US Tariffs Halt Shein's Planned London IPO

Table of Contents

The Impact of US Tariffs on Shein's Valuation

Increased US tariffs pose a significant threat to Shein's profitability, given its substantial market share in the United States. The higher import costs directly eat into profit margins, forcing the company to consider difficult choices. Shein's US operations represent a considerable portion of its overall revenue; reports suggest that the US accounts for a significant percentage of Shein's sales (specific figures would need to be sourced from reliable financial news outlets). This heavy reliance on the US market makes it particularly vulnerable to tariff increases.

- Higher import costs reduce profit margins: Increased tariffs translate directly to higher costs per item, squeezing profit margins and impacting the company's overall financial health.

- Potential price increases could alienate price-sensitive consumers: Passing on these increased costs to consumers through higher prices could alienate Shein's core customer base, who are drawn to its ultra-low prices. This could lead to reduced sales volume and further impact profitability.

- Reduced competitiveness in the US market against domestic and other international brands: Higher prices make Shein less competitive against both domestic US brands and other international fast-fashion companies that might not be as heavily affected by tariffs.

- Negative impact on investor sentiment concerning future growth and returns: The uncertainty surrounding future tariff policies and their potential impact on Shein's profitability creates a negative outlook for potential investors, leading to lower valuations and potentially impacting the success of any future IPO attempts.

Shein's London IPO Strategy and its Challenges

Shein initially opted for a London listing likely due to the London Stock Exchange's attractiveness to international companies. London's status as a global financial hub offers access to a diverse pool of European and global investors. The regulatory environment, while stringent, is also considered relatively favorable for large international corporations. A successful London IPO could potentially yield a higher valuation compared to other exchanges.

However, even without the tariff issue, Shein faces significant hurdles in securing a successful IPO. Scrutiny regarding its labor practices and sustainability concerns are major challenges that could deter potential investors.

- Access to European and global investors: London provides access to a wider, more international investor base than other exchanges.

- Regulatory environment in London: While rigorous, the London regulatory environment is generally considered transparent and efficient.

- Potential for higher valuation in London compared to other exchanges: London's prestige as a global financial center often leads to higher valuations for listed companies.

- Challenges in meeting stringent regulatory requirements: Shein needs to meet high standards of transparency and corporate governance, potentially requiring significant changes to its business practices.

Alternative Strategies for Shein's Future Growth

With the London IPO on hold, Shein needs to explore alternative avenues for capital raising and expansion. Several options exist, each with its own set of benefits and drawbacks.

- Private equity investment: Securing private equity funding could provide immediate capital infusion without the public scrutiny of an IPO.

- Strategic alliances with other businesses: Partnering with established brands or suppliers could offer access to new markets and resources.

- Exploring alternative geographical markets less susceptible to US tariffs: Diversifying its market focus away from heavy reliance on the US could mitigate future tariff risks.

- Focus on improving its sustainability credentials to attract ethical investors: Addressing sustainability concerns could attract investors seeking environmentally and socially responsible investments.

The Broader Implications for the Fast Fashion Industry

Shein's decision sends ripples throughout the fast-fashion industry. It highlights the growing uncertainties surrounding international trade and the increasing importance of geopolitical considerations for global businesses.

- Increased uncertainty for fast-fashion IPOs: Shein's experience could deter other fast-fashion companies from pursuing IPOs in the near future, creating a chilling effect on the market.

- Potential for greater regulatory scrutiny of the sector: The challenges Shein faces regarding labor practices and sustainability could lead to increased regulatory oversight of the entire fast-fashion industry.

- Shift in investment strategies towards more sustainable brands: Investors are increasingly focusing on ethical and sustainable businesses, potentially shifting investment away from companies with questionable practices like Shein.

- Increased pressure on companies to diversify their supply chains: The vulnerability of relying heavily on a single market becomes clear, pushing companies to diversify their operations geographically.

Conclusion:

The postponement of Shein's London IPO due to US tariffs underscores the significant impact of global trade policies on business strategies. The company's situation reveals the critical need for careful consideration of geopolitical factors when planning major financial events. Shein must now strategically navigate alternative growth paths, while the fast-fashion industry grapples with increasing scrutiny regarding sustainability and ethical practices. The future of Shein's IPO and the broader fast-fashion landscape remains uncertain, necessitating constant monitoring of evolving trade policies and investor sentiment. Stay informed about the impact of US Tariffs and the future of Shein's IPO plans.

Featured Posts

-

Child Predator Sentenced Inter Agency Collaboration Leads To Arrest

May 04, 2025

Child Predator Sentenced Inter Agency Collaboration Leads To Arrest

May 04, 2025 -

Cangkang Telur Sumber Nutrisi Untuk Pertumbuhan Tanaman Dan Kesehatan Hewan

May 04, 2025

Cangkang Telur Sumber Nutrisi Untuk Pertumbuhan Tanaman Dan Kesehatan Hewan

May 04, 2025 -

Russell Westbrook Situation Nuggets President Offers Update

May 04, 2025

Russell Westbrook Situation Nuggets President Offers Update

May 04, 2025 -

Otnosheniya Dzhidzhi Khadid I Kupera Pravda O Molchanii Modeli

May 04, 2025

Otnosheniya Dzhidzhi Khadid I Kupera Pravda O Molchanii Modeli

May 04, 2025 -

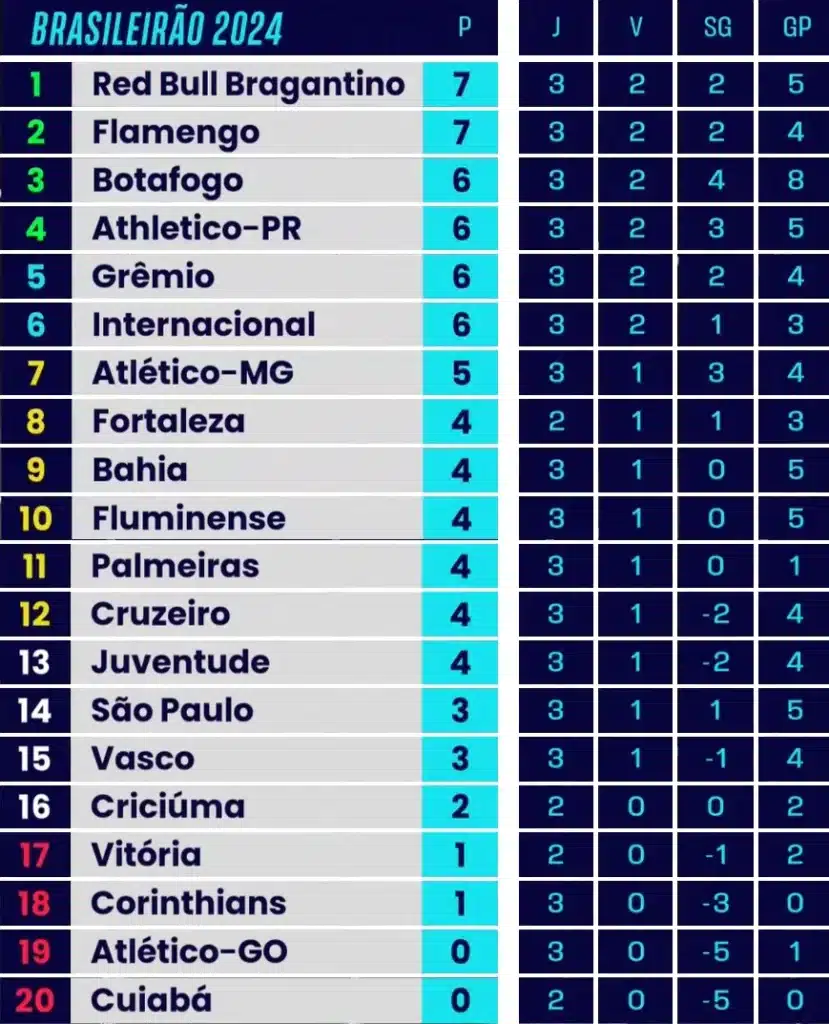

Tabela Do Brasileirao Serie A 2024 Confira A Programacao Completa

May 04, 2025

Tabela Do Brasileirao Serie A 2024 Confira A Programacao Completa

May 04, 2025