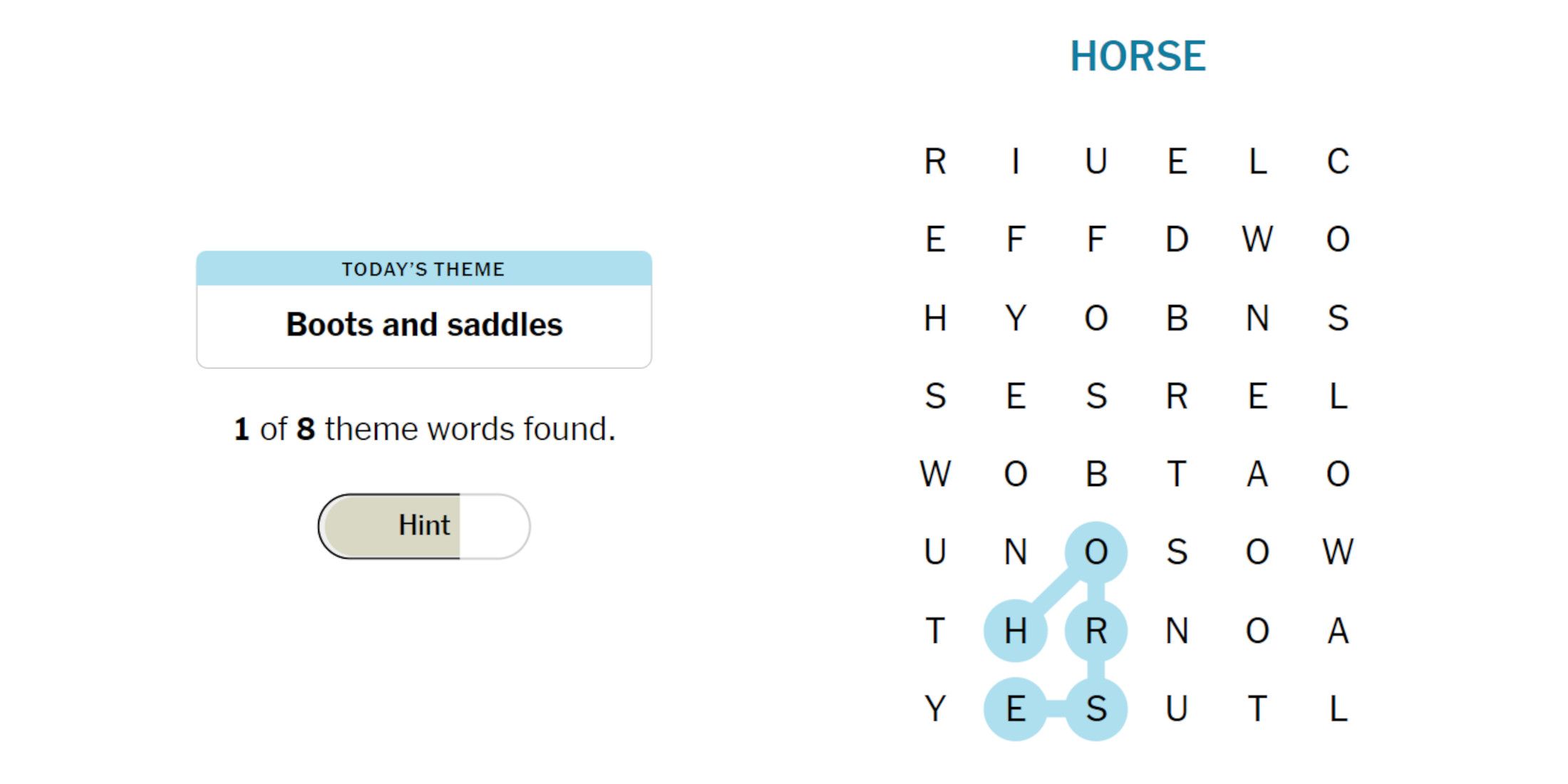

Solve The Nyt Strands Crossword April 4th 2025 Hints And Answers

May 10, 2025

Solve The Nyt Strands Crossword April 4th 2025 Hints And Answers

May 10, 2025 -

Nyt Strands Crossword April 4 2025 Complete Guide To Solving

May 10, 2025

Nyt Strands Crossword April 4 2025 Complete Guide To Solving

May 10, 2025 -

Strands Nyt Crossword Clue Solutions Thursday April 10th Game 403

May 10, 2025

Strands Nyt Crossword Clue Solutions Thursday April 10th Game 403

May 10, 2025 -

Strands Nyt Puzzle Solutions Saturday April 12 Game 405

May 10, 2025

Strands Nyt Puzzle Solutions Saturday April 12 Game 405

May 10, 2025 -

Nyt Strands Answers For Saturday April 12th Game 405

May 10, 2025

Nyt Strands Answers For Saturday April 12th Game 405

May 10, 2025