US Tariffs Halt Shein's Planned London Stock Market Listing

Table of Contents

The Impact of US Tariffs on Shein's Profitability

Shein's decision to postpone its London Stock Exchange listing is a direct consequence of the financial strain imposed by US tariffs. The impact on Shein's profitability is substantial, stemming from several key factors:

-

Increased import costs: US tariffs have significantly increased the cost of importing goods into the US market, a crucial market for Shein. These increased import costs directly eat into Shein's already slim profit margins, which are typically lower than those of traditional retailers due to its fast-fashion business model.

-

Vulnerability due to sourcing: Shein sources a massive volume of its goods from China, making it particularly vulnerable to these tariffs. The sheer scale of its operations magnifies the effect of even a small tariff increase.

-

Competitive pricing pressure: Shein has built its empire on offering incredibly low prices. The rising costs associated with tariffs make it increasingly difficult to maintain this competitive pricing strategy, potentially impacting sales volume and market share.

-

Supply chain disruption: The added costs and complexities of navigating tariffs also disrupt Shein's supply chain. Delays in delivery and increased logistical hurdles can further impact profitability and customer satisfaction.

-

Financial impact analysis: While Shein hasn't publicly released detailed financial statements detailing the exact impact of these tariffs, analysts estimate that the increased costs have significantly reduced its projected IPO valuation, making a listing less attractive at this time. The impact on overall revenue is likely substantial, potentially impacting future growth projections.

Shein's London Stock Exchange Listing: Why London?

Shein's choice of the London Stock Exchange for its IPO was a strategic move reflecting its global ambitions. Several factors contributed to this decision:

-

Access to European markets: London provides unparalleled access to the vast European market, a key target for Shein's continued expansion. Listing in London positions Shein favorably to tap into this lucrative consumer base.

-

Global expansion strategy: The London listing was a critical element in Shein's broader global expansion strategy. It aimed to enhance brand recognition, attract international investors, and further solidify its position as a global fast-fashion leader.

-

Attractive listing venue: The London Stock Exchange is renowned for its attractiveness to fast-growing technology and consumer brands, offering a sophisticated and well-regulated market environment. Shein likely hoped to benefit from the prestige and investor network associated with a London listing.

-

Investor interest: Before the significant impact of US tariffs became apparent, analysts predicted substantial investor interest in a Shein IPO, fueled by its impressive growth trajectory and market dominance in the fast-fashion sector.

Alternative Strategies for Shein Post-Postponement

The postponement of its IPO forces Shein to reassess its strategies and explore alternative options:

-

Supply chain diversification: To mitigate the impact of tariffs, Shein will likely need to diversify its sourcing. This could involve shifting production to countries with more favorable trade agreements with the US or exploring regional manufacturing hubs.

-

Alternative listing venues: Shein might explore other stock exchanges, such as those in Hong Kong or New York, though each carries its own set of considerations and challenges.

-

Profitability strategies: Maintaining profitability in the face of increased tariffs requires creative strategies. This might involve adjusting pricing models, streamlining operations, or focusing on higher-margin products.

-

Long-term implications: The delay could impact Shein's long-term growth prospects, potentially slowing its expansion and delaying its entrance into new markets. The postponement, however, buys them time to adapt and build a stronger foundation.

The Broader Implications for the Fast Fashion Industry

Shein's situation highlights broader challenges facing the fast-fashion industry:

-

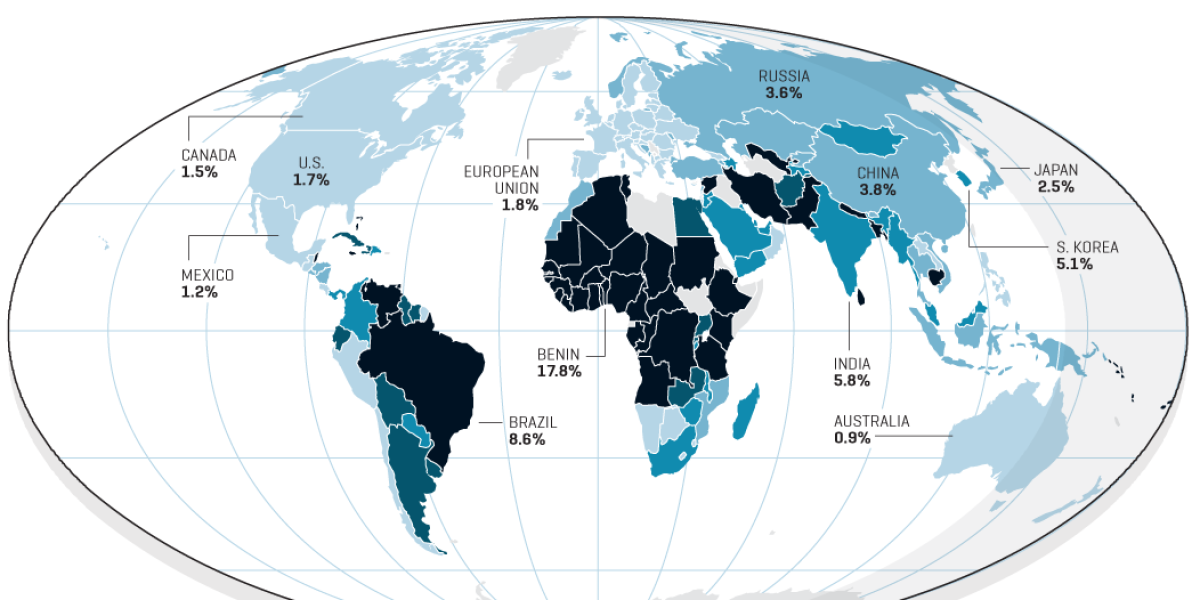

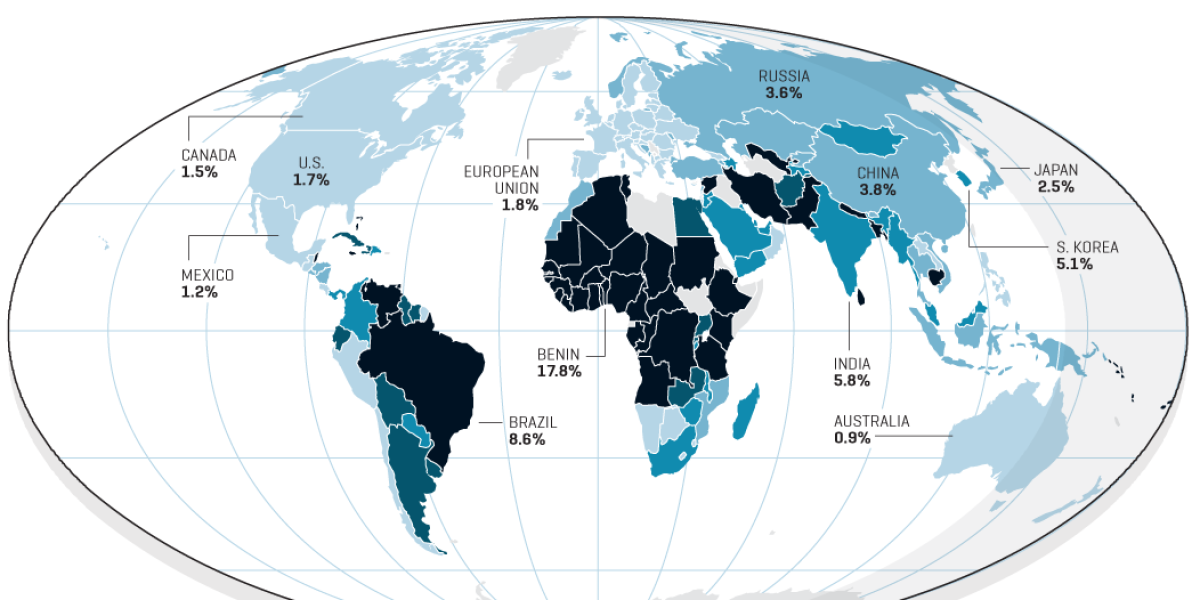

Impact on other brands: The impact of US tariffs is not limited to Shein; other fast-fashion brands relying heavily on imports from China are also experiencing increased costs and supply chain disruptions.

-

Global trade war implications: The ongoing trade tensions between the US and China underscore the volatility of the global trade environment and its profound impact on businesses operating across borders.

-

Challenges in a volatile market: The episode emphasizes the significant challenges faced by companies in navigating unpredictable global trade policies and adapting to the changing landscape.

-

Consumer impact: Increased import costs may translate into higher prices for consumers, potentially impacting purchasing habits and demand for fast fashion.

Conclusion

Shein's decision to postpone its London Stock Exchange listing due to US tariffs underscores the significant challenges faced by global businesses navigating the complexities of international trade. The increased import costs directly impact profitability, forcing companies to reassess their strategies and adapt to the changing landscape. This event serves as a stark reminder of the unpredictable nature of global trade and its impact on even the most successful businesses.

Call to Action: Stay informed on the latest developments in global trade and their impact on major companies like Shein. Continue to follow our coverage for updates on Shein's future plans and the evolving landscape of the fast fashion industry and its potential future stock market listings. Understanding the impact of US tariffs on Shein's IPO provides crucial insights into the dynamics of the global fast-fashion market.

Featured Posts

-

Dope Girls Cocaine Electronica And Glamour In The Trenches

May 05, 2025

Dope Girls Cocaine Electronica And Glamour In The Trenches

May 05, 2025 -

Revisiting The Most Iconic Final Destination Moment Why It Still Resonates

May 05, 2025

Revisiting The Most Iconic Final Destination Moment Why It Still Resonates

May 05, 2025 -

Ufc Des Moines Predictions Your Guide To Fight Night

May 05, 2025

Ufc Des Moines Predictions Your Guide To Fight Night

May 05, 2025 -

16 Year Old Stepsons Murder Stepfather Charged With Torture Starvation And Assault

May 05, 2025

16 Year Old Stepsons Murder Stepfather Charged With Torture Starvation And Assault

May 05, 2025 -

Anna Kendricks Nonverbal Cues What Her Body Language Revealed During A Conversation With Blake Lively

May 05, 2025

Anna Kendricks Nonverbal Cues What Her Body Language Revealed During A Conversation With Blake Lively

May 05, 2025